-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: 10-Year Tsy Yields Move Back Above 4% In Asia

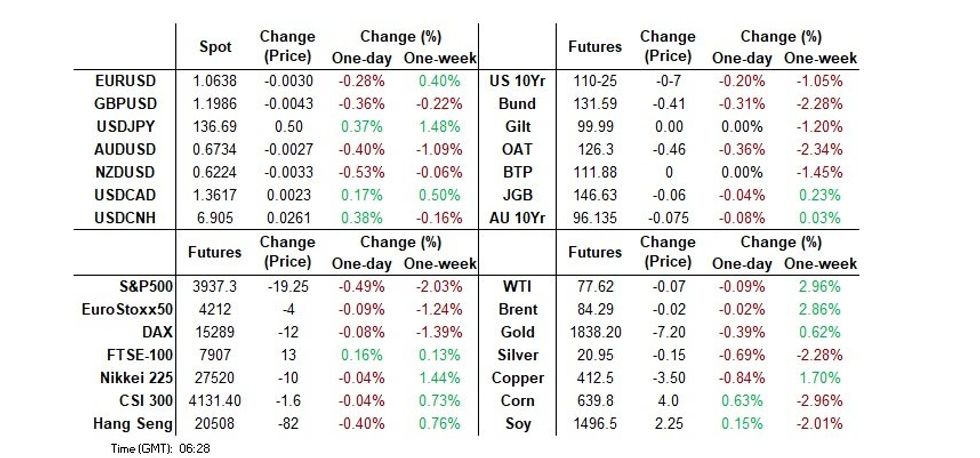

- Cash Tsys sit 1-4bp cheaper across the major benchmarks, the curve has bear flattened. 10-Year Tsy yields have pushed and held above 4.00%.

- That has allowed the USD to turn bid, while equities traded on a defensive footing, as the Asia-Pac region looked to the prices paid component in yesterday's ISM manufacturing survey and comments from Minneapolis Fed President Kashkari.

- Eurozone CPI and unemployment headline the European data docket today. Fedspeak from Governor Waller, comments from ECB's Schnabel & BoE's Pill, and the minutes from the ECB's most recent monetary policy meeting are also due.

US TSYS: Cheaper In Asia, 10 Year Yield Holds Above 4%

TYM3 deals at 110-25, -0-07, a touch off the base of its 0-11 range on elevated volume of ~150k.

- Cash Tsys sit 1-4bp cheaper across the major benchmarks, the curve has bear flattened. 10-Year Tsy yields have pushed and held above 4.00%.

- Tsys were marginally pressured in early dealing, cross market pressure from JGBs spilled over.

- The early cheapening extended through the session, there was no overt headline driver for the move. Asia-Pac participants seemingly focused on firmer than expected prices paid component in the latest ISM manufacturing survey as well as Wednesday's comments from Minneapolis Fed President Kashkari (’23 voter), as he noted that he has an open mind on a 25 or 50bp hike in March.

- Downside interest via TY and US options headlined on the flow side, although was light.

- In Europe today Eurozone CPI and unemployment headline, further out we have initial jobless claims. Fedspeak from Gov Waller will also cross.

JGBS: Curve Steepens, Futures Bounce Aided By Stellar Demand At 10-Year Auction

Thursday saw mixed performance on the JGB curve, with futures off early Tokyo lows and the super-long end under some light pressure. The former is -6 at the close, while wider cash JGB benchmarks run 0.5bp richer to 3.0bp cheaper, with the curve pivoting around 7s, twist steepening. Swap rates are little changed to 2bp higher, resulting in wider swap spreads out to 10s, while super-long spreads are flat to narrower. 10-Year JGB yields are pressed up against the BoJ's YCC cap.

- Stellar demand at the latest 10-Year JGB auction was noted. It would seem that short covering needs, alongside diminished expectations for near-term monetary policy setting tweaks from the BoJ, yield levels testing the Bank’s YCC cap and short-term relative value appeal (generated from moves such as the recent cheapening on the 5-/10-/20-Year butterfly) were the dominant factors here. JGB futures ticked higher in the wake of the auction, pressing to fresh Tokyo session highs, before fading from best levels.

- The super-long end and swap rates seemed to be driven by the movement we have seen in core global FI markets since yesterday’s local close, while the early stabilisation in the belly is a little more up in the air when it comes to identifying a driver. The well-received 10-Year auction flagged above dd help the wider space away from session cheaps.

- Comments from BoJ board member Takata stuck with the central BoJ view.

- Tokyo CPI and labour market data headline the domestic docket on Friday.

JAPAN: Net Purchases Of International Bonds Slow

Data from the Japanese MoF revealed a notable step down in the size of net purchases of international bonds on the part of Japanese investors last week, as weakness in core global FI markets intensified. Still, they managed to register a fourth straight week of net purchases of international bonds.

- Japanese investors also recorded a fifth straight week of net sales of international equities.

- On the other side of the ledger, international investors flipped to small net selling of both Japanese equities and bonds.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 211.6 | 2693.3 | 4753.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -440.4 | -202.0 | -2022.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -208.9 | 229.5 | 193.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -403.0 | 197.7 | -118.8 |

AUSSIE BONDS: ACGB Bid Fades But Outperforms U.S Tsys

ACGBs pulled back from firmest levels of Sydney trade, leaving YM -6.0 & XM -7.5 at the close, as the trans-Tasman bid from well-received NZGB supply and impulse from AU/US tightener flows faded alongside an extension of U.S. Tsy weakness in Asia-Pac hours. Cash ACGBs close near session cheaps, 6-7bp weaker with the curve 1bp steeper. AU/U.S. 10-year yield differential still manages to narrow -3bp to -17bp, after printing as tight as ~-20bp.

- Swaps cheapen 6-8bp with the 3s10s swap curve 1bp steeper.

- Bills were 2-7bp weaker on the day through the reds, steeper, but off session extremes.

- Terminal rate pricing on the OIS strip shows back above 4.20% after yesterday's CPI-inspired pullback resulted in a close below that level.

- With the local calendar light tomorrow, only home loan data for January is slated, the Aussie looks destined to seek guidance from abroad ahead of the RBA Policy Decision next Tuesday.

- Given the prevailing weakness in the global rates market, all eyes will turn to Eurozone CPI ahead of NY trading when we see if U.S. Tsy weakness in Asian trading is sustained, added to, or reversed.

NZGBS: Weaker But Continued Outperformance Vs. U.S. Tsys

NZGBs weaken on the day but close off session extremes, partly defying carry-over weakness for U.S Tsys in early Asia-Pac trade that pushed 5- to 10-year Tsy yields above Wednesday's NY session highs. With Q4 Terms of Trade surprising on the upside (the only local release), Resilience in NZGBs appeared linked to ACGB’s relative strength. Strong demand at the weekly NZGB auctions also aided the bid, with cover ratios of 2.9-3.2x seen across the NZGB May-28, Apr-33 & May-51 offerings.

- Cash NZGBs close 8bp weaker across the curve with continued outperformance noted versus U.S Tsys. The NZ/U.S. cash yield differential narrowed 4bp for the 2-year and 3bp for the 10-year. So far this week the 10-year NZGB benchmark has outperformed its U.S. equivalent by 16bp.

- Swap rates close 6-8bp higher, implying a slight short- to mid-curve swap spread narrowing.

- Subdued trading in RBNZ dated OIS continued today with pricing flat to 1bp firmer across meetings with April meeting pricing at 40bp of tightening and terminal OCR pricing just shy of the RBNZ’s projected OCR peak of 5.50% at 5.47%.

- ANZ consumer confidence data and a keynote address from RBNZ Governor Orr on "Navigating Heavy Seas: Sustainable growth, productivity and wellbeing for a stronger New Zealand" headline locally on Friday.

FOREX: USD Firms In Asia As Treasury Yields Tick Higher

The greenback has gained in Asia, US Treasury yields have ticked higher through the session aiding the USD bid.

- Kiwi is the weakest performer in the G-10 space at the margins. NZD/USD prints at $0.6225/35 down ~0.4% today. Q4 Terms of Trade printed early in the session at 1.8%, rising from -3.4% prior.

- AUD/USD is ~0.2% softer, last printing at $0.6740/45. Weaker than expected Building Approval weighed at the margins, January measure printing at -27.6% vs -7.0% expected.

- Yen is softer, USD/JPY prints at ¥136.40/50 ~0.2% firmer today. Q4 Capital Spending rose 7.7% a touch above expectations, whilst Company Profits was below expectations printing -2.8% vs 8.4% exp.

- EUR and GBP are both down ~0.2% as the broad based USD bid weighs.

- As noted, US Treasury Yields have ticked higher in Asia. 10 Year Yields are holding above 4%. Regional equities and US Equity futures are softer. The Hang Seng is ~0.5% lower and e-minis are down ~0.4%. BBDXY is ~0.2% firmer.

- In Europe today Eurozone CPI and unemployment headline, further out we have US Initial Jobless Claims.

FX OPTIONS: Expiries for Mar02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0545(E583mln), $1.0595-10(E2.0bln), $1.0620-25(E1.8bln), $1.0660(E797mln), $1.0800(E847mln)

- USD/JPY: Y132.00($1.1bln), Y132.50-60($1.2bln), Y136.00($770mln), Y136.65($855mln)

ASIA FX: USD Recoups Some Lost Ground

The USD is firmer against Asia FX, with the continued moved higher in US cash Tsy yields aiding broader USD sentiment, while some weaker than expected data outcomes have weighed at the margin as well. Dollar gains have been fairly uniform. Singapore PMIs are still to come today. Tomorrow, we get the China Caixin services PMI, the Indian services PMI and Singapore retail sales.

- USD/CNH sits close to session highs currently, last near 6.9100. We started the day close to 6.8700, now having lost a little over 0.40% in CNH terms (after yesterday's +1% gain). Onshore equities are down a touch at this stage.

- 1 month USD/KRW is up around 0.60% to 1311/12 for the session. IP growth was weaker than expected in y/y terms, while semiconductor inventories continued to climb, suggesting on-going headwinds for a key part of the export outlook. Other parts of IP were firmer, although data on domestic demand showed a further slowdown consumption spending. The Kospi has rallied, but is largely reflecting catch up from yesterday, when markets were shut.

- USD/THB has mostly stayed on the front foot today, albeit finding selling interest above 34.90. We last tracked at 34.80/85, around 0.15% weaker in baht terms for the session. This follows yesterday's strong 1.6% gain. We are somewhat wedged between the 100-day EMA (34.69) and the 200-day EMA (close to 34.90). We remain comfortably below recent highs near 35.40. Onshore equities are still lagging the baht rebound, while offshore investors remain net sellers of local equities.

- USD/IDR is trying to move above the 100-day EMA (15268), with spot last at 15270, around +0.25% above yesterday's closing level. We are also moving above the simple 50-day MA (15258.5). The local data calendar remains quiet until next week. BI Governor Warjiyo was once again on the wires stating that current policy levels will be enough to bring Indonesia inflation back to target. He also added the Fed could stay hiking interest rates until mid year, which would pressure other currencies (including IDR) against the USD. Still, BI stands ready to intervene to support the local currency. BI will also offer the following rates for export FX deposits (5.2% for 6 months, 4.92% for 3 and 4.64% for 1 month).

- INR is softer this morning, broad based USD/Asia strength driven by higher US Treasury Yields is weighing on the Rupee. We remain comfortably within recent ranges though. USD/INR was marginally softer yesterday, finishing dealing ~0.2% lower. The pair briefly dealt below its 20-Day EMA (82.57), however we sit a touch above that level this morning. Bulls still look to target a break of 83.00. Bears target 2023 lows at 80.89.

EQUITIES: More Caution Amid Higher Yields

The tone in regional equities has been more cautious today. Cross-asset headwinds from firmer US yields and a stronger USD have weighed at the margins. US equity futures are tracking lower at this stage (-0.36% for Eminis and -0.48% for the Nasdaq).

- After strong gains yesterday, we have seen China and HK bourses consolidate today. The HSI is down by around 0.4% at this stage, with the underlying tech index down 1%. This only unwinds a part of yesterday's +6.64% gain. Mainland China stocks are modestly in positive territory. The proximity of the NPC may also be driving some caution in markets.

- Trends have been mixed elsewhere, the Nikkei 225 close to flat, likewise for the Taiex. The Kospi has outperformed up near 0.80%, although markets were closed yesterday, so this may reflect some catch up. Offshore investors have added $136.8mn to local shares.

- Indian shares are tracking lower in the first part of trade, the Nifty down by 0.50% at this stage. The index continues to battle the 200-day MA, which remains nearby (17397.50, versus current levels of 17362).

- The trend is more positive in SEA, with the Philippines the bourse the standout at +1%. Positive earnings results are fueling broad based gains for the index.

GOLD: Better Week For Gold As USD Comes Under Pressure

Gold prices rose on Wednesday consistent with USD weakness driven by solid PMIs in China. After rising 0.5% bullion is down 0.1% during APAC trading and moving in a narrow range. It is currently around $1834.40/oz after a high of $1838.21 and a low of $1831.18. The USD index is up 0.1%.

- Conditions remain bearish for gold, as the US Fed’s hawkish stance is likely to continue for now. Rate cuts are not generally expected until 2024.

- The Fed’s Waller and Kashkari are speaking later on the economic outlook and race, justice and the economy respectively. These are likely the most important upcoming events for gold. In terms of data, there are US jobless claims and final Q4 readings for unit labour costs/productivity. There is also euro area February CPI data and the ECB minutes.

OIL: Crude Trading Sideways After Rising On China PMI Data

Oil prices have been trading sideways during the APAC session after rising around a percent on Wednesday following positive PMI data from China. Brent is around $84.39/bbl, hovering around the 100-day moving average, and WTI is $77.72. The USD index is up 0.1%.

- Oil prices are holding above last week’s lows but moving average studies remain in bear mode. Key short-term support for WTI is at $73.80, the February 22 low.

- The EIA reported a lower-than-expected US crude inventory build of 1.165mn down from the previous week’s 7.648mn. US oil exports rose a very strong 22.4% on the week.

- The Fed’s Waller and Kashkari are speaking later on the economic outlook and race, justice and the economy respectively. In terms of data, there are US jobless claims and final Q4 readings for unit labour costs/productivity. There is also euro area February CPI data and ECB minutes.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/03/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 02/03/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/03/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 02/03/2023 | 1230/1330 |  | EU | ECB Schnabel at MMCG Meeting | |

| 02/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/03/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/03/2023 | 1500/1500 |  | UK | BOE Pill Speech at Wales Week | |

| 02/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/03/2023 | 2100/1600 |  | US | Fed Governor Christopher Waller | |

| 03/03/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 02/03/2023 | 2300/1800 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/03/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.