-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Hope In The Driving Seat Into The Weekend

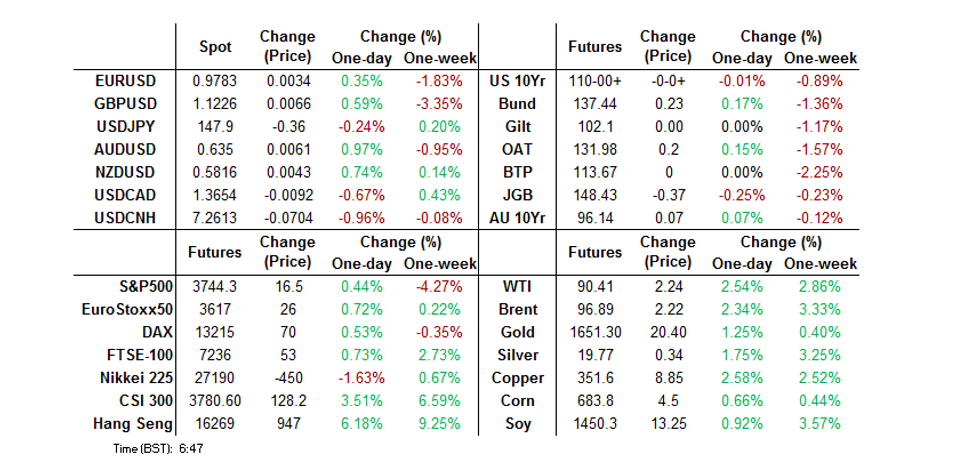

- Tsys remain underpinned into London as Chinese & Hong Kong equities rally and the broader USD weakens. China re-opening speculation, signs of the potential for deepening of Sino-German economic ties and BBG source reports noting that “U.S. audit officials completed their first on-site inspection round of Chinese companies ahead of schedule” have all factored into price action.

- Asia FX is mostly higher, led by CNH, which is up around 1% against the USD. THB has also rebounded strongly, while other pairs have recorded more modest gains. Firmer China/HK equities has fuelled broader gains in risk appetite throughout the region, with a number of positive afternoon headlines adding to the moves. For Monday next week, China October trade figures will be in focus, with Indonesia Q3 GDP also due. Thailand CPI is also due in the first part of next week (Mon-Wed).

- Outside of the U.S. NFP report, focus turns to Canadian jobs data, German factory orders, as well as comments from ECB's Lagarde, Nagel & de Guindos, BoE's Pill & Fed's Collins.

MNI US Payrolls Preview: Sequentially Softer But Still Solid

Markets

MarketsEXECUTIVE SUMMARY:

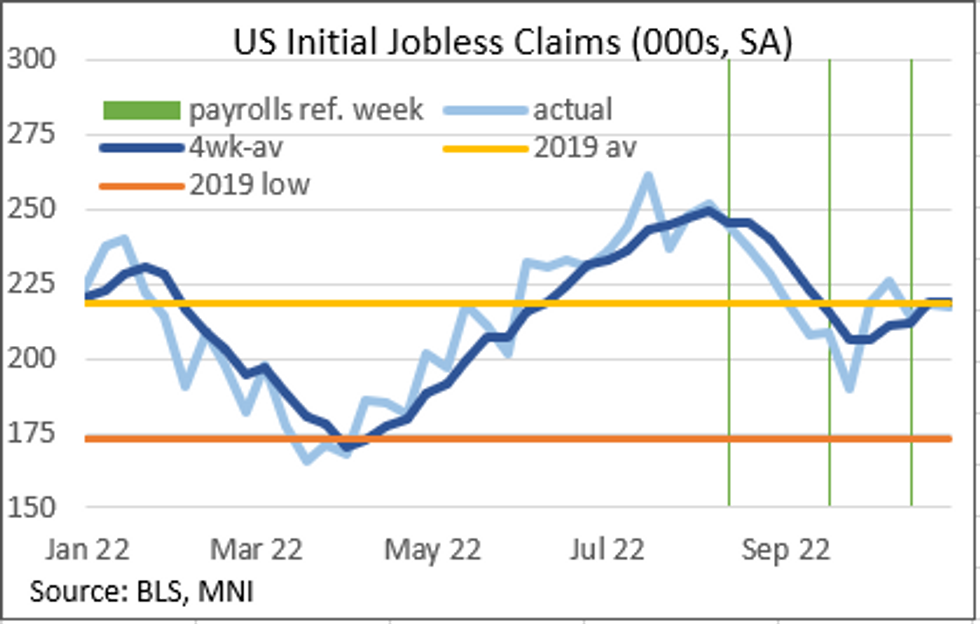

- Consensus looks for a payrolls report that would imply only a marginal easing in labor market tightness in October, with supply struggling to recover to pre-pandemic levels and an u/e rate near record lows.

- The usual combination of unemployment and participation rates will guide the market reaction, with AHE perhaps having less sway coming soon after the ECI in Q3, barring a notable surprise. ·

- Still, an in-line reading or higher would deliver a modestly hawkish reaction, with the FOMC meeting this week renewing policymakers’ concern that they haven’t yet seen much softening in the labor market.

PLEASE FIND THE FULL PREVIEW HERE:

US TSYS: Light Twist Steepening, With China Matters Dominating Pre-NFP

Tsys remain underpinned into London as Chinese & Hong Kong equities rally and the broader USD weakens.

- China re-opening speculation, signs of the potential for deepening of Sino-German economic ties and BBG source reports noting that “U.S. audit officials completed their first on-site inspection round of Chinese companies ahead of schedule” have all factored into price action.

- This came after weakness in the longer end of the Japanese curve and a bid for short dated Aussie bonds provided a light twist steepening impulse early in Asia trade.

- Cash Tsys run 2bp richer to 1bp cheaper across the curve, pivoting around 20s, with the 2-/10-Year spread hovering above the deepest levels of inversion registered during the current cycle (printed on Thursday). TYZ2 deals -0-00+ at 110-00+, a little off the peak of its 0-09 range on solid enough volume of ~95K.

- Flow was headlined by a couple of TY block sales (-1.4K & -1.9K), although these had no tangible impact on broader price action.

- Friday’s NY docket is headlined by the latest labour market report (see our full preview of that event here), meanwhile, post-FOMC blackout Fedspeak gets underway with addresses from Collins & Barkin.

US: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

| Societe Generale | +300K | Amherst Pierpoint | +260K |

| Credit Suisse | +250K | RBC | +230K |

| Bank of America | +225K | Daiwa | +225K |

| Deutsche Bank | +225K | Goldman Sachs | +225K |

| TD Securities | +220K | BNP Paribas | +215K |

| Citi | +190K | Wells Fargo | +190K |

| BMO | +180K | Morgan Stanley | +180K |

| Nomura | +180K | Barclays | +175K |

| HSBC | +175K | J.P.Morgan | +175K |

| Mizuho | +175K | Jefferies | +170K |

| Scotiabank | +150K | NatWest | +125K |

| UBS | +125K | ||

| Dealer Median | +190K | BBG Whisper | +241K |

JGBS: Steeper On Tokyo’s Post-FOMC Catch Up

JGB were subjected to post-FOMC catch up pressure after Thursday’s Japanese holiday, which saw the space on the defensive for most of Friday’s trade, before the wider core FI complex firmed (as we have outlined elsewhere), which allowed the space to edge away from cheapest levels of the day.

- Cash JGBs are little changed to ~5.5bp cheaper, with the super-long end leading the weakness. 10s remain capped by the upper limit of the BoJ’s YCC mechanism. JGB futures are -40, ~15 ticks off lows and ~100 ticks away from key technical support.

- Local news flow saw familiar rhetoric from Finance Minister Suzuki re: the JPY and the need for sound finances.

- Meanwhile, the Japanese cabinet OK’d the release of some the country’s reserve funds to pay for grain imports.

- Late in the session saw a couple of source reports do the rounds, pointing to requirements of ~Y22.8tn of bond issuance to finance the Japanese supplementary budget, providing a bit of a limit to the tick away from session cheaps for the space. The same reports indicated a record Japanese tax take in the current FY.

- 10-Year JGBi supply headlines the domestic docket on Monday.

JAPAN: Japan Shed Foreign Bonds Last Week

The latest round of weekly international security flow data revealed that Japanese investors upped their net sales of foreign bonds last week, recording the largest round of net weekly sales observed since late March into early April in the process. This represented a fifth consecutive week of net selling of foreign paper for Japanese investors.

- Elsewhere, foreign investors were net buyers of Japanese bonds after recording a record round of net sales in the previous week (when they were seemingly keen to test the BoJ’s resolve re: protecting its current YCC settings). This broke a streak of two weeks of net selling, although the 4-week rolling sum of the measure remains in heavy selling territory.

- Japanese investor flows surrounding foreign equities were virtually neutral in net terms.

- Meanwhile, foreign investors recorded sales of Japanese equities for a fourth week in five, although the pace moderated a touch vs. the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1600.6 | -489.5 | -3783.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 51.4 | 9.7 | 666.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 660.9 | -4804.6 | -5187.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -429.7 | -941.6 | -1289.0 |

AUSSIE BONDS: Firmer, Front End Leads The Bid

Aussie bonds firmed on Friday. A weaker USD surrounding Chinese re-opening hopes was a primary driver for a bid in U.S. Tsys which supported ACGBs during the latter rounds of Sydney dealing.

- EFPs were narrower all day, with receiver side flows in swaps lending a helping hand to ACGBs during early trade. This saw EFPS edge a little further away from cycle wides after the recent surge wider.

- YM was +11.0 at the bell, with XM +7.0, building on the overnight bounce from post-Sydney lows, while wider cash ACGB trade saw 7.5-11bp of richening as the curve bull steepened.

- The space looked through the latest round of economic projections provided in the RBA’s SoMP (with the major releases already flagged in Bank’s post-meeting statement earlier in the week, as is the norm).

- Elsewhere, slightly softer than expected Q3 real retail sales data was accompanied by negative revisions to the Q2 print,

- Bills were 6-16bp richer through the reds, with the backend of the whites and front end of the reds outperforming. RBA dated OIS has come in a touch more, pointing to a terminal cash rate of just over 4.00%.

- Looking ahead, next week’s domestic highlights include an address from RBA Deputy Governor Bullock (Wednesday), CBA household consumption data, NAB business and Westpac consumer confidence surveys (all due Tuesday) & inflation expectations (Thursday). We will also get the syndication of the new ACGB May-34.

NZGBs: Curve Twist Steepens On Global Impulses, Swap Spreads Narrow Again

Wider core global FI moves likely allowed the NZGB space to correct from cheapest levels on Friday, with a lack of domestic headline flow evident.

- The bid in the shorter end of the ACGB curve/EFP narrowing provided some trans-Tasman impetus, while light twist steepening in U.S. Tsys and post-holiday catch up weakness in the longer end of the JGB curve were also also observed.

- The major NZGB benchmarks finished 2bp richer to 2bp cheaper on Friday, twist steepening, pivoting around 7s.

- Meanwhile, swap rates were lower across the curve, resulting in swap spread tightening. This extended the recent narrowing of swap spreads witnessed since NZGBs were formally included in the FTSERussell WGBI (after some widening into that event), while the receiver side flows observed in Australian swaps may have also helped (although that dynamic faded a little as Sydney trade wore on).

- RBNZ dated OIS ticked incrementally lower on the day, with ~68bp of tightening now priced for this month’s meeting and a terminal OCR of just below 5.25% observed.

- Next week’s local docket is headlined by the release of the latest batch of quarterly inflation expectations data, monthly card spending data and the RBNZ’s Review and Assessment of the Formulation and Implementation of Monetary Policy.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- It confirmed that “a new 21 May 2034 Treasury Bond is planned to be issued via syndication in the week beginning 7 November 2022 (subject to market conditions). The Joint Lead Managers for the issue are Australia and New Zealand Banking Group; J.P. Morgan Securities Australia Limited; UBS AG, Australia Branch; and Westpac Banking Corporation.”

- On Tuesday 8 November it plans to sell A$150mn of the 0.25% 21 November 2032 Indexed Bond.

- On Thursday 10 November it plans to sell A$1.0bn of the 24 February 2023 Note, A$500mn of the 24 March 2023 Note & A$500mn of the 12 May 2023 Note.

FOREX: Sentiment Improves On Lead From China/HK Equity Space, USD Struggles Pre-NFP

The greenback sold off as the focus turned from the Fed's most recent monetary policy decision to the U.S. labour market data which will cross the wires after hours. The BBDXY fell 0.5% from Thursday's close, virtually erasing gains registered that day, with short-end U.S. Tsy yields sitting slightly lower.

- Risk sentiment turned positive, with a decent showing from Chinese/HK stocks lending support to the broader equity space. E-minis recouped their initial losses and now operate in the green. There were no obvious catalysts behind that move, outside of continued unverified re-opening speculation.

- Spot USD/CNH tumbled, outpacing losses in the BBDXY index. There was nothing unusual in the PBOC fix to boost the redback, with USD/CNY reference rate set at a new cyclical high and 593 pips below the sell-side estimate.

- G10 crosses traded in a typical risk-on pattern, with high-betas appreciating at the expense of traditional safe havens. The Aussie dollar outperformed on better iron ore prices and firmer commodity complex, leaving its Antipodean cousin NZD behind, out of sync with the move in Australia/New Zealand 2-year swap differential.

- Sterling firmed after cable found a base at $1.1150 and proceeded to chew into the prior trading day's losses. The pound came under pressure Thursday as the BoE delivered a 75bp hike while playing down terminal rate pricing and pointing to a bleak economic outlook.

- Outside of the U.S. NFP report, focus turns to Canadian jobs data, German factory orders, as well as comments from ECB's Lagarde, Nagel & de Guindos, BoE's Pill & Fed's Collins.

FX OPTIONS: Expiries for Nov04 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E615mln), $0.9790-00(E1.5bln), $0.9825(E650mln), $0.9900(E1.5bln), $1.0000(E2.3bln), $1.0100(E1.2bln)

- USD/JPY: Y146.00($607mln), Y147.00($973mln), Y148.00($580mln), Y149.00($553mln)

- GBP/USD: $1.1500(Gbp591mln)

- USD/CAD: C$1.3695-00($739mln), C$1.3800($689mln)

- USD/CNY: Cny7.2000($874mln), Cny7.3000($530mln)

AUDNZD: MNI Insight: AUD/NZD FX - Cyclical Drivers Aren't Turning Around Yet

The AUD/NZD cross has stabilized somewhat in the past session around the 1.0900 level, but it remains below all key simple MAs and EMAs. We are now down over 5% from late September highs.

- Still, cyclical drivers that have correlated well with the AUD/NZD cross this year, like swap differentials and the relative terms of trade backdrop, aren't pointing to a turnaround in sentiment for the cross yet. The relative central bank pricing outlook also remains skewed in NZD's favor, underpinned by a backdrop of relative data surprises in NZD's favor.

- China exiting its Covid-zero stance would arguably boost AU's commodity prices more than NZ's basket. This is a risk to be mindful of, although official rhetoric from China hasn't suggested a near term change is imminent. The other factor that could stabilize the cross is renewed global equity market weakness. Higher levels in the cross have coincided with weaker global equities this year, particular in September/early October. This fits with sensitivity to global risk periods for the two currencies as measured by their respective current account balances.

- See this link for the full piece.

ASIA FX: CNH & THB +1% Against the USD

Asia FX is mostly higher, led by CNH, which is up around 1% against the USD. THB has also rebounded strongly, while other pairs have recorded more modest gains. Firmer China/HK equities has fuelled broader gains in risk appetite throughout the region, with a number of positive afternoon headlines adding to the moves. For Monday next week, China October trade figures will be in focus, with Indonesia Q3 GDP also due. Thailand CPI is also due in the first part of next week (Mon-Wed).

- USD/CNH is down more than 1% so far in the session, aided by strong onshore and HK equity gains. The pair dipped to a low around 7.2425. Besides on-going re-opening speculation, China asset sentiment has been boosted by comments from German Chancellor Scholz who met with China President Xi today and stated Germany wants further economic ties with China. The US audit team, conducting on-site inspections of China companies listed on US exchanges, has also completed its work earlier, which has provided an additional sentiment lift.

- USD/KRW 1 month is back to 1416, -0.55% versus NY closing levels. The Kospi is up +0.60%, buoyed by positive spill over from China/HK equity gains. Offshore equity inflows have also been strong in recent weeks. 1410 support on the downside could be eyed.

- USD/SGD is down 0.50%, in line with the regional trend. This puts the pair back at 1.4145. Retail sales for September were better than expected, +11.2% y/y, versus +10.8% forecast, while ex-Autos stayed elevated at +16.8% y/y.

- USD/IDR hasn't pulled back, the pair is last +31 figs at 15728. Higher UST real yields from overnight is likely weighing at the margin. Offshore investors were net sellers of $23.26mn in Indonesian stocks, although the Jakarta Comp snapped a two-day losing streak. The benchmark equity index resumed losses this morning, sliding towards support from its 200-DMA.

- PHP is up 0.80%, last at 58.365. BSP Gov Medalla calibrated his rhetoric, noting that the central bank may match more Fed rate hikes if domestic inflation continues to accelerate (today's outcome was +7.7% y/y versus +7.1% expected). Medalla had earlier said that the BSP will hike its policy rate by 75bp at the next meeting, mimicking the Fed's latest move. In today's remarks, he refused to draw a line in the sand for the peso, noting that he flagged the next interest-rate move well in advance to avoid depleting the Philippines' dollar reserves.

- THB gains are slightly stronger than CNH. USD/THB was last at 37.55, +1.25% higher for the session. The pair's RSI is sending bearish signals. It fell from overbought territory back in September and failed to return above the 70 threshold as the price printed higher highs and then ebbed lower alongside the spot rate, currently being on the verge of confirming a bearish failure swing. Foreign investors were net buyers of $79.67mn in Thai stocks Thursday, extending a renewed streak of daily inflows.

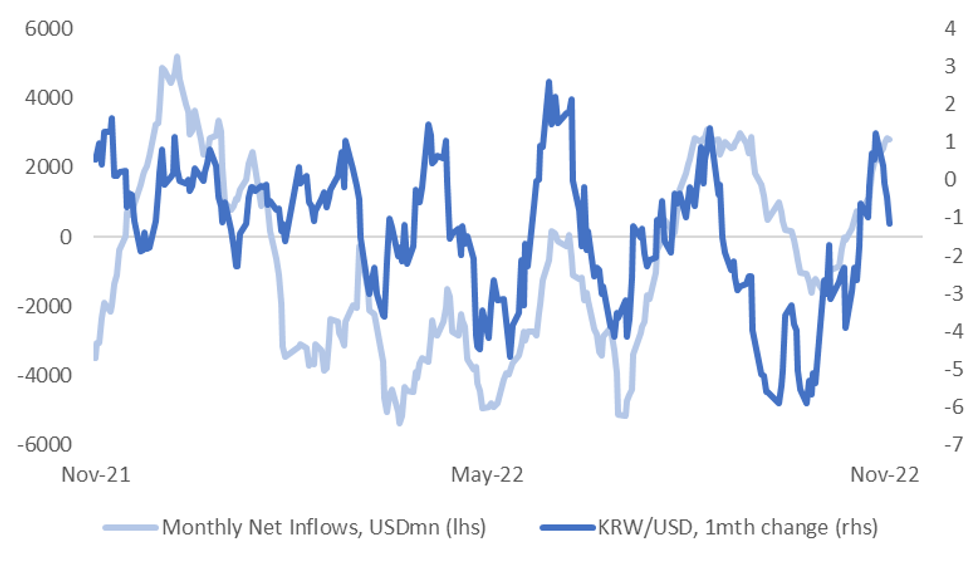

KRW: USD/KRW Maintains Recent Ranges, Equity Inflow Momentum Close To Recent Highs

1 month USD/KRW finished the NY session just under 1424. Resistance still appears ahead of the 1430 level, but more broadly the pair remains wedged between the 1410/1430 levels for now. Note onshore spot finished yesterday at 1423.95.

- The lead for the Kospi is once again a negative one (MSCI IT -2.28% overnight), although the local bourse has outperformed global tech indices this past week. To recap the Kospi was down 0.33% yesterday.

- Offshore investors continue to add to local shares though, with a further +$148.2mn in net inflows yesterday. Week to date flows are just over $1bn, while for the past month are just under $2.8bn, see the first chart below.

- The better flow backdrop has been one factor that has helped stabilized won sentiment (KRW/USD 1 month changes is the other line on the chart), particularly amidst higher USD/CNH levels and a still hawkish Fed backdrop.

Fig 1: South Korean Net Equity Flows & KRW/USD Trends

Source: MNI - Market News/Bloomberg

- It will be interesting to see if this type of flow momentum can be maintained and improve further. Towards the end of August, we ran out of momentum just above $3bn on a rolling monthly sum basis for net equity inflows.

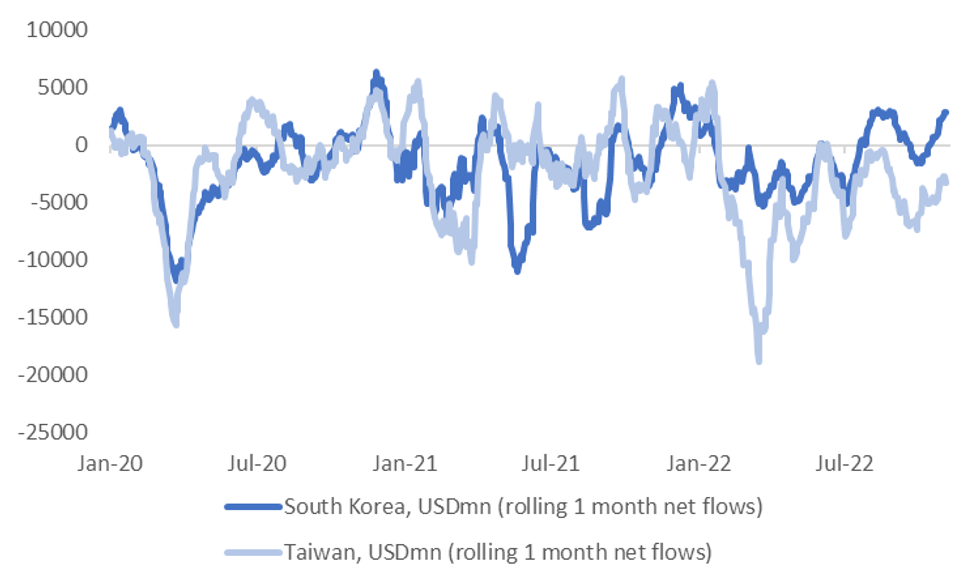

- South Korean net inflows do continue to outperform Taiwan though, see the second chart below. This gap has been evident for much of this year but has re-widened in recent weeks.

Fig 2: South Korean and Taiwan Equity Flow Trends (USDmn)

Source: MNI - Market News/Bloomberg

EQUITIES: HSI TECH +9%, As China/HK Stocks Rebound

China/HK related equities have again been the focus point. Strong gains have been recorded across all the major indices, particularly Hong Kong tech shares. This has helped lift US futures out of negative territory, although gains are modest at this stage, with only Nasdaq futures at +0.25/0.30%. Some regional markets are still in the red as well, so spill over from China/HK has not been uniform.

- Catalysts for the surge higher in HSI, ~+6% currently, are not clear from a headline standpoint. Once again, underlying sentiment has been governed by the tech space. The HSI tech sub index is up close to 9% at the moment. Some have pointed to the joint venture between large state-owned telco companies Tencent and Unicom as a potential catalyst.

- Otherwise, re-opening speculation is a likely factor, although we haven't seen any fresh developments on this front. The US audit inspectors have also finished on-site inspection work for China companies listed on US exchanges. Delisting risk has been a weight on market sentiment, albeit over a long period of time.

- The CSI 300 is up 2.7%, the composite index just over 2%.

- It has been more mixed elsewhere the Nikkei 225 is off just over 2%. This is more in line with US weakness from overnight, as tech related plays faltered. The Kospi has performed better, a trend evident for much of this week (up 0.47% today). The Taiex is off -0.30%.

- The ASX 200 is +0.40%, aided in part by higher resource names, as firmer commodity prices have been evident during today's session.

GOLD: Key Support Level Holds Despite Higher US Real Yields

Gold is +0.60% above NY closing levels, last just under $1640. This follows a weaker USD tone against the majors, with better China/HK equity sentiment seeing lower USD demand from a broader risk appetite standpoint.

- This comes after the overnight test sub $1620, where support held once again. This is the third time since late September this support zone has held.

- This came despite a surge in UST real yields overnight. We got to 1.74% for the 10yr.

- We are close to yesterday's highs, just above $1640, but beyond that is the $1660/$1670 region, which we haven't been able to trade above in a meaningful way since the first half of October.

OIL: Rebounds In Line With Broader Risk Appetite

Brent crude has spent much of the session on the front foot, up +0.77% so far. This is line with a firmer tone to broader risk appetite, led by China related equities. This puts us back above $95.30/bbl, with highs near $95.50/bbl for the session. Broadly, dips remain supported in Brent, although we can't break out of the 50-day ($92.79) to 100-day ($98.22) MA ranges for now. WTI is back above $88.80, +0.75% for the session.

- Earlier, Reuters reported that the G7 had agreed to a fixed price (rather than floating) when they finalize a price cap for Russia later this month. The UK Treasury stated it won't allow insurance services for oil shipped from Russia unless the price is at or below the cap (when it comes into effect in December).

- President Biden also reiterated earlier calls for oil/energy companies to invest more in the US or risk paying higher taxes.

- Elsewhere, Saudi Arabia announced it was lowering a key oil benchmark price for Asia customers for December delivery. The Arab Light grade will be set at $5.45/bbl above the regional benchmark, a 40 cents reduction. A softer demand backdrop for the region is being cited as the driver of this result. oil

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/11/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 04/11/2022 | 0745/0845 | * |  | FR | Industrial Production |

| 04/11/2022 | 0800/0900 | ** |  | ES | Industrial Production |

| 04/11/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/11/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/11/2022 | 0845/0945 |  | EU | ECB de Guindos Speech at Naturgy Foundation/IESE School | |

| 04/11/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/11/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/11/2022 | 0930/1030 |  | EU | ECB Lagarde Open Lecture | |

| 04/11/2022 | 1000/1100 | ** |  | EU | PPI |

| 04/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 04/11/2022 | 1215/1215 |  | UK | BOE Pill & Shortall MonPol Report National Agency briefing | |

| 04/11/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 04/11/2022 | 1230/0830 | *** |  | US | Employment Report |

| 04/11/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 04/11/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 04/11/2022 | 2000/1600 |  | US | Fed's Financial Stability Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.