-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China PMIs Print Tomorrow, Market Looks For Improvement

- Hong Kong equities are ending September on a firmer footing. Support points have been evident from further China housing/mortgage support, reported eased cross-border data restrictions and a possible US-China leaders meeting. China markets kicked off the Golden Week holiday today, so gains were limited to Hong Kong bourses. We still get official China PMIs tomorrow, which will be gauged for signs of further improvement in the growth backdrop.

- The USD pull back extended its pullback, with NZD and AUD outperforming. Higher HK equities and firmer metal prices aided the A$. In the bond space, US cash tsys sit ~2bps cheaper across the major benchmarks.

- In Japan, JGB futures are sitting just above session lows, -12 compared to settlement levels, despite the BOJ’s unscheduled bond purchase of Y300bn 5- to 10-year JGBS at market prices. Tokyo core CPI was weaker than expected in September.

- The final Q2 GDP read from the UK provides the highlight in Europe today. In the US we have consumer spending, wholesale inventories and University of Michigan consumer sentiment.

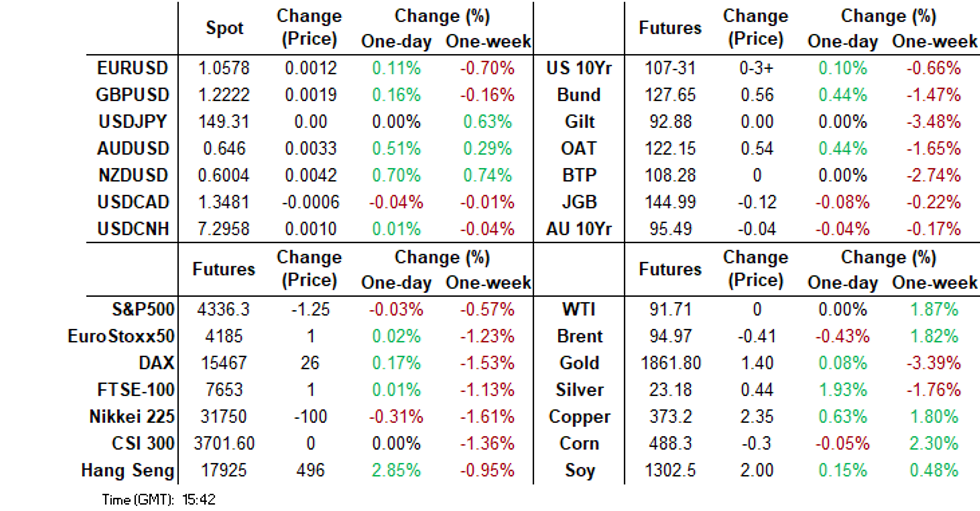

MARKETS

US TSYS: Marginally Cheaper In Asia

TYZ3 deals at 107-26+, -0-01, a 0-05 range has been observed on volume of ~68k.

- Cash tsys sit ~2bps cheaper across the major benchmarks.

- Tsys have ticked lower, albeit in narrow ranges, through today's Asian session with participants perhaps using Thursday's richening as an opportunity to enter fresh short positions.

- There was little reaction to Feds Barkin who noted that policymakers have time to determine if they need to do more work to cool inflation and that the labour market may offer some insight.

- On the docket today we have US consumer spending, wholesale inventories and University of Michigan consumer sentiment.

STIR: US Is The Outlier With Respect To $-Bloc Rate Hike Expectations

Market expectations for the terminal interest rates within the $-bloc have firmed slightly over the past week outside the US. The peripheral markets have at least one additional 25bp hike priced, compared to the less than 50% probability assigned in the US. Moreover, the US is the only market with expectations of an easing by June 2024. Terminal rate expectations and the cumulative tightening currently stand at:

- 5.43%, +10bps (FOMC);

- 5.28%, +26bps (BoC);

- 4.35%, +28bps (RBA); and

- 5.75%, +25bps (RBNZ).

Figure 1: $-Bloc STIR: Terminal Rate Expectations & June’24 Pricing

Source: MNI – Market News / Bloomberg

FED: Barkin Watching Labor Market To See If Fed Has More Work To Do

Fed Richmond President Barkin has stated that the central bank's decision to hold steady on policy rates earlier this month was the right move. He added that the central bank has time to see if it has done enough or if more work needs to be done. There is a wide range of scenarios in terms of the economic outlook, according to Barkin.

- The Richmond Fed President stated the path forward for interest rates will depend on the inflation backdrop and whether the Fed has done enough to bring down pressures, or whether we see persistence in price pressures.

- Barkin stated he is watching the labor market closely to gauge these risks.

JGBS: Unscheduled BOJ Bond Purchase Sees Futures Spike Higher But It Quickly Reverses

JGB futures are sitting just above session lows, -12 compared to settlement levels, despite the BOJ’s unscheduled bond purchase of Y300bn 5- to 10-year JGBS at market prices.

- In addition to the earlier releases of Tokyo CPI, industrial production and retail sales, the local docket has just printed Housing Starts and Consumer Confidence data. Housing starts print -9.4% y/y vs. -8.7% est., while confidence prints 35.2 vs. 36.2 est.

- The cash JGB curve has bear-steepened, with yields 0.6bp to 1.9bps higher. The benchmark 10-year yield is 0.4bp higher at 0.765%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also below the cycle high of 0.774% set today, before the BOJ bond purchase.

- Bloomberg reports that investors need to prepare for Japan’s benchmark 10-year bond yield rising to around 2% if the central bank’s inflation goal is realized and it ends its negative-rate policy, according to a former research chief at the Bank of Japan. (See link)

- Swap rates are slightly mixed across the curve. Swap spreads are tighter across maturities.

- Monday the local calendar sees BOJ Summary of Opinions (Sept. MPM), Tankan Mfg & Non-Mfg Indices and Jibun Bank Mfg PMI.

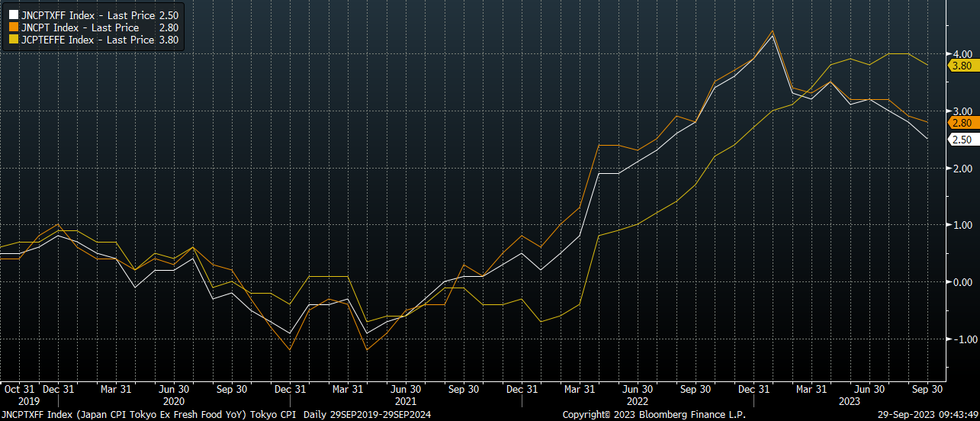

JAPAN DATA: Tokyo Core Inflation Pressures Continue To Moderate

Tokyo CPI was mixed for September. The headline y/y print was firmer than forecast at 2.8%, against 2.7% forecast. We were still down a touch on the prior 2.9% outcome. The core ex-fresh food metric was weaker though at 2.5% y/y (2.6% forecasts and prior 2.8%). The ex-fresh food, energy measure also printed below consensus estimates at 3.8%y/y (3.9% forecast, 4.0% prior). See the chart below.

- The core metric which excludes all food and energy also eased back to 2.4%y/y in September from 2.6% in August.

- Good prices were up 0.4% m/m, reversing the -0.1% falls in August. Services inflation was flat. Much of this month rise in goods inflation was food driven. We were +1.4% m/m, while fresh food surged 6.4% m/m. Clothing and footwear were +2.6% m/m, another source of pressures.

- Utilities continued to fall, -2.6% m/m, but were joined by entertainment, -1.8%, transport, commnication (-0.7%) and medical care (-0.1%).

- 7 out of 10 sub-indices saw slower or the same y/y price momentum compared with August.

Fig 1: Tokyo CPI - Y/Y, Headline & Core Measures

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Cheaper, Mid-Range, RBA Policy Decision Next Tuesday

ACGBs (YM flat & XM -4.5) are weaker, mid-range, after a relatively light domestic data docket. As previously outlined, private sector credit for August printed slightly better than expected (+0.4% m/m vs. +0.3% est. and +0.3% prior).

- Accordingly, domestic participants have likely been on headlines and US tsys/JGBs watch in Asia-Pac trade.

- US tsys have been pressured and are around session lows, 2-3bps cheaper across the major benchmarks.

- 10-year and longer-dated JGBs have pushed to their highest levels in the current cycle. The 10-year yield reached a post-YCC tweak peak of 0.774%. In response to this development, the BOJ conducted an unscheduled bond purchase of Y300bn in 5-to-10-year notes at market yields. The announcement caused JGB futures to initially spike higher, but these gains were swiftly reversed.

- The cash ACGB curve has twist-steepened, with yields 1bp lower to 4bps higher. The AU-US 10-year yield differential is 5bps higher at -9bps.

- The swaps curve has also twist-steepened, with rates -1bp to 4bps higher.

- The bills strip is slightly richer, with pricing +1 to +2.

- RBA-dated OIS pricing is slightly firmer across meetings. The market currently attaches a 13% chance of a 25bp hike for next week.

- Next week the local calendar sees a raft of second-tier data ahead of the RBA decision on Tuesday.

NZGBS: Closed On Cheaps, ~20% Chance Of A RBNZ Hike Next Wednesday

NZGBs closed at or near session cheaps, with benchmark yields 4-6bps higher. The local data docket was relatively light, with ANZ Consumer Confidence’s push to its highest reading since January 2022 as the highlight. Accordingly, domestic participants are likely to have been guided by spillover selling from US tsys and JGBs in Asia-Pac trade.

- US tsys have been pressured and sit at session lows, 2-3bps cheaper across the major benchmarks.

- 10-year and longer-dated JGBs have pushed to their highest levels in the current cycle. The 10-year yield reached a post-YCC tweak peak of 0.774%. In response to this development, the BOJ conducted an unscheduled bond purchase of Y300bn in 5-to-10-year notes at market yields. The announcement caused JGB futures to initially spike higher, but these gains were swiftly reversed.

- Swap rates are 4-9bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations at 5.77% (+27bps). The market currently attaches a 19% chance of a 25bp hike next week.

- Monday the local calendar sees the release of Building Permits for August, ahead of CoreLogic House Price Data and the RBNZ Policy Decision on Wednesday. Bloomberg consensus expects the OCR to be left unchanged at 5.50%.

FOREX: Antipodeans Firm in Asia

The Antipodeans have firmed in Asia extending Thursdays gains as firmer regional equities, the Hang Seng is up ~2%, boost sentiment.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD has broken the $0.60 handle in recent dealing and is now up ~0.7%. ANZ Consumer Confidence rose to its highest level since January 2022.

- AUD/USD is up ~0.5% and last prints at $0.6455/60. THe pair has ticked away from the 20-Day EMA ($0.6427), the next upside resistance level is at $0.6522 high from Sep 1. Support comes in at $0.6331 low from Sep 27.

- The Yen is little changed from opening levels and ranges have been relatively narrow. USD/JPY last prints at ¥149.35/40. The trend continues to be bullish, resistance comes in at ¥149.71, high from Oct 24 2022. Support is at ¥147.67, the 20-Day EMA.

- Elsewhere in G-10, EUR and GBP are following the broader USD move and are up ~0.1%. BBDXY is ~0.1% lower.

- The final Q2 GDP read from the UK provides the highlight in Asia today.

EQUITIES: Hong Kong Equities Surge On Multiple Support Points

Regional equities have been mixed today in holiday impacted markets. China markets are closed as the Golden Week holiday period kicks off. South Korean markets also remained closed. The stand out from a positive point of view has been the surge in Hong Kong equities. The HSI is up +2.7%. Trends elsewhere are mixed. US equity futures sit slightly higher at this stage. Eminis last near 4341, +0.08%. Earlier lows were at 4327.50.

- Hong Kong markets have been buoyed by a number of factors. Further support for China's housing market, with reports that Shenzhen will relax the mortgage rate floor for first home-buyers, is one positive.

- The FT notes that China cross-border data restrictions may be eased, which has also helped. The HSTECH index is up 3.66% at the break. The WSJ also notes that momentum is gaining for a potential Xi Jinping trip to the US.

- Elsewhere, Japan stocks are mixed, with the Topix down 0.50%, but the Nikkei 225 is a touch higher. Local bond yields continue to climb despite Tokyo core CPI printing weaker than expected.

- The ASX 200 is up 0.50%, aided by material stock gains, as firmer metal prices have boosted miners.

- In SEA, trends are mixed, with Malaysian, Philippines and Thailand shares lower. Indonesian markets have returned with a positive bias.

OIL: Consolidates After Thursday Losses, Still Up Strongly For The Past Week, Month & Quarter

WTI has largely tracked sideways near NY closing levels from Thursday in the first part of Friday trade. We did pop above $92/bbl briefly, but it wasn't sustained. The benchmark last tracked near $91.80/bbl (we closed on Thursday at $91.71/bbl). This still leaves us still nearly +2% firmer for the week, +9.76% for September and nearly 30% higher for the quarter. For Brent, we track above $95/bbl, following a similar trajectory to WTI. The benchmark has posted similarly impressive gains over the past quarter.

- Thursday's pull back has largely been described as technical in nature, given overbought readings on the RSI for example.

- Still, there is some speculation that with oils sharp rise in recent months we may start to see OPEC+ ease supply constraints. Until this/if it eventuates though, Q4 is likely to be exhibited by tight supply constraints.

- For Brent, the 20-dauy EMA sits back near $92.55/bbl. Recent highs rest at $97.69/bbl.

- Note we get official PMIs for September in China tomorrow. This will provide an update on the economic backdrop, as optimism over travel related oil demand firmed ahead of the Golden Week holiday period.

GOLD: Heading For The Biggest Weekly Loss In Eight Months

Gold has remained relatively stable during the Asia-Pac session, following a decline of -0.5% to $1865.03 on Thursday. It's worth noting that despite the USD index reversing its substantial Wednesday gains and US Treasuries experiencing a rally, there was surprisingly limited relief in bullion selling.

- Gold is headed for its biggest weekly decline in eight months, with the higher-for-longer interest rate environment taking its toll on the precious metal.

- US Treasuries finished at or near session bests, with yields 2-8bps lower. The 10-year yield climbed to a new 16-year high in a volatile morning session on heavy volume. US data was mixed. Weekly Claims printed lower than expected (204k vs. 215k est), but the GDP Price Index was lower than expected (1.7% vs. 2.0% est), Personal Consumption missed (0.8% vs. 1.7% est) and Pending Home Sales were below estimates (-7.1% vs. -1.0% est).

- Exchange-traded funds backed by the metal have accelerated sales of bullion. A particularly large outflow came from Blackrock’s iShares Gold Trust, which has shed 13 tons of gold this week, according to data compiled by Bloomberg.

- From a technical standpoint, Thursday’s low of $1857.76 saw the yellow metal push through the latest support at $1865.8 (76.4% retrace of Feb 28 – May 4 bull leg), with $1839.0 (50% retrace of the same move) up next, according to MNI’s technical team.

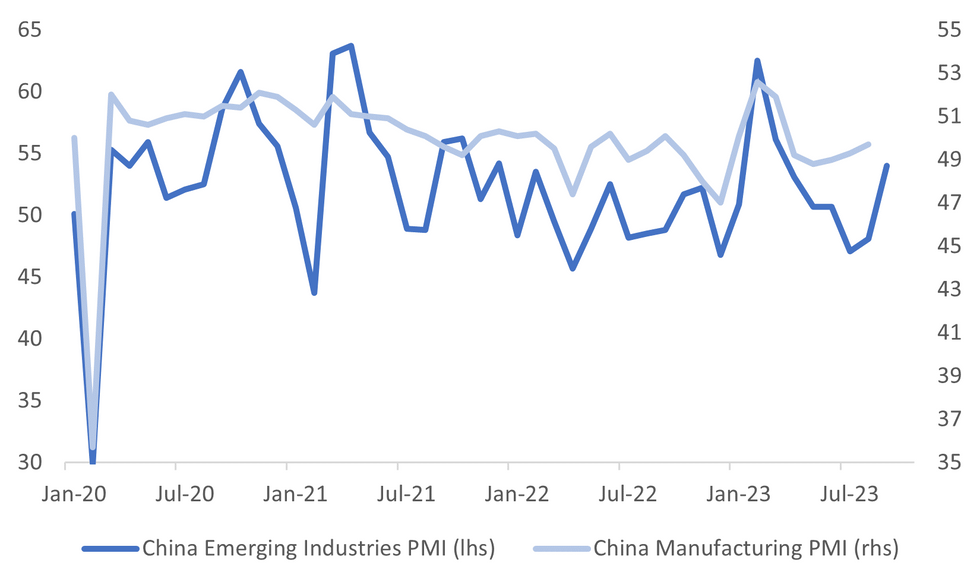

CHINA DATA: Official PMIs Out Tomorrow, Market Expects Improvement In Manufacturing & Services

A reminder that the official China PMIs print for September print tomorrow. The market expects the manufacturing PMI to rise to 50.1 from 49.7 prior (forecast range is 49.8-51.2 from 19 surveyed economists). On the services or non-manufacturing side, the market consensus is 51.6, versus 51.0 prior (forecast range is 50.5-52.8 from 10 surveyed economists).

- On the manufacturing side, the emerging industries PMI has already printed for September. The index rose to 54 from 48.1 in August. The correlation with the official manufacturing PMI is 67% for the past two years, although as the chart below highlights, there is a clear levels difference between the two series.

- By industry, the steel and oil sectors were better in September, but headwinds from housing likely remained and the external backdrop remains uncertain. Infrastructure spending should be supportive though.

- The housing backdrop may also weigh on the services side, as well as related consumer spending. If the non-manufacturing PMI does rise, it would be the first increase since March of this year.

Fig 1: China Official manufacturing PMI & Emerging Industries PMI

Source: MNI-Market News/Bloomberg

- More broadly, the market will be looking for signs of government stimulus efforts gaining traction. No doubt any positive surprises will be welcome from tomorrow's prints.

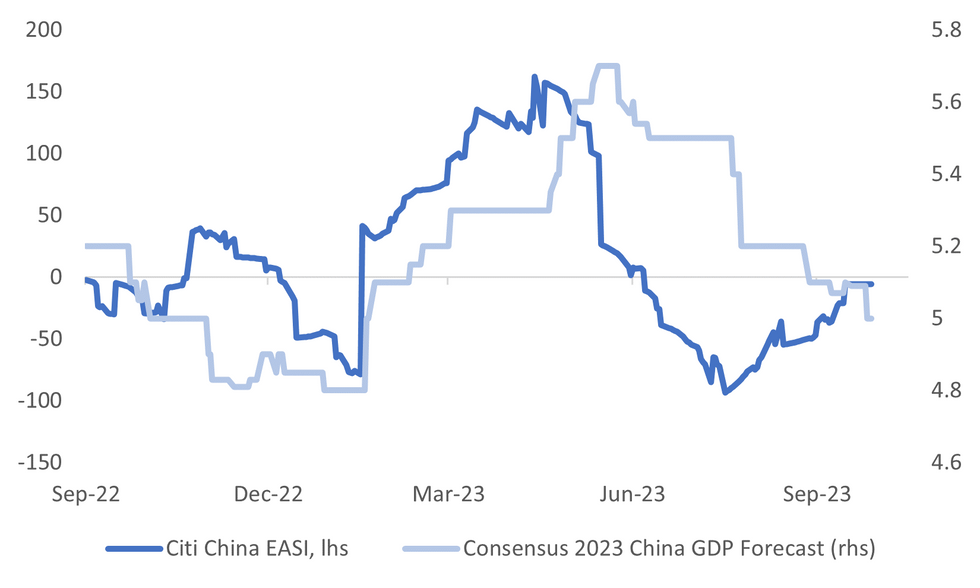

- This week's better industrial profits data saw some sell-side analysts firm their respective China GDP projections.

- The second chart below overlays the Citi China economic data surprise index against the consensus 2023 China GDP growth forecast. The surprise index is still negative but comfortably off recent lows. Further positive data momentum, should at the least, help prevent a further fall in growth expectations.

Fig 2: Citi China EASI Versus China GDP Consensus Growth Expectations (2023)

Source: Citi/MNI - Market News/Bloomberg

ASIA FX: Firms Amid Broader Dollar Pullback, China PMI & South Korea Trade Out Over The Weekend

Asian markets have been impacted by holidays today (China & South Korea out). The broader USD pull back has aided PHP, THB and MYR, which have been the strongest performers in the session to date. Note tomorrow we get the official China PMI prints for September. On Sunday South Korean September trade figures are out.

- USD/CNH dipped on the surging HK equity backdrop, but we didn't see much follow through. The pair got to low 7.2800 levels before rebounding. We sit back at 7.2950 in latest dealings. A reminder that China markets are closed today and through next week for the Golden Week holiday. We still get official PMI prints for tomorrow though.

- 1 month USD/KRW is slightly lower, but has been quiet given onshore markets remain closed. FTSE Russell has kept KTBs on the watch list for possible inclusion in the global bond index next year.

- BoT Governor, Sethaput Suthiwartnarueput, has stated it is now appropriate to pause in terms of interest rates. He stated that the key policy rate is at neutral and that if growth and inflation evolve as expected, rates can stay where they are. USD/THB sits off recent highs, last near 36.60. Lows for the session were near 36.50.

- USD/PHP sits comfortably away from the 57.00 resistance point, aided by a broader USD pull back and lower oil prices. Current levels near 56.70 remain close to the mid-point of the range seen in September. We are sub the 20-EMA, which sits at 56.75. Early September lows were near 56.50. We still await bank lending data for August, but most focus will rest on the Sep CPI print next Thursday. The market consensus, at this stage is for a 5.3% y/y print, unchanged from August (0.4% m/m is the monthly projection).

- The Rupee has opened dealing a touch firmer on Friday as broad based greenback flows dominate in early trade. USD/INR sits at 83.05/10. Technically the pair remains in an uptrend, bulls target the high from 20 October 2022 (83.2975). Bears immediate focus is the 83 handle which intersects with the 20-Day EMA (83.05). On tap today we have the August Fiscal Deficit, there is no estimate. Also due is the Eight Infrastructure Industries survey.

- USD/MYR has followed the broader USD move this morning falling ~0.4% as the pair re-opens after yesterday's holiday and is ticking away from Wednesday's 2023 high. USD/MYR has fallen below the 4.70 handle to sit at 4.6885.

- The SGD NEER (per Goldman Sachs estimates) sits a touch off yesterday's cycle highs, holding a narrow range this morning. We now sit ~0.3% below the top of the band. Broader USD trends continue to dominate flows for USD/SGD, the pair fell ~0.6% yesterday as risk sentiment improved through Thursday's session. In early dealing today we sit close to the 20-Day EMA ($1.3635).

SOUTH KOREA: FTSE Russell Holds Off Adding Korean Bonds To Global Index

FTSE Russell has held off including South Korea in its global bond index. The country will remain on the waitlist for another six months (see this BBG link for more details).

- FTSE noted: "The South Korean market authorities have undertaken, or are in the process of undertaking, several initiatives intended to improve the structure and accessibility of the South Korean capital markets for international investors."

- Reforms announced by the government, include expanding onshore FX trading hours and an agreement with Euroclear for settlement around KTB's. Next year is seen as potentially the more likely window for inclusion in the FTSE index, as these reforms can take stronger effect by then.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/09/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/09/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 29/09/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 29/09/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 29/09/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/09/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/09/2023 | 0645/0845 | ** |  | FR | PPI |

| 29/09/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 29/09/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/09/2023 | 0740/0940 |  | EU | ECB's Lagarde speaks at IEA-ECB-EIB Conference | |

| 29/09/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/09/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/09/2023 | - |  | UK | Publication of the Treasury bill calendar for October-December 2023. | |

| 29/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/09/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/09/2023 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 29/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 29/09/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 29/09/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 29/09/2023 | 1645/1245 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.