-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: CNH Bucking Stronger USD Trend As Holiday Period Approaches

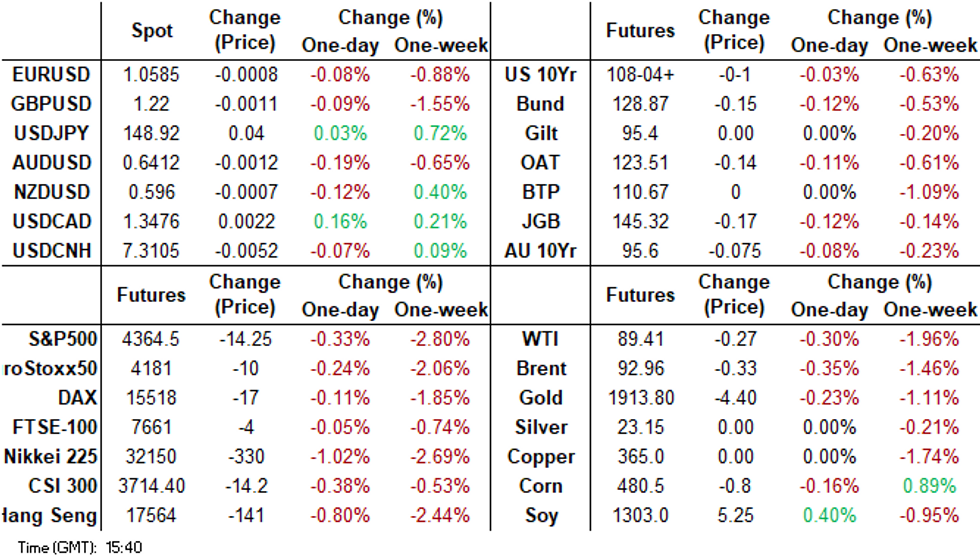

- Federal Reserve Bank of Minneapolis President Kashkari said he expects the US central bank will need to raise interest rates one more time this year and keep policy tighter for longer if the economy is stronger than expected. US Cash tsys sit ~2bps cheaper across the major benchmarks.

- The higher for longer Fed theme continues to dominate broader macro themes. The BBDXY continues to track higher, while equity sentiment remains under pressure for the major indices.

- USD/CNH is bucking the stronger USD trend, as the Golden Week Holiday period approaches. Spot USD/CNY is not too far off the top of its daily trading band (+2% above the USD/CNY fixing level). A number of other USD/Asia pairs have hit fresh YTD highs.

- Looking ahead, there is a thin docket in Europe today, further out we have US new home sales and Conference Board consumer confidence, along with a number of business surveys. Fedspeak from Gov Bowmen is due.

MARKETS

US TSYS: Marginally Cheaper In Asia

TYZ3 deals at 108-03, -0-02+, a 0-06+ range has been observed on volume of ~97k.

- Cash tsys sit ~2bps cheaper across the major benchmarks.

- Tsys were pressured in early dealing as the move lower seen yesterday continued in early dealing. The USD ticked higher and US Equity Futures fell.

- Support was seen in TY ahead of the 108-00 level. Ranges were narrow for the remainder of the session with little follow through on moves.

- Federal Reserve Bank of Minneapolis President Kashkari said he expects the US central bank will need to raise interest rates one more time this year and keep policy tighter for longer if the economy is stronger than expected.

- There is a thin docket in Europe today, further out we have US new home sales and Conference Board consumer confidence, Fedspeak from Gov Bowmen is due. We also have the latest 2 Year Supply.

JGBS: Futures Weaker Despite Solid Absorption Of 40Y Supply

JGB futures remain in negative territory in the Tokyo afternoon session, -23 compared to settlement levels, despite solid absorption of today’s 40-year supply.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined PPI Services.

- Cash JGBs are cheaper across the curve out to the 30-year, with yields 0.1bp (5-year) to 1.2bps (futures-linked 7-year) higher. The benchmark 10-year yield is 0.6bp higher at 0.742%, above BoJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.756%, set prior to the BOJ decision on Friday.

- The 40-year JGB yield is 0.4bp lower on the day at 1.846% and 1bp lower in post-auction trade. After a lacklustre 30-year auction earlier this month, today’s solid demand metrics suggest outright yields may be starting to provide adequate compensation for uncertainties and that the ongoing trend of local market participants shifting their portfolios from hedged offshore debt to holdings in yen-denominated bonds remains in play.

- The swaps curve has twist-flattened, pivoting at the 30s, with rates 0.1bp higher to 0.3bps lower. Swap spreads are mixed across maturities.

- Tomorrow the local calendar sees BOJ Minutes for the July Meeting, Leading and Coincident Indices, and Machine Orders.

- Tomorrow will also see BoJ Rinban operations covering 3- to 25-year+ JGBs.

AUSSIE BONDS: Cheaper But Off Worst Levels, CPI Monthly Data Tomorrow

ACGBs (YM -6.0 & XM -9.5) remain sharply cheaper but are above Sydney session lows. The local calendar has been light, ahead of the CPI Monthly release for August tomorrow. Accordingly, local participants have likely been on headlines and US tsys watch.

- US tsys have marginally extended yesterday's losses, with the 10-year yield printing a fresh cycle fresh in the Asia-Pac session. This leaves cash tsys ~2bps cheaper across the major benchmarks.

- Cash ACGBs are 5-9bps cheaper, with the AU-US 10-year yield differential unchanged at -15bps.

- Swap rates are 3-8bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -1 to -5.

- RBA-dated OIS pricing is flat to 2bps firmer across meetings, with terminal rate expectations at 4.32% (+25bps).

- (AFR) Some suggest the new RBA Governor Bullock, instead of raising interest rates, will soon be lowering them. Yet monetary policy in Australia is not as tight as in most economies. That does not seem justified by recent Australian data. (See link)

- Tomorrow the local calendar sees CPI Monthly release for August. Consensus expects 5.2% y/y after 4.9% in July.

- Tomorrow the AOFM plans to sell A$800mn of the 2.25% 21 May 2028 bond.

NZGBS: Closed Near Session Cheaps, Slightly Outperformed $-Bloc

NZGBs closed at or near local session cheaps, with benchmark yields 6-9bps higher. With the domestic calendar light until ANZ Business Confidence on Thursday, local participants have likely eyed US tsys in Asia-Pac dealings for guidance.

- US tsys have observed narrow ranges in recent dealing and are holding cheaper in Asia today. Little meaningful macro newsflow has crossed. TYZ3 sits a touch above support of 108-00, dealing at 108-03+, -0-02. Cash tsys sit ~2bps cheaper across the curve, with the 10-year yield having made a fresh cycle high of 4.5620%.

- The NZGB 10-year has slightly outperformed its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 1bp tighter at 67bps and 81bps respectively.

- Swap rates are 3-10bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations at 5.76%.

- The NZ economy has shown resilience to rising interest rates, past falls in house prices and intense cost-of-living pressures, the Treasury Dept. said in its Fortnightly Economic Update published Tuesday. “Nonetheless, growth has slowed and these headwinds, in addition to recent falls in commodity export prices, mean that growth will remain subdued for some time and provide room for inflation to continue to track down” (See link)

EQUITIES: Major Asia Pac Indices Tracking Lower, Eminis Just Above 200-Day EMA

Major regional Asia Pac equity indices are tracking lower, amid continued pressure from higher US yields, as the Fed's higher for longer theme continues to dominate broader sentiment. Only a handful of markets in South East Asia are tracking higher at this stage. US futures are lower. Eminis last near 4364, and not too far off the 200-day EMA (around 4355). The active contract is down 0.31%, while Nasdaq futures are -0.38% weaker this stage.

- US government yields are around 2bp firmer across the curve in Tuesday trade to date, building on solid gains from Monday's session. This is boosting the USD and weighing on broader risk appetite in the equity space.

- South Korea shares are the weakest performers, the Kospi off by around 1.25% at this stage. The headline index is now sub its simple 200-day MA. The Taiex is also weaker, down 0.80% at this stage. Japan's Topix is off ~0.55%, with Toyota losses weighing on aggregate trends.

- At the break, the HSI is down 0.84%. The index is back to late November 2022 levels. The CSI 300 is down 0.45%, with the index back sub 3700.

- In SEA, Thailand stocks are finding some support off the 1500 level (SET up 0.30%). Philippines PSEi is outperforming up +1.22%, with local banks surging on hawkish BSP rhetoric from yesterday.

FOREX: USD Marginally Firmer In Muted Asian Session

The USD is marginally firmer in Asia, albeit narrow ranges have been observed across G-10 FX. US Tsy Yields have nudged higher, the 10YY printed a fresh cycle high, and US Equity Futures are lower.

- AUD/USD is down ~0.1%, however a $0.6415/30 range has been observed. The trend condition remains bearish, support comes in at $0.6357, low from Sep 6 and bear trigger. Resistance is at $0.6502, 50-Day EMA.

- Kiwi is little changed from opening levels. NZ Tsy Noted that GDP growth will remain subdued for a long time, also saying that the path to lower inflation is unlikely to be smooth.

- Yen sits a touch below the ¥149 handle, there has been no follow through on moves today. The trend continues to be bullish, resistance comes in at ¥149.10, High from Oct 25 2022, and ¥147.71, high from Oct 24 2022. Support is at ¥147.12, the 20-Day EMA.

- Elsewhere in G-10 EUR and GBP are a touch pressured.

- There is a thin docket in Europe today, ECB speak from Lane is the highlight.

OIL: Broader Risk Off Outweighs Tight Supply Conditions

Oil is tracking lower in the first part of Tuesday trade. The Brent benchmark sits near $92.80/bbl. This is -0.45% down for the session so far, following Monday's flat outcome. WTI was last near $89.30//bbl, off a by a similar amount to Brent and follows a -0.40% fall in Monday trade.

- Broader risk appetite weakness, amid the further move higher in US yields (10yr last 4.55%, highs just above 4.56%) is weighing, with the USD firmer nearly across the board, and regional equity markets under pressure.

- These broader macro developments are outweighing further signs of tight supply. WTI prompt spreads have surged in recent dealings. Focus will be on the API report on stockpiles later today in the US, followed by the EIA report on Wednesday.

- For Brent, recent lows rest between the $92.00-$92.50/bbl region. The 20-day EMA rests back near ~$91.36/bbl. On the topside, recent rallies above $94/bbl have not been sustained.

GOLD: Pressured By A Resurgent USD As US Yields Hit Fresh Cycle Highs

Gold is slightly lower in the Asia-Pac session, after closing -0.5% at $1915.92 on Monday. Bullion came under strong pressure from a resurgent US dollar, fueled by a large bear steepening in US Treasuries and a surge in real yields.

- US Treasury yields climbed to new cycle highs across most maturities, with the 10-year printing a high at 4.5457% before marginally paring gains. The 30-year yield reached its highest since 2011 (4.6698%). The recent climb in oil prices combined with the Fed’s higher-for-longer message from last week and concerns over the US fiscal deficit weighed on US Treasuries.

- There was little reaction to the latest round of US data as the Chicago Fed Act. Index and Dallas Fed Mfg Activity Index were both weaker than forecast. Chicago Fed President Goolsbee said US rates were at their peak and the debate would soon shift to how long they'll hold there.

- A US government shutdown would have negative implications for its credit assessment as it would highlight the weakness of US institutional and governance strength compared to its peers, Moody’s said.

- Support at $1901.1 (Sep 14 low) could start to be eyed as the yellow metal remains far below last week’s pre-FOMC high of $1947.5, according to MNI’s technicals team.

THAILAND: MNI BoT Preview - September 2023: +25bps Projected, But A Very Close Call

- We sit in the +25bps camp for tomorrow's BoT meeting, which would take the policy rate to 2.50%. We note though it is a very close call. The sell-side community is close to evenly split between a hike and no change (the balance rests with no change per the Bloomberg survey).

- No change arguments rest with the recent evolution of data, with inflation under control and growth underwhelming. This is likely to see the central bank revise down its projections for both growth and inflation at this meeting.

- Still, the central bank is worried about the new expansionary policies of the government and has stated it will be forward looking in terms assessing the policy outlook. Rates are close to neutral but aren't in sharp contractionary territory. THB has weakened, the Fed looks to be to remain higher for longer and the next BoT meeting isn't until end November. These factors tip us to project a hike tomorrow, but equally we wouldn't be surprised by a hawkish hold.

- Full preview here:

SOUTH KOREA DATA: Headline Consumer Sentiment Dips Further, Inflation Expectations Steady

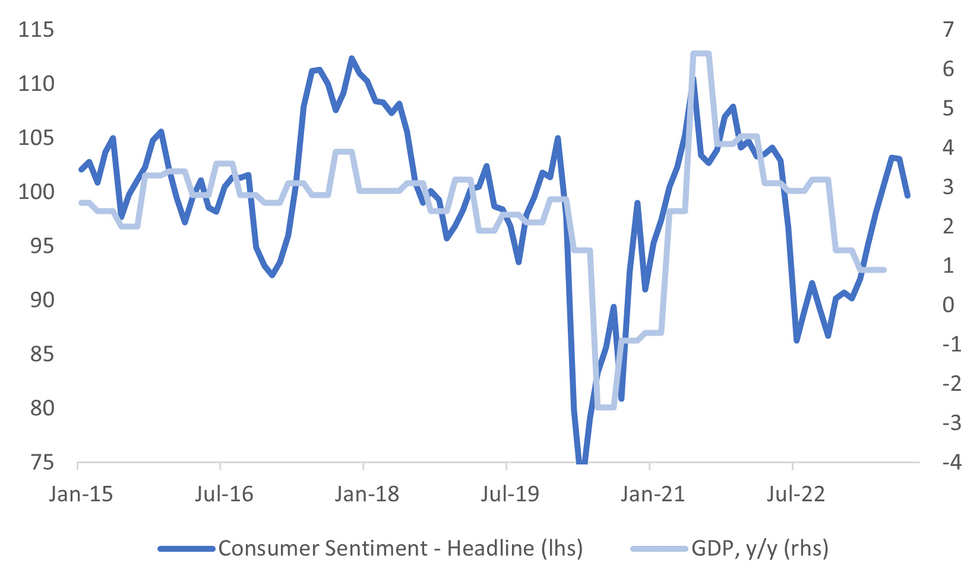

South Korean consumer sentiment dipped in terms of the headline measure for September. We are back to 99.7 from 103.1 in August. We are above earlier lows from 2023, but the run of improvement in the headline index has clearly come to an end. Note tomorrow we get the October reads for manufacturing and services business sentiment from the BOK.

- The first chart below overlays the headline consumer sentiment reading against y/y South Korean GDP growth. It's still pointing to some improvement in y/y momentum, but the rebound is likely to below what we saw in 2021.

- In terms of the detail, most indicators around the domestic economy ticked down, along with employment. Consumer spending plans also slipped. Measures are above earlier 2023 lows though.

Fig 1: South Korea Consumer Sentiment Index & GDP Y/Y

Source: MNI - Market News/Bloomberg/BOK

- On the price side, the expected inflation level held steady for the third straight month at 3.3%. Headline inflation has rebounded back to 3.4% y/y. Note the September CPI data comes out on October the 5th.

- The expected housing price level rose further to 110 from 107. Expected wages ticked down slightly.

ASIA FX: Fresh YTD Highs For Some USD/Asia Pairs, CNH Bucks Stronger USD Trend

With the exception of USD/CNH, all other USD/Asia pairs are firmer across the board. Equity weakness, for the most part, coupled with higher US yields, remain on-going headwinds. USD/KRW and USD/THB have made fresh YTD highs today. Tomorrow, we get South Korean business sentiment early, China industrial profits and later on the BoT decision. We look for a +25bps hike, but note it is a close call.

- USD/CNH has bucked the stronger USD trend seen elsewhere in recent sessions. Today we have spent most of our time near the 7.3100 level (range of 7.3059-7.3168 today). Spot USD/CNY tracks fairly close to 7.3100 as well in recent dealings. Earlier the CNY fix was set at 7.1727, the same level as yesterday's outcome. The USD/CNY fixing has been steady in recent sessions, despite higher USD index levels, see the chart below. We are approaching Golden Week, which kicks off this Friday and runs through all of next week. The authorities may wish to avoid a sharp move higher in USD/CNY ahead of this period. Local equity weakness has also been a headwind for CNY in recent sessions. Tight CNH funding is also a support point.

- Spot USD/KRW has broken to fresh YTD highs. The pair last just above 1348. A continued move higher could see the November 22 high from last year near 1363 targeted. Familiar drivers are in play for the won, with higher USD/JPY levels weighing, amidst a further rise in US yields. Local equities are under pressure, the Kospi off by nearly 1.25% at this stage to 2463 in index terms. This is lows going back to mid-May of this year.

- USD/IDR has pushed higher today, in line with broader USD gains and upside momentum in US yields. Spot was last near 15450, am IDR loss of around 0.33%. Headlines crossed earlier from BI that it is in the market to ensure FX supply/demand balance.

- The Rupee was pressured on Monday as rising US Tsy Yields and concerns over rising Oil prices weighed. USD/INR rose ~0.3% and finished dealing above the 83 handle albeit well within recent ranges. USD/INR has opened dealing ~0.1% above closing levels as the Rupee weakens in early trade. The pair last prints at 82.20/22. Data wise the docket is empty until Friday when the August Fiscal Deficit and Eight Infrastructure Industries survey crosses.

- The SGD NEER (per Goldman Sachs estimates) sits a touch off late August cycle highs after firming yesterday. We now sit ~0.5% below the top of the band. Broader USD trends continue to dominate flows for USD/SGD, the pair sits marginally below YTD highs and has observed narrow ranges in recent dealing. USD/SGD sits up ~0.1% at $1.3670/75 today. A reminder that yesterday CPI in August fell to 4.0% Y/Y from 4.1%. The core measure was also down to 3.4% Y/Y from 3.8%.

- USD/MYR continues to sit in narrow ranges a touch of YTD highs below the 4.70 handle. The data docket is empty this week, the next data of note is next Monday's S&P Global MFG PMI for September.

- USD/THB got to fresh highs of 36.415, before a surprise customs trade surplus print for August ($360mn, -$1761mn projected) helped calm sentiment. Dips back below 36.30 were supported. The pair last at 36.33. We expect a +25bps hike from BoT tomorrow, although note it is a very close call.

- USD/PHP sits above 56.90 in recent dealings, despite fresh hawkish rhetoric from BSP Governor Remolona (including the possibility of an off-cycle hike). The Governor stated resistance in USD/PHP is evident at 57.00.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/09/2023 | 0700/0900 |  | EU | ECB's Lane speaks at CEPR conference | |

| 26/09/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/09/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/09/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/09/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/09/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2023 | 1730/1330 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.