-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Markets Return Next Week Amid Growth Optimism

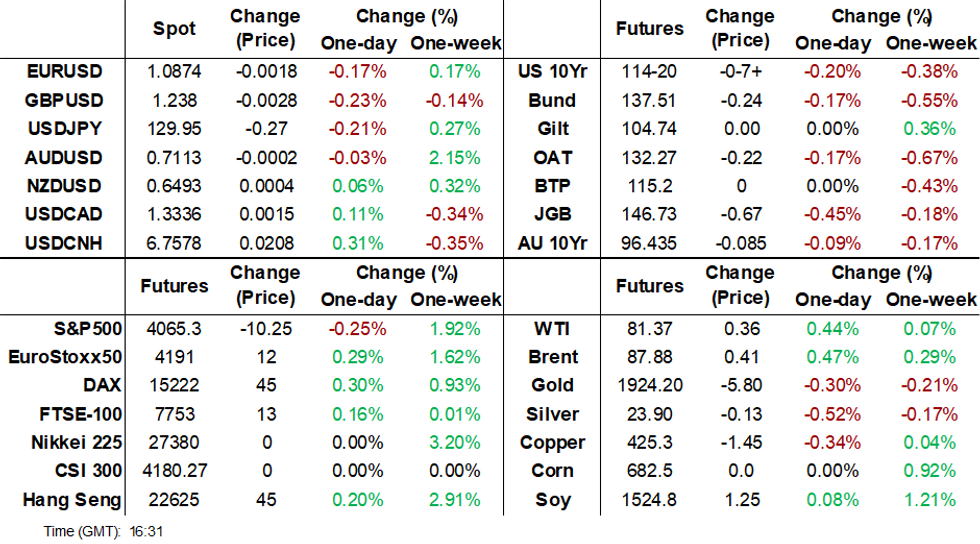

- Tech headwinds in the form of a disappointing update from Intel, coupled with Japan and the Netherlands reportedly agreeing to join the US in curbing technology exports to China, has preventing Asian equity markets from having a stronger rally to end the week. Still, optimism around travel/consumer spending through the LNY period in China is buoying optimism of a growth rebound as we progress further through Q1. China markets return from the LNY break on Monday.

- Japan remains the other focus point, with Tokyo CPI again printing stronger than expected. Inflation is expected to moderate given government efforts to curb utility costs, but the BoJ policy outlook will remain front and center for the market through the first half of this year.

- The CPI result helped JPY outperform, as the USD found some support elsewhere amid equity headwinds, with US futures staying in the red throughout the session.

MARKETS

US TSYS: Marginally Cheaper In Asia

TYH3 deals at 114-20+, -0-07, just off the base of its 0-08+ range on volume of ~70k.

- Cash tsys sit 1-3 bps cheaper across the major benchmarks.

- After a muted start, spillover pressure from JGBs, post Tokyo CPI release, weighed on tsys at the margins resulting in mild cheapening.

- The move marginally extended as Japan and Netherlands agreed to join US curbs on Chinese Chips. There was a bid in the greenback, however with liquidity impaired due to the Chinese holidays there was little follow through in Tsys.

- There is a thin docket in Europe today. Further out we have a slew of US data including personal income/spending, PCE Deflator, U of Mich Consumer Sentiment and Pending Home Sales.

EQUITIES: Tech Headwinds Limit Gains

Regional equity markets are mostly in the green, although headwinds in the tech space have taken the shine off what would have been a fairly positive end to the week for Asia Pac bourses. Intel's disappointing earnings update has kept US futures in the red for the whole session. We were last around -0.55% for Nasdaq futures, while Eminis are down -0.25% at this stage.

- Reports that Japan and the Netherlands will join the US in curbing technology related exports to China has also weighed on sentiment in the tech space.

- The HSI is back to flat for the session, after opening up higher. Semiconductor related names have fallen, although the HSI Tech sub index is still up 0.33% at this stage (yesterday we rose 4.26%, while the Golden Dragon index was up strongly in US trade for Thursday.

- Optimism around China re-opening, with strong anecdotes of travel and related expenditure through the LNY period is providing an offset.

- The Nikkei 225 is around flat at this stage as well, while the Kospi is +0.70%, but is off earlier highs. The Kospi is comfortably through the simple 200-day MA.

- Indian shares are down with the main indices off by around 1% at this stage. Adani shares continue to fall, after the recent short-seller report, while bank names are also down today.

OIL: Close To 100-Day EMA Resistance Point

Brent crude prices are marginally higher at this stage, last near 87.80, around +0.40% for the session. This puts us on track for a modest 0.23% gain for the week, with Brent consolidating somewhat after strong gains in the previous two weeks. Bulls will also be looking for a concerted break through $88/bbl before turning more bullish. Also note the 100-day EMA, which comes in at $88.28/bbl sit just above this level.

- Brent has been unable to sustain breaks above this resistance point since early July last year, see the chart below.

- Elsewhere EU officials are reportedly considering a $100/bbl cap for Russian diesel exports, while the cap would be lower for other products like fuel oil. Goldman Sachs warned that the next round of oil sanctions on Russia could be more disruptive than the first round, citing global diesel inventory levels as being tight.

- Looking ahead, China markets return from the LNY break next week, with PMI prints for January out on Tuesday. OPEC+ meetings will also take place over Tuesday/Wednesday, although no change is expected from an output standpoint at this stage.

Fig 1: Brent Crude Close To 100-Day EMA Resistance Point

Source: MNI - Market News/Bloomberg

GOLD: Tracking Lower For The Week

Gold tried to go higher at the start of the session, but couldn't sustain gains near $1935. We last close to $1922, with lows for the session coming around $1920. This is -0.4% and comes after Thursday's -0.87% dip. If sustained this would leave gold tracking at a loss for the week of 0.22%, which is modest but would be the first weekly lost since the first half of December.

- While USD indices remain close to recent lows, the gold trend appears to be consolidating somewhat, as we are now some distance below earlier highs in the week near $1950.

- Dips sub $1920 have been supported, while below that is the $1900 little.

- Next week's Fed meeting may also be bringing some cautiousness into the market.

- ETF gold holdings have actually started to track higher in recent sessions, but the move up is modest so far.

FOREX: Greenback Bid In Asia

The USD is trading on the front foot late in the Asian session, BBDXY is up ~0.2%, as Netherlands and Japan agreed to join US curbs on Chinese chips.

- USD/JPY also gave up its early CPI inspired gains having met support below ¥129.60 and is dealing a touch above ¥130.

- AUD/USD saw resistance above $0.7120, however is currently holding above $0.71.

- There have been narrow ranges in NZD/USD, kiwi is the strongest performer in the G-10 space at the margins as business conditions improved off record lows. The pair is dealing just above session lows at $0.6485/90.

- EUR and GBP are both ~0.2% softer vs the USD.

- Lunar NY Holiday impacted liquidity in Asia-Pac hours, with China still out.

- There is a thin docket in Europe today. Further out we have a slew of US data including personal income/spending, PCE Deflator, UofMich Consumer Sentiment and Pending Home Sales.

ASIA FX: Most USD/Asia Pairs Edge Higher

USD/Asia pairs have mostly been supported on dips today. Broader USD indices have tracked a touch higher, while regional equities have seen limited follow through from the positive US/EU session on Thursday, as tech headwinds today have weighed. Next week, the focus will be China markets returning from the LNY break, while South Korean IP prints on Monday as well.

- USD/CNH was weaker in the first part of trade, getting close to the 6.7200 level, amid optimism around improving growth amid strong travel/expenditure anecdotes from the LNY period. However, this proved short lived and we rebounded close to 6.7600, we last sit near this level. Tech headwinds around Japan and the Netherlands joining US chip export curbs has weighed on sentiment.

- 1 month USD/KRW dipped below 1227 in early trade but now sits back at 1230 in line with broader USD sentiment recovering. Equities are higher but away from best levels. A further $576mn in net equity flows has been seen today, bringing week to date net flows to +$2bn. Manufacturing sentiment data continued to point to growth headwinds though.

- Indian markets have re-opened after yesterday's holiday, with onshore equities under pressure. The NIFTY is bucking the more positive trends seen through the rest of the region and is tracking around 0.70% lower at this stage. The flow on effect to INR is limited so far, but may become more apparent if we see net equity outflows pickup. We had stabilized somewhat in terms of outflow pressures, but Wednesday saw resumed selling pressures from offshore investors. YTD we have seen -$1.6bn in net outflows. USD/INR spot was last tracking near 81.55, slightly lower for the session.

- USD/SGD printed fresh cycle lows in trading post Wednesday's December CPI print at $1.3104. We are slightly higher now, last around 1.3120/25. The SGD NEER (per Goldman Sachs estimates) is drifting higher post CPI, albeit a touch off yesterday's high. We sit ~0.5% below the upper end of the band. Headline was softer than expected, but core was sticky at 5.1% y/y. Technicals remain bearish for USD/SGD. We sit comfortably below the 20,50,100,200 EMAs. The next target for bears is the 2018 low at 1.3009, bulls first look to break 20-Day EMA at 1.3254 to halt the bear's momentum.

- USD/MYR continues to track lower. The pair is down a further -0.27% today, last at 4.2340/45, up modestly from earlier lows close to 4.2250. This brings ringgit gains in this holiday shortened week to 1.4%, comfortably the best performer in EM Asia FX. We are now back at levels that prevailed in mid April last year. MYR gains have accelerated since the 50-day MA fell below the 200-day MA, forming a so called death cross around a week ago. MYR has jumped ahead of IDR to be the second best performer (trailing only THB) within the region YTD to date.

- USD/THB has pushed higher, last near 32.90, +0.40% higher for the session. This pair continues to consolidate after a strong start to the year. The MoF maintained a 3.8% growth forecast for this year, which is close to the consensus. They do expect firmer tourism arrivals relative to BoT, with MoF forecasting 27.5mln arrivals in 2023.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 27/01/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/01/2023 | 0800/0900 | *** |  | ES | GDP (p) |

| 27/01/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/01/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 27/01/2023 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/01/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.