-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: All About U.S. Tsy Supply

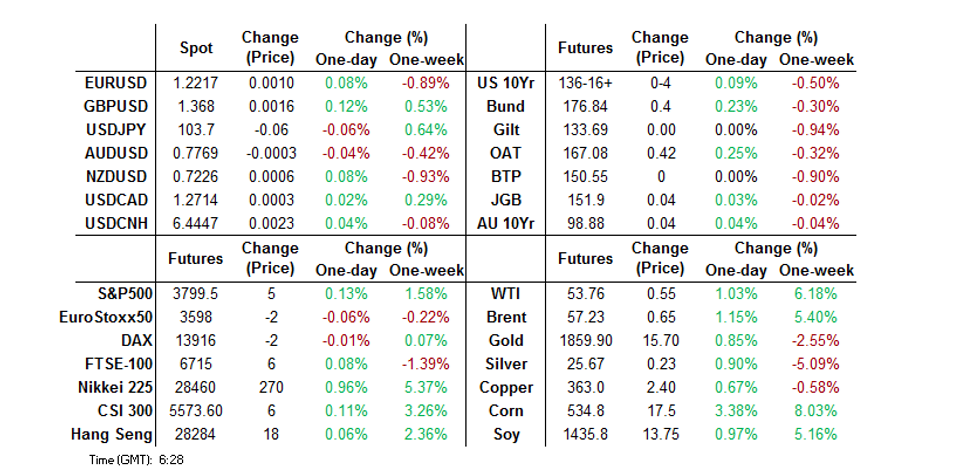

- U.S. Tsys firmed a little overnight, with focus on yesterday's strong 10-Year auction, while participants await today's 30-Year supply (30-Year Tsy yields failed to breach their March vol. highs on Tuesday).

- The DXY traded a touch weaker overnight, adding to the momentum seen in late NY trade on the U.S. Tsy yield downtick.

- The U.S. House of Reps is set to vote on Trump's impeachment later today, with some chatter that Senate Majority Leader McConnell is warming to the idea of the move.

BOND SUMMARY: Firmer But Off Best Levels

Asia-Pac investors were happy to participate in an extension of Tuesday's late NY Tsy rally, building on the momentum that came from a strong 10-Year Tsy auction. Flow dominated in Asia-Pac hours, with pockets of TYH1 buying and a 750 lot block lift of USH1 helping support early on. Headline flow was relatively light, with the U.S. House of Reps set to vote on Trump's impeachment on Wednesday. In an interesting turn, some reports have suggested that Senate Majority Leader McConnell may vote in favour of impeaching President Trump. T-Notes last +0-04 at 136-16+, after some light selling was seen in that contract, while cash trade has seen some modest richening, although the early bull flattening has unwound, with the long end back from Asia extremes, allowing the belly to outperform. Eurodollar futures unchanged to +1.0 through the reds, with Z1/Z2 flattener flow seen overnight. Local focus now moves to Wednesday's 30-Year Tsy supply, a raft of Fedspeak, as well as CPI and wage data. Matters on the Hill will also garner interest.

- JGB futures traded back to unchanged levels in early afternoon dealing, unwinding the morning bid, with little support seen on the back of a 5-Year JGB auction which was probably a little softer than most expected, but not outrightly weak. To recap, the auction saw the low price miss broader expectations (which stood at 101.05, per the BBG dealer poll), indeed the average price was in line with the expectations for the low price, while the tail widened marginally and cover ratio edged lower. Futures then regained some composure and finished +4, with long end outperformance at the fore in cash trade. Swap spreads were tighter out to 7-Years, but wider from 10-Years out. A widening of the regions covered by the Japanese state emergency is set to be officially announced later today.

- Aussie bonds firmed on the broader core FI bid, resulting in bull flattening of the curve, with YM unchanged and XM +4.0 at the bell. Swap rates finished unchanged to lower, while spreads were generally a little wider vs. ACGBs across the curve, with the widening most pronounced in the long end. In local news, The Australian covered comments from a Chinese embassy official who accused Australia of 'weaponising the concept of 'national security,' with the comments surrounding a failed A$300mn Chinese bid for an Australian construction company, which was scuppered by Australian Treasurer Frydenberg. Surplus E/S balances lodged at the RBA recorded another fresh all-time high.

FOREX: USD Rally Falters

The greenback held its worst levels for 4 days in Asia on Wednesday as markets digest headlines the US House will vote on Trump impeachment at approximately 1500EST.

- AUD/USD last down 9 pips at 0.7763. Tensions with China resurfaced after a bid by a Chinese state-owned company to buy an Australian construction company was shut down. Data showed job vacancies rose 23.4% in Dec after a 59.5% rise in November.

- NZD/USD is faring slightly better, up around 5 pips at 0.7224. Fitch affirmed NZ's ratings and outlook after market on Tuesday.

- USD/JPY last down 14 pips. There has been little in the way of notable local headline flow for JPY, with continued focus re: the potential expansion of the areas covered by the COVID-19 state of emergency. Japanese Prime Minister Suga news conference scheduled for 1000GMT/1900JST to give an update on the situation, while EconMin Nishimura proposed adding 7 prefectures to state of emergency.

- The PBOC fixed USD/CNY at 6.4605, some 218 pips firmer for the yuan on the weaker US dollar, but significantly softer than sell side estimates of 6.4510. According to Bloomberg analysts this is the biggest upside miss for the estimate since the inception of the metric in mid-2018.

- GBP has seen a continuation of yesterday's move, cable last changing hands at 1.3865, around 22 pips higher. EUR/USD 6 pips higher having seen a subdued session, last at 1.2213; sources note the move higher was capped by offers at 1.2220 and sizable option expiries between now and Jan 19.

FOREX OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-00(E543mln), $1.2200-10(E1.1bln), $1.2285-00(E985mln), $1.2350(E656mln)

- USD/JPY: Y102.00($525mln), Y103.00($1.4bln), Y103.70-80($990mln),

Y104.00-15($1.4bln) - USD/CAD: C$1.2750-65($790mln)

- USD/CNY: Cny6.45($594mln), Cny6.60($640mln)

- USD/MXN: Mxn19.85($520mln), Mxn20.00($500mln)

EQUITIES: U.S. Yield Pullback Provides Support In The Main

E-minis & regional equity indices generally traded unchanged to higher in Asia-Pac hours, after Wall St. recovered during the NY afternoon on the back of U.S. Tsy yield dynamics. The exception to the rule was China, with tech names heavy there, while some light pressure crept into the CSI 300 during afternoon trade with some focus on the potential for tighter liquidity into the Lunar New year evident.

- There was little in the way of notable headline flow evident during Asia-Pacific hours, with continued focus on all things U.S., namely the Fed, political drama and the outlook for fiscal policy.

- The Nikkei 225 was the biggest mover among the major regional indices, extending to yet another fresh, multi-decade high.

- Nikkei 225 +1.0%, Hang Seng unch., CSI 300 -0.7%, ASX 200 +0.1%

- S&P 500 futures +7, DJIA futures +64, NASDAQ 100 futures +31.

GOLD: Supported By DXY & U.S. Tsy Moves

The move away from fresh recent highs in longer dated U.S. Tsy yields and subsequent moderation of the recent DXY uptick has supported bullion since the NY afternoon, although spot continues to operate in familiar territory, with no meaningful movement on the technical front, last +$5/oz, trading around the $1,860/oz marker.

OIL: APIs & Broader Themes Support Crude In Asia

A larger than expected drawdown in the headline weekly API crude inventory estimates, a continued moderation of the DXY's recent uptick and light bid in e-minis has supported crude markets overnight with WTI & Brent sitting $0.60-0.70 above their respective settlement levels at typing.

- Tuesday saw crude specific headline flow dominated by questions re: Russia's compliance to the OPEC+ production pact in the month of December (which could have been one of the factors which resulted in Saudi Arabia's unilateral, voluntary output cuts, which are scheduled for the months of February and March).

- Elsewhere, the EIA slashed its projections for 2021 global crude oil demand in its latest STEO.

- Wednesday will see the release of the weekly DoE crude inventory report.

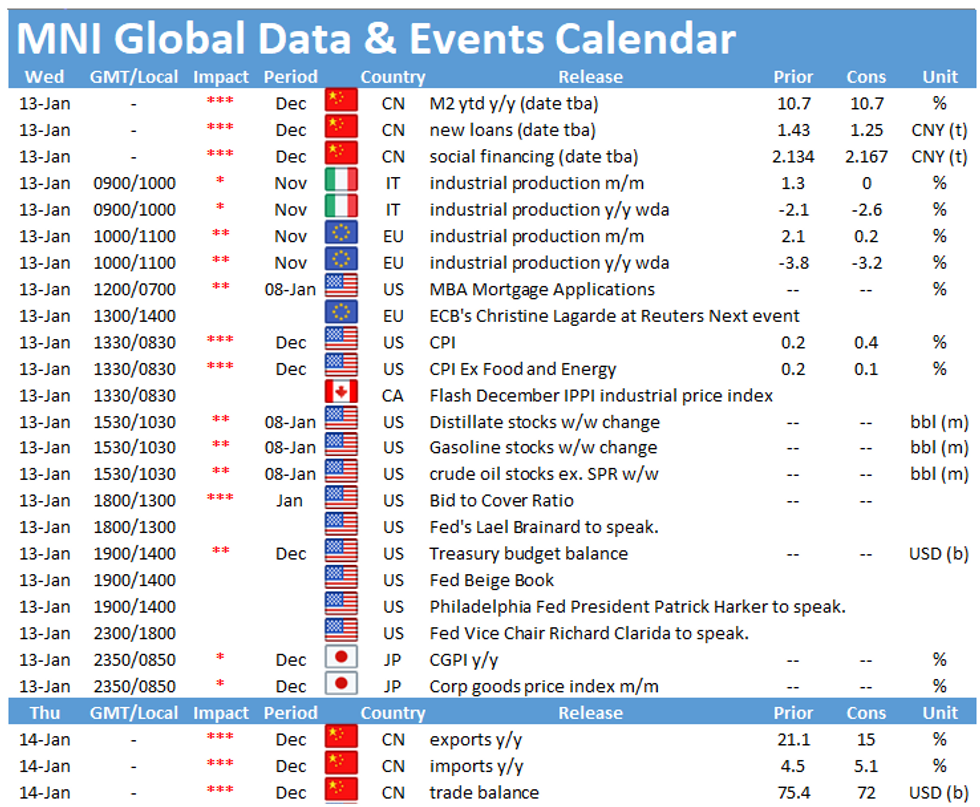

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.