-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Awaiting S&P's Italy Verdict

Fig. 1: Gilts Bear Steepen On The Week's Brexit Optimism

BBG, MNI

BBG, MNI

EGB SUMMARY: A steadier afternoon session

A steadier afternoon session for EGBs going into the weekend, as the street awaits for news on US stimulus and Brexit.

- Bund curve has reversed most of the flattening from this morning and sit bear steeper on the margin.

- BTP has been the best performer, a continuation from the large buying noted this morning.

- As such, BTP/Bund spread is 3.4bps tighter on the day.

- Looking ahead, after market a few ratings are scheduled

- S&P on the UK (current rating: AA; Outlook Stable), the EFSF (current rating: AA; Outlook Stable), Greece (current rating: BB-; Outlook Stable) & Italy (current rating: BBB; Outlook Negative).

- Fitch on the Netherlands (current rating: AAA; Outlook Stable).

- DBRS Morningstar on Greece (current rating: BB (Low); Stable Trend).

- Bund futures are up 0.08 today at 175.27

- BTP futures up 0.49 at 148.94

- OAT futures up 0.19 at 169.34.

GILT SUMMARY: Back To Flat

Having steadily sold off through the morning, gilts have clawed back losses and now trade close to unch on the day.

- Last yields: 2-year -0.0384%, 5-year -0.0315%, 10-year 0.2837%, 30-year 0.8507%.

- The Dec-20 gilt future trades at 135.57, similarly in line with yesterday's close.

- Short sterling futures are broadly 0.5-1.0 ticks lower on the day.

- Flash PMI data for October, published this morning, showed a slight deterioration in momentum, but indicated that the services and manufacturing sectors were still firmly rooted in expansion mode. Retail sales volumes surprised higher in September with ex Auto series increasing 1.6% Y/Y vs 0.5% survey.

- Reuters reports that France is preparing a compromise on access to UK fishing waters in a bid to help the EU secure a Brexit deal.

- The DMO sold GBP1.75bn of 1-/3-/6-month T-Bills.

DEBT FUTURES / OPTIONS:

- 0LH1 100.00/100.12/100.25c fly, bought for 1.5 in another 2k (4k total)

- 0LH1 100.12/100.25/100.50c fly. Bought for 0.75 in 2.5k

- LM1 100.00/100.125/100.25/100.375c condor, bought for 2.75 in 4k

- LM1 100.12/100.37cs 1x1.5, bought for 3.25 in 10k (ref 100.01, 20 del)

- LZ1 100^, bought for 23.75 in 500

- ERU1 100.625c, bought for 4 in 3k (ref 100.55)

- 3RZ0 100.375/100.25ps, bought for 1.25 in 1k

- RXZ0 178c, bought for 9 in 5k

- RXZ0 177/178cs 1x2 bought for 3 in 1.25k

- RXZ0 174.00/173.00ps 1x1.5, bought for 10 in 2.8k

- RXZ0 174.00p/176.00c^^, sold at 76 in 2.5k

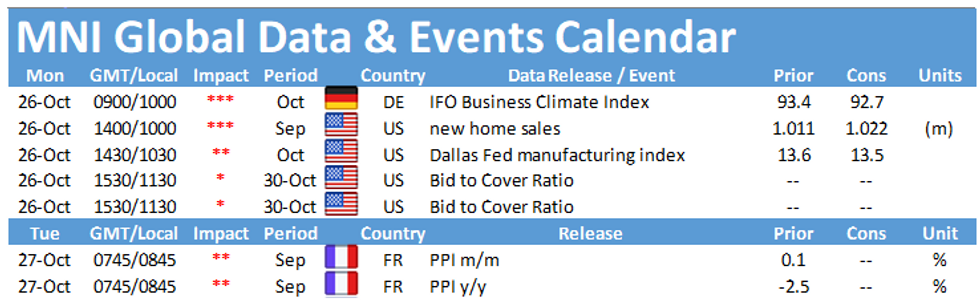

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.