-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Australian CPI Steady, But Services Inflation Higher

- Australian February CPI was steady at 3.4% y/y, slightly lower than Bloomberg consensus. Cash ACGBs are 2bps richer, with the AU-US 10-year yield differential 4bps lower at -21bps. In NZ, NZGBs closed flat to 1bp cheaper but near the session’s best level. Today the focus was on the Budget Policy Statement. In Tokyo afternoon trading, JGB futures are stronger, +13 compared to the settlement levels, after responding positively to the 40-year auction results.

- In the FX space, the USD remains supported. We saw fresh highs back to 1990 for USD/JPY near 152.00. Further rhetoric from FinMin Suzuki around potential bold action helped curb topside in the pair, but dips have been shallow. Onshore USD/CNY spot continues to gravitate higher, despite a supportive fixing backdrop. Hong Kong & China equities are mostly lower, positive trends were evident elsewhere.

- Commodities were softer in some parts, with iron ore slipping back towards $100/ton, while oil also weakened.

- Looking ahead, the Fed’s Waller and ECB’s Cipollone and Elderson speak. The March European Commission survey prints.

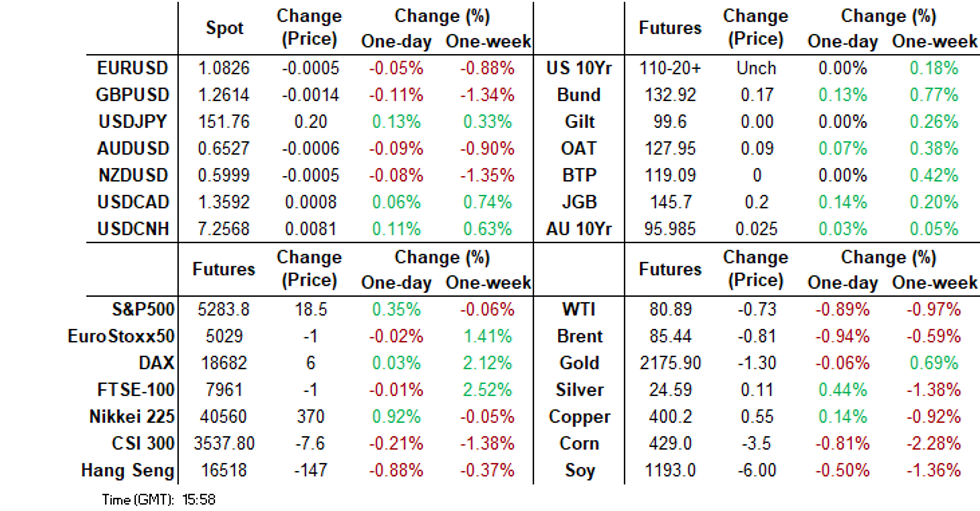

MARKETS

US TSYS: Treasury Futures Little Changed, Bullish Bets Hit Lowest Since July

- Jun'24 10Y futures have traded sideways on Wednesday, while volumes remained on the low side, we hit lows of 110-19 and a high of 110-21+ and now trade - 00+ at 110-20. 5Y traded similar making lows of 106-30+ and a high of 107 heading into the European open we currently trade -00+ for the day at 106-31

- Looking at technical levels: Initial support lays at 110-08+ (Mar 21 low) while below here the 109-24+ (Mar 18 low/ the bear trigger), further down 109-14+ (Nov 28 low). While to the upside resistance holds at 110-30+ (Mar 21 & 22 high), above here 110-31+ (50-day EMA), while a break above here would open a retest of 111-24 (Mar 12 high).

- Cash Treasury curve has done very little today with the 2Y yield +0.4bp at 4.595%, 10Y +0.2bp to 4.234%, while the 2y10y unchanged at -36.354

- (Bloomberg) -- What Baltimore Bridge Collapse Means for Inflation (See link)

- (Bloomberg) -- Bond Managers Unwind Bullish Futures Bets to Lowest Since July (See link)

- Wednesday Data Calendar: Wholesale Sale/Inventories, Tsy $43B 7Y Note Auction while Fed Gov Waller will discuss economic outlook at Economic Club NY at 1800ET (text, Q&A).

JGBS: Stronger After 40Y Supply Absorbed Smoothly

In Tokyo afternoon trading, JGB futures are stronger, +13 compared to the settlement levels, after responding positively to the 40-year auction results. The issuance of 40-year bonds encountered a solid reception, with the actual high yield undershooting dealer expectations (1.925% versus the realised yield of 1.905%). Moreover, the cover ratio rose to 2.487x from 2.148x at the January auction.

- There weren’t any domestic data drivers to flag today.

- (Bloomberg) -- BoJ Board Member Naoki Tamura says the manner in which monetary policy is managed is going to be extremely important for a slow, steady normalization to put an end to extraordinarily large-scale easing. (See link ICYMI)

- (Bloomberg) -- The impact of cost-push inflation stemming from imports is expected to ease and people’s livelihood is likely to improve, BoJ Governor Ueda says. (See link ICYMI)

- The cash JGB curve has bull-flattened, with yields flat to 2bps lower. The benchmark 10-year yield is 0.5bp lower at 0.733% versus the YTD high of 0.801%.

- The 40-year yield is 2bps richer in post-auction dealings at 2.072%.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates 3bps lower to 1bp higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see Weekly International Investment Flow data, along with BoJ Rinban operations covering 3- to 25-year JGBs.

AUSSIE BONDS: Richer After CPI Monthly Data, Retail Sales Tomorrow

ACGBs (YM +2.0 & XM +2.0) sit slightly richer on the day but 4-5bps stronger than pre-CPI levels.

- February CPI was steady at 3.4% y/y, slightly lower than Bloomberg consensus. Seasonally adjusted it rose 0.5% m/m, with the annual rate rising to 3.7% from 3.5%.

- Inflation continues to be contained by goods and tradeables prices. However, domestically driven inflation remains sticky as services in February rose to 4.2% y/y from 3.7% and non-tradeables to 4.8% from 4.7%. This area remains a particular focus for the RBA.

- The mixed messages from the February data confirm the importance of the quarterly CPI due on April 24.

- (AFR) Trimmed mean inflation, the RBA’s preferred measure for price changes, rose slightly from 3.8% to 3.9%. (See link)

- Cash ACGBs are 2bps richer, with the AU-US 10-year yield differential 4bps lower at -21bps.

- Swap rates are 1bp lower.

- The bills strip is slightly cheaper, with pricing -1 to -2.

- RBA-dated OIS pricing is little changed on the day across meetings. A cumulative 40bps of easing is still priced by year-end.

- Tomorrow, the local calendar sees Retail Sales, Consumer Inflation Expectations, Private Sector Credit and Job Vacancies data.

AUSTRALIAN DATA: CPI Steady But Services Inflation Higher

February CPI was steady at 3.4% y/y, slightly lower than Bloomberg consensus. Seasonally adjusted it rose 0.5% m/m and the annual rate is up to 3.7% from 3.5% in December. While the ex volatile items & holiday travel eased 0.2pp to 3.9% y/y, the trimmed mean rose 0.1pp to 3.9% and services were higher too. The mixed messages from the February data confirm the importance of the quarterly CPI due on April 24.

- Inflation continues to be contained by goods and tradeables prices with them easing to 2.9% y/y and 0.8% respectively, and the lowest since mid-2021.

- However, domestically driven inflation remains sticky as services in February rose to 4.2% y/y from 3.7% and non-tradeables to 4.8% from 4.7%. This area remains a particular focus of the RBA and as a result of the upcoming Q1 CPI data.

- Housing, food, alcohol & tobacco and insurance remained the main drivers of annual inflation. Rents rose 7.6% y/y up from 7.4%, as vacancy rates remained low. Insurance is up 16.5% y/y and the rise has been broadbased across types.

Source: MNI - Market News/ABS

AUSTRALIAN DATA: Falling Inflation & Low Unemployment Helping Consumers’ Mood

In February, the unemployment rate fell 0.4pp to 3.7%, underutilisation rate -0.5pp to 10.3%, and CPI inflation was steady at 3.4% y/y. The misery index using headline CPI and underutilisation, as a result, fell to its lowest since the end of 2007. Therefore it is not surprising that seasonally adjusted Westpac consumer confidence has troughed and while still depressed rose 0.9% m/m in February. Non-seasonally-adjusted sentiment fell 1.8% in March but seasonally adjusted it rose another 0.6% m/m, the highest level since June 2022. Moderating inflation while most people who want a job have one with enough hours is helping households to feel less pessimistic. If the RBA can achieve its goal of holding onto employment gains while returning inflation to the band, then it may just be able to stay on its “narrow path”.

Australia misery index vs Westpac consumer confidence

Source: MNI - Market News/Refinitiv

NZGBS: Closed Flat, Budget Policy Statement The Focus

NZGBs closed flat to 1bp cheaper but near the session’s best level. Today the focus was on the Budget Policy Statement.

- (Bloomberg) NZ Treasury has downgraded expectations for GDP growth in the Budget Policy Statement. It sees 0.1% annual average growth through June 2024 and 2.1% annual average growth through June 2025. As a result, tax revenue over five years to 2028 will be NZ$13.9b less than projected in HYEFU. (See link)

- (Bloomberg) NZ Finance Minister Nicola Willis will press ahead with tax cuts this year even as the stagnant economy curbs government revenue. Tax relief will be announced in the May budget and delivered from July 1, Willis said today in Wellington. (See link)

- Cash US tsys are dealing little changed in today's Asia-Pac session.

- Swap rates closed flat to 1bp lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is slightly softer across meetings. A cumulative 68bps of easing is priced by year-end.

- Tomorrow, the local calendar sees ANZ Consumer and Business Confidence.

- Tomorrow, the NZ Treasury plans to sell NZ$275mn of the 3% Apr-29 bond and NZ$225mn of the 4.25% May-34 bond.

- Later today will see US Wholesale Sale/Inventories and $43bn of 7Y US tsy supply. Also, Fed Gov Waller will discuss the economic outlook at Economic Club NY at 1800ET (text, Q&A).

NZ BUDGET: Government’s 2024 Growth & Inflation Estimates Revised Down Sharply

The new government has released its Budget Policy Statement which will guide its decisions for the 2024 budget which will be published on 30 May. But the scenario it is starting with involves slower growth and tax revenues, and as a result a surplus is not likely until 2028, but that is not a “given”.

- The updated economic scenario includes the higher multi-year capital allowance, but not any of the “announced or proposed” policy changes. They will be included in the May budget. Updated fiscal forecasts are also not included in today’s statement.

- 2024 growth has been revised down sharply since the Half Year Update to 0.1% from 1.5% but 2025 has been revised up to 2.1% from 1.5%. This doesn’t impact the unemployment rate materially for this year but it is now forecast to be 0.3pp lower next year and the year after.

- Inflation has been revised down sharply for 2024 to 3.3%, close to the top of the RBNZ’s band, from 4.1% in the mid-year update, with it easing to 2.2% in 2025 (revised down from 2.5%. Despite the RBNZ’s independence, Treasurer Willis said that there’s “scope” for rate cuts later this year, which was likely driven by the downward revisions to Treasury’s inflation forecasts.

- Tax revenues have been adjusted downwards over the forecast horizon with 2026 2.6% lower than in the Half Year Update. The government still plans to cut taxes for all income levels but won’t need to borrow to achieve this election promise.

- The government is going to target net debt of 20-40% of GDP.

NZ DATA: Job Ads Continue Decline As Economy Slows

SEEK job ad data show that the labour market has eased considerably as demand for labour slows at the same time as labour supply rises. New job ads fell 2.6% m/m in February, they have now fallen five of the last six months with the weakness concentrated in the cities. Ads are now down 26.7% y/y to their lowest level since the pandemic-affected October 2020. The number of applicants per job seeker rose 3.2% m/m in January to its highest since the series began in 2008 and three times the February 2019 level. Construction saw the largest decline in job ads while they rose in healthcare.

NZ SEEK new job ads 2013=100

Source: MNI - Market News/SEEK

FOREX: USD/JPY Prints Fresh Highs, Downside Limited Despite Further FX Rhetoric

The USD index sits higher, last around 1245. We aren't above 1247, which has marked recent highs, but broader USD trends remain positive. US yields are close to unchanged, while US equity futures are higher, although this hasn't lent support to higher beta FX in the G10 space.

- USD/JPY sits back under 151.70. We got to 151.97 earlier, fresh highs in the pair back to 1990. Earlier comments from BoJ Governor Ueda and board member Tamura didn't show any hawkish push back to the recent BoJ outcome. This weighed on yen at the margins. Comments from FinMin Suzuki in terms of fresh rhetoric around FX weakness, including stating that the authorities were prepared to take bold action, helped curb yen weakness.

- Still, the USD/JPY pull back has been shallow and 1 week risk reversals are not too far off recent highs, suggesting the market is not too concerned around a very sharp USD/JPY pull back.

- Elsewhere, AUD/USD was last near 0.6520/25, up slightly from session lows (0.6511). We weighed earlier by the Feb monthly CPI miss (3.4% y/y, versus 3.5% forecast), although the detail showed firmer services inflation. Another headwind has come from weaker HK/China stocks, due in part to earnings concerns. Iron ore prices are also lower, back sub $103/ton.

- Note as well USD/CNY spot has risen back close to highs from last Friday, near 7.2300. This is another constraint, particularly on the likes of AUD.

- NZD/USD is back to 0.5995, but like AUD is up from earlier lows (0.5988). Today focus has been on the NZ Budget Policy statement. The government plans to push ahead with tax cuts, even as the return to surplus gets pushed out. The NZ Treasury sees scope for RBNZ cuts in H2 this year.

- Later the Fed’s Waller and ECB’s Cipollone and Elderson speak. The March European Commission survey prints.

ASIA EQUITIES: China & HK Equities Mostly Lower, Mainland Prop The Exception

Hong Kong and China equities are mostly lower today, Mainland Property names the exception, while corporate earnings have started to be released. In the property space, Shimao Group has yet to move any closer to agreeing on restructuring terms with their creditors while Longfor looks to repay offshore loan. Elsewhere, Apple reports a drop in iPhone shipments in February, China EV maker BYD missed forecast profit, China will look to take the US to the WTO over EV subsidies, while earlier China Industrial Profit rose to 10.2% Feb from -2.3% in Jan

- Hong Kong equities are mostly lower today, with the HSTech Index as the worst performer down 1.70%. The Mainland Property Index is the top performer today, potentially moving higher on news Longfor will start repaying offshore debt with the index up 0.68%, while the HSI is down 0.75%. In China, small-cap names are faring the worst, with the CSI1000 down 1.75% and down about 5.5% for the past week. ChiNext is down 1.46%, while large-cap CSI300 is down just 0.49%.

- China Northbound flows were 4.7billion yuan on Friday, with the 5-day average at -1.34billion, while the 20-day average sits at 2.24 billion yuan.

- In the property space, a key creditor group of Chinese developer Shimao Group Holdings Ltd. has yet to support any of the four options proposed by the company for restructuring its offshore debt, extending negotiations that have lasted over a year and a half. Despite Shimao's offerings, which include debt-to-notes swaps and zero-coupon mandatory convertible bonds, the final debt restructuring plan remains under discussion, reflecting the ongoing challenges faced by Chinese developers amidst the country's property-sector debt crisis, while Longfor Group informed some investors during an investor call that it intends to initiate early repayment of an offshore syndicated loan due in January 2025, possibly commencing next month by remitting around 500 million to 1 billion yuan monthly

- In February, Apple's iPhone shipments in China dropped by 33% compared to the previous year, reflecting a continuing decline in demand exacerbated by the resurgence of Huawei as a competitor and a broader slowdown in the Chinese smartphone market, leading analysts to anticipate further deterioration in iPhone sales throughout the year.

- BYD Co., China's EV leader, reported annual profit slightly below analyst expectations at 30.04 billion yuan, missing the forecast of 30.94 billion yuan. Despite overtaking Tesla as the world's largest electric car seller in Q4 2023, BYD faces challenges in maintaining this title due to seasonal sales fluctuations around the Lunar New Year holiday. The company aims to boost EV adoption through aggressive price cuts and expansion into the luxury market, amidst a competitive landscape where industry growth is expected to slow down for the second consecutive year.

- China has taken its disagreement with the US regarding electric vehicle subsidies to the World Trade Organization, arguing that elements of President Joe Biden's climate law passed in 2022 are discriminatory and have distorted the global EV supply chain. The complaint follows US restrictions on electric car tax credits and reflects escalating tensions over trade and geopolitics in the EV sector. Despite China's legal challenge, experts suggest the case may face hurdles and is unlikely to compel the US to alter its policies. China's nurturing of its domestic EV industry through subsidies and support, including exclusivity for local battery manufacturers in the past, further underscores the complexities of the dispute.

ASIA PAC EQUITIES: Equities Mostly Higher, BoJ Speak, AU CPI Holds Steady

Regional Asian equities are mostly higher today. Japanese equities are getting a boost from the weaker yen. BoJ speak has been the main focus in the region, Ueda expressed confidence in achieving the price target due to the very low current short-term rate, Suzuki & Tamura mentioned they will do the utmost to ensure FX stability. South Korea had business manufacturing data earlier, while Australia had CPI data.

- Japan equities are higher today as the yen edged closer towards a 34 year low, while investors have also been seen adjusting positions heading into FY end later this week. Exports have been the largest gainers today with wholesale trading and transportation names the top gainers in the sector. BoJ's Tamura is currently speaking in Aomori where he emphasized that accommodative financial conditions will persist, indicating a commitment to maintaining supportive monetary policies. He stresses the importance of future monetary policy guidance in ensuring a gradual move towards policy normalization. Tamura expects a positive cycle of wages and prices to continue and highlights the goal of normalization as restoring the function of interest rates. He expresses optimism that a virtuous cycle in the economy is likely to persist. The Topix is up 0.95%, led higher by real estate names after data showed land prices had climbed, while hawkish comments from the BoJ helped add speculations borrowing costs will remain low, while the Nikkei 225 is up 1.24%.

- South Korean equities opened slightly higher but have erased those gains to now trade in the red. Earlier the BoK business manufacturing and non-manufacturing sentiment indicators printed for April. On the manufacturing side we slipped to 73 from 75. Non-manufacturing eased to 69 from 70. While foreign investors have pumped $3.4b into the markets over the past 5 days. The Kospi is now down 0.10%

- Taiwanese equities are higher today, with the Taiex now up 0.50%, after initially opening a touch lower. Semiconductor names have been the largest contributors to index moves today, while recently there has been a lot of talk from policy officials warning investors to stop flooding the market and pumping stock as they fear stock market bubbles while also looking at cracking down on internet influencers. Taiwan equity flows had largely been tracking SK's however have diverged over the past week with -$955m of net outflows occurring.

- Australian equities are higher today, earlier we had WBC Consumer confidence which fell from the month prior hitting -1.8% vs 6.2% in Feb, while the leading index rose to 0.8% from -0.8% in Jan and finally CPI data was in line with Jan coming in at 3.4% vs 3.5% expected. Most sectors ticked higher today, other than tech and Utilities. The ASX200 closed up 0.51%

- Elsewhere in SEA, New Zealand equities are lower today, down 0.18% earlier NZ released their Budget Policy Statement where they announced the treasury had downgraded expectations for GDP growth, Singapore Equities are 0.76% higher, Indian Equities up 0.70%, Philippines equities are down 0.12%, while Malaysian equities are down 0.32%

ASIA EQUITY FLOWS: China Equities Continue To See Inflows, Taiwan Flows Turn Negative

- China equities pushed higher on Tuesday, while flows via northbound connect were again positive with 4.7b yuan flowing in. Market see-sawed on Tuesday, while the CNY pushed higher helping the local market. Corporate earnings are the focus looking ahead with many Chinese Banks and Insurers reporting today, the banks reports will give investors into a look at their exposures to the property space which could set the tone for the coming months. Elsewhere China has Industrial Profit due out shortly. The 5-day average is 1.3b vs the 20-day average at 2.24b both comfortably above the longer term 100-day average.

- South Korean equities surged higher on higher after Micron Technology rallied 6.25%. As the day progressed investors looked to take profit with the Kospi finished the session up about 1%. On the data front Consumer confidence dropped to 100.7 from 101.9, there was little else in the way of market headlines. SK saw $515m of foreign investors inflows on Tuesday with the majority of that heading to tech names. the 5-day average is now $981m vs the 20-day at $178m inline with longer term 100-day average of $181m

- Taiwan equities traded lower on Tuesday with higher tech names not able to keep the market in positive territory, this could have something to do with regulators and government officials warning of inflated equities prices. Taiwan saw their second day in a row of outflows with -$336m leaving the market, taking the 5-day average to -$191m, the 20-day average sits at just $35m well below the longer term 100-day at $176m

- Thailand, Indonesian & Philippines equity markets saw modest foreign investors flows on Tuesday with very little in the way of market headlines, India was back from their public holiday although lag their flows reporting by a day.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 4.7 | 6.7 | 73.1 |

| South Korea (USDmn) | 516 | 3407 | 11279 |

| Taiwan (USDmn) | -336 | -956 | 5966 |

| India (USDmn)** | 0 | -731 | 971 |

| Indonesia (USDmn) | -26 | 36 | 1765 |

| Thailand (USDmn) | 39 | -506 | -1920 |

| Malaysia (USDmn) *** | 3 | -11 | -92 |

| Philippines (USDmn) | -32 | -31.7 | 168 |

| Total (Ex China USDmn) | 165 | 1208 | 18137 |

| * Northbound Stock Connect Flows | |||

| *** Data Up To March 25 |

OIL: Crude Continues To Fall After Large US Stock Build Reported

After falling almost a percent on Tuesday, oil prices have continued shifting lower during APAC trading today after US data showed a large crude stock build. Weaker risk sentiment and a slightly stronger US dollar (US index +0.1%) are also weighing on oil and other commodities. WTI is down 0.8% to $80.97 off the intraday low of $80.81. Brent is 0.9% lower at $85.48/bbl after a low of $85.51.

- Bloomberg reported that there was a significant crude stock build of 9.34mn barrels last week, according to people familiar with the API data. However, gasoline inventories fell 4.44mn, while distillate rose 500k. The official EIA data is out later today, including refining rates.

- Fed easing, extended OPEC supply cuts, possible resumption of sanctions on Venezuela and geopolitical tensions are all positive for oil prices, but demand uncertainty in China, non-compliance with OPEC quotas and strong supply from the US remain negatives.

- Later the Fed’s Waller and ECB’s Cipollone and Elderson speak. The March European Commission survey prints.

GOLD: Holding Just Below All-Time Highs, Awaiting Friday US Inflation Data

Gold is slightly lower in the Asia-Pac session, after closing 0.3% higher at $2178.80 on Tuesday. An intraday high of $2200 was seen early, despite US Treasuries being little changed on the day.

- Bullion sits just below of its all-time high of $2200.89 ahead of Friday’s release of US PCE deflators, the Federal Reserve’s preferred inflation gauge. That said, the scope for any major surprises should be limited in Good Friday trading, with the CPI and PPI figures feeding into that release.

- According to MNI’s technicals team, the trend condition in gold remains bullish. Indeed, recent moves signal scope for a climb towards $2230.1, a Fibonacci projection. Key short-term trend support has been defined at $2146.2, the Mar 18 low.

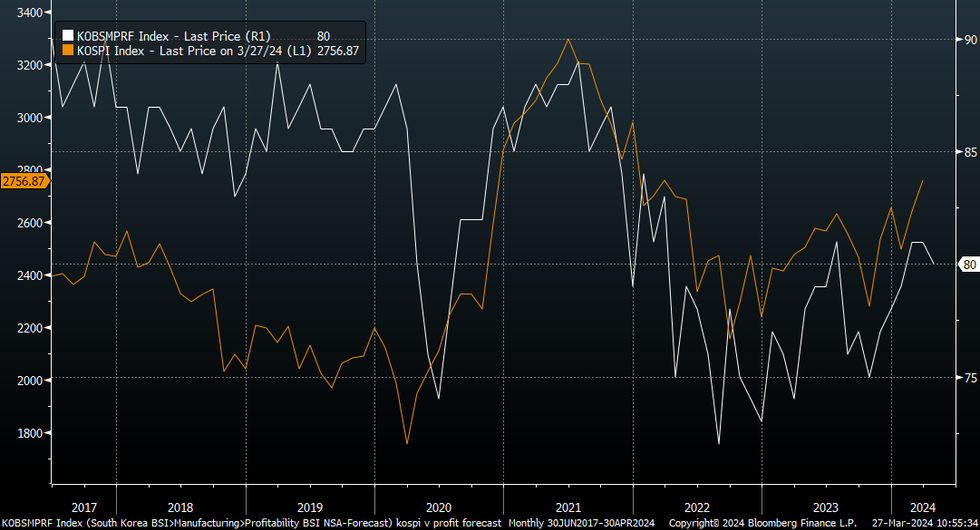

SOUTH KOREA DATA: Manufacturing Sentiment Eases, But Export Expectations Edge Higher

Earlier the BoK business manufacturing and non-manufacturing sentiment indicators printed for April. On the manufacturing side we slipped to 73 from 75. Non-manufacturing eased to 69 from 70.

- The manufacturing print is reasonably well correlated with South Korean GDP growth. The downtick in April is consistent with moderate GDP growth. We are still comfortably above recent rough points for the manufacturing index. Note as well we saw yesterday's consumer sentiment index tick down.

- In terms of the detail, we saw more of a downtick in conditions for small and medium sized enterprises rather than large ones. Domestic expectations also eased more so than the export outlook.

- The first chart below overlays the export expectation against South Korea export growth. The steady recovery is consistent with a supportive export growth backdrop, which is likely to be a more important driver of growth over domestic demand in the near term.

Fig 1: South Korea Manufacturing Export Expectations & Export Growth Y/Y

Source: MNI - Market News/Bloomberg

- Manufacturers' profit expectations also ticked lower, albeit slightly. The chart below plots these expectations against the Kospi index. Part of the upbeat local equity outlook recently has reflected optimism around the government's 'value up' program.

- On the non-manufacturing side, most sub-indices ticked lower by a point or so. The headline index is only marginally above early 2024 lows.

Fig 2: Kospi Versus South Korea Manufacturers Profit Expectations

Source: MNI - Market News/Bloomberg

ASIA FX: USD Strength Continues, Some USD/Asia Pairs At Or Near YTD Highs

USD/Asia pairs are higher across the board, albeit with some outperformance from a couple of currencies. Weaker G10 currencies against the USD, coupled with a mixed regional equity market sentiment, have lent the USD support. USD/CNY spot is back close to Friday highs in what still looks like a catch up trade to broader USD gains. Tomorrow's data calendar is fairly quiet, with Singapore money supply, Thailand manufacturing activity and India fiscal figures for Feb due.

- USD/CNY spot pushed higher from the open, but has been unable to breach the 7.2300 level, which is also where we topped out on Friday. USD/CNH is also higher, but has remained under the 7.2600 handle. Onshore equities are weaker amid earnings concerns. China President Xi Jinping has met with several US executives but it remains to be seen what comes of the meeting. China Feb industrial profits improved on the Jan outcome (to +10% ytd y/y) but didn't impact sentiment.

- 1 month USD/KRW has made fresh highs back to Jan. The pair getting close to 1346. Broader USD sentiment is weighing on the won, while we haven't seen any fresh pushback from the authorities around weaker FX levels yet. Onshore equity gains have slowed, but the won hasn't benefited from recent upside, so this may not be an important driver in the near term. Korea manufacturing sentiment eased in April but the export outlook still improved.

- Spot and 1 month USD/TWD has probed above 32.00, around recent highs, but we haven't seen any follow through yet. Comments from CBC Governor Yang don't suggest a follow up hike is likely. The Governor stating inflation between 0-2% is acceptable, while recent TWD weakness has been USD driven. The TWD NEER is off lower in recent months but remains comfortably above 2023 lows.

- Spot USD/IDR is at 15850, fresh highs for the year. Foreign Investors sold bonds at the highest rate since May 2023 on Monday, with an outflow of $335m. The 5-day average is now -$86m, the 20-day average is -$57m while the longer term 200-day average is -$3.10m. Indonesia's losing presidential candidate has urged the court to disqualify the president-elect, as well. Like elsewhere, the market is likely to be wary of BI intervention risks.

- Spot USD/PHP is slightly lower, last under 56.30. There appears to be some resistance around the 56.30/40 region in pair, which has marked recent highs. There has been little in the way of market headlines or economic data today.

PHILIPPINES: Philippines Sov Debt Curve A Touch Flatter, Property Prices Fall

The Philippines USD sovereign debt curve is flatter today with the front-end out-performing. There has been little in the way of market headlines or economic data today

- The PHILIP curve s touch flatter as the front-end out-performs, the 2Y yield is 2bps higher at 4.81%, 5Y yield is unchanged at 4.92%, the 10Y yield is unchanged at 4.99%, while 5yr CDS is also unchanged at 62.5bps.

- The PHILIP to UST spread difference has day very little over the past day with the 2y is 20bps (unchanged), the 5yr is 70.5bps (+0.5bp), while the 10yr is 76bps (+1bps)

- Cross-asset moves: the USD/PHP is down 0.10% at 56.268, PSEi Index is up 0.07%, Corporate Credit curve is 1-5bps lower over the past week with selling in the front-end, while US Tsys yields are unchanged

- Residential real estate prices fell by 3.6% quarter-on-quarter in Q4, compared to a 3.4% increase in the previous quarter, according to the Bangko Sentral ng Pilipinas. Year-on-year, home prices rose by 6.5%, down from a 12.9% increase in Q3. The number of home loans grew by 30.5% year-on-year and 26.9% quarter-on-quarter. Average appraised values for new housing units were 89,042 pesos per square meter nationwide and 134,178 pesos per square meter in Metro Manila.

- Looking Ahead: Calendar is light for the remainder of the month

INDONESIA: Indon Sov Curve Unchanged, Presidential Candidate Calls For Re-Run

Indonesian USD sovereign debt curve has had an uneventful day, yields are mostly unchanged for the day. In market headlines, Indonesia's losing presidential candidate has urged the court to disqualify the president-elect.

- The INDON sov curve is mostly unchanged on Wednesday, the 2Y yield unchanged at 4.93%, 5Y yield is unchanged at 4.88%, the 10Y yield is +1bps at 5.01%, while the 5-year CDS is also +0.75bp at 72.5bps

- The INDON to UST spread is slightly tighter in the front-end with the long-end a touch wider after out-performing and moving tighter the past two days, the 2yr is 34bps (-1bps), 5yr is 65.5bps (-0.5bp), while the 10yr is 77.5bps (+1.5bps).

- In cross-asset moves, the USD/IDR is 0.39% higher, with the IDR now falling to the lowest level since November, the JCI is 0.19% lower, Palm Oil is down 1.65%, while US Tsys yields are unchanged.

- Foreign Investors sold bonds at the highest rate since May 2023 on Monday, with an outflow of $335m. The 5-day average is now -$86m, the 20-day average is -$57m while the longer term 200-day average is -$3.10m

- {Reuters) -- Indonesia's losing candidate urges court to disqualify president-elect (See link)

- Looking ahead: Indonesia has a very quiet rest of the month in terms of data, with the next major data release not until April 1st

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/03/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 27/03/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/03/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 27/03/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 27/03/2024 | 0900/1000 |  | EU | ECB Cipollone At House of the Euro Event | |

| 27/03/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/03/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 27/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/03/2024 | 1230/1330 |  | EU | ECB Elderson At Climate-Related Financial Risks Panel | |

| 27/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/03/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/03/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/03/2024 | 2200/1800 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.