-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Brexit "Deadline" Nears

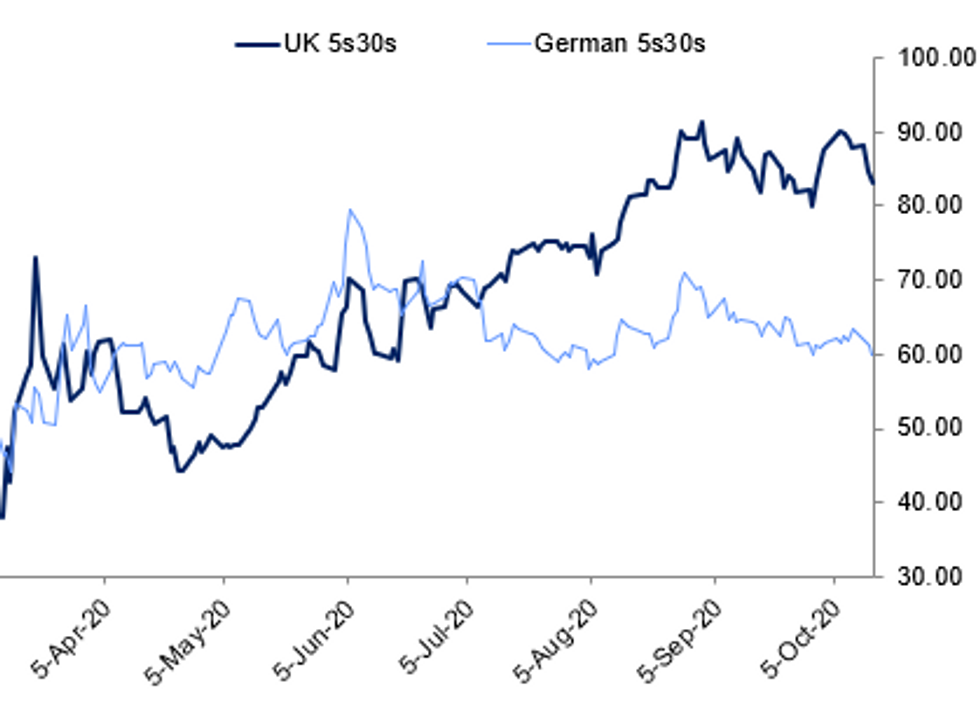

Fig.1: Bull Flattening In Gilts And Bunds

Bloomberg, MNI

Bloomberg, MNI

EGB SUMMARY: Bunds outperform in core FI space

- After lagging the moves in Treasuries and gilts yesterday, Bunds are the outperformers today in core fixed income space.

- Equities are a little lower but European fixed income is seeing a bigger move than equity markets would imply. Indeed, we note that we are approaching the key level on the continuation yield chart of -0.591%, the May 5 low and a key technical level. If this level is to be breached our tehnical analyst would be looking for initially the psychological -0.600% level ahead of the -0.614% level - the 61.8% retracement of the Mar 9 - 19 move.

- Peripheral spreads, with the exception of Italy, which is close to flat on the day, have also widened today.

- Bund futures are up 0.31 today at 175.37 with 10y Bund yields down -2.2bp at -0.579% and Schatz yields down -1.0bp at -0.749%.

- BTP futures are up 0.31 today at 150.38 with 10y yields down -2.3bp at 0.634% and 2y yields down -1.2bp at -0.362%.

- OAT futures are up 0.19 today at 169.54 with 10y yields down -1.3bp at -0.309% and 2y yields down -0.2bp at -0.697%.

GILT SUMMARY: Brexit Deadline Nears

Gilts have traded firmer today, but there appears to be little concern about the impending deadline for Brexit negotiations informally set by the UK PM.

- Gilts have traded firmer today with yields up to 2bp lower and the curve bull flattening, mirroring the wider theme among core European sovereign bond markets. Last yields: 2-year -0.0497%, 5-year -0.0584%, 10-year 0.221%, 30-year 0.776%. The 2s30s spread is 2bp narrower.

- The Dec-20 gilt future trades at 136.08, near the middle of the day's range (L:136.00 / H136.26).

- Bloomberg reports that UK Prime Minister Boris Johnson will decide whether to continue Brexit negotiations after a meeting with EU leaders on Thursday and Friday, citing a source close to discussions.

- PM Johnson continues to resist implementing a national breakdown - or circuit breaker - and is instead continues to refer to the recent introduced three-tier system for tightening social restrictions.

- There are no further UK economic data releases this week.

DEBT FUTURES/OPTIONS:

- DUZ0 112.02/00ps vs 112.40/60cs, sold the cs at -2 in 5k. Was also sold in 13k last week

- RXZ0 177/177.5cs, bought for 7.5 in 3k

- RXX0 176/177cs, bought for 6.5 in 2.5k

- 0RZ0 100.50/100.625 ^^ sold at 2 in 2.75k

- ERU1 100.75 calls bought for up to 1.75 in 15k

- 0LZ0 100.00/100.12cs, bought for 5 in another 7,151 (ref 100.04, 36 del). They bought 6k earlier

- LU1 100.25/100.50cs 1x2, bought for 1.75 in 3k

- LM1 100.00/100.125/100.25/100.375 call condor bought for 3 in 2.5k

- LH1 99.875/100.00/100.125 c1x3x2 bought for 1.75 in 2k

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.