-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: 2-Way Swing In Bonds In Asia, Market Continues To Test BoJ

- AUD is the weakest performer in the G-10 space at the margins, weaker than expected wages data prints have weighed there. Elsewhere, moves have been limited as the USD consolidates, NZD was volatile around the RBNZ rate decision however the Kiwi is now little changed on the session.

- NZGBs had a subdued reaction to the RBNZ policy decision as the central bank delivered on the expected 50bp rate hike and left its peak OCR projection at 5.50%, albeit now seen slightly later. While the RBNZ noted tentative signs of easing price pressures, they still saw higher rates as necessary with demand outpacing supply and labour shortages contributing to heightened wage inflation.

- Ahead we have regional and final national CPI from Germany, although it will be the minutes covering the February FOMC meeting headline today’s docket.

US TSYS: Marginally Richer In Asia, Regional Matters Dominate

TYH3 deals at 111-03+, -0-01+, in the middle an 0-08 range on elevated volume of ~183K.

- Cash Tsys sit 1-2bps richer across the major benchmarks.

- Weakness in JGBs weighed on Tsys in early dealing, TY futures briefly looked below Tuesday's low.

- Spillover from ACGBs in lieu of Australian Q4 wage data aided a recovery from session cheaps in Tsys.

- Tsys were able to marginally extend gains post the RBNZ rate decision, as there was a lack of hawkish surprise in the post-meeting statement and press conference, with unscheduled BoJ Rinban operations also adding support at the margins.

- The richening largely held although Tsys did tick away from best levels.

- In Europe today we have regional and national CPI from Germany. Further out, minutes of the February FOMC meeting headline today’s NY docket. We also have the latest round of 5-Year Tsy supply.

JGBS: Curve Twist Flattens, BoJ Defends Breach Of YCC Band

Pressure from the spill over stemming from Tuesday’s moves in wider core global FI markets lingered in the belly of the JGB curve, with limited reaction to the BoJ deploying an unscheduled round of Rinban purchases covering 5- to 25-Year paper as it looked to fend off the latest upside breach of its YCC band (which has lingered, although the 0.51% level has not been touched as of yet, with 10-Year JGB yields operating between there and 0.50% for almost all of the session, last printing in that range ahead of the close).

- Futures edged away from session lows alongside wider core global FI markets, before another modest uptick was seen after the Rinban purchases were announced. The contract is -13 at the bell, while wider cash JGBs were 1bp cheaper to 5bp richer as the curve twist flattened. There wasn’t an overt driver for the super-long end bid, with some pointing towards potential purchases from domestic life insurers (after they sold super-long paper in Jan) and/or BoJ YCC tweak speculation via flatteners.

- Details of the unscheduled Rinban ops revealed an uptick in cover ratios, although the offers that the operations attracted weren’t larger in nominal terms, with cover impacted by the downsizing of the operations vs. scheduled purchases.

- BoJ’s Tamura added little fresh to the policy debate.

- Marginally firmer than expected services PPI data will have added to the pressure in early Tokyo trade.

- JGBs will be closed on Thursday the country observes a national holiday (this may have triggered some short cover in futures into the close).

AUSSIE BONDS: AU/US Yield Differentials Narrow After Wages Data

ACGB yields reverse sharply after Q4 WPI undershoots expectations (3.3% Y/Y Vs. 3.5% Y/Y) and defies RBA business liaison intelligence that suggested a near-term pick-up in wage growth. YM and XM close -3.0 and -6.0 respectively after being down 16bp. Cash ACGB yields print 2-6bp cheaper with the 3/10 curve 4bp steeper. The AU-US yield differential narrows to -7bp.

- Swap rates close 2-6bp higher led by the 10-year.

- Bills close up 2-5bp, well off session cheaps.

- RBA-dated OIS gaps lower with WPI data for all meetings beyond April led by September which declines by 12bp. Terminal rate expectations close at 4.22%.

- Pricing for the near-term meetings was however little changed with the market convinced that the wage data was unlikely to force an RBA rethink of the "further increases in interest rates" message in the February Decision Statement. With the current government sympathetic to the unions and the Secretary of the ACTU on the newswires today saying “more needs to be done to get wages moving”, the RBA is unlikely to abandon its forecast for higher wages growth ahead.

- With U.S. Tsys heavy and WPI data providing a domestic catalyst, the recent bout of ACGB outperformance may have further to run.

- Australian Q4 Capex data is out tomorrow.

AUSTRALIA: Wages Surprise To Downside, Consistent With Inflation Target

The Wages Price Index (WPI) surprised to the downside rising 0.8% q/q to be up 3.3% y/y from 3.2% in Q3. The quarterly increase was also less than Q3’s upwardly revised 1.1% q/q, which had been impacted by the 5.2% national minimum wage rise in July, but in line with Q2’s 0.8% rise. The data show that while wage rises are continuing they were not accelerating at the end of last year, which will be good news for the RBA but likely to drive more rhetoric and policies from the government to boost wage growth.

- The ABS notes that while Q4’s WPI rise was lower than Q3 it was also the highest rise in Q4 over the last 10 years. The annual rate is the highest since Q4 2012. But real wages remain very negative.

- 21% of private sector jobs recorded a wage rise which was down from 23% in Q4 2021 but the increases received were 4%, down slightly from Q3’s 4.3% but significantly higher than Q4 2021’s 2.8%. It is in line with what the RBA says is consistent with its inflation target.

- Private sector wages rose 0.8% q/q compared with the public sector at 0.7% with the large gap between annual rates continuing at 3.6% versus 2.5%. The gap has been driven by many public sector agreements being multi-year.

Source: MNI - Market News/ABS/SEEK

NZGBS: RBNZ Fails To Spark A Meaningful Post-Decision Reaction

NZGBs had a subdued reaction to the RBNZ policy decision as the central bank delivered on the expected 50bp rate hike and left its peak OCR projection at 5.50%, albeit now seen slightly later. While the RBNZ noted tentative signs of easing price pressures, they still saw higher rates as necessary with demand outpacing supply and labour shortages contributing to heightened wage inflation.

- NZGB yields close 9-11bp higher. After yesterday’s outsized short-end NZGB response to NZ Treasury comments on RBNZ policy (re: the impact of the cyclone), there was the risk of a ‘sell the rumour, buy the event’ reaction today given the RBNZ’s non-committal response to the issue. That clearly wasn’t the case with 2-year yields holding close to 20bp higher than Monday’s close.

- Swap rates move 3bp lower post-decision, closing 9-10bp higher.

- RBNZ-dated OIS pricing declines 1-2bp for the further out meetings. Terminal rate expectations currently sit just below ~5.40%, 15bp higher than the level prevailing at the end of last week.

- With the RBNZ failing to surprise, the market guidance may have to come from abroad with Australia the most likely candidate after the lower-than-expected Q4 WPI print sparked a stellar outperformance vs. NZ. AU-NZ 2-year swap differential narrowed 14bp on the day.

FOREX: USD Consolidates, AUD/NZD Off Recent Highs

AUD is the weakest performer in the G-10 space at the margins, weaker than expected wages prints have weighed on the Aussie. Elsewhere moves have been limited as the USD consolidates, NZD was volatile around the RBNZ rate decision however the Kiwi is now little changed.

- AUD/USD is ~0.3% softer today, last printing at $0.6830/35. Australian WPI printed at 3.3 YoY vs exp 3.5%. Terminal RBA cash rate projections ticked lower after the data release. Downside support sits at $0.6812 the low from Feb 16.

- NZD/USD is little changed from yesterday's closing levels. The pair rallied ~0.6% from session lows in the aftermath of the RBNZ decision before paring gains. The lack of hawkish surprise and the bank leaving its terminal rate forecast unchanged, albeit slightly later, contributed to the lack of follow through.

- AUD/NZD now sits below the $1.10 handle, 2-Year AU-NZ rate differentials widened post Australia WPI and the RBNZ decision weighing on the pair. The cross is down ~1% from Monday's high.

- Elsewhere, USD/JPY is dealing at ¥134.90/95. Jan PPI Services printed at 1.6% marginally firmer than the estimated 1.5%.

- EUR is marginally firmer and GBP is little changed.

- Cross asset flows are mixed, e-minis are ~0.2% firmer and 10 Year US Treasury Yields are ~1bp lower. BBDXY is flat.

- In Europe today we have regional and national CPI from Germany as well as MBA Mortgage Applications. Minutes of the February FOMC meeting headline today’s docket.

FX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.3bln), $1.0635-50(E571mln), $1.0670-75(E833mln)

- USD/JPY: Y134.00($599mln), Y134.25($715mln)

- AUD/USD: $0.7000(A$828mln)

ASIA FX: USD/Asia Pairs Maintain Positive Bias

USD/Asia pairs are mostly higher today, although gains have been more modest compared to yesterday's session. Regional equities are on the backfoot, but USD indices are close to unchanged. USD/CNH tested its 100-day EMA, above 6.9000, but is now back below this level. Still to come today is Taiwan Q4 GDP revisions, while a meeting between the South Korean Finance Ministry and onshore FX dealers will be the other focus point. Tomorrow, the BoK decision is on tap, no change is expected. Singapore CPI is also out.

- USD/CNH continues to trade with a positive bias. Today we tested the 100-day EMA near 6.9040, but now sit back at the 6.8990/00 level. Onshore equities are weaker, the CSI 300 tracking -0.80% at this stage. The CNY fixing was neutral relative to expectations.

- Spot USD/KRW is higher, +0.60% to 1303/04, playing catch up to won weakness in the NDF space since yesterday's onshore spot close. We are off earlier session highs as the Finance Ministry is meeting with FX dealers later today to discuss won weakness. The 1 month NDF is slightly below NY closing levels, last around 1302. Onshore equities are weaker, amid tech headwinds and higher core yields. Tomorrow the BoK is expected to stand pat, keeping the policy rate steady at 3.50%.

- Similarly, USD/TWD spot is back above 30.51, fresh highs in the pair back to mid January. We continue to track equity sentiment fairly closely. SGD has outperformed somewhat, with USD/SGD holding below the 1.3400 level for now. The NEER is higher, per Goldman Sachs estimates. Tomorrow Jan CPI will be in focus.

- USD/IDR is pushing higher, last close to 15220 level, around +0.20% on closing levels yesterday. This is line with core yields, particularly in the US real yield space, from the Tuesday session. Indonesian equities remain under pressure, off 1.30% today.

- USD/THB continues to gravitate higher, last just above 34.68. Local politics will be in focus, as the Thai PM stated yesterday he would dissolve the local parliament in March. This should pave the way for elections in May.

MNI BoK Preview - February 2023: A Hawkish Hold

- The BoK faces a delicate balancing act at the current juncture. Inflation pressures have moved off 2022 highs, but remain elevated from an historical standpoint. Inflation expectations have ticked higher over the last few months, although through much of 2021 and 2022 headline inflation led expectations rather than the other way around. While there are some signs of easing services related inflation pressures, the BoK is likely to want to see more evidence of such trends before being more comfortably around the outlook.

- On the growth side, momentum has clearly cooled. External headwinds persist, particularly in the tech space, while domestic demand is showing signs of the cumulative rate hikes over the past 18 months. Such a growth backdrop warrants caution in terms of additional rate hikes.

- Fed developments have also turned more hawkish since January, which has helped push USD/KRW back above 1300, some 7% above early February lows. This is also likely to bias the BoK away from sounding too dovish, at the margins.

- See the full preview here:

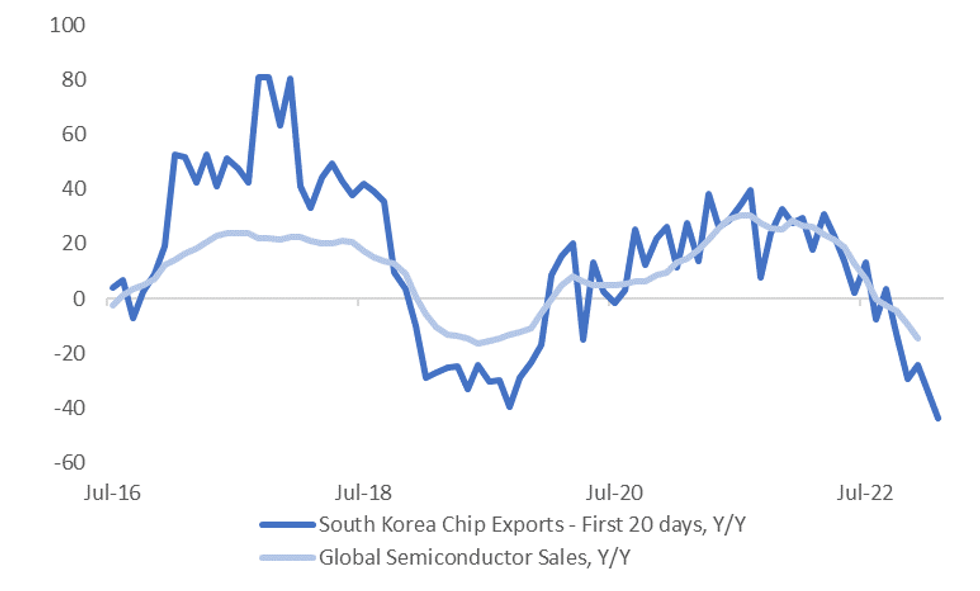

SOUTH KOREA: Export/Tech Headwinds Persist

Earlier today, South Korean business sentiment for March showed an improvement in the headline results. This was more evident in non-manufacturing (to 74 from 70), rather than manufacturing (to 66 from 65). The manufacturing index is only just up from recent lows. The sub-index, measuring export expectations, also ticked lower. The first chart below plots South Korean export growth against this series.

- Export expectations remain above 2020 lows, but continue to trend lower. This is consistent with yesterday's first 20-days of trade data for Feb. Headline export wasn't that poor, but average daily export growth was close to -15% y/y.

- The tech backdrop remains quite soft, the second chart below plots y/y momentum for chip exports (first 20-days) against y/y in global semiconductor sales.

Fig 1: South Korean Exports Versus Manufactures Expectations

Source: MNI - Market News/Bloomberg

Fig 2: South Korea Chip Exports & Global Semiconductor Sales

Source: MNI - Market News/Bloomberg

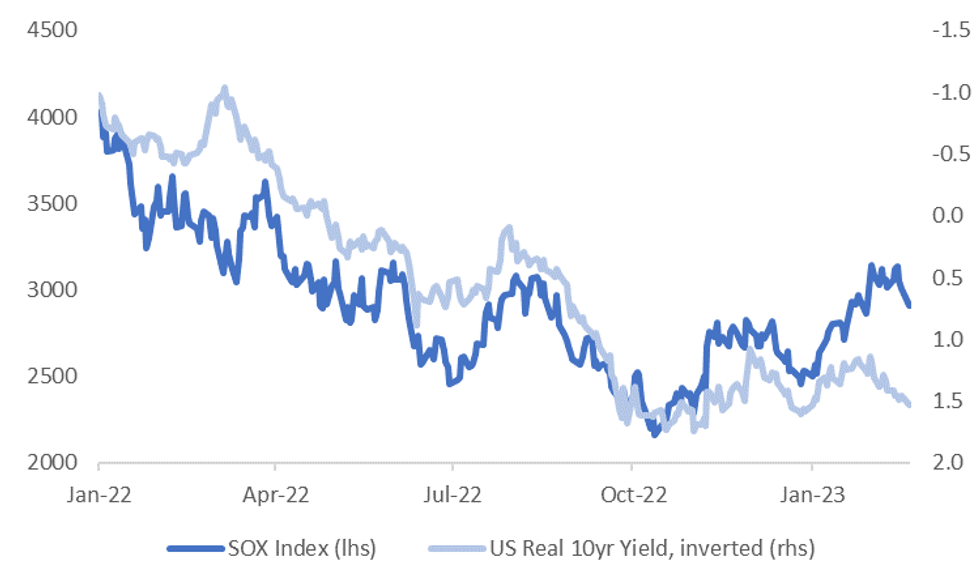

- This comes against a backdrop of rising core yields. The final chart below is the US 10yr real yield (inverted) against the SOX semiconductor equity index. Higher yield/tighter rate expectations have generally weighed on the equity outlook for this sector over the past 12 months.

- Such a backdrop is challenging for the won, which has lost 5.5% since the start of the month (the worst performer in EM Asia FX), but also continues to paint a challenging global growth backdrop, even with recent resilient data outcomes in the major economies.

Fig 3: US Real 10yr Yield & SOX Semiconductor Index

Source: MNI - Market News/Bloomberg

EQUITIES: Tracking Lower, HSI Recovers, As HK Budget Supports Households

(MNI Australia) Regional equities are mostly tracking lower, in line with sharp falls on Wall St from Tuesday's session. US futures are slightly higher so far today (+0.20% for eminis, +0.25% for the Nasdaq) but this hasn't aided sentiment.

- HK stocks have recovered from earlier losses, the headline index back to around flat currently. Headwinds persist as the index flirts with correction territory, but sweeteners in the HK budget, announced today, around consumption vouchers and homebuyer tax cuts, have turned sentiment around.

- China shares are tracking lower, the CSI 300 off by a little over 0.65% at this stage. Onshore China media reported China President Xi Jinping calling for more homegrown equipment and software, as well as basic subject research. Market concern around US-China tensions likely remains in the background.

- Tech sensitive plays are under pressure. The Kospi off by 1.60%, with offshore investors selling $339.2mn of local shares so far today. The Taiex is slightly better, at 0.87%, while the Nikkei 225 is down by 1.25%. This follows sharp moves lower in tech indices for Tuesday, as core yields rose.

- Other major markets are mostly tracking lower. The JCI and PSEI off by around 1.25% at this stage. NZ stocks also close slightly lower, as the RBNZ stayed the course raising rates by 50bps and keeping the terminal rate expectations at 5.50%.

GOLD: Bullion Close To 2023 Lows As Waits For FOMC Minutes

Gold prices were down 0.3% on Tuesday due to a rise in Treasury yields and have been zig-zagging during APAC trading as the market waits for the FOMC minutes. It has been trading narrowly between $1834.97 and $1838.48 and is current around $1836.40/oz. The USD index is flat today.

- Trend conditions remain bearish as the Fed is expected to remain hawkish for now. Gold prices are currently close to the early January lows

- Gold will be focused on the FOMC meeting minutes released later and Fed Williams’ discussion of inflation. There is little in the way of data.

OIL: Crude Waiting On Direction From Fed Minutes

MNI (Australia) - Oil prices have been range trading today after falling on Tuesday. The market is waiting for direction on Fed policy from the minutes published later. A more hawkish tone to the Fed has been weighing on crude this month. Brent is down 0.2% to $82.85/bbl and WTI -0.2% to $76.20. The USD index is flat.

- Both Brent and WTI have been trading in a range of less than a dollar and below their 50-day simple moving averages. The oil price outlook is neutral for now.

- Data showed that Russian exports have been strong over the last 4 weeks despite its announcement to cut output by 500kbd. 3.2mbd are being shipped to China, India, Turkey and others, which is the highest since data began being recorded at the start of 2022, according to Commerzbank (DJ). It appears that the increased demand for oil by China since it reopened is being met by Russia, thus limiting the upside for prices.

- The market will be focused on the FOMC meeting minutes released later and Fed Williams’ discussion of inflation for some direction on policy. There is also the delayed API inventory data but there is little in the way of economic data.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 22/02/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 22/02/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 22/02/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2023 | 0900/1000 | *** |  | DE | Hesse CPI |

| 22/02/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 22/02/2023 | 0900/1000 |  | DE | Destatis Press Conference on Updated CPI Weights | |

| 22/02/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 22/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/02/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 22/02/2023 | 2230/1730 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.