-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Slowdown Fears Dominate The Asia Pac Session

- Regional equities are by and large weaker across the board. Focus has again been on China/Hong Kong shares. We opened up weaker and losses accelerated post the China PMI data print misses. In Hong Kong the HSI is off by nearly 3%. This puts the index down over 20% from Jan highs.

- It was hard to find many positives in terms of the PMI results. The weaker price components and softer activity outcomes will see the market continue to call for policy easing. USD/CNH has once again made fresh highs, pushing above the 7.1200 handle before retracing. This has spilled over to the rest of the region, although parts of SEA FX have outperformed. NZD/USD is weakest in the G10 space, testing below 0.6000. The BBDXY is back close to 1247.

- Cash US tsys are around 1bp richer across major benchmarks in Asia-Pac trade, ahead of the House vote on the Debt ceiling deal later on Wednesday.

- Later the Fed publishes its Beige Book and Collins, Bowman, Harker and Jefferson all speak. In terms of data, there are the May Chicago PMI and April JOLTS job openings released. The EU Financial Stability Review is due and ECB President Lagarde will speak.

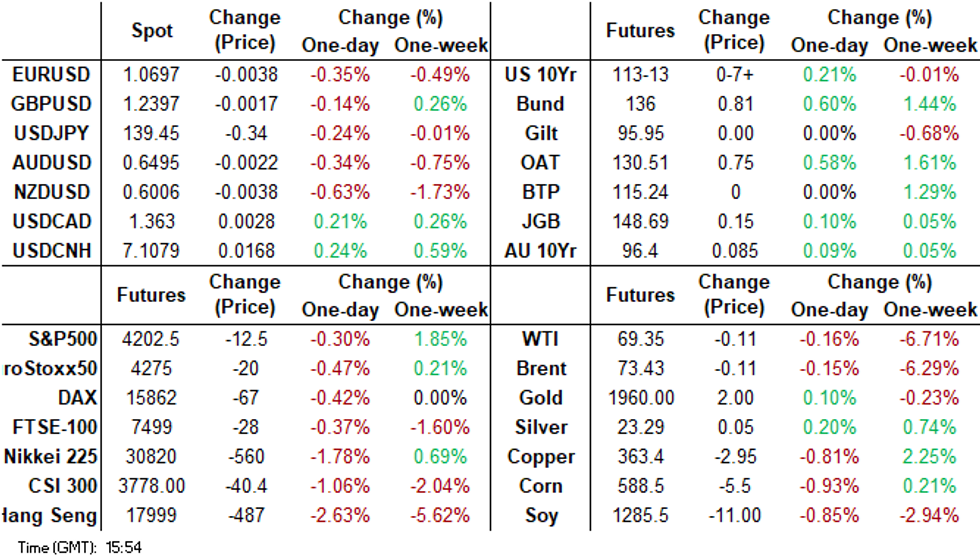

MARKETS

US TSYS: Slightly Richer In Asia-Pac Trade, Focus Also On US Employment Data

TYU3 is currently trading at 114-06, +5 from NY closing levels. There have been no new developments on the debt-ceiling bill’s passage other than the previously outlined news that a key House of Representatives committee voted to send it to the full chamber for a Wednesday vote.

- Cash tsys are around 1bp richer across major benchmarks in Asia-Pac trade.

- The attention now shifts towards crucial employment data scheduled for release later this week. The ADP private employment data, typically released on Wednesday, will be published on Thursday due to the holiday. The May Non-Farm Payrolls report will be unveiled on Friday, with the current median estimate projecting a gain of +190,000 jobs for May compared to the previous figure of +253,000.

- Fed enters policy blackout at midnight Friday.

FED: Alternate Member Mester Can’t See Reason To Pause Yet

Cleveland Fed President Mester has given an interview with the FT where she sounded quite hawkish saying that she sees no “compelling reason” to pause rate hikes just to gather more information if the data are pointing to a need for further tightening to contain inflation. She believes that “everything” remains on the table for the June 14 meeting. She is currently not a FOMC member but will join the committee in 2024.

- Mester believes it is a better strategy to hike now and then hold for “a while until you get less uncertain”. She said that the debt-ceiling deal had relieved some uncertainty.

- Markets have a 58% chance of a 25bp hike priced in for June. Some FOMC members have suggested that there could be a pause. Mester believes that the central bank should only pause when the risks of doing “too little” are evenly balanced with doing “too much”. She thinks the May payroll (June 2) and inflation (June 13) data will be key to the June decision.

- She has been disappointed with the slow progress in bringing inflation down and she thinks that “we may have to go further”, signalling that she doesn’t believe it’s time to pause yet. Policy decisions are only going to get harder from here.

GLOBAL: Sharp Easing In Supply-Chain Pressures Yet To Be Seen In OECD Core Prices

The April Federal Reserve of New York’s global supply chain pressure index fell to its lowest since November 2008 and is signalling a sharp easing in global headline inflation pressures and should begin to put more downward pressure on core over the coming months. OECD and non-Japan Asian inflation eased in April but not in all countries. The large gap between inflation rates is reflected in the difference in central bank activity.

- OECD CPI inflation in April moderated to 7.4% y/y from 7.7% the previous month and is now down 3.3pp from its October 2022 peak. Underlying was at 7.1% from 7.2% but is only down 0.7pp from its peak, signalling the stickiness that is worrying central banks and likely to sustain tightening biases for the time being. Given base effects from energy prices are going to put downward pressure on headline over the rest of the year, it is likely to fall below core soon.

- The Fed is currently expected to pause at its June 14 meeting but the ECB is likely to hike 25bp on June 15 and the BoE on June 22.

- Non-Japan Asian inflation ex China eased to 4.3% y/y in April from 4.9% to be down 2.1pp from the September 2022 peak, while core was steady at 3.8% and 0.4pp lower than the January 2023 high. Central banks across Asia have begun to pause monetary tightening as inflation heads back to target, whereas most in the OECD are either continuing or only now contemplating pivoting, reflecting that Asian inflation remains well below the OECD’s.

Source: MNI - Market News/Refinitiv

Source: MNI - Market News/Refinitiv

JGBS: Richer, Curve Twist Flattens, Weaker Data, BoJ Ueda Comments On Inflation

JGB futures are stronger in afternoon Tokyo trade, reaching a session high of 148.79 in morning trade and currently standing at 148.73, +19 compared to the settlement levels.

- JGB futures were supported by a slight richening in US tsys in Asia-Pac trade. Cash tsy yields are around 1bp lower as a bill to suspend the $31.4 trillion U.S. debt ceiling advanced as a key House of Representatives committee voted to send it to the full chamber for a Wednesday vote.

- In terms of domestic drivers, weaker-than-expected data supported the market, but this impetus was somewhat neutralised by comments from BoJ Governor Ueda on inflation, stating that it may be tough to deny the chance we are already in a new normal, different from the period of “low for long”.

- Cash JGBs hold their twist flattening in afternoon Tokyo trade with yields lower beyond the 1-year zone. The benchmark 10-year yield is 1.1bp lower at 0.424%. The outperformer on the curve is the 20- to 40-year zone, which sees yields 1.3 to 1.9bp lower.

- The swaps curve has bull flattened with rates 0.3-2.2bp lower. Swap spreads are tighter across the curve.

- The local calendar tomorrow sees Q1 Capital Spending and Company Profits, Weekly Investment flow data and Jibun Bank PMI Mfg (May F).

- The MoF also plans to sell Y2.7tn of 10-year JGBs.

AUSSIE BONDS: Richer, Mid-Range After CPI Monthly Upside Surprise

ACGBs continue to display strength on the day, with YM +3.0 and XM +5.5. However, they are currently positioned mid-range for the Sydney session. Futures opened at their highest levels of the session but experienced a downward spike in response to the release of stronger-than-expected monthly CPI data (6.8% y/y versus 6.4%). The market quickly realised that a significant portion of the inflationary surprise was driven by automotive fuel prices. As a result, futures swiftly reversed their initial movement and have since traded within a narrow range.

- Cash ACGBs are 4-5bp richer with the curve flatter.

- The AU-US 10-year yield differential is 2bp wider after the data at -5bp.

- Swap rates are 2-3bp lower with EFPs wider.

- The bills strip twist flattens with pricing -7 to +6.

- RBA dated OIS is 4-8bp firmer across meetings with a 40% chance of a 25bp hike in June priced.

- Bloomberg reports that Goldman now expects the RBA to hike +25bp in June and July to a terminal rate of 4.35%.

- The local calendar has Judo Bank PMIs (May F) and Private Capex Expenditure (Q1) scheduled for release tomorrow. Expectations point towards increases in capital expenditure for both equipment and building & structures. Additionally, the second estimate for planned capital expenditure in 2023-24 will be disclosed.

AUSTRALIAN DATA: Details Show Inflation Still Moderating, Rents Rise Further

The CPI for April rose to 6.8% y/y from 6.3%, higher than the 6.4% expected. It peaked at 8.4% in December 2022. The main driver of the increase was a fuel-related base effect, as the fuel excise was halved in April last year. Excluding volatile items, the CPI rose 6.5% down from 6.9%. Looking through special factors, inflation continues to move in the right direction at the start of Q2. The trend should assure the RBA that policy is working but also confirm their concerns re housing. The RBA’s Q2 2023 CPI forecast is 6.3%.

- The seasonally-adjusted CPI rose a moderate 0.3% m/m after 0.5% in March, only slightly higher than the series average. Excluding volatile items rose only 0.2% m/m after 0.6%. 3-month momentum in both series continues to ease.

- Housing remained one of the main contributors to annual inflation rising 8.9% y/y but down from March’s 9.5%. This moderation was driven by the new dwelling component which is being helped by lower building material costs. However, rents rose by 6.1% y/y up from 5.3%. The RBA expects them to rise further by close to 10%. (See RBA: Supply-Side Reforms Needed To Increase Housing & Reduce Rents)

- Food price inflation remains high at 7.9% but down from 8.1% in March.

Source: MNI - Market News/ABS

RBA: Productivity Growth Needs To Rise To Meet Inflation Target

RBA Governor Lowe again made it clear that the central bank is resolute in bringing inflation down and that it is damaging and hurts everyone. Monetary policy is restrictive and working but unit labour costs need to come down with higher productivity growth for the Board to meet its target. Lowe believes that the RBA can still tread the “narrow path” but “success is not yet assured” and “vigilance” still required.

- RBA Governor Lowe made it very clear that productivity growth needs to rise because 3.5-4% unit labour cost (ULC) growth is not consistent with inflation at 2.5% inflation. Thus if productivity doesn’t rise towards its 1% historical average, then rates may rise further to bring inflation to target by mid-2025. 4% nominal wage growth is not a problem if there is productivity growth. Lowe was not worried that wages would rise by 5%, like in other countries.

- Lowe reiterated that the central bank is pushing time boundaries and any indication it will be longer will require tighter policy, as can’t risk the onset of an inflation mentality. Expectations remain a concern, as households and businesses are less confident RBA will contain inflation.

- The Board remains very data dependent and ULC are just one of a number of factors that will impact decisions, including services inflation, inflation expectations, global growth, consumption and jobs. It remains concerned about the persistence of services inflation given overseas trends and overall saw risks to inflation skewed to the upside.

- The 2023 budget didn’t change the rate outlook and Lowe saw it as “broadly neutral” for the economy. He said that the energy market intervention was “helpful” and that with rebates would take 0.75pp off inflation and helps to keep inflation expectations down.

NZGBS: Richer But Off Bests, Underperforms US Tsys

NZGBs closed 2-3bp richer but at session cheaps. The intra-session decline was influenced by the movement of US tsys, which retreated from their earlier highs in the Asia-Pacific session Cash US tsys remain richer, but only by 1bp across benchmarks. NZGBs nonetheless underperformed US tsys with the NZ/US 10-year differential 4bp wider at +60bp.

- Swap rates closed flat to 4bp lower with the 2s10s curve 4bp flatter.

- RBNZ dated OIS closed 1-2bp softer across meetings.

- ANZ business confidence rose to -31.1 in May from -43.8, which is the highest since December 2021, but still well below the +4.3 historical average. Business activity rose to -4.5 from -7.6 and while it has been improving over 2023 also remains well below average. Activity is signalling that growth probably troughed in H1 2023 and inflation expectations that CPI inflation should moderate further.

- The local calendar is light tomorrow ahead of Q1 data for the Terms of Trade and Volume of All Buildings on Friday.

- Later today sees the release of the May Chicago PMI, April JOLTS and the Fed’s Beige Book.

- The NZ Treasury announced that they plan to sell NZ$200mn of the 0.25% 15 May 2028 bond, NZ$150mn of the 4.25% 15 May 2034 bond and NZ$50mn of the 2.75% 15 May 2051 bond tomorrow.

NZ DATA: ANZ Survey Signaling Inflation Moderation & GDP Trough

ANZ business confidence rose to -31.1 in May from -43.8, which is the highest since December 2021, but still well below the +4.3 historical average. Business activity outlook rose to -4.5 from -7.6 and while it has been improving over 2023 also remains well below average. Activity is signalling that growth probably troughed in H1 2023 and inflation expectations that CPI inflation should moderate further.

- Price/cost related components remained elevated but continued to moderate. Inflation expectations peaked in November 2022 at 6.4% and have been gradually easing since. In May they fell to 5.5% from 5.7%, which is still too high but heading in the right direction. Pricing intentions also fell further to 52.4 from 53.7 but still over double the historical average. Business costs eased to 84.1 from 84.2 and down from the 95.9 peak in early 2022.

- Other components showed that capacity pressures are easing in the economy with employment expectations falling to -5.7 from -2.4 and capacity utilisation to -1.2 from +0.8.

Source: MNI - Market News/Refinitiv

NZ GDP y/y% vs ANZ business activity outlook

Source: MNI - Market News/Refinitiv

EQUITIES: Hang Seng 20% Off January Highs

Regional equities are by and large weaker across the board. Focus has again been on China/Hong Kong shares. We opened up weaker and losses accelerated post the China PMI data print misses. US futures have also been dragged lower. Eminis were last down over -0.20%, tracking near 4205. Nasdaq futures have shed earlier gains, last -0.15%.

- We didn't see much of market reaction after the US debt ceiling bill cleared its first major hurdle. It was passed in the Republican controlled House Rules Committe by 7-6 votes. This clears the way for the bill to be voted on by the full house on Wednesday.

- In Hong Kong the HSI is off by over 2% to the break. This puts the index down over 20% from Jan highs. The tech sub index is 2.47% weaker.

- The CSI 300 is down over 1% and back sub 3800 at the break. We did see a decent rebound post the break yesterday and into close. Data momentum continues to soften though, with PMIs surprising again on the downside for May, with detail also soft.

- The Topix has faltered, down over 1%, while the Nikkei 225 is off by 1.5% at this stage, with weaker tech related plays weighing. The Kospi and Taiex are also modestly lower.

- SEA stocks are mostly weaker, although losses are under 1% this stage. The ASX 200 is down by 1%, with lower commodity prices weighing on the materials sector.

FOREX: USD Higher As Weaker China PMIs Hit Equity/Commodity Sentiment, NZD/USD Tests Sub 0.6000

The USD is higher across the board, with the BBDXY last near 1247.20, around 0.20% firmer versus NY closing levels from Tuesday. Recent highs in the index rest between 1248.50-75. China matters have dominated the Asia Pac session, with weaker official PMI prints weighing on broader risk appetite and boosting the USD.

- NZD/USD has been the weakest performer, falling nearly 0.70% and briefly dipping sub 0.6000. ANZ activity and business confidence figures suggested the economy likely troughed in H1, but inflation pressures continued to ease.

- NZD was weighed by softer commodity prices, weaker equity sentiment, as was the AUD. AUD/USD has fallen through 0.6500, last at 0.6495, very close to recent lows. Iron ore is back $97/ton, while CMX copper has lost 0.8% so far today. The weaker China PMIs clouding the demand outlook.

- AU Apr CPI was firmer than expected, and Goldman's is now forecasting RBA hikes in June and July, but this hasn't provided much offset for AUD/USD (AUD/NZD is higher though, last near 1.0820).

- USD/JPY is slightly higher, the pair last at 139.85, although the yen has outperformed in the G10 space on heightened risk aversion. Japan Apr activity data was weaker than expected, while BoJ Governor Ueda gave a wide ranging speech, but nothing that shifted the policy needle.

- Later the Fed publishes its Beige Book and Collins, Bowman, Harker and Jefferson all speak. In terms of data, there are the May Chicago PMI and April JOLTS job openings released. The EU Financial Stability Review is due and ECB President Lagarde will speak.

OIL: Prices Just Above Tuesday’s Lows As China Demand Outlook Deteriorates

Oil prices sank by over 4% on Tuesday and those losses have been slightly extended during the APAC session as markets remain risk averse in the face of disappointing May China PMI data. Crude markets have struggled in the face of China’s disappointing recovery and today’s PMIs confirmed that sentiment. Oil prices are down around 0.3% today while the USD index is up is 0.2%.

- Brent is trading around $73.50/bbl, off the intraday low of $73.41. WTI has held above $69 with a low of $69.15 and is currently trading at about $69.25.

- The China composite PMI in May eased to 52.9 from 54.4 with manufacturing falling further below the breakeven-50 level at 48.8. China is the world’s largest importer of crude and so this was not good news for markets.

- Market indicators are pointing to ample near-term physical supply. Later API US inventory data are published. Bloomberg cited Wood Mackenzie data showing that crude stocks at Cushing rose 1.05mn barrels in the latest week indicating softer demand.

- Later the Fed publishes its Beige Book and Collins, Bowman, Harker and Jefferson all speak. In terms of data, there are the May Chicago PMI and April JOLTS job openings released. The EU Financial Stability Review is due and ECB President Lagarde will speak.

GOLD: Higher With Lower US Tsy Yields, Focus Shifts Employment Data

Gold is exhibiting slight weakness in the Asia-Pacific session, trading at 1958.18 (-0.1%). This follows a 0.8% gain in the gold price on Tuesday as US tsy yields declined, driven by hopes that the US Congress will successfully pass a debt-ceiling deal to avoid a default.

- Both President Joe Biden and Republican House Speaker Kevin McCarthy have expressed confidence in garnering the necessary support for the bill ahead of the upcoming vote, which could take place as early as Wednesday. The agreement has received early backing from influential members of both parties' moderate and pragmatic factions.

- The market focus now turns to the release of the ADP private employment data on Thursday and the Non-Farm Payrolls report on Friday. These releases come amidst increasing expectations that the Federal Reserve will likely raise interest rates again in June or July in an effort to address persistent inflationary pressures. This anticipation has weighed on the price of gold in recent weeks. It is worth noting that the Federal Reserve will enter a policy blackout period starting at midnight on Friday.

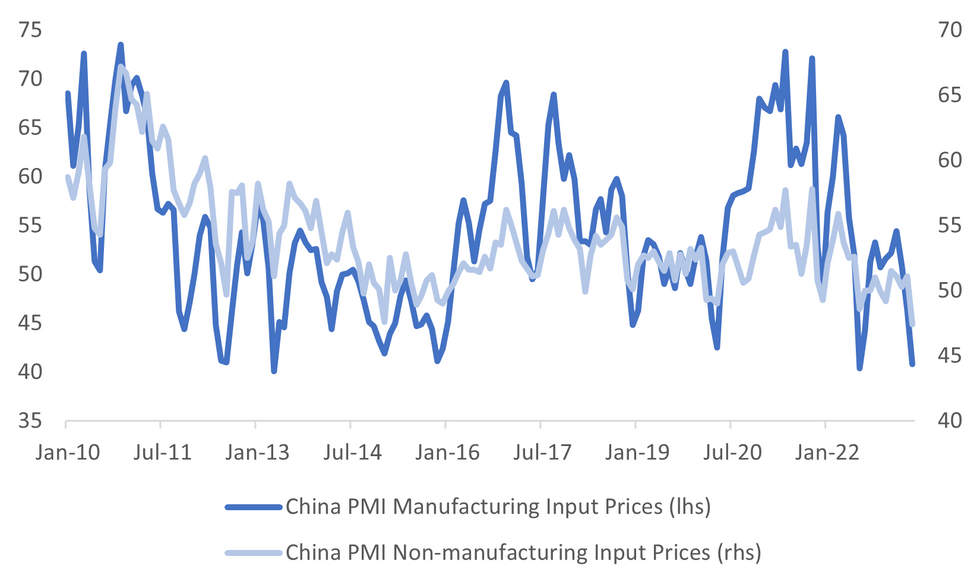

CHINA DATA: Weak Details In PMI Prints, Softer Price Gauges Likely To See Easing Calls Persist

It is hard to find many positives in terms of the China official PMI results. On the manufacturing side, output is back below the 50 expansion/contraction point (49.6 in May from 50.2). New orders eased to 48.3 from 48.8, while employment is back to 48.4. New export orders also declined to 47.2 from 47.6.

- Interestingly, there was also a sharp drop in both input prices and output prices. The input measure back to 40.8 from 46.4, while output prices eased to 41.6 from 44.9. This is likely reflective of the softer commodity price backdrop, but doesn't suggesta robust demand backdrop either. The correlation is stronger between the PMI input price measure and the PPI rather than CPI. Still, we will likely see easing calls persist.

- By scale of enterprise, activity in larger enterprises held up better relative to smaller enterprises.

Fig 1: China Manufacturing PMI Versus China IP Growth

Source: MNI - Market News/Bloomberg

- It was a similar story on the services side, albeit with index levels at higher starting points. Input prices fell to 47.4 from 51.1, while selling prices eased to 47.6 from 50.3. The second chart below overlays input prices for both the manufacturing and services side,

- New orders fell sharply as well to 49.5 from 56.0.

Fig 2: China PMIs - Input Prices Down Sharply

Source: MNI - Market News/Bloomberg

ASIA FX: Fresh Highs Again In USD/CNH, Parts Of SEA FX outperform

USD/CNH has once again made fresh highs, pushing above the 7.1200 handle. This has spilled over to the rest of the region, although parts of SEA FX have outperformed. Weaker China PMIs have weighed on broader risk appetite. Still to come is the BoT decision, with a +25bps hike expected, while later on India Q1 GDP is due. Tomorrow the Caixin manufacturing PMI prints in China, as well as South Korea May trade figures.

- The CNY fixing was again close to neutral, while the weaker PMIs suggest further easing calls are going to persist from the market. Price measures were noticeably weaker across the manufacturing and services PMIs. USD/CNH has moved above 7.1200 in its latest dealings. Onshore spot is above 7.1000. Focus is likely to rest on any late equity market recovery, with the CSI 300 down 1..1% at this stage.

- 1 month USD/KRW was weaker in early trade, but is back above 1320 now due to higher USD/CNH levels. Onshore equities have softened, the Kospi off 0.15%, but offshore investors have still added a further $218.7mn to local shares. Earlier data showed weakness in terms of IP and retail sales for Apr.

- USD/TWD 1 month has rebounded strongly, up over 0.60%, last near 30.70. The Taiwan equity rally has stalled. The simple 200-day MA is around the 30.75 level.

- USD/THB is weaker, last in the 34.70/75 region. USD/THB is 0.5% lower than Monday’s post-election high. The discussion on which party will take the House Speaker role will be conducted between just Move Forward and Pheu Thai. But there is a growing call amongst coalition parties that it should go to an experienced member and Pheu Thai leader Cholnan’s name is being increasingly mentioned. BoT is expected to hike 25bps later.

- USD/PHP has also edged away from recent highs, after getting close to fresh YTD highs. The pair was last in the 56.20/25 region.

- USD/IDR has breached the 15000 level, printing fresh highs back to early April. The pair was last at 14990/95. Lows from late March close to 15050 may be the next upside target. Also note the simple 100 day MA is just under 15100, the 50-day sits back near 14958. The softer commodity price backdrop is weighing, with palm oil prices continuing to make fresh lows (last MYR3400).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 31/05/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 31/05/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2023 | 0630/0730 |  | UK | DMO to Publish Gilt Op Calendar for Jul-Sep | |

| 31/05/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2023 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/05/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 31/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/05/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 31/05/2023 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2023 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2023 | 1230/1430 |  | EU | ECB Lagarde Q&A at Generation Euro Students' Awards | |

| 31/05/2023 | 1250/0850 |  | US | Boston Fed's Susan Collins | |

| 31/05/2023 | 1250/0850 |  | US | Fed Governor Miki Bowman | |

| 31/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/05/2023 | 1315/1415 |  | UK | BOE Mann Panellist at Pictet Family Forum | |

| 31/05/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 31/05/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/05/2023 | 1730/1330 |  | US | Philadelphia Fed's Pat Harker | |

| 31/05/2023 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 31/05/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 01/06/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.