-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI EUROPEAN MARKETS ANALYSIS: Chinese Tech Equities Struggle Again

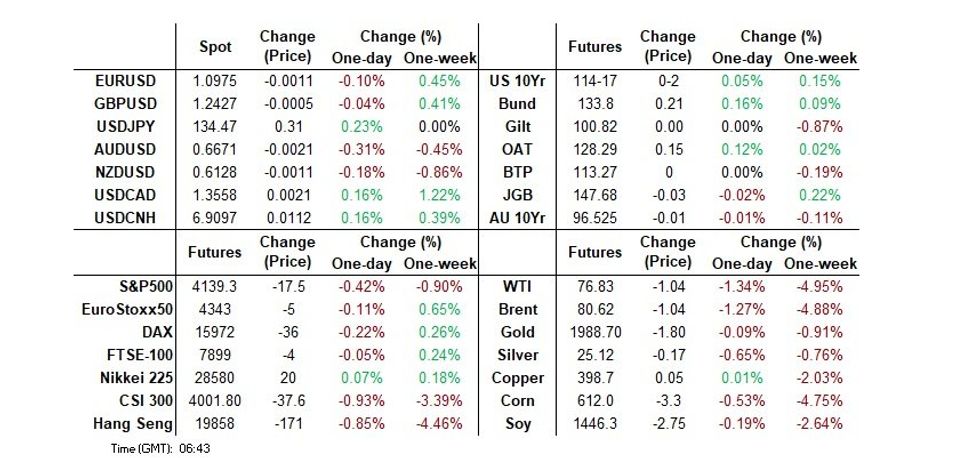

- Some of the major Asia-Pac equity indices have continued to struggle today as similar themes from late last week impact sentiment. China and Hong Kong markets have weakened further. U.S. e-mini futures opened weaker and have stayed negative through the Asia Pac session.

- The USD has mostly been on the front in the first part of trading this week. We sit close to session highs for the BBDXY, last around 1226.75. This is below highs from late last week (around 1228.70), but the USD has generally been supported on dips. Weaker equities and commodities have aided the USD, with little flow on effects from a modest pullback in U.S. Tsy yields on the dollar.

- The latest Ifo survey out of Germany and several rounds of ECB speak headline the European docket today. Meanwhile, activity indicators from the Chicago & Dallas Feds provide the highlight of the U.S. data slate.

US TSYS: A Touch Firmer As Chinese & HK Equities Struggle

Tsys have firmed at the margins in Asia-Pac hours, with TYM3 last +0-03 at 114-18, at the top of its narrow 0-03+ range, on light volume of ~41K. Cash Tsys run 1-2bp richer across the curve, with the intermediate zone outperforming.

- Tsys looked to weakness in Chinese & HK equities (centred on continued worry re: U.S. actions against the tech sector) and BoJ governor Ueda pointing to no imminent change in the Bank’s YCC settings for support.

- E-minis are lower in sympathy with Chinese tech equities, shedding 0.3-0.4%.

- Hawkish rhetoric from ECB’s Wunsch did little to impact the space, given his historical leaning and recent run of such comments.

- A quick reminder that the Fed is now in its pre-FOMC blackout period. Governor Cook offered the final round of Fedspeak ahead of the weekend, but was non-committal re: the May meeting, going over well-trodden areas of debate (banking stress, credit tightening, broad-based inflation and a resilient economy), pointing to a bumpy road when it comes to bringing inflation back down to target.

- Sellers of FVM3 108.00 puts provided the highlight on the flow side overnight, but those particular screen-based flows were comfortably under 10K on the volume side.

- The latest Ifo survey out of Germany and several rounds of ECB speak headline the European docket today. Meanwhile, activity indicators from the Chicago & Dallas Feds provide the highlight of the U.S. data slate.

JGBS: Futures Back To Flat After Gov. Ueda Cools YCC Change Speculation

JGB futures are currently flat to settlement levels but have rebounded from earlier lows after BoJ Governor Ueda's comments in Parliament put an end to speculation of an imminent change to the YCC setting ahead of this week's BoJ policy decision. Governor Ueda responded to a question about the conditions required for the BoJ to consider a tweak to YCC, stating that the BoJ's inflation forecast for the next half-year, year, and year-and-a-half must be strong and close to the target rate of 2%.

- There hasn’t been much in the way of other domestic drivers.

- JBM3 remains comfortably in the range of 147.40-147.92, which it has generally traded in since early April, barring a few probes through the lower limit last week.

- Cash JGB 4-7-year zone has maintained its relative richening versus the 2-year and the 10-40-year zones. The benchmark 10-year yield is 0.2bp lower at 0.470%, below the BoJ's YCC limit of 0.50%.

- Swaps curve twist steepens pivoting in the 20-year zone. Swap spreads are marginally wider across the curve, except for the 2-year and 10-year zones.

- Looking ahead, the local calendar is light until Friday when Tokyo CPI, Retail Sales and Industrial Production data on Friday, ahead of the BoJ Policy Decision on the same day.

- The MoF is scheduled to sell 2-year JGBs on Wednesday.

AUSSIE BONDS: Treads Water Ahead Of Q1 CPI On Wednesday

ACGBs sit little changed (YM -1.0 and XM flat) at or near bests after trading in a narrow range in the Sydney session. With local news flow light ahead of tomorrow’s ANZAC Day holiday, ACGBs have been willing to be guided by US Tsys. US Tsys are marginally richer in Asia-Pac trade.

- Cash ACGBs are flat to 1bp cheaper with the AU-US 10-year yield differential -4bp at -10bp.

- Swap rates are 1bp lower with EFPs 2bp tighter.

- Bills strip is steeper with pricing flat to -4.

- Q1 CPI data is scheduled for release on Wednesday and is expected to confirm that inflation peaked at the end of 2022. According to BBG consensus, annual headline inflation is expected to slow to +6.9% from 7.8% in Q4. Trimmed Mean CPI is expected to print +1.4% Q/Q and +6.7% Y/Y versus +1.7% and +6.9%.

- According to market pricing, however, the deceleration in underlying inflation may not be enough to keep the RBA on hold with a cumulative 22bp of tightening priced by August.

- ACGB futures will trade normal SYCOM hours on either side of tomorrow’s holiday and be guided by a raft of second-tier releases with the Chicago & Dallas Feds, S&P/CS House Prices Index and New Home Sales as the highlights.

AUSTRALIA: Q1 CPI Data To Ease, Watch Domestic Components

Q1/March CPI data are released on Wednesday and are expected to confirm that inflation peaked at the end of 2022 but that may not be enough to keep the RBA on hold. The quarterly data will include the goods/services and non-tradeables/tradeables breakdown, which should give an indication of trends in domestically-driven inflation. NZ saw a pickup in the non-tradeables CPI in Q1 to 1.7% q/q and 6.8% y/y (Q4 1.5% and 6.6%) and there is a high correlation between Australian and NZ CPI data.

- The Bloomberg consensus has Q1 CPI rising 1.3% q/q and 6.9% y/y, lower than Q4’s 1.9% and 7.8%. NZ’s moderated in Q1 but not as sharply as is expected in Australia.

- Q1 CPI forecasts are spread between 1.2% and 1.7% q/q (with most estimates 1.2-1.4%) and 6.7% and 7.5% y/y (most estimates 6.8-7%). The ANZ, NAB and CBA all expect a 1.3% rise, in line with consensus, but Westpac is forecasting 1.4%.

- Trimmed mean is projected to moderate by less than the headline with forecasts at 1.4% q/q and 6.7% y/y after 1.7% and 6.9% in Q4. Estimates are in a broad range from 0.9% to 1.8% q/q and 6.2% to 7% y/y with most in the 1.3-1.5% and 6.6-6.8% spans. CBA and Westpac forecasts are in line with consensus but NAB is projecting a 1.3% and 6.6% increase and ANZ 1.5% and 6.8%.

- The monthly CPI moderated over January and February and is expected to do so again in March to 6.5% from 6.8%. Expectations are between 6.2% and 7.1% - so some analysts are expecting it to rise. Most forecasts are between 6.3% and 6.6% with NAB at 6.3% and ANZ 6.5%. Electricity prices will be included in March, unlike the previous two months.

Source: MNI - Market News/Refinitiv/ABS

Fig. 2: Australia vs NZ non-tradeables CPI y/y%

Source: MNI - Market News/Refinitiv/ABS

NZGBS: Little Changed Ahead Of ANZAC Day Holiday

NZGBs closed flat to 1bp richer after trading in a relatively tight range. In the absence of domestic drivers, the market was content to track US Tsys, which were 1-2bp stronger in Asia-Pac trade after a weaker close ahead of the weekend. NZGBs outperformed US Tsys with the NZ/US 10-year yield differential 3bp narrower than Friday’s local close at +58bp.

- Swap rates are flat to 2bp higher with the 2s10s curve 2bp flatter and short-end implied swap spreads wider.

- RBNZ dated OIS closed little changed with 20bp of tightening priced for the May meeting. Easing expectations for Feb-24, off the expected terminal OCR of 5.52% (July), are currently 46bp.

- The Antipodean markets are closed tomorrow for the ANZAC Day holiday ahead of the release of ANZ Business (Thu) and Consumer Confidence (Fri).

- In Australia, the calendar highlight will be the release of Q1 CPI on Wednesday.

- Ahead of the local market’s opening on Wednesday, the US data docket will see a raft of second-tier releases with the Chicago & Dallas Feds, S&P/CS House Prices Index and New Home Sales as the highlights.

FOREX: Weaker Commodities Continue To Weigh On AUD/USD, USD/JPY Dip Sub 134.00 Supported

The USD has mostly been on the front in the first part of trading this week. We sit close to session highs for the BBDXY, last around 1226.75. This is below highs from late last week (around 1228.70), but the USD has generally been supported on dips. Weaker equities and commodities have aided the USD, with little flow on effects from the pull back in UST yields (-1.0-1.7bps lower across the curve) on the dollar.

- USD/JPY started the session on the back foot, back down through 134.00 but quickly recovered to back in the 134.40/50 region now. New BoJ Governor Ueda spoke in parliament and appeared to push back against any fresh YCC tweaks at Friday's policy meeting. Friday highs in USD/JPY came close to 134.50, so this act as a near term focus point for the market.

- AUD/USD remains on the back foot, down to 0.6675, off by a further 0.25%. This is through Friday session lows. Iron ore has fallen again, down nearly 3% in terms of the active Singapore contract to $105/ton. Oil has also weakened, along with gold.

- NZD/USD is a touch lower, but is outperforming the AUD at the margins. NZD last at 0.6135. Note tomorrow is ANZAC day in AU and NZ, which will leave both markets closed and may have impacted liquidity today.

- EUR/USD is touch lower, last near 1.0980, while GBP/USD steady around 1.2435.

- Looking further ahead, we have the German IFO out later, along with the ECB's Panetta. In the US, the Dallas Fed manufacturing survey is the main focus point from a data standpoint.

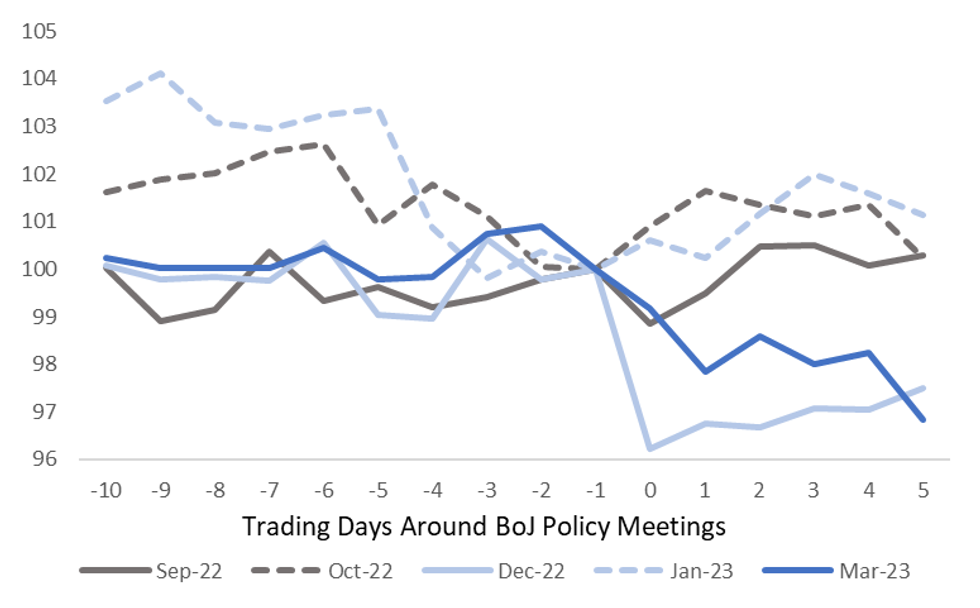

JPY: Yen Has Tended To Strengthen In The Lead Up To Prior BoJ Meeting Outcomes

The main event risk this week from a domestic standpoint will be Friday's BoJ meeting outcome. Looking back over the past 5 BoJ meetings, the general tendency has been for USD/JPY to trend lower into the meeting outcomes. This may reflect market hedging around a possible BoJ surprise, particularly after the Dec 22 meeting outcome. Still, expectations heading into this meeting remain quite low in terms major policy shifts.

- The chart below plots USD/JPY performance in the 10 day prior to the meeting outcome, with USD/JPY levels indexed to 100 for the day prior to the meeting outcome.

- Two weeks prior to the meeting USD/JPY has been an average around 1% higher, 1 week prior, around 0.5% higher. Of course, outside factors can be also driving yen during this periods, not just market expectations/risks around the BoJ outlook.

- Last week's performance for yen, where we down slightly against the USD, which underperformed the historical norms modestly, at least going back over the past 5 meetings.

- Post the BoJ meeting outcome, we typically see USD/JPY move lower in the week after the announcement, although these results are skewed by the post Dec-2022 outcome (YCC change) and in March of this year, which was influenced by broader risk aversion post the SVB collapse.

- If we look at 1 month implied vols, they have trended higher in the lead up to the past two BoJ meetings (Jan & Mar), by around 1vol. We didn't see a discernible trend prior to meeting outcomes last year.

- For risk reversals, the skew has been to the downside, particularly in the lead up to recent policy meetings.

Fig 1: USD/JPY Performance Around The Past 5 BoJ Meetings

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Apr24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0930-35(E737mln), $1.1000(E574mln)

ASIA FX: Mostly Firmer USD, USD/KRW Hits Fresh YTD Highs

USD/Asia pairs are mostly on the front foot through the first part of the Monday session. USD/KRW has hit fresh YTD highs, while USD/CNH is through recent highs, last above 6.9100. PHP has outperformed somewhat, as onshore markets return from Friday's holiday. Still to come today is Taiwan unemployment, IP and money supply figures for March. Tomorrow, Q1 GDP for South Korea prints, while Malaysia markets return. Indonesian markets remain closed until Wednesday.

- USD/CNH got through last Wednesday's highs above 6.9100, touching 6.9129. We sit just below these levels currently. The CNY fixing was neutral, while onshore equities remain weak, albeit posting a more modest loss so far today compared to Friday's session. Northbound stock connect flows are negative for the second straight session.

- Spot USD/KRW has gotten to fresh YTD highs, last in the 1336/37 region. +0.60% above closing levels from the end of last week. Onshore equities continue to unwind recent gains (Kospi -0.85% today), while offshore investors have returned as net sellers (-$139.6mn). USD/KRW is comfortably above its 200-day MA, which sits under 1325. Note President Yoon's trip to the US kicks off this today.

- USD/THB has gravitated higher, although has found some selling interest above 34.50. Moves above 34.50 or towards this region have generally been faded by the market going back to mid-March. Note the 100-day EMA is nearby, around 34.53. A modestly firmer USD backdrop, coupled with lack of portfolio inflow momentum remain headwinds for the baht. A host of comments from the BoT Governor have hit the wires. They look to be in line with previous commentary around the inflation, growth and tourism outlooks for 2023. The Governor also noted that monetary policy decisions are data dependent, although the focus should remain on financial stability and normalizing conditions.

- In Singapore, March CPI came in as expected for headline, +5.5% (6.3% prior), while core was a touch below expectations (5.0% y/y, 5.1% forecast, 5.5% prior). USD/SGD is higher at 1.3360/65, in line with broader USD gains. This is also in line with Friday highs. The SGD NEER is slightly lower, last -1.09% from the top end of the band per Goldman Sachs estimates.

- USD/PHP is under 56.00, after onshore markets return from holidays. Local equities are outperforming, up 0.72%. We remain well-below highs from early last Thursday near 56.40 for USD/PHP.

EQUITIES: China/HK Weaker Further, South Korea Shares Continue To Unwind April Gains

Some of the major indices have continued to struggle today as similar themes from late last week impact sentiment. China and Hong Kong markets have weakened further, while there have been some pockets of strength in the region, gains have been modest for the most part. US futures opened weaker and have stayed negative through the Asia Pac session, last -0.30% weaker.

- The CSI 300 is off by a further 0.43% at this stage, leaving the index very close to its 200-day MA (4014.3, versus last levels of 4015.20). Weakness looks to be a carry over from last week, with the threat of further investment curbs from the US weighing, particularly in the tech space. Northbound stock connect flows are negative so far today, -1.54bn yuan. This comes after decent -7.62bn yuan in outflows from last Friday.

- The Golden Dragon Index ended last week on a softer footing, while the HSI is off by 0.63% in the first half of trading today, although the tech sub index is outperforming (+0.2%).

- South Korean shares are underperforming, down 0.83% for the Kospi as we continue to see some unwinding of recent outperformance. The Taiex is faring better, close to flat, despite a negative lead from the SOX on Friday.

- Japan shares are modestly higher, the Topix +0.18, while Australian shares are around flat.

- In SEA, Philippine shares have outperformed, up 0.88%, as markets return from Friday's holiday. Most other markets are in the red though.

EQUITIES: MNI US EARNINGS SCHEDULE - Quarterly Cycle Reaches Crescendo

EXECUTIVE SUMMARY

- The quarterly earnings cycle hits a crescendo in the coming week, with 45% of the S&P500’s total market cap set to report. Reports are persistent across the week, but Tuesday is likely the most notable session for the index, as Alphabet, McDonald’s, Microsoft, PepsiCo and Visa are all due.

- Earnings season so far has been relatively solid, with the average firm tending to beat on EPS and revenues – although EPS metrics have held up well relative to sales.

- So far this quarter, the consumer discretionary sector is outperforming on both an EPS and sales basis, while financials, communication services and financials have generally performed poorly.

- Full schedule including timings, EPS and revenue expectations here: MNIUSEARNINGS240423.pdf

GOLD: Better US Data And Fed Hiking Prospects Weigh On Bullion

Gold prices were 1% lower last week after trading in a range of $1969.31 to $2015.09. They fell 1.1% on Friday after optimistic US data. Today they are down slightly to $1980.55/oz and close to the intraday low of $1978.59, as the USD index is up 0.1%. Support is at $1969.30, the April 19 low.

- Bullion has been unable to reverse Friday’s losses during the APAC session, as expectations of further Fed hikes persist. This week there will be important data for the May 3 Fed decision, including Q1 GDP and March core PCE prices.

- The German Ifo survey for April is released later today and also the US Chicago and Dallas Fed Indices. The upbeat April US PMIs on Friday weighed on bullion and so good reads from the Fed indices could also be negative.

OIL: Crude Down During APAC Trading As Demand Worries Dominate

Oil prices have unwound all of Friday’s gains and are down over 1% during the APAC session. WTI is 1.2% lower to $77.02/bbl and Brent -1.0% to $80.82. The USD index is up 0.1%.

- WTI is trading around its intraday low of $76.98. The high was $77.99 earlier. It is holding above its simple 50-day moving average of $76.54 but has just broken through the 100-day moving average of $77.05. Brent is also around its intraday low of $80.75. The high earlier was at $81.87. It is now below its key simple moving averages. Oil prices fell over 5% last week.

- Demand worries drove oil during APAC trading, as Asian refiners threaten to reduce output as margins shrink and US recession concerns persist. But China’s Golden Week holiday starts on the weekend and could boost demand for plane fuel.

- Bloomberg is reporting that Russian refineries have cut output for maintenance and because of official cutbacks.

- The German Ifo survey for April is released later today and also the US Chicago and Dallas Fed Indices. The upbeat April US PMIs on Friday boosted crude and so good reads from the Fed indices today could also be signalling better demand conditions. This week there will be important data for the US growth outlook and May 3 Fed decision, including Q1 GDP and March core PCE prices.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2023 | 0900/1100 |  | EU | ECB Panetta Panels Event by Bruegel Think Tank | |

| 24/04/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2023 | 1330/1530 |  | EU | ECB Panetta Into at ECON Hearing on Digital Euro | |

| 24/04/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.