-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

MNI Colombia Central Bank Preview - Sep 2021: Gradual Tightening To Commence

Executive Summary:

- BanRep are widely expected to raise their overnight lending rate by 25bps to 2.00%.

- Recent commentary has left few doubts that the governing board will initiate policy tightening at this meeting, with the majority expecting a gradual hiking path.

- However, given the sharp rise in headline inflation, coupled with a strong economic recovery, there may be risks of the MPC taking even bolder action.

Click to view the full preview: MNI BanRep Preview - September 2021.pdf

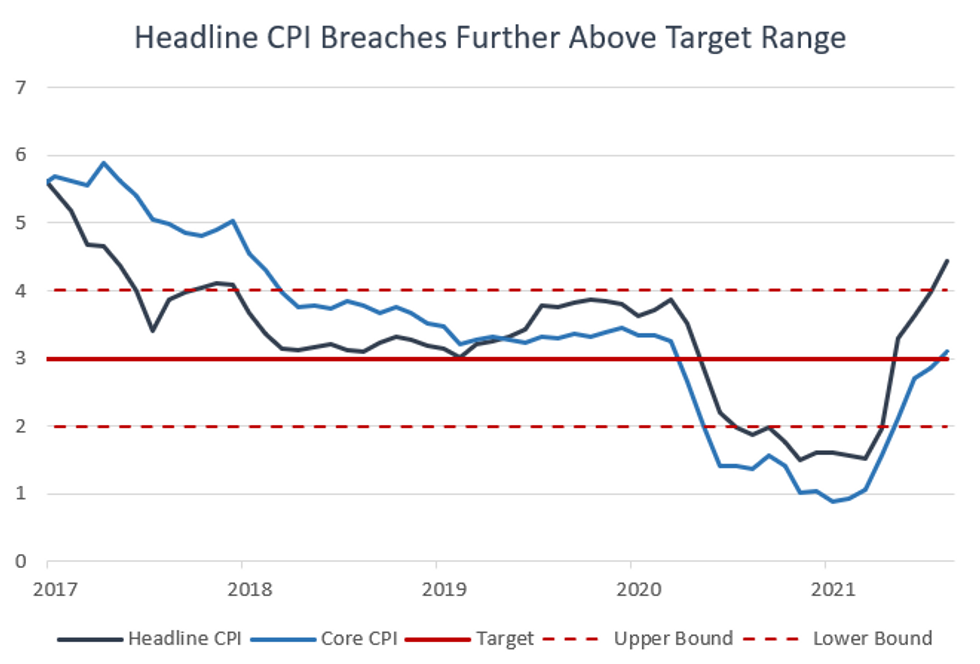

Headline Inflation Continues Ascent Past Upper Tolerance Band

Annual headline CPI for August rose to 4.44%, above expectations of 4.2%. This represents the highest print since April 2017, extending the breach above the upper tolerance band of the inflation target.

While the board may be concerned with rising headline inflation contaminating inflation expectations, Core CPI close to target should temper at least some of the anxiety.

Economic activity continues to surprise to the upside with the latest data printing 14.3% versus a 13.1% median estimate. President Duque's latest remarks suggest the economy will grow over 7% in 2021. This sentiment was echoed even more recently by Finance Minister Restrepo, backing this year's GDP growth to surprise on the upside. Constant mention by officials relating to the lagging recovery of the labour market appears to be the key indicator to maintain a somewhat accommodative stance.

Markets

Despite a volatile trading range of 3740-4045, USDCOP finds itself in very similar territory to where the pair resided at the July meeting around 3840. The IBR swaps curve has shifted higher with tenors between 9months and 20 years rising between 80-110 basis points. Greater than expected tightening at this juncture, or a considerably more hawkish tone will likely see pressure in the front end of the curve as market participants adjust their expected path for short-term tightening of policy. JPMorgan are expecting a 50bps increase at this meeting, describing the potential front-loading of hikes as a down-payment that could then allow BanRep to more comfortably ease into a more gradual pace thereafter.

MNI/Bloomberg

MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.