-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN MARKETS ANALYSIS: Asia Ends Week On Cautious Note

- Asia shows a degree of caution as the U.S. returns from holidays, but core FI retreat from early highs even as JPY remains buoyant

- Familiar themes eyed as concern over caveats surrounding the launch & distribution of Covid-19 vaccine and continued spread of infections linger

- U.S. President Trump says he will give away power if the Electoral College picks Joe Biden as the new POTUS

- JGBs come under pressure after a soft 2-Year auction, recovery in the Nikkei 225

BOND SUMMARY: Core FI Pull Back After Early Uptick, Soft 2-Year JGB Auction Adds Pressure

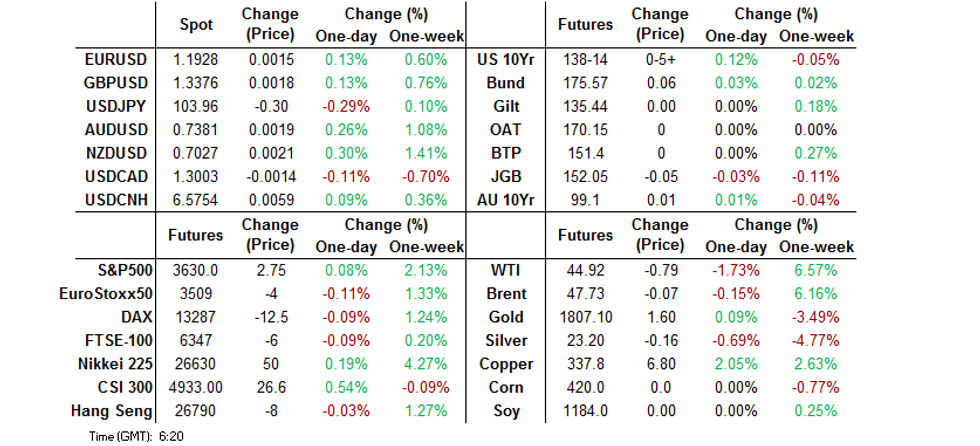

T-Notes jumped in early Tokyo trade, moving above Thursday highs as a mild sense of broader caution emerged. The contract peaked at 138-17+ and reversed its course, eventually wiping out earlier gains. It last trades +0-05+ at 138-14. Cash Tsy curve bull flattened upon returning from holidays. Yields last sit 0.4-3.0bp richer, off lows & flats. Eurodollar futures trade unch. to +0.5 tick through the reds. U.S. President Trump held a press conference, noting that he will relinquish power once the Electoral College chooses Joe Biden, but refused to comment on his presence at his successor's inauguration and potential for his renewed presidential bid in future.

- JGB futures edged higher early on, peeking above overnight highs, before turning its tail. The sell-off resumed after lunch, with a soft auction of 2-Year JGBs (underwhelming bid/cover ratio of 3.21x, relatively long tail, low price lower than exp.) adding some fresh pressure. The contract closed at 152.05, 5 ticks shy of the previous settlement. Cash JGB yields finished mixed, mostly a touch higher across the curve. 20s & 40s lagged at the margin early on, after Japanese bond dealers said yesterday that the market could digest more issuance of these tenors. Tokyo CPI report showed continued, faster than exp. deflation. News flow revolved around local coronavirus matters/the third extra budged being drafted by the government, with PM Suga's adviser pointing to the need for a more sizeable stimulus than forecast by bond traders. Looking ahead, the BoJ will release its Dec bond-buying plan later today.

- In Australia, XM pulled back from initial highs and erased most gains. Cash ACGB curve bull flattened, with yields seen unch. to -1.1bp come the end of play. The AOFM auctioned A$1.5bn worth of ACGB 0.50% 21 Sep '26 and released its weekly issuance slate. The space showed little interest in the latest escalation in Sino-Australian trade spat, weighed against the news that Victoria recorded 28 days without new coronavirus, meeting the official definition of being virus-free.

JGBS AUCTION: Japanese MOF sells Y2.5195tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.5195tn 2-Year JGBs:

- Average Yield -0.139% (prev. -0.130%)

- Average Price 100.481 (prev. 100.461)

- High Yield: -0.134% (prev. -0.127%)

- Low Price 100.470 (prev. 100.455)

- % Allotted At High Yield: 30.8217% (prev. 73.1880%)

- Bid/Cover: 3.212x (prev. 3.984x)

JGBS AUCTION: Japanese MOF sells Y6.1558tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1558tn 3-Month Bills:- Average Yield -0.0897% (prev. -0.0989%)

- Average Price 100.0241 (prev. 100.0263)

- High Yield: -0.0856% (prev. -0.0940%)

- Low Price 100.0230 (prev. 100.0250)

- % Allotted At High Yield: 91.5868% (prev. 35.0742%)

- Bid/Cover: 2.941x (prev. 2.707x)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.50% 21 Sep 2026 Bond, issue #TB164:

- Average Yield: 0.3988% (prev. 0.3937%)

- High Yield: 0.4025% (prev. 0.3950%)

- Bid/Cover: 4.0300x (prev. 4.5220x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 40.5% (prev. 64.0%)

- bidders 42 (prev. 49), successful 17 (prev. 16), allocated in full 10 (prev. 7)

AUSSIE BONDS: AOFM Releases Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 2 December it plans to sell A$2.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 3 December 2020 it plans to sell A$1.5bn of the 26 March 2021 Note & A$500mn of the 25 June 2021 Note.

- On Friday 4 December 2020 it plans to sell A$1.5bn of the 0.25% 21 November 2025 Bond.

- The AOFM noted that the next tender for the issue of Treasury Indexed Bonds is planned to be held on Tuesday, 8 December 2020.

- The AOFM also noted that the final tenders of Treasury Bonds, Treasury Notes and Treasury Indexed Bonds in 2020 are planned to be conducted in the week beginning 7 December 2020.

FOREX: Asia To End Week On Cautious Note

A sense of caution crept into G10 FX space in Asia after the U.S. Thanksgiving market closure translated into a slow start to the session. Questions surrounding AstraZeneca's Covid-19 vaccine research & the logistics of any future jab continued to temper initial enthusiasm about earlier reports from vaccine trials. Worrying global coronavirus situation & lockdown measures imposed across Europe helped keep risk appetite in check. JPY picked up a bid and outperformed all of its G10 peers, with USD/JPY sliding through the Y104.00 mark.

- The greenback brought up the rear in G10 basket. Outgoing U.S. President Trump said that he will give away power if the Electoral College chooses Joe Biden, bud deflected questions about his presence at Biden's inauguration & potential for running again in 2024.

- AUD held up well despite further escalation in Sino-Australian trade spat and a bearish 50-/100-DMA crossover in AUD/USD.

- USD/CNH recoiled after the release of Chinese industrial profits, even as their growth accelerated to a nine-year high of +28.2% Y/Y. Earlier in the day, the China Securities Journal suggested that the PBoC will not "proactively raise the policy rate for some time to come," although gradual exit from stimulus measures will continue.

- KRW printed its best levels against the greenback in 29 months, as the dollar went offered. This comes after repeated assurances from South Korean Finance Ministry & BoK that officials are ready to intervene to stabilise FX markets if needed.

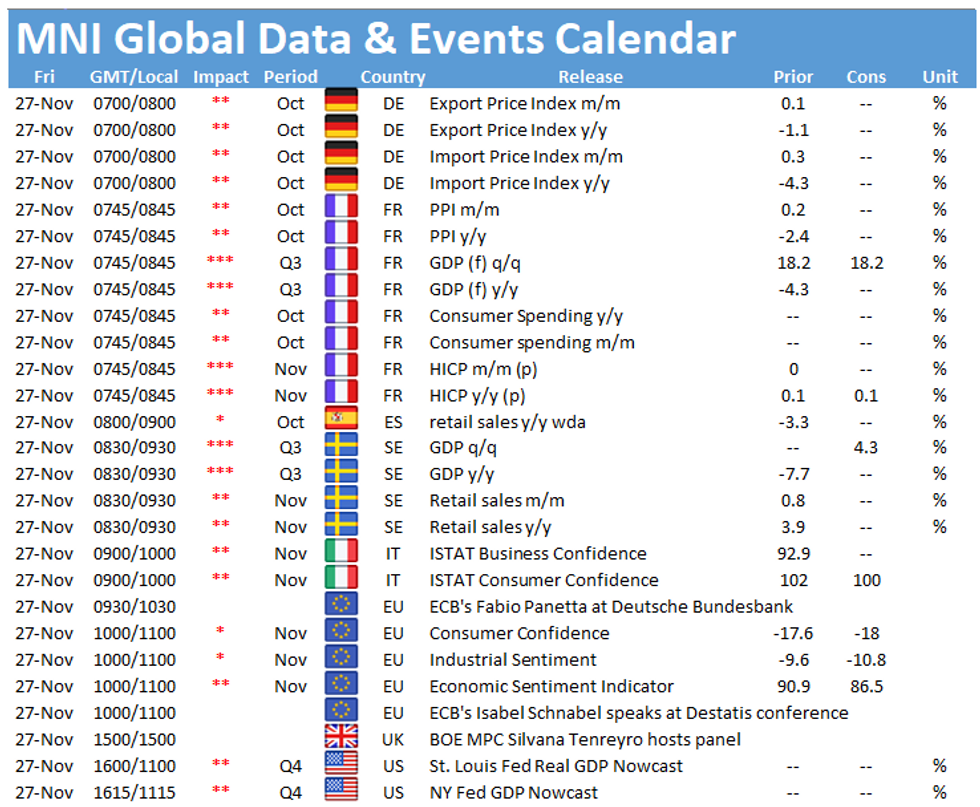

- Eyes move to flash French CPI & final French GDP, Swedish GDP & retail sales, Norwegian unemployment & EZ sentiment gauges, as well as comments from ECB's Schnabel & Panetta.

FOREX SUMMARY: Expiries for Nov27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1695-01(E838mln), $1.1850-60(E1.1bln), $1.1925(E550mln)

- USD/JPY: Y105.15-25($756mln), Y105.42($500mln)

- AUD/USD: $0.7250(A$1.8bln), $0.7325-30(A$1.3bln-A$1.27bln AUD calls), $0.7430(A$813mln)

- NZD/USD: $0.6950(N$676mln), $0.7050(N$865mln)

- USD/CAD: C$1.3000($600mln), C$1.3165-75($584mln)

- USD/CNY: Cny6.54($500mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.