-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Colombia Central Bank Preview - Oct 2021: Tightening Pace In The Balance

Colombia Central Bank

Executive Summary:

- BanRep will continue their hiking cycle at their October meeting with the broad majority expecting another 25bp hike to 2.25%.

- However, due to the previous 4-3 split board vote and the ongoing upward pressure on headline CPI, the decision to accelerate the pace of hikes to 50bps hangs in the balance.

- Arguments for a continuation at the initial 25bp increment focus on anchored core inflation and central bank rhetoric committed to a gradual approach.

- This debate is also reflected in differing opinions among sell-side analysts.

Click to view the full preview: MNI Colombia Central Bank Preview - October 2021.pdf

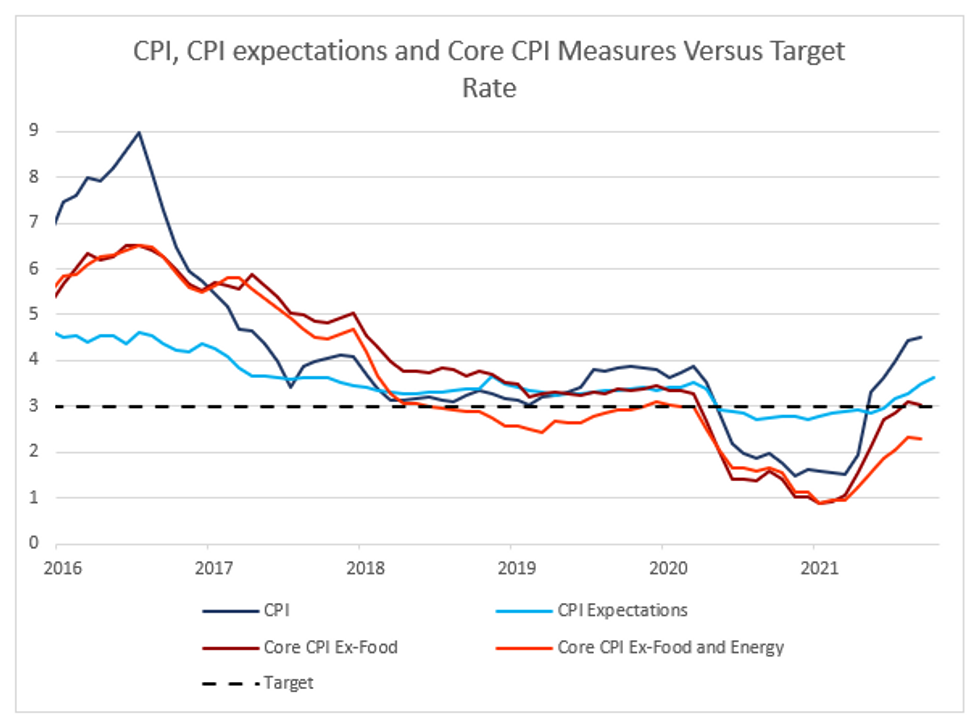

Headline CPI Expectations Creep Further Above Target

Headline annual CPI rose to 4.51% in September versus an estimate of 4.49% and up from a prior reading of 4.44% Additionally, in the latest central bank survey, 12-month ahead CPI forecasts have continued to increase, highlighting a gradual de-anchoring of expectations from target. Combined with this acceleration, analysts note that higher energy prices as well as near-term base effects (low prints across Oct-Nov 2020) will likely keep upward pressure on the headline rate. For the dissenters at the September meeting, advocating for a 50bp hike, this may reiterate their viewpoint conveyed where they "signalled their uncertainty over how transitory or permanent the shocks to inflation will prove to be".

On the other hand, core CPI moderated slightly in September to 0.3% m/m versus an estimate of 0.32% keeping the annual ex-food figure close to the 3% target and the ex-food and energy figure also well below 3%.

MNI/Bloomberg

MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.