-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN MARKETS ANALYSIS: AUD Pressured After CPI Falls

- AUD was pressured and ACGB's rose after Australia's May CPI print was weaker than expected.

- Kiwi was the weakest performer in the G-10 space at the margins as risk sentiment waned on reports that the US is looking at additional curbs on chip exports to China. US Equity futures were lower, NASDAQ futures are down ~0.4%.

- In an unusual move, Brent traded at a discount of around 10c to Dubai earlier, due to concerns re OECD rate hikes and the impact it will have on oil demand, according to Bloomberg. This means that lower grade crude was trading at a premium. If Brent closes lower, then this is the first time this has happened since November 2020. The spread has been narrowing due to reductions in output from the Middle East, whereas large US crude shipments (lighter, sweeter oil) to Europe have weighed on Brent.

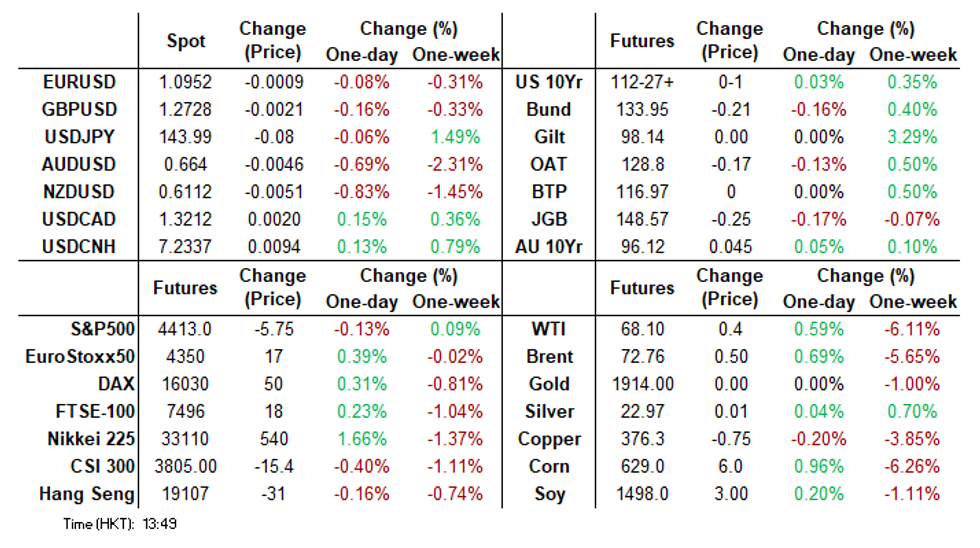

MARKETS

US TSYS: Curve Marginally Steeper In Asia

TYU3 deals at 112-28, +0-01+, a narrow 0-03+ range has been observed on volume of ~50k.

- Cash tsys sit 2bps richer to flat across the major benchmarks, light bull steepening is apparent.

- Tsys briefly firmed after a rally in ACGB's, in lieu of weaker than forecast inflation, spillover over. However there was little follow through on the move and tsys ticked away from session highs.

- Narrow ranges were observed for the remainder of the session and little meaningful macro news flow crossed.

- The data calendar is light in Europe, today's session is highlighted by a panel with Fed Chair Powell, ECB's Lagarde, BOJ's Ueda and BOE's Bailey at the Sintra conference. We also have the latest 7-Year Supply.

JGBs: Futures At Cheaps, Gov. Ueda On ECB Panel Later Today

In the Tokyo afternoon session, JGB futures are trading lower by 28 points compared to settlement levels. With a lack of significant domestic catalysts, it seems that the domestic market has been influenced by movements in US Treasury yields. In Asia-Pacific trade, cash Treasury yields have remained relatively stable across the major benchmarks after retracing their earlier gains.

- However, it is worth noting that there seems to be some follow-through selling following yesterday's 20-year supply, which saw a lower-than-expected cut-off price, a wider tail, and a lower cover ratio.

- The cash JGBs curve bear steepens led by the futures-linked 7-year zone (2.1bp cheaper). The benchmark 10-year yield is 1.6bp higher at 0.390%.

- The benchmark 20-year is 1.6bp cheaper at 0.974. The yield on 20-year debt advanced 1.5bp to 0.958% yesterday.

- Swap rates are higher across the curve with the 7-year zone leading (+1.4bp). Swap spreads are wider out to the 5-year zone and generally tighter beyond.

- Later today BOJ's Ueda is on a panel at the ECB Forum with Fed Chair Powell, ECB's Lagarde, and BOE's Bailey.

- The local calendar tomorrow sees Retail Sales (May), International Investment Flows (June 23) and Consumer Confidence (June).

- The MoF also plans to sell Y2.9tn 2-year JGBs.

AUSSIE BONDS: Richer But Off Bests, As Core CPI Measures See Smaller Declines

ACGBs sit stronger (YM +4.0 & XM +4.0) but well off session bests seen immediately following the release of lower-than-expected CPI monthly data for May. A closer inspection of the data revealed much smaller declines for the CPI ex-volatile items & holiday travel and the trimmed mean series. This assisted the move from market highs.

- Cash ACGBs are 1bp richer after the data to be 4-5bp richer on the day. The AU-US 10-year yield differential is -7bp on the day at +13bp.

- Swap rates are 6bp richer on the day with EFPs tighter.

- Bills are richer across the strip with pricing +4 to +7.

- RBA-dated OIS pricing is 4-6bp softer for meetings beyond August after the CPI data. The market now attaches a 31% chance of a 25bp hike in July.

- Tomorrow's local calendar sees the release of Retail Sales for May, which is anticipated to provide additional confirmation of the ongoing consumer slowdown.

- Australia’s first budget surplus in 15 years will be larger than the A$4.2 billion seen just last month, Treasurer Jim Chalmers said, as elevated commodity prices and a tight labour market bolster revenue. (See link)

- Australia is bound for a recession after rapid interest-rate increases, so its sovereign bonds offer a “fantastic opportunity” with many investors underpricing that risk, according to PIMCO. (See link)

NZGBS: At Cheaps, NZDM Announcement Weighs, NZ/AU 10-Year Differential Wider

NZGBs closed at or just off session cheaps, 1-4bp cheaper on the day. News that NZ Treasury plans weekly auction offerings NZ$500m bonds in July appears to have weighed. Recent weekly auctions have been NZ$400mn.

- The local market was also guided by US tsys and ACGBs. Cash tsys are dealing little changed across the major benchmarks in Asia-Pac trade after giving back early strength.

- ACGBs gapped higher after May's CPI Monthly printed lower than expected. The revelation that the core measures saw much smaller declines saw the gains pared. The NZ/AU 10-year yield differential widened by 7bp on the day.

- Swap rates closed 3bp lower with implied swap spreads 7-8bp tighter.

- RBNZ dated OIS pricing closed little changed.

- NZ Prime Minister Hipkins discussed his country’s interest in boosting economic ties with China during a meeting with Chinese President Xi Jinping in Beijing on Tuesday. (See link)

- The local calendar sees the release of the latest ANZ Business Outlook survey tomorrow. On Friday, Consumer Sentiment is expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

- Later today BOJ's Ueda is on a panel at the ECB Forum with Fed Chair Powell, ECB's Lagarde, and BOE's Bailey.

OIL: Crude Bounces, Unusual Negative Brent-Dubai spread

Oil prices trended down earlier in the APAC session because of continued demand worries, but have bounced off their intraday low to be higher on the day helped by the US crude stock drawdown and the USD index coming off its highs. WTI is up 0.7% to around $68.20/bbl after a low of $67.74 earlier. Brent is also 0.7% higher at $73.05 following a low of $72.57.

- In an unusual move, Brent traded at a discount of around 10c to Dubai earlier, due to concerns re OECD rate hikes and the impact it will have on oil demand, according to Bloomberg. This means that lower grade crude was trading at a premium. If Brent closes lower, then this is the first time this has happened since November 2020. The spread has been narrowing due to reductions in output from the Middle East, whereas large US crude shipments (lighter, sweeter oil) to Europe have weighed on Brent.

- There have also been huge opposing positions in Middle East crude taken by China’s largest oil company and refiner which have clouded the market.

- Bloomberg is reporting that the Brent-Dubai exchange of futures for swaps for August has narrowed to 4c/bbl from $2 at the start of June. It is an indicator of flows from west to east.

- Later EIA US inventory data prints. Fed’s Powell, ECB’s Lagarde, BoJ’s Ueda and BoE’s Bailey all speak at the ECB Sintra conference. US May trade and inventories are released as well as the Fed’s bank stress test report.

GOLD: Lower After US Data Pushes Yields Higher

Gold is slightly higher (+0.1%) in Asia-Pac trading after closing at a three-month low as a flurry of data showed a surprisingly strong US economy, giving the Federal Reserve more scope to keep raising rates.

- In May, durable goods orders experienced a 1.7% m/m increase, surpassing expectations of -0.9%. Additionally, new home sales saw a substantial 12.2% m/m rise in May, contrary to the expected -1.2% decline. Furthermore, the US Conference Board Consumer Confidence Index exceeded expectations and reached its highest level since January 2022.

- Bullion faced downward pressure as tsy yields increased, which is a disadvantage for gold due to its lack of interest-bearing characteristics.

- The prospect of further tightening measures in the US and other countries is adding downward pressure on the precious metal, which has declined approximately 7% since its peak in early May.

- However, there is still some concern that a hawkish stance by the Federal Reserve could potentially push the world's largest economy into a recession, providing some support for gold.

FOREX: AUD Off Post-CPI Lows

AUD has trimmed some of its post CPI losses, the AUD was down as much as 1% as May CPI was weaker than forecast, before paring losses to sit ~0.6% softer.

- AUD/USD prints at $0.6640/45, the pair found support below $0.6627, 61.8% retracement of May 31 to Jun 16 rally. The next support level is $0.6610 the Jun 6 low. AUD/NZD sits unchanged, the cross found support ahead of the $1.08 handle and erased losses of as much as 0.4%.

- Kiwi is the weakest performer in the G-10 space at the margins. NZD/USD is down ~0.7% and last prints at $0.6120/25. The pair sits a touch above the support at the low from 23 June ($0.6117), a break through here opens the low from June 8 ($0.6031).

- Yen is a touch firmer, however ranges have been narrow with little follow through. Early in the session Japan's Kanda said that Japan will respond appropriately to excessive FX moves.

- Elsewhere in G-10, EUR and GBP are down ~0.1%. NOK is ~0.3% softer, however liquidity is generally poor in Asia.

- Cross asset wise; US equity futures are pressured coming after the WSJ reported that the US is considering new curbs on chip exports to China. E-minis are down ~0.2% and NASDAQ futures are down ~0.4%. BBDXY is ~0.1% firmer and US Tsy Yields are a touch softer across the curve.

- The data calendar is light in Europe, today's session is highlighted by a panel with Fed Chair Powell, ECB's Lagarde, BOJ's Ueda and BOE's Bailey at the Sintra conference.

AUSTRALIA: Underlying Inflation Now Above Headline, Proving Sticky

May headline CPI inflation came in well below expectations at 5.6% y/y after 6.8% in April, the lowest since April 2022. As the details of the April data were not as strong as the headline, neither is May as soft as it looks. The moderation in the annual rate this month was significantly helped by base effects as May 2022 rose 1.1% m/m but May this year was flat on the month, signalling an easing in headline price pressures. The underlying measures moderated but not by as much and continue to signal that core is slower to come down. Ahead of the July 4 RBA meeting the labour market remains very tight but inflation pressures are easing but in line with its forecast so far.

- The ABS specifically pointed to the CPI ex volatile items & holiday travel series to look through some of the recent volatility. It rose a solid 0.5% m/m to be up 6.4% y/y, down slightly from April’s 6.5%. It peaked in December at 7.3% and is now down 0.9pp compared with headline’s -2.8pp. The trimmed mean moderated to 6.1% in May from 6.7% and is 1.1pp below its peak. Underlying inflation is stickier and now running above headline.

- The ABS noted that prices for most items are still rising but by less than they have been. The largest positive contributors to inflation were housing (+8.4% y/y), food (+7.9%) and furniture & household items (+6%) but fuel fell 8% (driven by lower global prices). New homes rose at their lowest since November 2021 (+8.3%) but rents continued to rise at +6.3% y/y in May up from 6.1%.

- ABS noted that higher rents, wages & utilities were being passed on by restaurants to customers.

Source: MNI - Market News/ABS

AUSTRALIA: RBA Dated OIS Softer After CPI Monthly Miss

RBA-dated OIS pricing is 4-6bp softer for meetings beyond August after the CPI Monthly data misses, printing 5.6% y/y versus expectations of 6.1%. April’s reading was 6.8% y/y.

- As the details of the April data were not as strong as the headline, neither is May as soft as it looks. The ABS specifically pointed to the CPI ex volatile items & holiday travel series to look through some of the recent volatility. It rose a solid 0.5% m/m to be up 6.4% y/y, down slightly from April’s 6.5%.

- The trimmed mean moderated to 6.1% in May from 6.7% and is 1.1pp below its peak. Underlying inflation is stickier and now running above headline.

- The market now attaches a 31% chance of a 25bp hike in July versus 37% yesterday.

Figure 1: RBA-Dated OIS – Pre-Data Vs. Post-Data

Source: Bloomberg / MNI - Market News

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/06/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/06/2023 | 0800/1000 | ** |  | IT | PPI |

| 28/06/2023 | 0800/1000 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 28/06/2023 | 0900/1100 |  | EU | ECB de Guindos Panels ECB Forum | |

| 28/06/2023 | 1030/1130 |  | UK | BOE Pill Panels ECB Forum | |

| 28/06/2023 | 1030/1230 |  | EU | ECB Lane Panels ECB Forum | |

| 28/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/06/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2023 | 1330/1430 |  | UK | BOE Bailey Panels ECB Forum | |

| 28/06/2023 | 1330/1530 |  | EU | ECB Lagarde Panels ECB Forum | |

| 28/06/2023 | 1330/0930 |  | US | Fed Chair Jerome Powell | |

| 28/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.