-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Tighter Ahead Of Jan Tax Deadline

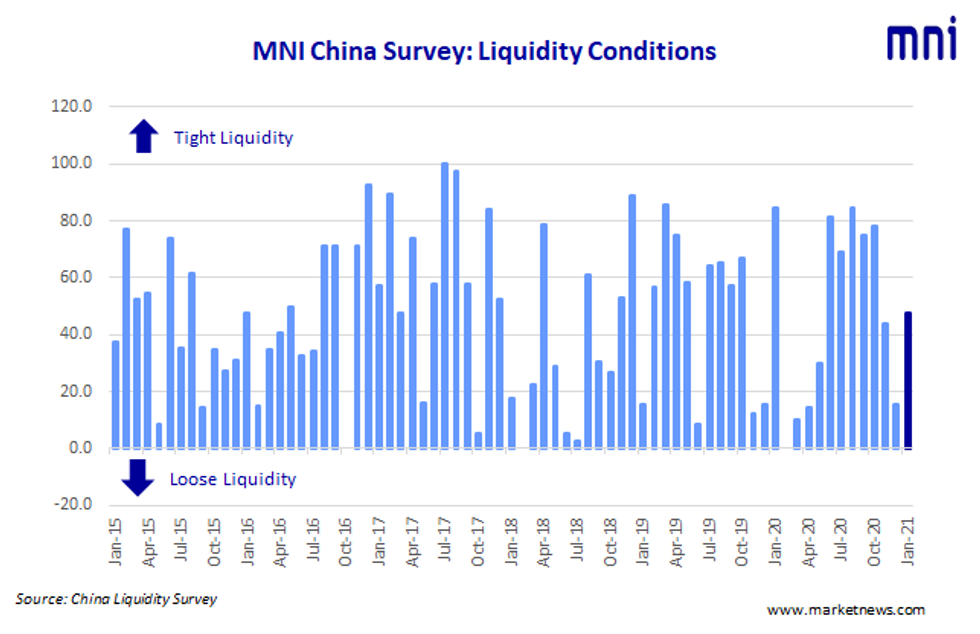

MNI Jan China Liquidity Conditions Index 47.4 Vs 15.7 Dec

Liquidity conditions tightened modestly across China's interbank market in early January but the move wasn't seen as reflecting a significant shift in central bank policy, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index rose to 47.4 in January from 15.7 in December, with 62.8% respondents reporting the conditions "neither too loose nor too tight", although 16% of those surveyed reported an obvious tightening in liquidity.

The higher the index reading, the tighter liquidity appears to survey participants.

Source: MNI China Liquidity Survey

Source: MNI China Liquidity Survey

"Tax payments drained money from the interbank market this month compared with December, but the big injection from the central bank has eased tension," a trader with a medium-sized commercial bank in Guangzhou told MNI, referring the CNY280 bln reverse repos injection last Wednesday when tension peaked. Many of the responses to the MNI survey came before the Jan 20 tax deadline and ahead of the People's Bank of China's move.

A trader with one of big state-owned banks said that now the PBOC had eased the situation, it would maintain current conditions ahead February's Chinese New Year, the peak season for cash demands.

The central bank conducted CNY500 billion MLF in January to replace the maturing CNY540.5 billion MLF and TMLF -- the first drain in the last six months -- and injected a net CNY54 billion via open market operations, as of January 25, MNI calculated.

OUTPERFORMING ECONOMY

The Economy Condition Index stood at 76.3 in January, slipping from 90.6 in December, but the ninth consecutive reading above 70. Although 9 out of 10 participants are confident over the outperforming economy, some 10% of traders were still worried by the gloomier retail sales recovery.

The economy had recovered well, but there were "lingering concerns in some provinces of a re-emergence of Covid-19," the Guangzhou based trader warned.

China's economy grew 6.5% y/y in Q4, or 2.3% y/y for the year, data released this week showed. Led by industrial production and exports. The latest PMI stood at 51.9, underlining the relative strength of the economic recovery .

POLICY STABILITY

The PBOC Policy Bias Index climbed to 57.9 in January from 50.0 last month, with as many as 84.2% traders certain of continued policy from the PBOC, taking their lead from Sun Guofeng, head of Monetary Policy Department who said on Jan 15 that "stability shall be the top priority for the monetary policy in 2021".

Policies will likely remain prudent, "with more flexibility managing liquidity," a Beijing based trader with the top state-owned bank commented.

The Guidance Clarity Index reads at 68.4 in January, slightly down from the 68.8 recorded last month, as a majority of traders said they were clear in what the PBOC wants to convey, with Guangzhou based trader citing "really great guidance".

RATES DECLINING

The 7-Day Repo Rate Index slid to 65.8 from last 71.9. The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.7851% on Jan 26.

The 10-year CGB Yield Index, fell for a second month to 36.8 in January, after the 37.5 reading in the previous month, as longer-dated yields edged higher.

The MNI survey collected the opinions of 19 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed-income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Jan 11 – Jan 22.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.