-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: A$ & NZD Aided By China Equity Rescue Headlines

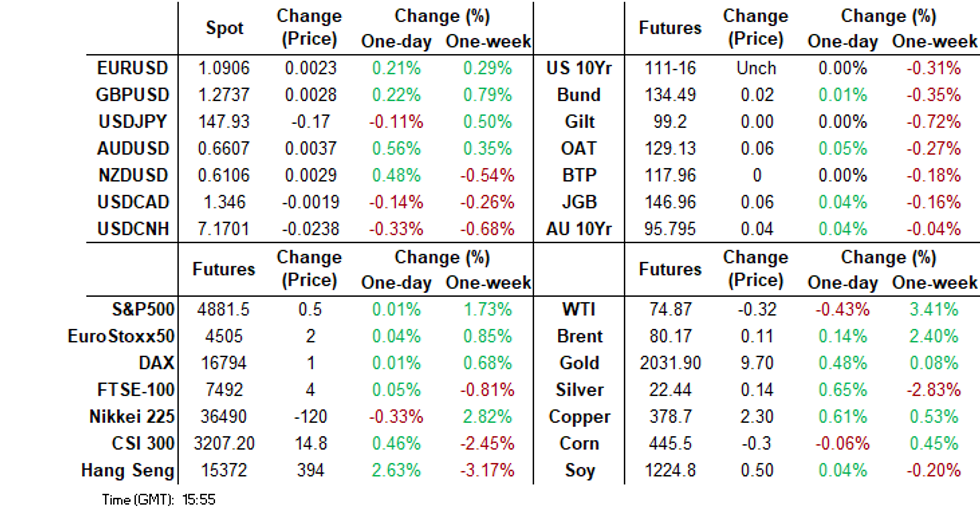

- There wasn't a large market response to the BOJ outcome. All policy parameters were left unchanged, while key inflation forecasts remained sub 2%. JGB futures have pared post-BoJ decision gains to be dealing +4 compared to settlement levels. USD/JPY has unwound all of the post BOJ Spike as well.

- Regional equities are mostly higher, with HK leading the way today, post news that China may look to support the equity market through a large rescue package. USD/CNH is down to 7.1700, aided by these headlines, along with continued tight liquidity. AUD and NZD are leading the G10 move higher against the USD.

- Looking ahead, January US Richmond/Philly Fed indices are released, and euro area preliminary consumer confidence is out.

MARKETS

GLOBAL: Global Container Rates Rose 20% Last Week

Global shipping rates jumped again last week as Houthi attacks against merchant shipping in the Strait of Bab el-Mandeb continued. More ships are avoiding the Red Sea and going around southern Africa instead which can take an additional 14 days and those that are still travelling to the Suez Canal are paying crews extra. As a result the FBX global container index increased 20.5% in the week to January 19.

- While the rise in shipping rates is well below the rise seen in 2021, they have been disinflationary until late 2023 and are now likely to slow the pace the of inflation returning to target, particularly in Europe. New contracts are agreed in March and so the biggest jump may be ahead of us.

- The China/east Asia to the Mediterranean rate rose 9.1% last week to be up 189% this year compared with 140% for the global index. China/east Asia to the east coast of north America soared 35.2% and is now 114% higher in January. The risks to US inflation from increased shipping costs may delay the first Fed rate cut.

- Around 28mn barrels of crude and products have so far been rerouted from the Red Sea, according to OB. The Iran-backed Houthis have said that they won’t attack Russian, Chinese, Saudi or UAE shipping, but warned against cooperating with the US. The US and UK attacked Houthi positions on Monday, the eighth such attack, to protect the “free flow of commerce”.

Source: MNI - Market News/Refinitiv

US TSYS: Muted Move Post BoJ Announcement, China Equity Rally Fizzles

TYH4 is trading at 111-16+, + 00+ from NY closing levels.

• Subdued move in cash bonds post the BoJ decision. The 2yr is 1bp lower today and unchanged from prior, with the 10yr about 1.7bp lower, reflecting about a 1bp move lower since BoJ rate decision.

• China equity market rally has fizzled a bit after the Hang Seng initially rallied 3.5%, currently trading 2.7% on the day, while the CSI 300 has reversed all gain to be trading 0.20% lower today.

• As a reminder the BOJ Ueda presser is still to come

• US data is light on tonight, with Richmond Fed Manufacturing index, and Tsy 2Y note sales the only things to note

JGBS: Post-BoJ Rally Pared

JGB futures have pared post-BoJ decision gains to be dealing +4 compared to settlement levels.

- As largely expected, the BoJ delivered no changes in policy, forward guidance or its explicit easing bias. There have also been no signals regarding the termination of the Negative Interest Rate Policy (NIRP). The upper bound reference on long-term yields was also maintained at 1%.

- In terms of forecasts, FY24 Core CPI has been downwardly revised to 2.4% y/y from 2.8% but FY25 has been upwardly revised slightly to 1.8% from 1.7% previously. FY24 & FY25 Core Ex-Energy CPI forecasts were left unchanged at 1.9%.

- A more hawkish development would have been if the 2025 forecast was at or above 2%.

- Cash JGBs have maintained their twist-flattening, pivoting now at the 3s, but the rally at the long end has been pared. The 40-year yield is 3.7bps lower at 2.004% versus a low of 1.98%.

- The benchmark 10-year yield is 1.2bps lower at 0.646% versus a post-BoJ low of 0.635%.

- The swaps curve has bull-flattened, with rates flat to 3bps lower. Swap spreads are generally wider.

- Tomorrow, the local calendar sees Trade Balance and Jibun Bank PMIs (P) data, along with BoJ Rinban Operations covering 1-25-year JGBs.

BOJ: BoJ Leaves Policy, Forward Guidance and Easing Bias In Place

As largely expected, the BoJ has delivered no changes in policy, forward guidance or its explicit easing bias. There have also been no signals regarding the termination of the Negative Interest Rate Policy (NIRP).

- The upper bound reference on long-term yields has been maintained at 1%.

- In short, the BoJ sees the price trend to rise to goal toward the end of the projection period, with the risks more or less balanced for the economy and prices.

- Concerning the Outlook Report, the BoJ said “Toward the end of the projection period, underlying CPI inflation is likely to increase gradually toward achieving the price stability target, as the output gap turns positive and as medium- to long-term inflation expectations and wage growth rise. The likelihood of realizing this outlook has continued to gradually rise, although there remain high uncertainties over future developments.”

- The last sentence around realising the outlook wasn't in the Oct outlook report from 2023. Still the BoJ notes in today's outlook report that high uncertainties remain.

- In terms of forecasts, FY24 Core CPI has been downwardly revised to 2.4% y/y from 2.8% but FY25 has been upwardly revised slightly to 1.8% from 1.7% previously. A more hawkish development would have been if the 2025 forecast was at or above 2%.

- FY24 & FY25 Core Ex-Energy CPI forecasts were left unchanged at 1.9%.

- FY24 GDP forecast has been lifted to 1.2% y/y from 1.0% previously.

AUSSIE BONDS: Richer & At Highs, BoJ Decision Adds Support

ACGBs (YM +4.0 & XM +3.5) are richer and at Sydney session highs after business conditions eased in the final month of last year and confidence remained at below-average levels.

- The key driver of global bonds in today’s Asia-Pac session however was the BoJ Policy Decision. As largely expected, the BoJ delivered no changes in policy, forward guidance or its explicit easing bias. There were also no signals regarding the termination of the Negative Interest Rate Policy (NIRP). Long-end JGB yields gapped lower on the decision but that move has largely been unwound.

- US tsys are dealing ~1bp richer on the day after being largely unchanged in pre-BoJ trade.

- Cash ACGBs are 4-5bps richer, with the AU-US 10-year yield differential 1bp tighter at +10bps.

- Swap rates are 5-6bps lower.

- The bills strip is flat to +5, with the reds leading.

- RBA-dated OIS pricing is flat to 4bps softer across meetings, with Sep-Dec leading. A cumulative 40bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Judo Bank PMIs (P) and the Westpac Leading Index.

- Tomorrow, the AOFM plans to sell A$800mn of the 3% November 2033 bond.

AUSTRALIAN DATA: Economy Continued To Slow At End Of 2023

The December NAB business survey was mixed with confidence rising 7 points to -1 from -8, driven by retailers, but conditions declining 2 points to +7, still higher than 2019 but only just above the series average. Confidence is below the historical average despite the December improvement, as the business outlook is clouded by still above-target inflation and geopolitical and policy developments. NAB notes that the deterioration in business conditions likely resulted in the easing in price pressures.

- Conditions eased over 2023 starting at 22 in January and finishing at 7 after the RBA brought rates to 4.35% and cost-of-living pressures continued to be an issue for the entire year. Confidence was volatile in 2023 but finished the year around the annual average.

- Business conditions were weighed down by the trading environment (-3 points) and employment (-2 points) while profitability was unchanged. The deterioration was driven by manufacturing and construction but services were still robust. Capacity pressures eased with the utilisation rate down to 82.7%, remaining above average.

- Forward orders improved 1 point to -3, which is still below average.

- Export sentiment deteriorated with exports down 1 point and sales down 5 points.

- See NAB report here.

Source: MNI - Market News/Refinitiv

AUSTRALIAN DATA: Price Pressures Easing But More Needed

NAB notes that the deterioration in business conditions likely resulted in the easing of price pressures. All the survey price and cost measures eased in December with the price of final products posting the smallest increase since the Covid-impacted February 2021. The data is seasonally adjusted and so shouldn’t be impacted by the Cyber Week discounts.

- In terms of costs, purchase costs rose a robust 1.6% but down from November’s 2.5%. Australia is less likely to be impacted by the increase in global shipping costs, as goods from Asia don’t need to travel through the Suez or Panama Canals.

- Labour costs rose a solid 1.8% but eased from November’s 2.3% and are below the 2023 average of 2.6%. The NAB price/cost data is in quarterly equivalent terms.

- Final product prices increased 0.9% in December after 1.2% and retail prices rose 0.6% after 1.8%. If this moderation in prices is maintained, the retail series is consistent with the RBA’s target band but final product inflation needs to moderate further.

Source: MNI - Market News/Refinitiv

NZGBS: Richer, Q4 CPI Tomorrow

NZGBs closed 3bps richer across benchmarks after relatively narrow trading ranges. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Performance of Services Index.

- Global bond trading was subdued ahead of the BoJ Policy Decision, which has just been released. As expected, the BoJ left policy and forward guidance unchanged. The afternoon session for JGB trading commenced after the local close.

- US tsys are largely unchanged on the day, with the 10-year around 1bp lower.

- Elsewhere, there was a slight risk on move post-China equity news, as China mulls a stock market rescue package. Spillover was somewhat limited for global bonds.

- Swap rates closed 1-4bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 5bps softer across meetings, with Aug-Dec leading. A cumulative 93bps of easing is priced by year-end.

- ICYMI, the RBNZ has begun consultation on activating debt-to-income restrictions and loosening loan-to-value ratios for residential lending.

- Tomorrow, the local calendar sees Q4 CPI. Bloomberg consensus expects headline CPI to rise 0.5% q/q and 4.7% y/y, lower than the RBNZ forecast at 0.8% q/q and 5.0% y/y and down from Q3’s 1.8% q/q and 5.6% y/y.

FOREX: USD/JPY Reverses Post BoJ Gains, AUD & NZD Firm On Higher Equities

The USD is modestly softer. AUD and NZD have rallied on a firmer regional equity, mainly led by HK, amid fresh rescue hopes in the space from the China authorities. USD/JPY rose initially post the BoJ outcome, but is now back lower. The BBDXY sits down a little over 0.10%, last near 1235.40.

- The BoJ meeting came and went without any dramatic changes from the central bank. There were some modest tweaks to the inflation and growth forecasts. Core CPI for 2025 was kept under 2%, a more hawkish development would have been to raise this to 2% or higher.

- Still, the central bank sees itself gradually moving towards its inflation goal by the end of the projection period, albeit with uncertainty. For USD/JPY we got to a high of 148.55 post the meeting outcome, but we now sit back near 148.00. We still have Ueda's press conference to come.

- AUD/USD is up around 0.40%, last close to session highs, but unable to breach the 0.6600 in a sustainable fashion. Positive spill over from HK equity gains are likely helping at the margin. Iron ore is also higher, last above $131/ton. USD/CNH is also around 0.30% lower, last near 7.1710/20.

- NZD/USD is back close towards 0.6100, up 0.30% for the session, but is trailing the AUD modestly.

- Looking ahead, focus for the Tuesday session shifts to UK public finances data, the prelim Eurozone consumer confidence release and the latest ECB bank lending survey. In the US the Richmond Fed Index is out.

EQUITIES: China Equity Rescue Package, BoJ Rate Decision

Regional equities are mostly higher, with HK leading the way today, post news that China may look to support the equity market through a rescue package. US futures have been muted today, Nasdaq futures just holding onto gains up 0.10%, while Eminis were last near 0.01% higher.

- Japan has been dominated today by the BoJ rate decision, as the BoJ maintains policy rate at -0.1%, equity market sold off post the announcement. The Nikkei 225 was up as much at 0.73% prior to the decision and has since sold off to trade just 0.20% higher, while the Topix is now only marginally higher at this stage.

- Hong Kong and Mainland China indices have been active today, on the back of the news that China may look to stimulate the Equity market through a $278b rescue package (BBG). However, the rally has fizzled as investors suspect it may not be enough to have a real impact, the Hang Seng was up 3.5% at one stage to currently settle at 2.7% higher, while CSI is hovering around the unchanged levels for the day, after a 5% fall in the Hang Seng Mainland properties index yesterday the news of a rescue package has helped eras most of those loses to be trading 3.10% higher today.

- Elsewhere in Asia, equity markets the Taiex opened trading up 0.30% but has slowly given all gains back today to trade 0.15% higher. MSCI Sing up 0.67%, while India (Nifty 50 up 0.37%) became the world's fourth largest share market for the first time, overtaking Hong Kong.

- In Australia, the ASX 200 is up around 0.50%, largely on the back of the China Equity rescue package, with Australian business conditions data showing confidence remains weak. In SEA markets, markets are largely up between 0.20%-0.50% with the exception of Indonesia, which is 0.20% lower currently.

OIL: Crude Little Changed, US/UK Strike Houthis

Oil prices are little changed during APAC trading today and have been moving in a narrow range. WTI is flat at $74.73/bbl, but close to its intraday high of $74.82. Brent has broken through $80 during the session but is just below at $79.97, after a high of $80.10. The USD index is 0.1% lower.

- The US and UK hit Houthi sites on Monday in defence of commercial shipping. Ongoing geopolitical tensions in the Red Sea are providing a floor for oil prices. The market is also sensitive to any further Ukrainian attacks on Russian oil and gas infrastructure.

- Whereas IEA forecasts of plentiful supply have been putting a lid on how far crude can rally. US industry-sourced inventories are released later today and the recent cold snap may drive a further decline as production and refining were impacted by the weather.

- Another quiet calendar today with January US Richmond/Philly Fed indices released and euro area preliminary consumer confidence.

GOLD: Steady, Paring Of Rate Cut Expectations Weighs

Gold is steady in the Asia-Pac session, after closing 0.4% lower at $2021.70 on Monday.

- Bullion has come under pressure recently as rate cut expectations for the Federal Reserve have been scaled back.

- Fed speakers are in blackout ahead of next week’s FOMC meeting.

- The market is currently assigning less than a 50% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a week ago.

- According to MNI’s technicals team, support for the precious metal is seen at $2001.9 (Jan 17 low).

ASIA FX: CNH Firms, Aided By Stock Rescue Headlines & Tight Liquidity

CNH and KRW are the main pockets of strength so far in Tuesday trade. Hong Kong equity sentiment has rallied sharply on a potential China stock rescue. Mainland shares are only modestly higher at this stage. USD/CNH dipped back sub 7.1700 this afternoon. Elsewhere trends are more mixed. Still to come is Taiwan IP figures for Dec. Tomorrow, we have South Korea consumer confidence early, followed by the BNM decision late on in Malaysia.

- USD/CNH got to lows of 7.1664 a short while ago. We sit higher now, last near 7.1700, around 0.3% stronger in CNH terms. The only remaining EMA is the 100-day near 7.1630 to break on the downside. Onshore equities are marginally higher, but HK markets are up close to 3%. See this BBG link for more details around the potential stock rescue plan. To the extent this plan involves shifting SOE funds from offshore back into the domestic market it should be seen as a yuan positive all else equal. Other CNH supports have been evident in terms of tighter CNH liquidity and a widening USD/CNY fixing error term.

- 1 month USD/KRW is back to the 1331/32 region, with some positive spill over from lower USD/CNH levels. Onshore South Korean equities are marginally higher at this stage, the Kospi +0.40% firmer.

- Spot USD/SGD is lower, last near 1.3390/95. Dec CPI was slightly stronger than forecast. Headline printed at 3.7% y/y (3.5% forecast), while core was 3.3% y/y (3.0% forecast). Note we have the next MAS policy announcement on Monday.

- There are relatively steady trends elsewhere. USD/THB sits lower, last near 35.60, around 0.20% firmer in baht terms. The IMF expects Thai GDP to improve to 4.4% this year from 2.5% boosted by fiscal stimulus and robust consumption but then the economy is forecast to slow to 2% in 2025. It sees the risks to the downside.

MALAYSIA: MNI BNM Preview - January 2024: On Hold, Unlikely To Ease Before The Fed

- None of the 21 economists surveyed by Blomberg expect BNM to shift policy at tomorrow’s meeting. This would leave the policy rate at 3.00%, which is where it has been since May last year. Our firm bias is also for no change at the policy meeting.

- Inflation pressures continue to moderate, albeit at a reduced pace compared to earlier in 2023. The outlook for inflation is also mixed enough to caution the BNM against a dovish shift. This point is reinforced by weaker FX levels on both a spot basis and in NEER terms.

- Like elsewhere in the region, BNM is likely to wait for a more definitive Fed shift before it eases policy.

- See our full preview here:

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 23/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/01/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 23/01/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 23/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/01/2024 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

| 24/01/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/01/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.