-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: BTP Strength Continues

By Tim Cooper, Tim Davis and Bruce Jeffery

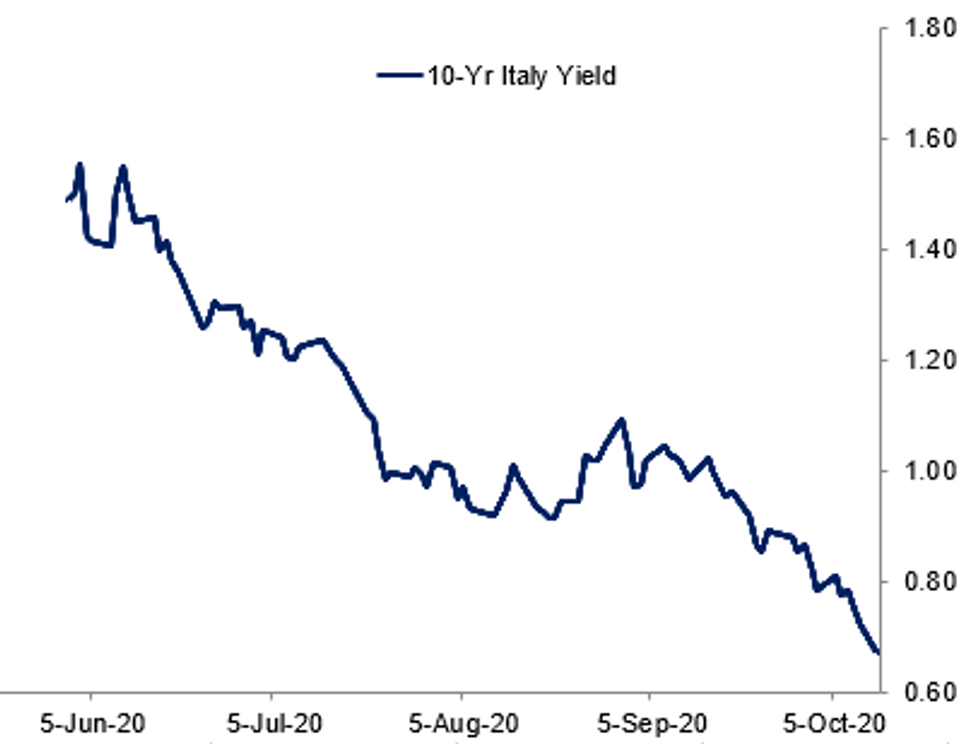

Fig 1: Italian Debt Continues To Rally

Bloomberg, MNI

Bloomberg, MNI

EGB SUMMARY: BTPs continue to outperform

Bunds have traded largely within Friday's range (albeit hitting a high of the day one tick higher than Friday at 174.87. Volatility has been fairly subdued today with North America on holiday.

- Equities have moved higher today across the region with peripheral spreads narrowing but there has been little in the way of standout headline news or data.

- BTPs continue to be among the outperformers with 10-year spreads to Bunds now as low as 122bp - the lowest levels since May 2018. We note that the tightest closing level since Q1 2016 is now in sight at 113bp.

- Bund futures are up 0.15 today at 174.83 with 10y Bund yields down -1.7bp at -0.545% and Schatz yields down -1.2bp at -0.731%.

- BTP futures are up 0.41 today at 149.88 with 10y yields down -4.6bp at 0.677% and 2y yields down -1.8bp at -0.347%.

- OAT futures are up 0.17 today at 169.20 with 10y yields down -1.9bp at -0.286% and 2y yields down -0.5bp at -0.694%.

GILT SUMMARY: BoE Conducts Survey On NIRP Readiness

It has been a relatively uneventful session for gilts in light of the lack of data/news headlines and the US public holiday.

- Gilts have marginally firmed with cash yields 1bp lower on the day. Last yields: 2-years -0.0342%, 5-year -0.0392%, 10-year 0.2661%, 30-year 0.8464%.

- The Dec-20 gilt future trades at 135.56, near the top end of the day's range (L: 135.37 / H: 135.58).

- The Bank of England has written to financial institutions in the UK asking about their ability to deal with negative interest rates. While this may be cited as evidence that the Bank is gearing up for further policy rate cuts, it could also just reflect the Bank's own analytical work into the efficacy of NIRP.

- The BoE purchased GBP1.473bn of short-dated gilts with offer-to-cover of 4.3x.

- Looking ahead, tomorrow sees the release of claimant count data for September and employment/earnings data for August.

DEBT FUTURES/OPTIONS:

EGB/Euribor/Short Sterling options flow today included:

- RXF1 180/181cs, sold at 12 in 1k and at 12.5 in 2k

- DUZ0 112.20/112.00ps vs DUZ0 112.40/112.60cs, bought the ps and receive 0.5 in 4,750

- 0LZ0 100.00c vs 2LZ0 100.00c, sold the 1yr at 2 in 4k

- 0RZ0 100.50/100.62cs 1x2, bought for 4.5 in 3k (Ref 100.555, 50 del)

- ERZ0 100.50c, bought for 4 in 2.5k (ref 100.53)

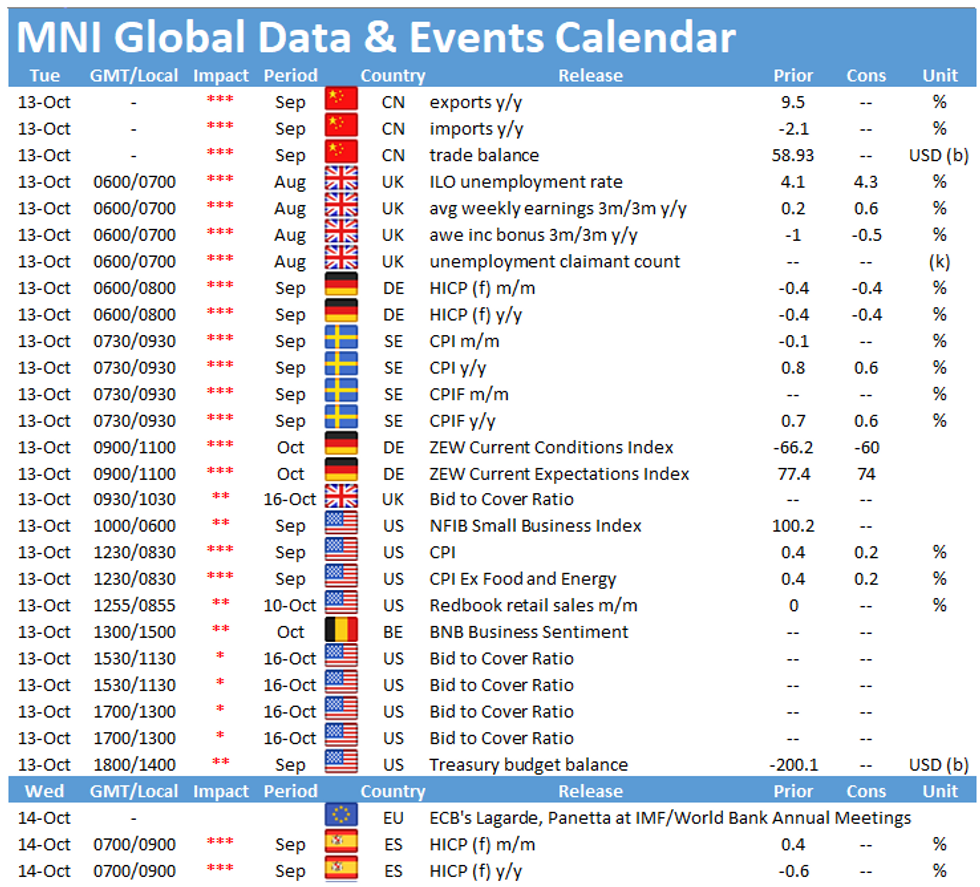

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.