-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Defensive Start To Friday 13

- The broader defensive feel from Thursday's NY session spilled over into the final Asia-Pac session of the week.

- Little in the way of meaningful macro headline flow or economic data to counter the risk-off tone overnight.

- Focus remains on the broader COVID dynamic, as well as U.S. fiscal impasse, leaving markets to look to the December FOMC & ECB meetings.

BOND SUMMARY: Bonds Hold Firm In Asia After Thursday Rally

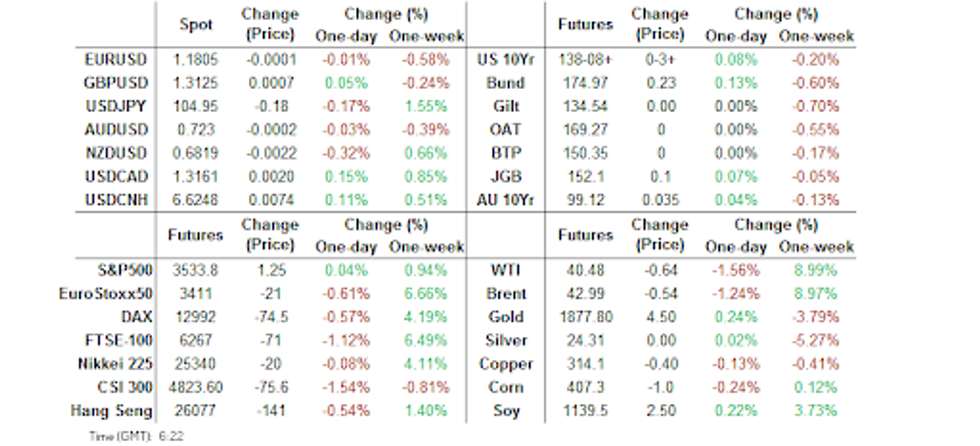

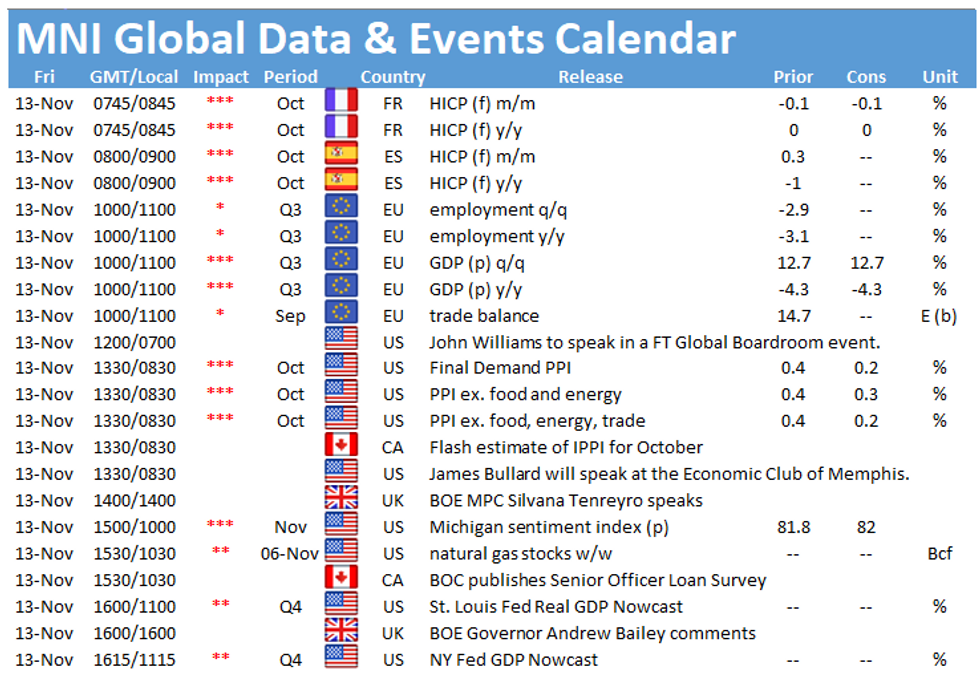

There was little to really counter the negative feeling that surrounded Thursday trade during Asia-Pac hours. As a result, T-Notes traded through Thursday's high, but lacked any meaningful follow through, last +0-04 at 138-09. Cash trade saw yields richen by 0.4-1.1bp, with 10s the marginal outperformer. Macro headline flow has been light since the re-open, with little of note on the Asia-Pac docket on Friday. Eurodollar futures are virtually unchanged through the reds. As a reminder, markets re-focused on familiar issues of stress on Thursday, namely the U.S. (and indeed global) COVID dynamic, worries re: related social restrictions in the U.S., ongoing political tension in DC, a wider sense of fiscal impasse on the hill (with the Trump administration seemingly stepping back from the negotiations) and soft U.S. CPI data. Bull flattening was at the fore as a result, with 30s richening by over 10.0bp come the bell, going out at strongest levels of the day. The local docket sees the release of U.S. PPI data & UoM sentiment reading, in addition to Fedspeak from Williams & Bullard.

- JGB futures held a tight range, with the only real news flow of note for the space surrounding COVID worry in Japan. The contract finished +10 on the day, while the cash curve generally richened, although the super-long lagged for a second day, cheapening at the margin, allowing super-long swap spreads to tighten.

- In Australia, after some early focus on the broader defensive feel evident in NY hours, the AOFM's announcement re: next week's syndicated tap of ACGB 2.75% 21 May 2041, which will be up to A$6.0bn in size, added some pressure to the longer end of the space, before the early dynamic (and perhaps an eye on the upcoming cash flow matters within the space) provided fresh support. YM +0.5 and XM +3.0 at the bell. Worth flagging that early desk discussions covered some apparent overnight flattening flow, lodged via a block trade of 6.0K YM and 1.7K XM. Cash ACGB trade saw the 10-12 Year sector outperform, with the long end not fully recovering from the syndication announcement.

FOREX: Defensive Flows Take Hold In Asia, Orr's Warning Undermines Kiwi

Coronavirus worry kept riskier FX in check, as Japan and the U.S. reported new daily records of infections Thursday, while a number of central bank heads warned against premature optimism. The yen topped the G10 scoreboard as participants sought a safe haven. Lingering concerns over the deadlocked fiscal talks and political transition in the U.S. helped undermine risk appetite.

- NZD led commodity FX lower as a new community transmission of Covid-19 was found in Auckland and RBNZ Gov Orr joined other central bankers in reminding that the economic recovery is a "big if". The Governor cited the new infection as a pointing to continued uncertainty and noted that the last MPS was based on a "very bold" assumption that New Zealand's will re-open by 2022.

- Focus today turns to EZ trade balance & flash GDP, final French CPI, flash U.S. U. of Mich. Survey. Central bank speaker slate includes Fed's Williams & Bullard, ECB's Rehn, de Cos & Weidmann and BoE's Bailey, Cunliffe & Tenreyro.

FOREX: MNI Market Analysis - USD Index, A Medium-Term Chart Assessment

The USD Index (NDX) hasn't weakened since the low print of 91.75 on Sep 1. The medium-term chart however continues to highlight a bearish backdrop.

- Moving average analysis highlights a downtrend. Both the 20- and 50-day EMAs remain in a bear mode condition.

- Momentum, looking at the 14-day RSI, is not highlighting any structure that would provide an early warning sign of base building.

- Key resistance levels worth noting are:

- 93.17/44, the area between the 20- day and 50-day EMAs.

- 94.30, Nov 4 high

- 94.74, Sep 25 high and the key reversal trigger. A break would signal a change in the medium-term direction

- Key support levels to watch:

- 92.13, Nov 9 low.

- 91.75, the key bear trigger and Sep 1 low. A break would resume the broader downtrend that started in March and open levels around 90.60.

FOREX OPTIONS: Expiries for Nov13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E703mln), $1.1735-40(E935mln),

$1.1770-75(E522mln), $1.1795-00(E1.4bln), $1.1840-55(E1.8bln), $1.1870-75(E952mln), $1.1900(E512mln),

$1.2000(E1.78bln-EUR calls) - USD/JPY: Y101.00($995mln-USD puts), Y104.65-75($502mln), Y105.50($560mln)

- EUR/GBP: Gbp0.8950(E586mln), Gbp0.9045-50(E807mln)

- AUD/USD: $0.7300(A$599mln-AUD calls), $0.7325-35(A$763mln), $0.7400(A$568mln-AUD calls)

- USD/CAD: C$1.3125($900mln)

- USD/CNY: Cny6.51($500mln), Cny6.60($1.1bln), Cny6.75($600mln)

EQUITIES: Equities Struggle In Asia On Wall St. Spillover, E-Minis Mixed

The negative impetus from Wall St. spilled over into Asia-Pac hours, with little in the way of macro headline flow to counter the momentum after markets chose to re-focus on familiar risks on Thursday (COVID worry, related U.S. social mobility restrictions, DC fiscal impasse & U.S. political clouds). This biased the major regional indices lower in the final session of the week, while e-minis dealt either side of unchanged.

- •Nikkei 225 -0.5%, Hang Seng -0.3%, CSI 300 -1.6%, ASX 200 -0.2%.

- •S&P 500 futures +4, DJIA futures -8, NASDAQ 100 futures +41.

GOLD: Confined

Little to report for bullion over the last 24 hours or so, with a push lower in benchmark & real U.S. Tsy yields providing support, as well documented risks (outlined elsewhere) came back to the fore. The USD has been a little more mixed, providing no real decisive input for gold. Spot last dealing little changed, just shy of 1,880/oz, with bulls still needing to force a break above the 50-EMA.

OIL: Little To Support Crude Overnight

WTI & Brent sit ~$0.50-0.60 softer than settlement levels at typing, with little to support the space in a news light Asia-Pac session. This comes after the benchmarks shed ~$0.30 come Thursday's settlement, with a more risk averse feel evident on well documented, and familiar sources of risk, with regional equities adding to the pressure during the final Asia-Pac session of the week.

- The latest round of weekly DoE inventory data saw a surprise build in headline crude stocks (which was at odds with the drawdown seen in the API estimate), while refinery utilisation saw a surprise downtick. Elsewhere, products saw larger than expected/surprise draws, in line with the picture provided by the API estimates, while Cushing stocks saw a small drawdown. U.S. crude production was essentially unchanged in the most recent week.

- Thursday also saw the release of an Energy Intelligence source piece, which noted that "Iran's oil exports could rise by as much as 500,000 barrels per day by February, according to a senior Iranian official, if US President-elect Joe Biden takes a less rigorous approach to enforcing "brutal" sanctions imposed under incumbent Donald Trump."

- Finally, the IEA's latest monthly oil market report saw the Agency slash its '20 global crude demand forecast, noting that it does not expect COVID vaccines to provide a significant boost for crude demand until well into '21.

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Stable) & France (current rating: AA; Outlook Negative)

- Moody's on Austria (current rating: Aa1; Outlook Stable)

- S&P on the Netherlands (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Cyprus (current rating: BBB (low), Stable Trend) & the UK (current rating: AAA, Negative Trend)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.