-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY Threatens To Breach Y111.00 At End Of Japanese FY

EXECUTIVE SUMMARY

- BIDEN'S INFRASTRUCTURE ADDRESS EYED

- FED'S BARKIN SEES EXCESS SAVINGS DRIVING ECONOMY FOR YEARS

- OFFICIAL CHINESE PMIS TOP EXP.

- PBOC TO TAKE MEASURES TO ENSURE STABLE LIQUIDITY IN APRIL (CSJ)

- JPY WEAKNESS EVIDENT AT END OF JAPANESE FY/MONTH-END

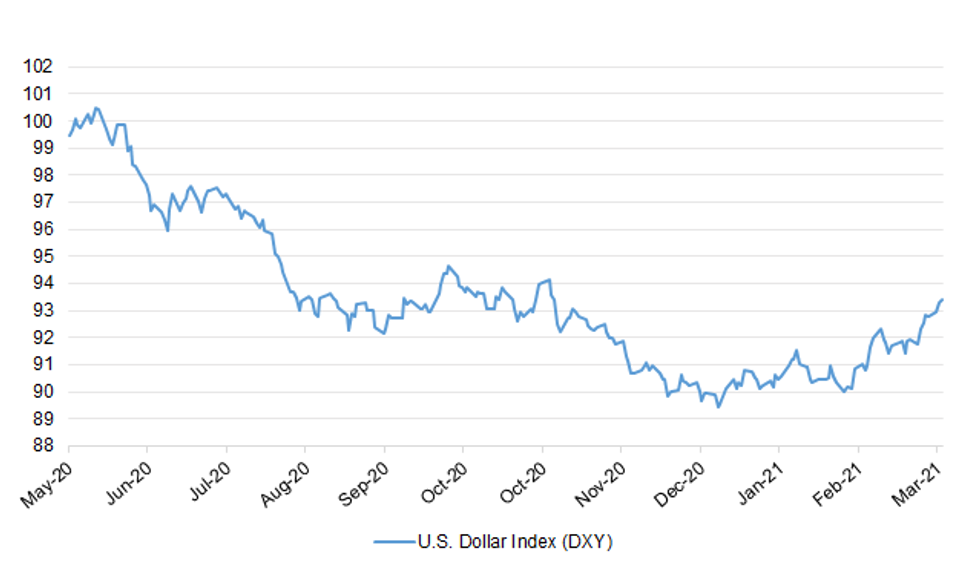

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Fines on hauliers who fail to take a coronavirus test will not be imposed until April 19 under plans to offer a grace period that critics warn risked importing mutant strains of the virus (Matt Dathan writes). From next Tuesday any driver entering the country from outside the UK and Ireland will be tested if they remain for longer than two days. (The Times)

SCOTLAND: Scotland's political leaders have clashed over whether a second independence referendum is needed as the country recovers from the pandemic. SNP leader Nicola Sturgeon said the country was in danger of going in the "wrong direction" if it left decisions on the recovery to Boris Johnson. But her pro-UK opponents said the last thing the country needed was the "divisiveness" of a referendum. They were taking part in a BBC Scotland debate ahead of the election on 6 May. (BBC)

EUROPE

CORONAVIRUS: Germany and France are negotiating with Russia to buy the Sputnik V vaccine after the AstraZeneca jab was restricted to people under the age of 60 in several European countries because of fears about its side effects. Last week Angela Merkel, the German chancellor, directly referred to Sputnik jabs, saying: "On the Russian vaccine, I have been of the opinion for some time that we should use any vaccine that has been approved by the European medicines regulator." (The Times)

GERMANY: Chancellor Angela Merkel said Germany will halt the use of AstraZeneca Plc's Covid vaccine for people younger than 60 starting on Wednesday after new cases of rare blood clots emerged. The policy change, endorsed by state health ministers, came after the release of new data on potential side effects of the vaccine. Germany's vaccination commission said the shots should only be administered to older people as those very rare side effects predominantly occurred in the younger recipients. "These are findings that we and the vaccine commission cannot ignore," Merkel told reporters Tuesday night. "We all know that vaccination is the most important tool against the coronavirus -- that we have different vaccines at our disposal is our good fortune." (BBG)

IRELAND: Ireland will begin easing some restrictions from April 12, after more than three months in lockdown. Travel restrictions will be loosened while some sports and construction will resume, Irish Prime Minister Micheal Martin said in a national address. Limits on household mixing will also be reduced. The government may open so-called non-essential retail in May and hotels in June, depending on the state of the virus, Martin said. Vaccines are to ramp up sharply in the second quarter he added. "We are on the final stretch of this terrible journey," he said. (BBG)

RIKSBANK: Riksbank Governor Stefan Ingves says that "for today and for the foreseeable future," inflation becoming "too high" is "certainly not an issue." If inflation were to rise above the bank's 2% target, "that wouldn't be a problem either for a while," Ingves says; "inflation a little bit higher than 2% isn't really much a problem," Ingves says in online speech. If, "at some future date" inflationary expectations are rapidly increasing after a period of inflation above 2%, "that would produce an increase in the policy rate eventually; rates would go up, that's the end game if we end up with too much inflation." Says Sweden's high level of household debt "will become problematic sooner or later." (BBG)

GREECE: On the assumption that the roll-out of vaccines continues according to plan, the next months present perhaps an opportunity to gradually and carefully move to support measures of a more growth enhancing character that would support this transition, Greek Finance Minister Christos Staikouras says at a virtual event. I think that it's necessary that emergency measures are only withdrawn in a gradual manner and following very specific announcements of governments' plan to this effort. It's also necessary that emergency measures become more targeted. (BBG)

IRELAND/RATINGS: Ireland's credit profile (A2 stable) reflects the country's open, flexible and wealthy economy, which registered an impressive performance before the coronavirus crisis, Moody's Investors Service said in an annual report today. The country also has strong economic prospects based on substantial competitiveness gains, as well as robust export and productivity growth, which is linked to the large presence of high value added multinational corporations. "The Irish economy has been relatively resilient to the pandemic shock, thanks to the strong performance of the multinational sector," said Sarah Carlson, a Moody's Senior Vice President and the report's author. "The economy continued to expand in 2020 and the increase in debt has been much more modest than with peers." (Moody's)

U.S.

FED: As more Americans are vaccinated and households and businesses benefit from fiscal support, there are reasons to be optimistic about the U.S. economy, New York Federal Reserve Bank President John Williams said on Tuesday. Low interest rates reduce borrowing costs and help the economy rebound, Williams said during a virtual event organized by the New York Fed and AARP about small businesses. But fiscal support will also be important for the recovery going forward, Williams said. (RTRS)

FED: Richmond Federal Reserve Bank President Thomas Barkin on Tuesday said he is very "bullish" on the U.S. economy this year, and expects household savings accumulated during the COVID-19 pandemic to help fuel growth in 2022 and 2023 as well. "People just have a lot of money in their pockets," Barkin told the Montgomery County Chamber of Commerce. As vaccinations accelerate and people feel more comfortable going out to dinner and getting on airplanes, he said, they'll spend more of that money, but there's "no way" it will all get spent this year. (RTRS)

FED: The coming summer could see millions of Americans rehired if current trends hold and progress against the pandemic continues, Federal Reserve president Raphael Bostic said on Tuesday, describing that as one of the "upside risks" he is watching. "We could see a burst of activity and performance coming into the summer which could lead us to see even more robust recovery," Bostic said in comments to the Atlanta World Affiars Council. "A million jobs a month could become the standard through the summer." (RTRS)

FED: Dallas Federal Reserve Bank President Robert Kaplan says that he takes a position "different than the median" among Fed officials on interest rate hikes and that he "will be advocating that we should be taking action" once benchmarks for employment and inflation are met. (Nikkei)

FISCAL: U.S. President Biden will give his heavily awaited infrastructure-related address at 16:20 Eastern Time on Wednesday (21:20 London). (MNI)

FISCAL: U.S. President Joe Biden will roll out a roughly $2 trillion job and infrastructure spending plan on Wednesday that will fund road and bridge projects alongside job initiatives over 8 years, according to two sources familiar with the plan. (RTRS)

FISCAL: The White House on Wednesday is expected to unveil a plan to spend $2.25 trillion on a jobs and infrastructure package that could form a cornerstone of President Biden's economic agenda, two people familiar with the matter said. Biden's plan will include approximately $650 billion to rebuild the country's infrastructure, such as its roads, bridges, highways and ports, the people said. The plan will also include in the range of $400 billion toward home care for the elderly and the disabled, $300 billion for housing infrastructure and $300 billion to revive U.S. manufacturing. And it will include hundreds of billions of dollars to bolster the nation's electric grid, enact nationwide high-speed broadband and revamp the nation's water systems to ensure clean drinking water, among other major investments, the people said. (Washington Post)

FISCAL: President Biden is preparing to go to the mat for four tax increases worth about $1.8 trillion to help pay for his infrastructure and social safety net plans, advisers tell Axios. Biden will outline an array of tax proposals beginning on Wednesday — an opening bid ahead of months-long negotiations mostly within the Democratic Party — but these are his priorities. The biggest-ticket item would raise the corporate rate from 21% to 28%. That's worth $730 billion over 10 years, according to the Tax Policy Center. (Axios)

FISCAL: Three House Democrats say they won't support any of President Joe Biden's tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the $10,000 cap on state and local tax deductions, making them just one vote shy of the number needed to block the president's tax plan in the narrowly divided House. "We say 'No SALT, no deal.' The GOP passed an unfair cap of $10,000 on state and local tax (SALT) deductions to pay for their 2017 tax giveaway," Representatives Bill Pascrell and Josh Gottheimer of New Jersey and Tom Suozzi of New York said in a statement Tuesday. "Therefore, we will not accept any changes to the tax code that do not restore the SALT deduction and put fairness back into the system." (BBG)

FISCAL: President Joe Biden will not call for a wealth tax to help pay for his multitrillion-dollar Build Back Better initiative, according to multiple people familiar with the White House's thinking. In doing so, he will sidestep a proposal that progressive Democrats, led by Sen. Elizabeth Warren (D-Mass.), say would raise trillions of dollars in revenue and narrow income inequality. The decision comes amid intense debate in Washington over how to fund the president's sprawling package, which could top $3 trillion. Democrats are pushing for a variety of tax hikes to fund the legislation, while Republicans are vowing to oppose any package that relies on tax increases to raise revenue. (POLITICO)

FISCAL: More Senate Democrats are pressuring President Joe Biden to extend rescue measures as the U.S. recovers from a coronavirus-fueled economic drubbing. Twenty-one members of the Senate Democratic caucus wrote to the president Tuesday urging him to include recurring direct payments and enhanced jobless benefits as part of his recovery plan. The senators, led by Finance Committee Chair Ron Wyden of Oregon, aim to tie the aid to economic conditions so relief does not lapse too early. (CNBC)

FISCAL: Social Security and other federal beneficiaries who do not normally file tax returns can expect their $1,400 stimulus payments to be issued this weekend, the IRS and Treasury Department said on Tuesday. The majority of the payments will be sent electronically and received on April 7, the government agencies said. (CNBC)

FISCAL: The Biden administration is expanding an existing pause on student loan interest and collections to include more than 1.1 million borrowers who are in default, the U.S. Department of Education announced Tuesday. The borrowers, whose defaulted loans are part of the Federal Family Education Loan program, were ineligible for the current payment pause and interest waiver — implemented last year by the Trump administration and extended by President Biden through September — due to their loans being held by private entities. (CNBC)

CORONAVIRUS: Covid-19 deaths in the U.S. are expected to bottom out in the next two weeks and then may inch higher as the nation races to blunt an incipient new wave of cases with its vaccination campaign. A plateau or small increase -- instead of the hoped-for decline -- could mean tens of thousands of additional fatalities. The deaths are likely to dip to 6,028 in the week ending April 10 before slightly increasing, according to the Covid-19 Forecast Hub, a project from the University of Massachusetts Amherst's Reich Lab. Its so-called ensemble forecast, which was updated Tuesday, is based on dozens of independent models and projects fatalities four weeks into the future. (BBG)

CORONAVIRUS: Michigan Gov. Gretchen Whitmer (D), battling a surge of coronavirus infections in her state, appealed on Tuesday to White House officials to shift away from a strict population-based formula for vaccine allocation and instead rush more doses to hard-hit parts of the country. "I know that some national public health experts have suggested this as an effective mitigation tool," she said during the White House coronavirus response team's weekly call with governors, according to a recording of the conversation obtained by The Washington Post. "And I know we'd certainly welcome this approach in our state." (Washington Post)

EQUITIES: Sen. Elizabeth Warren (D-Mass.) called for more oversight and transparency of hedge funds after Archegos Capital Management's fire sale of assets. "Archegos' meltdown had all the makings of a dangerous situation — largely unregulated hedge fund, opaque derivatives, trading in private dark pools, high leverage, and a trader who wriggled out of the [Securities and Exchange Commission's] enforcement," Warren said in a statement emailed to The Hill on Tuesday. "Regulators need to rely on more than luck to fend off risks to the financial system: we need transparency and strong oversight to ensure that the next hedge fund blowup doesn't take the economy down with it," Warren said. (The Hill)

EQUITIES: A FOX reporter tweeted the following on Tuesday: "Sr. Wall Street execs perplexed that @CreditSuisse and @Nomura still havent placed a number on losses tied to Archegos, speculating the firms are still "trapped" in the trade. Leading to widespread speculation that $CS will do a capital raise." (MNI)

EQUITIES: President Joe Biden plans to allow a pandemic-related ban on visas for certain temporary workers, enacted by former President Donald Trump, to expire Wednesday, according to people familiar with the matter. The moratorium, which affected H-1B visas used by technology companies to hire foreign coders and engineers, was imposed last June. Biden is opting not to renew it, said the people, who asked not to be identified because the decision hasn't been announced. The White House declined to comment. (BBG)

OTHER

U.S./CHINA: Federal Communications Commissioner Brendan Carr on Tuesday called for new steps to ensure Huawei Technologies and ZTE equipment is barred from U.S. telecommunications networks and ensure no electronic devices produced with forced labor enter the United States. (RTRS)

U.S./CHINA: An annual human rights report released by the State Department accused the Chinese government of "crimes against humanity" and reaffirmed a decision to label China's treatment of minority Uyghurs in its western region of Xinjiang as "genocide." The publication Tuesday of the "2020 Country Reports on Human Rights Practices" signaled continued tensions with China under President Joe Biden, who has maintained many of the Trump administration's hard-line policies against Beijing. (BBG)

U.S./CHINA/HONG KONG: The United States strongly condemns moves by China to further reduce political participation and representation in Hong Kong and is deeply concerned by a second delay in the territory's LegCo elections, the U.S. State Department said on Tuesday. "We are deeply concerned by these changes to Hong Kong's electoral system, which defy the will of people in Hong Kong and deny Hong Kongers a voice in their own governance," a State Department spokesman said in an email when asked about the changes finalized on Tuesday. The sweeping overhaul of Hong Kong's electoral system will drastically curb democratic representation as authorities seek to ensure "patriots" rule the global financial hub. (RTRS)

CORONAVIRUS: The World Health Organization's chief said a mission to study the origins of the coronavirus in China was too quick to dismiss the theory of a lab leak, with the U.S. and other governments joining in criticism of the investigation. WHO Director-General Tedros Adhanom Ghebreyesus said the probe didn't adequately analyze the possibility of a lab accident before deciding it's most likely the pathogen spread from bats to humans via another animal. In a briefing to member countries Tuesday, he said he is ready to deploy additional missions involving specialist experts. (BBG)

CORONAVIRUS: The United States signed on to a joint statement with 13 other nations Tuesday criticizing the World Health Organization's long-anticipated report on the origins of Covid-19. In a joint statement, the governments of Australia, Canada, Czechia, Denmark, Estonia, Israel, Japan, Latvia, Lithuania, Norway, South Korea, Slovenia, United Kingdom and the United States, wrote that the report "was significantly delayed and lacked access to complete, original data and samples." (CNBC)

GLOBAL TRADE: Britain's international trade secretary has called for the world to "get tough with China" as part of a shake-up of the global trading regime which she claims is "stuck in the 1990s". Liz Truss will on Wednesday urge the US and other G7 countries to work to revive the World Trade Organization, which has been caught in the crossfire between Washington and Beijing. Speaking ahead of a virtual meeting of G7 trade ministers on Wednesday — the UK is the current chair of the group of advanced economies — Truss urged the US to put its weight behind the daunting task of reforming the WTO. (FT)

GLOBAL TRADE: UMC and Powerchip Semiconductor Manufacturing plan to raise OEM prices for chips by another 10% in April, after a hike earlier this year, Taipei-based DigiTimes reports, citing unidentified people in the industry. (BBG)

GLOBAL TRADE: Senior trade officials from the United States met on Tuesday with their counterparts from Uzbekistan, Kazakhstan, Kyrgyz Republic, Tajikistan, and Turkmenistan on a range of trade issues, underscoring their desire to strengthen trade ties among countries in the region, and with the United States. Participants in the meeting of the U.S.-Central Asia Trade and Investment Framework Agreement (TIFA) also discussed the importance of digital trade for achieving broad-based inclusive economic growth and innovation, they said in a joint statement. The officials agreed to focus on ensuring the free flow of information across borders, transparency, competition, and non-discrimination, and to include women, small and medium enterprises and other stakeholders, in shaping new policies. (RTRS)

GLOBAL TRADE: The head of the Port of Los Angeles on Tuesday urged companies to pick up their shipments in a more expedited manner to help ease congestion. "The container dwell time is much higher than it was pre-pandemic," Executive Director Gene Seroka said on CNBC's "Squawk on the Street," referring to the length of time a container spends at the port. (CNBC)

AUSTRALIA/CHINA: Nearly 9,000 litres of red wine from a vineyard owned by renowned Australian pearling company Paspaley Group were detained in south China last month, as Beijing's block on Australian wine continues amid a protracted dispute between the two countries and new anti-dumping duties on the trade. Some 8,640 litres from Paspaley's Bunnamagoo Estate winery and 2,646 litres of red wine from Australian private label supplier Lindsdale were stopped in Shenzhen for poor labelling and excessive use of additives, respectively, Chinese customs data showed. (SCMP)

RBNZ: New Zealand's central bank has eased restrictions on bank dividend payments, allowing them to distribute as much as 50% of net income to shareholders. The decision partially reverses steps the Reserve Bank took in April last year to provide more credit to the economy via the banking system. The remaining 50% limit will be lifted in July 2022 subject to no worsening in economic conditions, the central bank said in a statement Wednesday in Wellington. New Zealand's enjoyed a V-shaped recovery in the second-half of 2020 after the RBNZ slashed interest rates and the government unleashed a record fiscal stimulus to support incomes. The decision to halt dividends was aimed at supporting financial stability and keeping capital within the banking system. The nation's four biggest banks are all wholly owned units of Australian lenders. (BBG)

SOUTH KOREA: Finance Minister Hong Nam-ki has forecast domestic demand and the job market will gradually improve as the country is on a recovery track amid the pandemic, the finance ministry said Wednesday. Hong made the assessment during his online meeting Tuesday with Alastair Wilson, managing director and head of the sovereign risk group of global rating agency Moody's Investors Service. The country held its annual consultation meetings with Moody's between March 25 and 30 over its economic conditions and policy response to the COVID-19 pandemic. The minister said private spending and consumer sentiment are recovering and job data for March is expected to show marked improvement. The country reported job losses for the 12th straight month in February, but its job reduction eased from January. Hong, meanwhile, sounded the alarm against growing national debt. (Yonhap)

CANADA: Canada took another step toward achieving its goal of vaccinating all willing Canadians by September, announcing a significant jump in Pfizer-BioNTech vaccine deliveries for the month of June. Prime Minister Justin Trudeau said Tuesday that the pharmaceutical company confirmed it will "move up" five million doses from later in the summer into June, bringing Canada's total expected doses from 4.6 million to 9.6 million for that month alone. (Global News)

CANADA: MNI REALITY CHECK: Canada GDP Resilient As Firms Adapt to Covid

- Canadian industry leaders told MNI the economy has become more resilient as firms adapt to pandemic shutdowns, though growth prospects still rest on how soon vaccines roll out and whether more lockdowns are imposed in the meantime.

BRAZIL: Commanders of Brazil's army, navy and air force were fired on Tuesday after President Jair Bolsonaro dismissed his defense chief as part of a broader cabinet restructuring. The shake-up, precipitated by congressional allies who have been unhappy with the president's pandemic response, displeased the heads of the military who received no advance warning about the replacement of Defense Minister Fernando Azevedo e Silva, according to two people close to the armed forces who asked not to be named because the discussions are private. (BBG)

BRAZIL: Brazil's central government reported a primary budget deficit of 21.2 billion reais ($3.7 billion) in February, the Treasury said on Tuesday, less than the 26.5 billion reais shortfall economists in a Reuters poll had forecast. That was also 22% smaller in real terms than the deficit in the same month a year ago, while the primary deficit accumulated in the 12 months through February was 776.8 billion reais, worth 9.9% of gross domestic product, Treasury said. (RTRS)

BRAZIL: Brazil's Treasury on Tuesday warned that the 2021 federal budget approved by Congress threatens one of the government's key pillars of fiscal stability, and urged the estimates for mandatory spending be brought up to a more "realistic" level. "The underestimation of mandatory spending in the budget causes problems for the ceiling because such spending will have to be compensated for by cuts in parliamentary amendments or discretionary spending," the Treasury said. "Mandatory expenditures should be brought (up) to a realistic value," it said, adding that Brazil continues to face a "very challenging year both for the health of the population and the health of the public finances." The Treasury's comments echo warnings a day earlier from the Independent Fiscal Institute (IFI) watchdog that the government is on course to break its spending cap by 39 billion reais ($6.8 billion) this year. (RTRS)

BRAZIL: Without fiscal balance, monetary policy becomes less efficient, Central Bank President Roberto Campos Neto says in a virtual event. First concern is the need to reopen the economy through vaccination. "In 2, 3 months we will have vaccinated a large part of the priority Group." Reflation scenario is different in developed and in emerging countries. (BBG)

BRAZIL: Brazil hit a record of 3,780 on Covid-19 deaths as the pandemic spirals out of control in Latin America's largest country. Total coronavirus fatalities reached 317,646 and 84,494 new cases were registered in the last 24 hours, totaling almost 12.7 million, while the country works to speed up vaccination under new Health Minister Marcelo Queiroga. The country's health regulator issued a good practices certificate for Janssen's facilities, but denied the same certification for Bharat Biotech. Brazilian foundation Fiocruz expects to file a request to start testing the AstraZeneca/Oxford vaccine in children, the head of the organization Nisia Trindade, said in an online event promoted by the World Health Organization. (BBG)

BRAZIL: Brazil just reached a grim Covid-19 milestone, and a reporter based in Sao Paulo doesn't see the situation improving in the near future. "We have people dying because of lack of oxygen, people are literally suffocating," Patricia Campos Mello, a reporter for Folha de Sao Paulo, told CNBC's "The News with Shepard Smith" on Tuesday. "There are no medications for intubation, there are no ICU beds. It's a combination of lack of planning and just denialism of the seriousness of the disease." "The situation is completely out of control," Campos Mello added. (CNBC)

RUSSIA: Suspected Russian hackers stole thousands of State Department officials' emails last year, according to two Congressional sources familiar with the intrusion, in the second known Kremlin-backed breach on the department's email server in under a decade. The hackers accessed emails in the department's Bureau of European and Eurasian Affairs and Bureau of East Asian and Pacific Affairs, the congressional sources said. It does not appear at this point that the classified network was accessed, a third official said. (POLITICO)

SOUTH AFRICA: South Africa's government bowed to pressure from religious groups and increased the number of those allowed to attend public gatherings, even as fears grow of an impending resurgence in coronavirus infections. As many as 250 people can now attend indoor activities and 500 outdoors, President Cyril Ramaphosa said in an address to the nation on Tuesday night. The raised limit will be reviewed in 15 days, allowing festivals such as Easter and Passover to come and go under eased restrictions. The decision came after days of debate about how South Africa should address an upcoming holiday period that sees millions of people travel to see family and friends and attend religious ceremonies. While active Covid-19 case numbers have dropped dramatically since January, the country lags behind emerging-market peers in vaccinations, with only 240,000 health workers inoculated to date. (BBG)

IRAN: Efforts to sketch out initial U.S. and Iranian steps to resume compliance with the 2015 nuclear deal have stalled and Western officials believe Iran may now wish to discuss a wider road map to revive the pact, something Washington is willing to do. (RTRS)

MIDDLE EAST: The U.S. has granted Iraq a 120-day waiver to avoid penalties for buying natural gas and electricity from Iran, as the Biden administration takes a more lenient stance than the Trump administration. This is the first official test of President Joe Biden's diplomacy with Iraq over Iran, following the Trump administration's withdrawal from the Iran nuclear deal and subsequent resumption of sanctions, which put Baghdad in the crosshairs since it relies on Iran for energy supplies. (Iraq Oil Report)

BONDS: Ontario Teachers' Pension Plan has slashed its holdings of government bonds from developed countries after reaping large gains during last year's plunge in yields. The pension fund, one of Canada's largest investment managers, eliminated exposure to sovereign debt with negative interest rates and reduced its holdings of the lower-yielding bonds. Teachers' generated more than C$10 billion ($7.9 billion) in investment income from the asset class in the first half of 2020, the fund said in reporting its 2020 results Tuesday. Its fixed income portfolio gained 20.7%. Such gains won't be repeated any time soon, Ziad Hindo, chief investment officer of the C$221.2 billion ($175 billion) fund, said in a statement. (BBG)

METALS: As Australia deepens its connection to the Quad grouping with the U.S., Japan and India, forming a de facto anti-China tag team in the Indo-Pacific, Beijing has found it increasingly uncomfortable to depend so much on Canberra for iron ore -- the basic material behind its own military buildup. But that dependence may very well change by 2025, says Peter O'Connor, senior analyst of metals and mining at Australian investment firm Shaw and Partners. "They are very serious" about diversifying supply and flattening the cost curve of iron ore, O'Connor told Nikkei Asia. The top focus for China's diversification push is Guinea, a poor country in West Africa, O'Connor said. A 110 km range of hills called Simandou is said to hold the world's largest reserve of untapped high-quality iron ore. (Nikkei)

METALS: China is considering a number of tax changes for its steel industry to encourage imports and reduce exports amid a push to reduce the nation's carbon emissions, according to two people familiar with the matter, who asked not to be identified because they're not authorized to speak publicly. (BBG)

OIL: OPEC expects oil inventories to drop by about 445 million barrels in 2021 in the latest supply and demand outlook being reviewed by a technical meeting on Tuesday, according to a copy of the report seen by Reuters. The figure is larger than the implied 2021 stock draw of 406 million barrels seen a month ago by OPEC in a similar report, showing deep supply curbs are reducing the supply overhang. OPEC+ experts, the Joint Technical Committee, met on Tuesday ahead of a ministerial meeting on Thursday to decide oil output policy. The producers are withholding millions of barrels of daily supply to support the market. (RTRS)

OIL: A panel of OPEC+ technical experts agreed to revise down oil- demand estimates for 2021, signaling a more negative view of the market just days before the group decides on production policy. The OPEC+ Joint Technical Committee now estimates that global oil demand will expand by 5.6 million barrels a day this year, down from 5.9 million previously, according to delegates and documents seen by Bloomberg. The revision, which mainly affects the next few months, follows a recommendation from OPEC Secretary-General Mohammad Barkindo earlier on Tuesday that the coalition should remain very cautious. (BBG)

CHINA

CORONAVIRUS: China reported six confirmed cases and three asymptomatic Covid-19 infections on Wednesday, the first cluster since mid-February, the country's National Health Commission said. Local health authorities in Ruili city in the southwestern province of Yunnan found one person testing positive for the coronavirus on March 29 during a regular screening among key populations, the provincial health commission said. Subsequent contact tracing led to the discovery of another eight people who tested positive. Among them, four are Burmese and the other five are Chinese. The province boasts caves that are the natural habitat for bats, from which Chinese scientists found a distant relative of the Sars-CoV-2 virus years before the pathogen caused an outbreak in Wuhan and spawned the global pandemic. (BBG)

PBOC: The PBOC is likely to inject more liquidity in April via reverse repos and medium-term lending facilities to meet demand for tax payments and the issuance of local government debts, the China Securities Journal reported citing analysts. There will be a liquidity gap of around CNY300 billion in the banking system if the PBOC doesn't make any injections, the newspaper said citing Sun Binbin, analyst at Tianfeng Securities. The PBOC has made no net injections in the past three weeks, the newspaper said. (MNI)

ECONOMY: China will step up support for small businesses, including providing more financial and fiscal support, to revive weak private investment and further this year's growth momentum, the Economic Information Daily said in an analysis of the current state of the economy. While growth is likely to exceed 10% in Q1, partly due to last year's lower base of comparison, central and local planning and finance officials are urging quicker starts for infrastructure investment projects and more tax cuts to prevent a slowdown later this year, the newspaper said. (MNI)

POLICY: China will promote high-quality development of the central region and the greater opening of inland provinces, according to a statement on the government website following a top Politburo meeting chaired by President Xi Jinping on Tuesday. The Central region should focus on building modern industries supported by advanced manufacturing along with the urbanization of the Central Plains, the statement said. The region should promote low-carbon industries and environmentally sound development, the government said. (MNI)

FISCAL: Chinese local governments sold 55.7b yuan of bonds at an average yield of 3.45% in Feb., the Ministry of Finance says in a statement. That includes 29.5b yuan of general bonds and 26.2b yuan of special Bonds. (BBG)

BANKS: Postal Savings Bank of China led the country's top six national banks with 5% growth in net profits last year, followed by Bank of China with 3% while the other four including ICBC registered around 1%, the 21st Century Business Herald reported citing the annual reports. Profits of the six majors totaled CNY1.34 trillion, it said. The China Construction Bank saw its NPL rise by 0.14 percentage point to 1.56%, and increased provisions dragged its profit growth to 1.6% from 5.3% in the previous year, the newspaper said. (MNI)

OVERNIGHT DATA

CHINA MAR M'FING PMI 51.9; MEDIAN 51.2; FEB 50.6

CHINA MAR NON-M'FING PMI 56.3; MEDIAN 52.0; FEB 51.4

CHINA MAR COMPOSITE PMI 55.3; FEB 51.6

MNI DATA IMPACT: China March PMI Rises to 3-Mon High At 51.9

China's manufacturing activity as measured by the Purchasing Manager Index (PMI) rose to 51.9 in March from 50.6 in February, reaching a three-month high as manufacturers accelerated their production after the Chinese New Year holidays, the National Bureau of Statistics said on Wednesday. The PMI registered a 13th-month expansion above the breakeven 50.0 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN FEB, P INDUSTRIAL OUTPUT -2.6% Y/Y; MEDIAN -1.8%; JAN -5.2%

JAPAN FEB, P INDUSTRIAL OUTPUT -2.1% M/M; MEDIAN -1.3%; JAN +4.3%

JAPAN FEB LOANS & DISCOUNTS CORP +7.46% Y/Y; JAN +7.29%

JAPAN FEB HOUSING STARTS -3.7% Y/Y; MEDIAN -4.9%; JAN -3.1%

JAPAN FEB ANNUALISED HOUSING STARTS 0.808MN; MEDIAN 0.804MN; JAN 0.801MN

JAPAN FEB CONSTRUCTION ORDERS +2.5% Y/Y; JAN +14.1%

AUSTRALIA FEB BUILDING APPROVALS +21.6% M/M; MEDIAN +3.0%; JAN -19.4%

AUSTRALIA FEB PRIVATE SECTOR HOUSES +15.1% M/M; JAN -11.8%

AUSTRALIA FEB PRIVATE SECTOR CREDIT +1.6% Y/Y; MEDIAN +1.7%; JAN +1.7%

AUSTRALIA FEB PRIVATE SECTOR CREDIT =0.2% M/M; MEDIAN +0.3%; JAN +0.2%

NEW ZEALAND MAR, F ANZ BUSINESS CONFIDENCE -4.1; FLASH 0.0

NEW ZEALAND MAR, F ANZ ACTIVITY OUTLOOK 16.6; FLASH 17.4

Business sentiment and activity indicators ticked down in March, consistent with our view that the economy would start to struggle a bit more as the lack of tourists reached its seasonal cash-flow peak impact and the unsustainable bounce in retail spending started to dissipate. The levels remain relatively robust but may have peaked for now. (ANZ)

SOUTH KOREA FEB INDUSTRIAL OUTPUT +0.9% Y/Y; MEDIAN +1.0%; JAN +7.8%

SOUTH KOREA FEB INDUSTRIAL OUTPUT +4.3% M/M; MEDIAN +1.1%; JAN -1.2%

SOUTH KOREA FEB CYCLICAL LEADING INDEX CHANGE +0.2 M/M; JAN +0.3

SOUTH KOREA APR BUSINESS SURVEY M'FING 91; MAR 85

SOUTH KOREA APR BUSINESS SURVEY NON-M'FING 78; MAR 73

UK MAR BRC SHOP PRICE INDEX -2.4% Y/Y; FEB -2.4%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:29 am local time from the close of 2.2434% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 58 on Tuesday vs 35 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5713 WEDS VS 6.5641

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a sixth day at 6.5713 on Wednesday, compared with the 6.5641 set on Tuesday.

MARKETS

SNAPSHOT: USD/JPY Threatens To Breach Y111.00 At End Of Japanese FY

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 212.67 points at 29226.01

- ASX 200 up 100.155 points at 6837.7

- Shanghai Comp. down 21.222 points at 3435.455

- JGB 10-Yr future down 5 ticks at 151.18, yield down 0.1bp at 0.090%

- Aussie 10-Yr future down 2.0 ticks at 98.170, yield up 1.8bp at 1.801%

- U.S. 10-Yr future -0-03 at 131-03, yield up 3.02bp at 1.733%

- WTI crude up $0.3 at $60.89, Gold down $4.89 at $1680.31

- USD/JPY up 47 pips at Y110.83

- BIDEN'S INFRASTRUCTURE ADDRESS EYED

- FED'S BARKIN SEES EXCESS SAVINGS DRIVING ECONOMY FOR YEARS

- OFFICIAL CHINESE PMIS TOP EXP.

- PBOC TO TAKE MEASURES TO ENSURE STABLE LIQUIDITY IN APRIL (CSJ)

- JPY WEAKNESS EVIDENT AT END OF JAPANESE FY/MONTH-END

BOND SUMMARY: Core FI A Touch Lower In Asia

Weakness in T-Notes allowed the 7- to 10-Year zone of the cash Tsy curve to underperform overnight, cheapening by ~3.5bp on the day, with T-Notes last printing -0-03+ at 131-02+. The move was aided by JPY weakness (much of the JPY movement surrounded the end of FY flows in Japan around the Tokyo fix), and firmer than expected official PMI readings out of China. Elsewhere, participants continue to look ahead to today's infrastructure related address from U.S. President Biden.

- Some modest pressure crept into the JGB space on the back of the same drivers. Cash trade sees 20+-Year paper a touch cheaper, with the remainder of the curve trading either side of unchanged, while futures sit 6 ticks softer on the day. The BoJ left the size of its 3- to 5- & 10- to 25+-Year JGB purchases at unchanged levels, with little to note on the offer/cover front. As we noted earlier, the BoJ's April Rinban plan is due to hit after hours and this is the first time that we will see the outright purchase amounts given in the Rinban plan (ranges were given in the past). Some have suggested that the BoJ could cut the size of its super-long JGB purchases, while others have suggested that any such move would come too soon after the BoJ's March decision and may risk muddying the message of a need for low yields across the entirety of the curve.

- Aussie bonds generally drifted lower in the wake of the firmer than expected official PMI readings out of China and stronger than expected local building approvals data, with the pressure applied to U.S. Tsys also noted. Futures have corrected from worst levels, although there is little in way of support seen from the previously flagged "modest" month-end extension for local bond market indices. A reminder that today's ACGB Nov '31 supply wasn't the firmest in pricing terms, but was still smoothly absorbed. YM -0.5, XM -2.0. the 10- to 12-Year zone of the curve underperforms in cash ACGB trade.

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y520bn of JGB's from the market, sizes unchanged from previous operations.

- Y370bn worth of JGBs with 3-5 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.00% 21 Nov '31 Bond, issue TB#163:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.00% 21 November 2031 Bond, issue TB#163:- Average Yield: 1.8381% (prev. 1.7759%)

- High Yield: 1.8400% (prev. 1.7775%)

- Bid/Cover: 2.4675x (prev. 3.3000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 85.3% (prev. 84.2%)

- bidders 43 (prev. 41), successful 23 (prev. 10), allocated in full 14 (prev. 4)

EQUITIES: Negative Note For Quarter-End

Asia-Pac markets are mostly in the red, taking a negative lead from the US. Markets await clarity on the latest fiscal stimulus package from the US. In Japan the financial sector is the laggard, hampered by reports that Mitsubishi UFJ will also take a hit from Archegos Capital Management fire sale. Markets in mainland China are lower despite strong PMI data, repo rates have risen heading into month and quarter end. Australia and India are the outperformers, gaining after declining for the previous two sessions. Most major indices in Asia are on track for their first monthly loss since last October. Futures in the US are higher, bouncing after declines yesterday.

OIL: OPEC+ Meeting Eyed

Crude futures are essentially flat in Asia-Pac hours; WTI up $0.01 from settlement levels at $60.56, while Brent is $0.06 higher at $64.20 – the benchmarks are holding declines from yesterday.

- Markets look ahead to the OPEC+ meeting on Thursday, the group are expected to maintain output cuts given signs in the last few weeks of the fragility of the oil rally. There are reports that Saudi Arabia has not yet decided its position on oil production quotas. The OPEC+ JMMC met ahead of the meetings and revised down oil demand, they now forecast that global demand will expand by 5.6m bpd this year, a 300k bpd reduction. The downward revision came after OPEC SecGen Barkindo warned the group must remain cautious.

- Elsewhere, data from API yesterday showed headline crude inventories rose again, adding 3.91m bbls. Downstream stockpile figures were more bullish, gasoline stocks fell 6.01m bbls while distillate stocks rose 2.6m bbls.

- There are positives though, in China PMI figures were strong while the IMF will upgrade growth forecasts next week.

GOLD: Probing Tuesday's Low

U.S. Tsy yields have nudged higher in Asia-Pac hours after their pullback during Tuesday's NY session, with the broader DXY a touch firmer (although that is mainly due to JPY weakness vs. the USD, with the moves vs. G10 FX a little more nuanced on a case by case basis), building on Tuesday's bid. Spot gold is lower as a result, last -$5/oz at $1,680/oz, but hasn't yet managed to force a sustained, meaningful break below Tuesday's trough. Bears currently eye the bear trigger in the form of the Mar 8 low (located at $1,676.9/oz) as their next technical target.

FOREX: JPY Falters Into Japanese FY-End, G10 FX In Risk-On Mood

Optimism surrounding the upcoming fiscal announcement from U.S. Pres Biden and a round of strong official Chinese PMI readings resulted in risk-on flows across G10 FX space. The yen went offered into the final Tokyo fix of the Japanese fiscal year, extending losses thereafter as wider sentiment remained buoyant. Demand for the greenback helped push USD/JPY towards the psychological Y111.00 barrier, but the round figure proved resilient.

- The usual talk of quarter-/month-end flows lending support to the greenback did the rounds. The DXY extended its recent rally to a fresh five-month high as U.S. Tsy yields firmed ahead of Biden's speech.

- Commodity-tied currencies & growth proxies benefitted from appetite for riskier assets and sighed with relief as crude oil bounced off yesterday's low. The Aussie led the way, with AUD/USD consolidating above $0.7600 as BBG trader sources flagged morning purchases by Aussie exporters.

- The PBOC set its central USD/CNY mid-point at CNY6.5713, in line with sell-side estimates. USD/CNH traded sideways, looking through upbeat Chinese data.

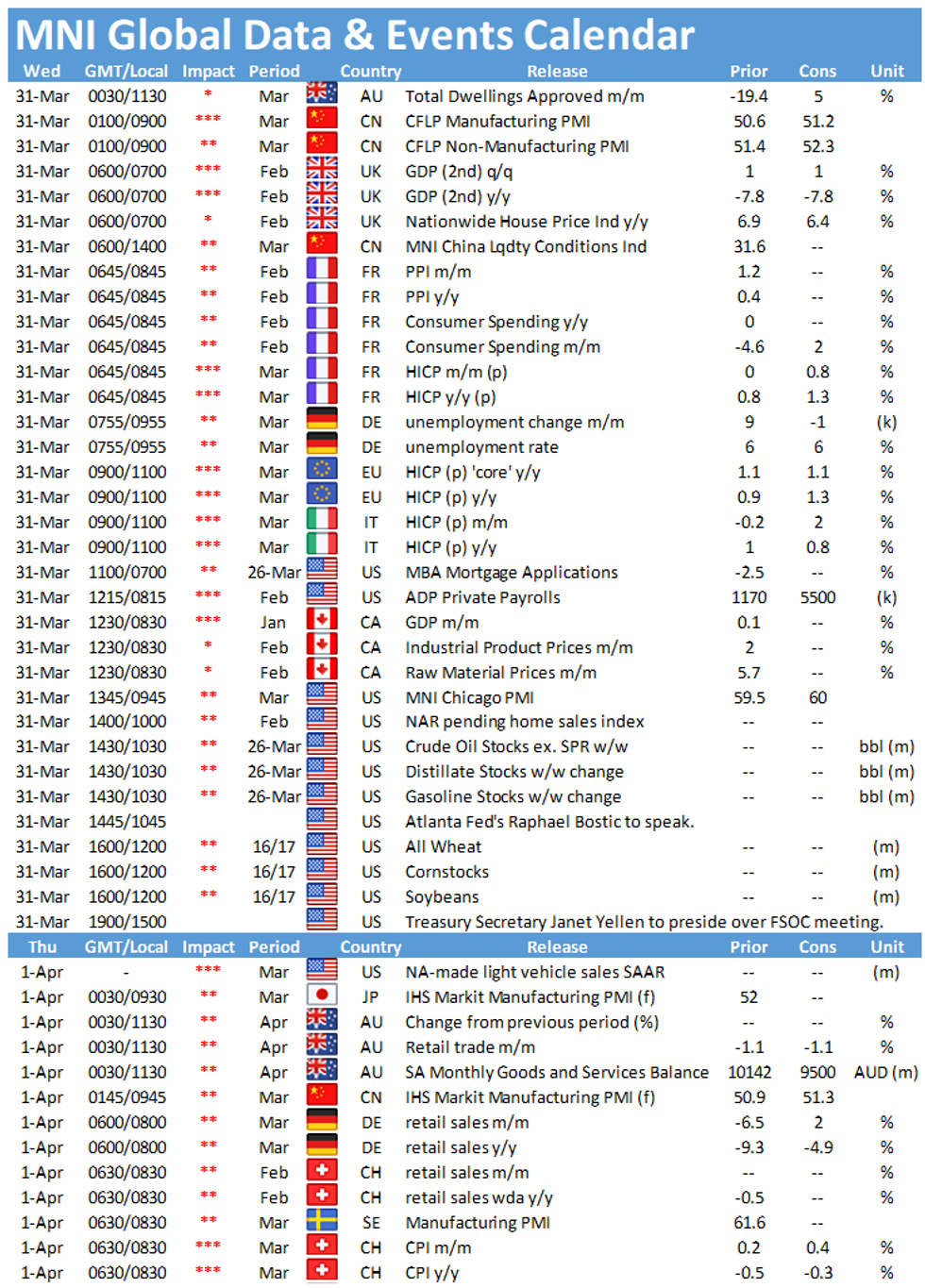

- U.S. MNI Chicago PMI, UK & Canadian GDPs, flash EZ, French & Italian CPIs, German unemployment and comments from ECB's Villeroy, Rehn & Visco take focus from here.

FOREX OPTIONS: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E714mln), $1.1725-30(E648mln-EUR puts), $1.1750(E1.2bln), $1.1770-75(E1.2bln), $1.1785-90(E818mln), $1.1800(E1.2bln), $1.1850(E1.36bln-EUR puts), $1.1880(E606mln), $1.1900(E1.8bln), $1.1920-25(E1.7bln), $1.1945-56(E1.3bln), $1.2000(E1.0bln)

- USD/JPY: Y108.50($725mln), Y109.50($630mln), Y110.00($2.6bln-$2.48bln of USD puts), Y110.15-20($1.25mln-USD puts), Y110.50($685mln-USD puts), Y110.80($475mln-USD puts)

- GBP/USD: $1.3650-70(Gbp686mln), $1.3800(Gbp921mln-GBP puts), $1.3825(Gbp432mln-GBP puts), $1.3945-50(Gbp537mln), $1.3960-75(Gbp720mln), $1.4000(Gbp751mln)

- EUR/GBP: Gbp0.8515-25(E1.2bln-EUR puts), Gbp0.8540-50(E1.3bln-EUR puts), Gbp0.8600(E1.3bln-E1.2bln of EUR puts), Gbp0.8645-50(E664mln)

- USD/CHF: Chf0.9250($660mln)

- AUD/USD: $0.7450(A$864mln), $0.7500(A$1.3bln), $0.7600-05(A$732mln), $0.7650(A$774mln), $0.7675-90(A$917mln), $0.7700(A$1.0bln), $0.7750-60(A$1.8bln), $0.7770-80(A$1.3bln), $0.7790-0.7800(A$1.1bln), $0.7825-30(A$615mln)

- AUD/JPY: Y84.45(A$782mln)

- EUR/AUD: A$1.5450-60(E696mln-EUR puts)

- USD/CAD: C$1.2500($837mln), C$1.2600-05($690mln), C$1.2645-50($1.1bln-USD puts)

- USD/CNY: Cny6.50($660mln), Cny6.5600-20($1.1bln), Cny6.62($1.0bln)

- USD/MXN: Mxn19.95($890mln), Mxn20.25($516mln), Mxn20.30($631mln), Mxn20.56($680mln), Mxn20.90($540mln)

- USD/ZAR: Zar14.75($511mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.