-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CNB Preview - February 2023: Repo Rate On Hold Before Board Rejig

Executive Summary:

- The CNB are expected to keep interest rates unchanged in a 5-2 vote split (hawkish dissenters: Mora, Holub), replicating the outcome of the previous meeting

- With the repo rates set to stay on hold, the main focus will be on the new set of economic projections, albeit with little room for notable surprises on that front

- It will be the final monetary policy decision for outgoing Bank Board members Marek Mora and Oldrich Dedek, while little is known about the views of their successors

Full preview including summary of sell-side views here:

MNI CNB Preview - February 23.pdf

Recent communications from the CNB’s Bank Board members suggest that the overall sentiment has not shifted and interest rates will in all likelihood remain unchanged this week. The Board is expected to replicate the familiar 5-2 vote split, with known hawks Tomas Holub and Marek Mora dissenting in favour of tighter monetary policy settings. The focus will be on the updated set of economic forecasts, with little potential for major surprises on that front.

A stand-pat decision is fully baked in and would match a unanimous sell-side consensus call. While some analysts flag the risk of renewed rate hikes if inflation unexpectedly spikes higher, most seem to believe that the tightening cycle is effectively over and already discuss the most likely timing of policy loosening. Based on the latest data signals and central bank communications, we also expect the CNB to keep the repo rate unchanged at 7.00% this Thursday, in a split decision, as the Bank Board remains in a wait-and-see mode.

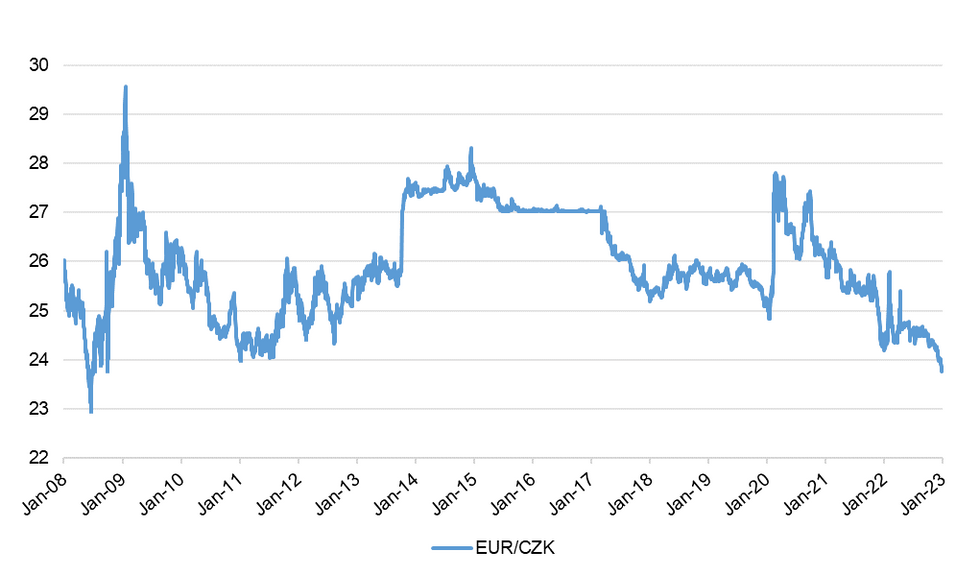

Figure 1. The Czech Koruna has appreciated to its best levels since 2008.Source: MNI - Market News/Bloomberg

Figure 1. The Czech Koruna has appreciated to its best levels since 2008.Source: MNI - Market News/Bloomberg

In addition, the central bank will likely stick with its current FX regime, even as there has been no need to prop up the Czech Koruna in the recent weeks. Data from the CNB showed that the central bank did not step into FX markets in November, which was its first month without interventions since December 2021. The turn of the year saw further Koruna appreciation, keeping the CNB and its interventions at bay. That said, with recessionary concerns doing the rounds, the Koruna may face renewed pressure in the months to come. Hence, the CNB will likely reaffirm its readiness to intervene, in order to maintain a key buffer against imported inflation while rates remain stable.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.