-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Ticks Higher To Start The Month

- USD ticks higher in Asia after some modest weakness into the NY close.

- Headline flow was relatively light overnight, with broader activity hampered by a holiday in Hong Kong.

- Global PMIs, the U.S. ISM m'fing release and the latest Riksbank monetary policy decision are due to hit on Thursday.

BOND SUMMARY: Action Limited In Asia After Month-End Vol.

{AU} AUSSIE BONDS: Much like U.S. Tsys, the ACGB space isn't going anywhere fast, with no impetus drawn from today's local data releases, while the presence of the latest round of scheduled ACGB purchases (covering maturities of Nov '28 to May '32) is likely providing an underlying bid to that area of the curve. YM -0.5, while XM is unch. on the day.

- A quick reminder that our policy team's latest RBA insight piece (published during the London morning on Wednesday) highlighted their understanding that "fresh Covid-19 outbreaks and the slow pace of Australia's vaccine rollout are having more of an impact on the economy than the Reserve Bank of Australia expected when it made its most recent forecasts in May, weighing on its calculations as it considers an extension of its yield guidance." The clear market consensus is that the RBA chooses NOT to roll its 3-Year yield target over to ACGB Nov '24 from ACGB Apr '24 at its July meeting.

- Looking ahead to Friday, housing finance data, A$1.0bn of ACGB 0.25% 21 November 2025 supply and the AOFM's more detailed guidance on issuance plans for FY21/22 are set to headline locally.

JAPAN: Another Round Of Net Selling Of Foreign Bonds Seen Near Month-End

The latest round of weekly Japanese international security flow data was dominated by the net selling of foreign bonds by Japanese investors, bringing an end to a 3-week run of net purchases. The latest weekly release reveals a pattern of notable net selling of foreign bonds by Japanese investors during the final full week of the calendar month covering the Apr-Jun '21 period (such a dynamic was also witnessed in Feb '21, but not Mar '21, with the Feb instance linked to rebalancing of the broader portfolios ahead of the turn of the Japanese FY), although the Jun '21 instance represented the smallest round of such net selling. Still, the 4-week rolling sum of the measure remained comfortably in positive territory (it actually nudged higher as the large round of net selling at the end of May fell out of the sample).

- There was little to note elsewhere in the dataset.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1026.5 | 983.5 | 1034.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 22.7 | -208.1 | -12.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -281.5 | 291.0 | 1809.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -147.1 | -191.7 | -279.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

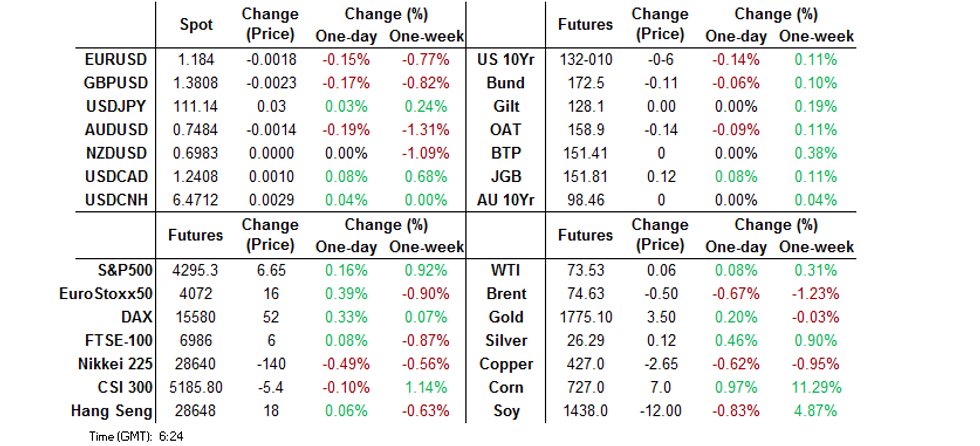

FOREX: Greenback Holds Onto Gains, USD/JPY Round Trips From Fresh Multi-Month High

The DXY clung to its Wednesday's gains and operated close to multi-week highs, as participants assessed the condition of U.S. labour market in the interim between two back-to-back local jobs reports. Monthly ADP employment change topped expectations yesterday, ahead of the upcoming weekly jobless claims.

- USD/JPY pierced resistance from Jun 24/30 highs of Y111.12 and rose to its highest point since Mar 2020, but then erased gains into the Tokyo fix. EUR/JPY slipped before the expiry of EUR1.2bn worth of options with strikes at Y131.25 at today's NY cut.

- The PBOC set its central USD/CNY mid-point at CNY6.4709, 17 pips above sell-side estimate. USD/CNH ignored the fixing, but blipped higher after Caixin M'fing PMI marginally missed expectations.

- NZD outperformed in G10 FX space as BBG Commodity Index extended gains, while ANZ upgraded their NZ labour market forecasts and reiterated their hawkish RBNZ rhetoric. The bank said that NZ jobs market is "rapidly approaching full employment."

- CAD also traded on a firmer footing, while AUD lagged behind its commodity-tied peers, amid lingering concerns surrounding the local Covid-19 situation.

- Focus turns to a slew of global PMI reports, U.S. initial jobless claims, Riksbank MonPol decision and comments from Fed's Bostic & BoE's Bailey as well as ECB's Lagarde & de Cos.

FOREX: The USD Bucks Consensus In H121

With Q2 now in the books the G10 FX scorecard flags that only the CAD (on the oil market rally and hawkish developments surrounding the BoC) and GBP (largely on the UK's early outperformance in the fight vs. COVID when compared to most of its peers, in addition to positive capital inflow dynamics and perhaps an unwind of some of the Brexit-related negativity) outperformed the USD during H121. The broader DXY was up ~2.8% YtD come the end of June, bouncing ~3.6% from the January (YtD) lows.

- The JPY finds itself at the bottom of the G10 FX table at present, with the upward bias in U.S. equity markets YtD and the consensus view that the BoJ will not tighten policy over the broader forecast horizon (vs. the developments in tightening expectations at the Fed) weighing on the safe haven.

- A reminder that the consensus at the start of '21 was for a bearish year for the USD.

- CFTC non-commercial net positioning (covering the USD's G10 peers with CME futures contracts, in addition to MXN, BRL & RUB) suggests that speculators are still looking for a weaker USD (net short the equivalent of ~$13.0bn or ~7.2% of the relevant open interest), although the latest positioning swing (in the week ending 22 June) saw the largest round of net USD buying since Mar '21, totalling the equivalent of ~$6bn. Note that leveraged funds currently hold a marginal net short USD position across the aforementioned futures contracts (net short the equivalent of ~$2.2bn or ~1.2% of the relevant open interest), while the cumulative position declared by asset managers is much deeper (net short the equivalent of ~$55.3bn or ~30.7% of the relevant open interest).

- The net short positioning registered across all 3 of the aforementioned investor groups sits off of the cycle extremes that were registered earlier this year.

- Expectations surrounding the future of Fed policy (in outright and relative terms) seemingly represent the biggest risk to the broader view re: USD weakness at present, with a consensus now in place that looks for a declaration of a Fed taper announcement by the end of calendar '21 (with the potential for hints surrounding the matter to be dropped at the Jackson Hole symposium, scheduled for August), and broader expectations for the tapering to get underway in early '22 at the latest. Note that the latest FT survey surrounding Fed policy pointed to 50bp of Fed hikes taking place by the end of '23, with the majority of those surveyed being of the view that at least that amount of tightening would take place, based on a ~75% degree of certainty (a "large minority" attributed a 90% degree of certainty to at least 50bp of tightening over that period).

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

FOREX OPTIONS: Expiries for Jul1 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1930-50(E803mln)

- EUR/JPY: Y131.25(E1.2bln)

- NZD/USD: $0.6900(N$552mln)

ASIA FX: EM Currencies Hit By Negative Risk Sentiment

Risk sentiment in Asia was broadly negative with elevated coronavirus case numbers and extended lockdown weighing.

- CNH: Offshore yuan is weaker, accelerating losses after Caixin manufacturing PMI missed estimates.

- SGD: Singapore dollar is weaker. There were reports earlier that the UK and Singapore have agreed an MOU for cooperation in financial services while data showed private home prices rose 0.9% in Q2 after a 3.3% rise in Q1.

- KRW: The won weakened, data showed the trade surplus widened to $4.440bn in June from $2.94bn previously, but slightly narrower than expectations. Exports rose for the eighth straight month, up 39.7% and beating estimates of 33.8% while imports rose 40.7% above estimates of 33.6%.

- TWD: Taiwan dollar is slightly stronger. Data from IHS Markit showed manufacturing PMI fell to 57.6 in June from 62.0 previously. On the geopolitical front China's President Xi spoke at a communist party event and said achieving national reunification is party's mission and that China must take resolute action to defeat Taiwan independence.

- MYR: Ringgit is weaker, Malaysia's Markit M'fing PMI deteriorated to 39.9 this month from 51.3, suggesting that the manufacturing sector have entered a sharp contraction. This was the worst reading since April 2020, when the original outbreak of Covid-19 battered the global economy.

- IDR: Rupiah declined, there were reports that emergency Covid-19 restrictions will take effect from Jul 2 - 20. EconMin Hartarto didn't elaborate on the details, but Reuters said a document seen by them noted that containment measures will be applied in Java and Bali.

- PHP: Peso dropped, Philippine Markit M'fing PMI registered at 50.8 this month vs. 49.9 in May, suggesting that the sector is expanding again. Elsewhere, the unemployment rate eased to 7.7% in May from 8.7% seen in Apr, on the back of upticks in both employment and participation.

- THB: Baht bucked the trend and posted some gains after hitting a multi-month low yesterday. Thailand's Markit M'fing PMI improved to 49.5 in Jun from 47.8 prior, falling short of returning above the breakeven 50 level. IHS Markit noted that the latest wave of Covid-19 infections "kept Thailand's manufacturing sector in contraction for a second straight month as demand and production fell".

ASIA RATES: PBOC Drains Liquidity From System

- INDIA: Yields lower in early trade. Bonds fell yesterday and could come under further pressure today after a report that the government will start selling more debt maturing in less than seven years from July to compensate states for the Goods and Services Tax shortfall. NewsRise ran a report citing a government official that India will selling additional debt from July to raise INR 1.58tn due to a shortfall in GST. Finance Minister Sitharaman had earlier said the central government will borrow 1.58t rupees on behalf of states to compensate for a revenue shortfall.

- SOUTH KOREA: Futures are higher in South Korea. Data was positive, but coronavirus concerns have sapped risk sentiment in South Korea. There were 762 new cases in the past 24 hours, down slightly from Wednesday but still above the important 600 threshold and holding near a two month high. Due to the concentration of cases in the greater Seoul area, the health authorities decided to tighten restrictions in the capital area for two weeks till July 14. The local authorities also announced later in the day the greater Seoul area will hold off on implementing the central government's eased social distancing scheme for one week, just hours before the new rules were set to take effect. If virus cases continue to increase, the social distancing level will be raised across the country.

- CHINA: The PBOC drained a net CNY 20bn of liquidity from the system via OMO's today, comes after drip feeding CNY 100bn of liquidity into the market in the five sessions to the end of June. Repo rates are lower today, the 7-day repo rate pulling back from multi-month highs to sit at 2.20% - in line with the PBOC's prevailing rate.

- INDONESIA: Yields mixed, some mild flattening on the curve. Indonesian officials have finalised strict mobility curbs for Java and Bali amid a surge in new Covid-19 infections. The restrictions will take effect Friday through Jul 20. Pres Widodo has resisted calls for a hard nationwide lockdown, fearing its economic consequences. Data showed CPI rose 1.33% Y/Y in June, slower than the May print and below estimates of 1.45%, Core CPI was above estimates at 1.49%. Elsewhere Indonesia's Markit M'fing PMI eased to 53.5 from 55.3, noting that despite the current wave of Covid-19 " both production and sales growth remained at strong levels and it would be important to see the pandemic situation come under control soon so as not to further affect the performance of manufacturing firms"

EQUITIES: Down Day

Equity markets in the Asia-Pac region are in the red today amid broad negative risk sentiment, headline flow and liquidity were thin with markets in Hong Kong observing a public holiday. Markets in China were lower, Ciaxin PMI was softer than expected which follows a miss in official NBS PMI data yesterday. Markets also lower in Japan, suggestions that Japan might extend Covid-19 measures in the Tokyo area continue to do the rounds. Markets in Australia are lower, South Australia become the latest state to tighten lockdown measures. Elsewhere PMI survey's from the region showed that activity slowed in the latest period with elevated coronavirus cases adduced. In the US futures are higher after a mixed finish on Wednesday, markets await US NFP data on Friday.

GOLD: No Extension On Recent Move Lower

Gold has continued to respect the recently established range over the last 24 hours or so, despite the previously outlined formation of a bearish technical pattern, with spot last dealing little changed around $1,775/oz. The lack of follow through leaves the well-defined technical picture intact. On the fundamental side it would seem that the downtick in our weighted U.S. real yield measure (which finished off of session lows on Wednesday owing to the month-end related uptick in nominal yields late in the NY session) has seemingly countered the latest uptick in the broader DXY, lending support to bullion.

OIL: WTI Closes In On $74/bbl Ahead Of OPEC+ Meeting

WTI & Brent trade a handful of cents above settlement at typing. The full July OPEC+ videoconference kicks off Thursday, at which the country representatives are due to discuss the possibility of an output hike of circa 550,000bpd. Reports circulated suggesting there remains some acrimony between certain OPEC members, with Saudi Arabia reportedly preferring a gradual approach to easing output curbs, whereas Russia are pressing for a swifter response.

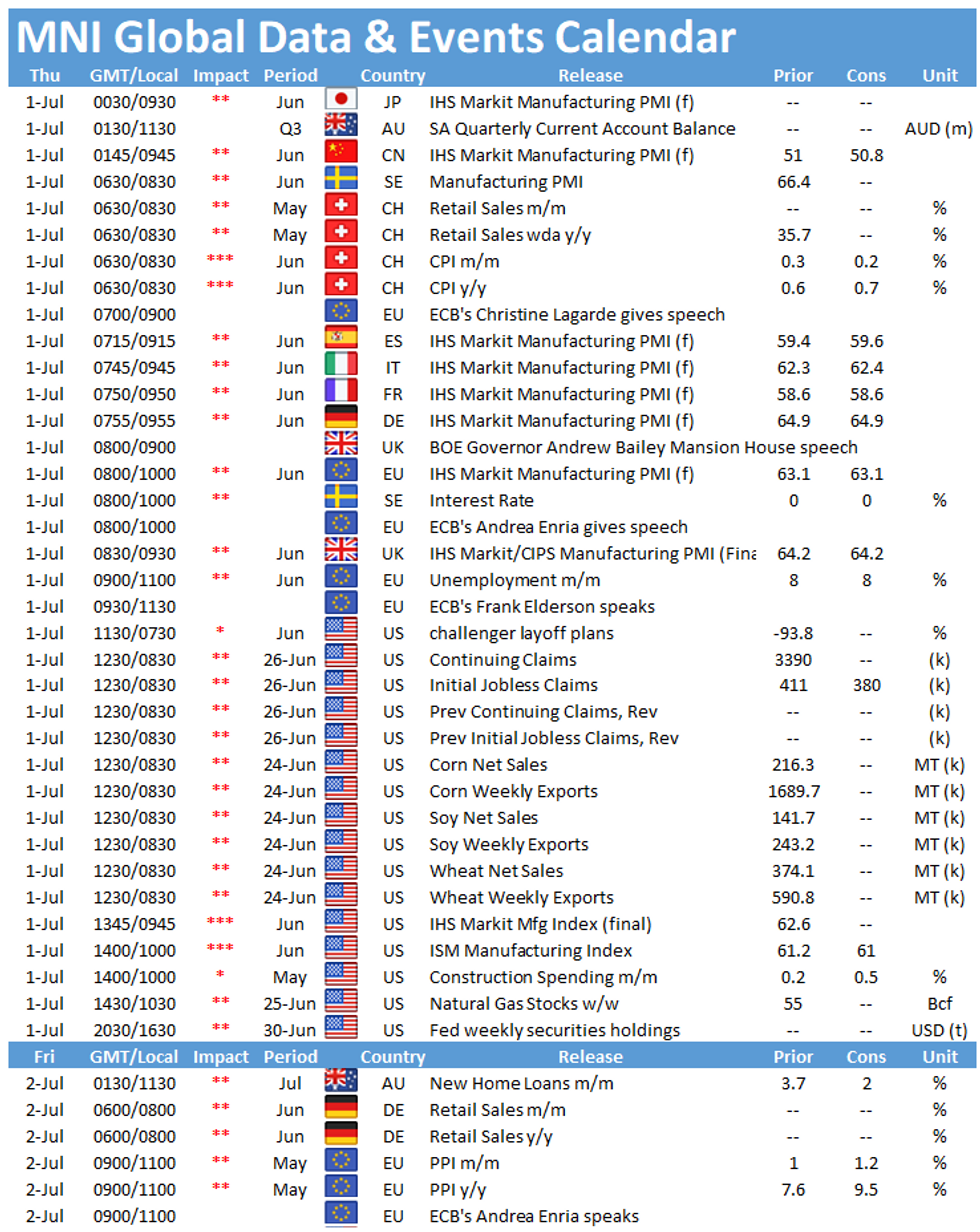

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.