-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: Dollar Tumbles Against Asian FX, CNH Remains Sidelined

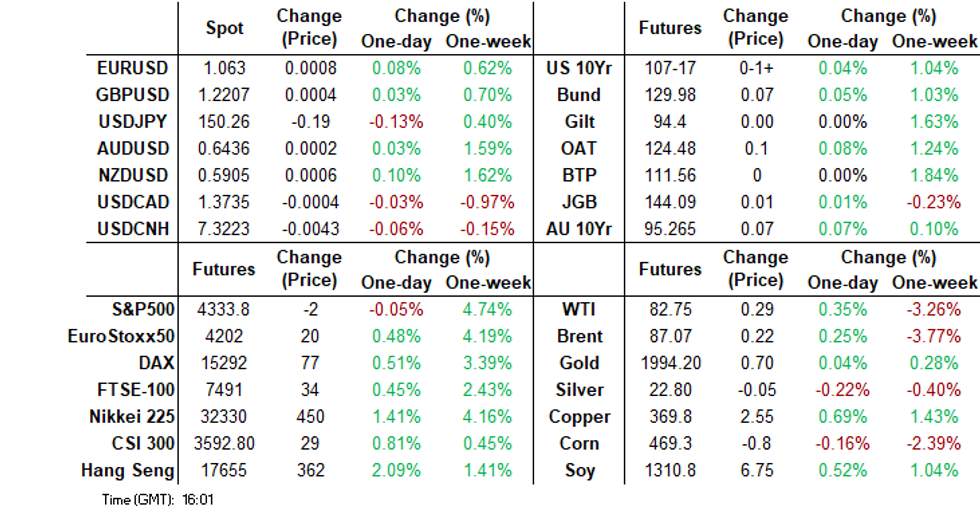

- US Cash tsys have been closed in today's Asian session due to the observance of a national holiday in Japan and will reopen in the London session. This comes ahead of the NFP print later in the US. The USD has drifted lower against the majors, the BBDXY down 0.15%.

- Dollar losses have been much more prominent against some of the Asian currencies. KRW is up near 1.8%, PHP 1.4%, IDR 0.70%, as regional risk appetite continues to recover in the equity space and local FX welcomes the lower US real backdrop. CNH has only firmed a touch.

- Oil prices have continued to firm, but still remain sharply down for the week. Early Friday focus is likely to be on Blinken's trip to Israel.

- Looking ahead is the US NFP, the MNI preview is here. Also due today is the final print of Services PMI and the ISM Services Survey. Some BoE speak is also on tap, along with Canadian employment figures.

MARKETS

US TSYS: Cash Re-Opens In London, NFP In View

TYZ3 deals at 107-15, -0-00+, a 0-05+ range has been observed on volume of ~59k.

- Cash tsys have been closed in today's Asian session due to the observance of a national holiday in Japan and will reopen in the London session.

- Tsys have observed a narrow range in Asia with little follow on moves, the Japanese holiday affected general liquidity.

- US Equity futures were moderately pressured in early trade as Apple's Q4 Sales Outlook disappointed. A recovery was seen from session lows however e-minis and NASDAQ futures are holding lower. There was little spillover into the Tsys and the greenback remained stable.

- The proximity to this evening's NFP also limited activity in Asia. The MNI preview is here.

- Also due today is the final print of Services PMI and the ISM Services Survey.

ECB: Schnabel Not Ruling Out Further Rate Hikes

ECB's Schnabel has delivered a speech in St Louis in the US. Given the current monetary stance, Schnabel stated that inflation should be back to 2% by 2025. The long period to get inflation back to target reflected stickier underlying inflation conditions. Labor shortages and a higher proportion of service in aggregate activity are complicating factors from an inflation standpoint, Schnabel stated (RTRS).

- Two conditions have to be met to bring inflation back to the ECB's target, lower unit labor costs and firms have to absorb higher wages via profit margins.

- Inflation expectations are also fragile, while fresh supply side shocks (with the Middle East situation raised as one risk) could cause fresh destabilization to the inflation outlook. Therefore, the door to future rate hikes can't be closed (see this BBG link).

- Finally, the Euro area is stagnating but not in a deep recession.

AUSSIE BONDS: Richer, Narrow Ranges, Awaiting US Payrolls Data

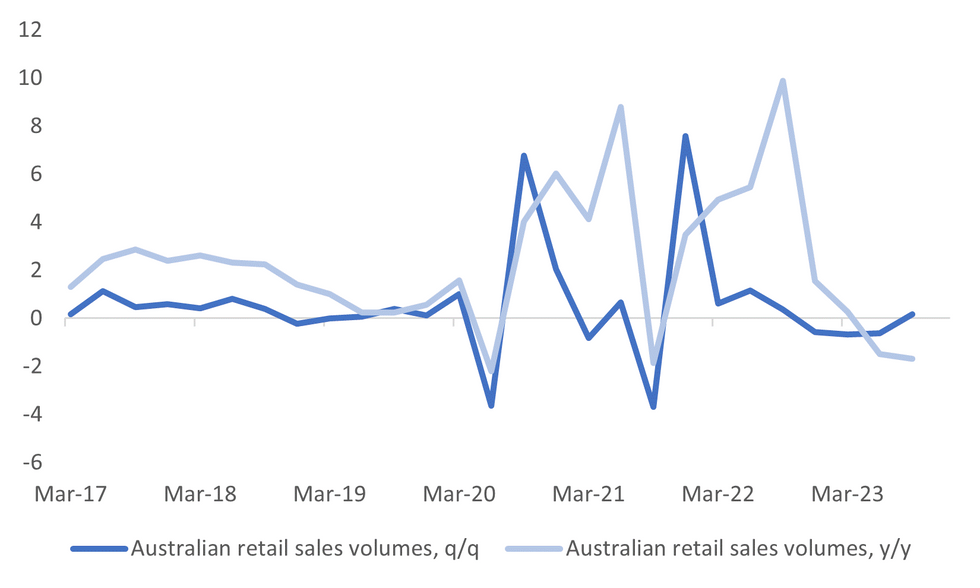

ACGBs (YM +1.0 & XM +4.5) are richer but near Sydney session cheaps after Q3 retail sales volumes unexpectedly rose 0.2% q/q in Q3. This was stronger than expected (consensus -0.3%), although the Q2 dip was revised down a touch to -0.6%. It was the first rise in quarterly retail sales volumes since Q3 last year.

- With cash tsys closed in Asia due to the observance of a national holiday in Japan, the local market traded in a narrow range in the latter part of the session ahead on US Non-Farm Payrolls later today.

- Cash ACGBs are 2-5bps richer, with the 3/10 curve flatter.

- Swap rates are 1-5bps lower, with EFPs little changed.

- The bills strip is slightly mixed, with pricing +/-1.

- Looking ahead to next week, the local calendar sees Melbourne Institute Inflation Gauge and ANZ-Indeed Job Advertisements on Monday, ahead of the RBA Policy Decision on Tuesday. Bloomberg consensus is almost unanimous (21/24 economists polled) in expecting a 25bp hike to 4.35% at next week’s meeting.

- RBA-dated OIS pricing assigns a 69% probability to a 25bp rate hike next Tuesday.

- Next Wednesday, the AOFM plans to sell A$800mn of the 2.75% Jun-35 bond.

- TCorp announces that it has increased the existing 3.00% Mar-28 benchmark bond by A$600mn via reverse enquiry.

AU STIR: RBA Dated OIS Prices 40bps Of Tightening Ahead Of Tuesday’s RBA Decision

RBA-dated OIS pricing is 1-2bps softer across meetings today ahead of the RBA Policy Decision on Tuesday.

- The market currently assigns a 67% probability to a 25bp rate hike next Tuesday. This percentage had risen to 80% following the release of higher-than-expected Q3 and September CPI data in late October. However, it retreated in the days following RBA Governor Bullock's non-committal comments during her appearance before the Senate Economics Committee.

- The recent moderation in expectations has also been influenced by major central banks opting to maintain their policy rates.

- Expectations for the terminal rate now stand at 4.47%, signifying an increase of 40bps by May 2024. These expectations had peaked at 4.54% in late October, marking the highest level since mid-July.

Figure 1: RBA-Dated OIS Terminal Rate Expectations Versus Cash Rate

Source: MNI – Market News / Bloomberg

AU-US Bonds: AU-US 10-Year Yield Differential Too Tight

Today, the AU-US 10-year cash yield differential is 2bps higher at +8bps after the cash US Tsy 10-year finished 11bps richer on Thursday. A reminder that cash tsys are closed in Asia due to the observance of a national holiday in Japan.

- At +8bps, the cash AU-US 10-year yield differential currently sits near the middle of the range of +/-30bps which has been observed since November.

- The recent underperformance in the ACGB 10-year can be attributed to a 50bp widening in the AU-US 3-month swap rate 1-year forward (1y3m) over that period. The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

- However, a simple regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 9bps too low versus its fair value (i.e., +8bp versus +17bp).

Figure 1: AU-US Cash 10-Year Yield Differential (%) Vs. Regression Fair Value (%)

Source: MNI – Market News / Bloomberg

AUSTRALIAN DATA: Q3 Retail Sales Suggests Some Improvement in Discretionary Spending, Although Caveats Apply

Australian retail sales volumes rose 0.2%q/q in Q3. This was stronger than expected (consensus -0.3%), although the Q2 dip was revised down a touch to -0.6%. This was the first rise in quarterly retail sales volumes since Q3 last year. In y/y terms we were still down -1.7% see the chart below.

- By industry, food retailing was -0.3%q.q (-0.9% prior). Household goods rose 0.8% q/q (-1.4% prior). Department stores rose 1.5%q/q (-1.5% prior), while cafes, restaurants were 0.4% q/q (-0.1% prior).

- These details suggest some improvement in discretionary spending but some caveats from the ABS apply from a broader macro standpoint.

- The ABS noted that "The rise in September was supported by lower price growth for retail goods, unusually warm weather, and special events like the FIFA Women’s World Cup.”

- Additionally stating, “Volumes are lower despite a period of strong population growth. On a per capita basis, retail volumes are down 4.0 per cent compared to this time last year, the largest 12-month fall in the history of the series,” (see this link for more details).

Fig 1: Australian Retail Sales Volumes

Source: ABS/ MNI - Market News International

NZGBS: Slight Twist-Flattening, Awaiting US Payroll Data

At the local close, NZGBs exhibited a slight twist-flattening of the curve, with yields 1bp higher to 2bps lower. With the domestic calendar empty today and cash tsys closed in Asia due to the observance of a national holiday in Japan, the local market largely drifted through the session ahead on US Non-Farm Payrolls later today.

- US tsy futures are dealing at 107-16+, +0-01 compared to the NY close. US equity futures sit lower as Apple’s Q4 sales outlook continues to weigh.

- Swap rates closed 1bp higher to 2bps lower, with the 2s10s curve flatter and implied swap spreads wider.

- RBNZ dated OIS pricing is little changed, with terminal OCR expectations at 5.56% (+6bps by Feb’24).

- In the final election result, the NZ Nationals need the support of 2 other parties to form government after losing 2 seats.

- Looking ahead to next week the docket is relatively light with Q4 Inflation Expectations the highlight. We also have October Mfg PMI and Card Spending.

- Next Thursday, the NZ Treasury plans to sell NZ$175mn of the 4.5% May-30 bond, NZ$225mn of the 2.0% May-32 bond and NZ$100mn of the 2.75% Apr-37 bond.

FOREX: Narrow Ranges In Asia, NFP In View

There have been narrow ranges across G-10 FX on Friday. The USD is a touch lower, BBDXY is down ~0.1%. The proximity to todays NFP print is perhaps limiting activity. Cross asset wise US Equity Futures are softer after Apple's Q4 Sales Outlook disappointed. Japanese markets are closed which has affected general liquidity.

- AUD/USD has observed a narrow $0.6425/35 range for the most part this morning. There has been little follow through on moves. Technically short term gains in AUD/USD are considered corrective. Resistance comes in at $0.6456, high from Nov 2, and $0.6501, high from Sep 29. Support is at $0.6270, low from Oct 26 and bear trigger.

- Kiwi is little changed, NZD/USD sits in a narrow range a touch below the $0.59 handle.

- Yen is also flat, technically the bullish conditions in USD/JPY are intact. Resistance comes in at ¥151.72, Oct 31 high, and ¥151.95, high from Oct 21 and major resistance. Support is seen at ¥149.78, 20-Day EMA.

- The Scandies are marginally outperforming in the space however moves have not yet followed through and liquidity is generally poor in Asia.

- October’s NFP print provides the highlight today, the docket is relatively light in Europe with French Industrial Production the standout release.

EQUITIES: Asia Pac Equities Continue Recovery, US Futures Weighed By Apple

Regional equity markets are a sea of green in Friday trade, with solid gains across the board. This follows strong gains in US and EU markets during Thursday trade. US equity futures are lower in the first part of Friday trade, largely thanks to Apple losses post a disappointing earnings update late in Thursday trade. Eminis are down 0.07%, last near 4333, Nasdaq futures are underperforming, off 0.25% at this stage. We also have the US NFP print later.

- Note Japan markets are closed today.

- In Hong Kong, the HSI is up over 2% at the break, led by the tech sub-index (+2.31%). In China, the CSI is up 0.86% at the break, putting the index ack to 3585 levels. Markets largely ignored the weaker than expected Caixin services PMI print (although the index remain in expansion territory).

- Northbound stock connect flows are tracking higher, +6.84bn yuan at this stage.

- The Kospi is +0.80% higher, away from session highs. Offshore and institutional investors have been net buyers, while retail investors have been sellers. The Taiex is around 0.50% firmer.

- The ASX 200 is up over 1%, with financials and materials leading the move higher.

- In SEA, gains are broad based, with Singapore markets (+2%), and the returning Philippines bourse, +1.2% the standouts.

OIL: Recovers Further Ground, But Still Down Sharply For The Week

The bias in oil benchmarks has been to push higher in the first part of Friday trade. Brent was just off session highs last near $87.20/bbl. This is close to Wednesday session highs ($87.24/bbl), but we haven't breached this level yet. Brent is 0.35% firmer, following Thursday's 2.62% gain, but we are still down nearly 3.7% for the week at this stage. WTI was last near $82.85/bbl, following a similar trajectory but off 3.15% for the week.

- The broader risk on tone in regional Asia Pac equities has likely aided the oil bid, although the USD is only down slightly against the majors.

- The focus in the near term will be on US Secretary Of State Blinken's trip to Israel today (due to arrive 10am local time/8am BST). This comes after Israel stated it had encircled the Gaza Strip's largest city, while Blinken will reportedly ask Israel to minimize causalities in Gaza (see this RTRS link).

- After this, later on we get the US NFP report, while next Tuesday we get an update on China trade, which will include details around oil imports.

GOLD: Headed For Its First Weekly Decline On Fading Haven Demand

Gold is steady in the Asia-Pac session, after closing +0.2% at $1985.78 on Thursday.

- Bullion seems to be on track for its first weekly decline in four, as the demand for safe-haven assets wanes while the Middle East conflict remains contained.

- The reduction in the conflict premium has outweighed the decrease in Treasury yields and indications that the Federal Reserve is shifting away from policy tightening.

- Notably, the 10-year US Treasury yield experienced an 8bp drop on Thursday, closing at 4.66%. This marks a cumulative decrease of 36bps since it reached its highest level since 2007 last week, peaking at 5.02%.

- The market now looks ahead to Non-Farm Payrolls data this evening. It will be watched for its impact on the Fed’s rate path.

- From a technical standpoint, gold’s current level neither troubles support at $1950.4 (20-day EMA) or resistance at $2009.4 (Oct 27 high). Nevertheless, the trend outlook appears bullish, according to MNI’s technicals team.

CHINA DATA: Caixin Services PMI Also Below Expectations, But Remains In Expansion Territory

The Caixin services PMI printed at 50.4 for October, which was below the consensus (51.0), but a slight improvement on the September read (50.2). The index remains above the 50.0 expansion/contraction point. The composite still faltered to 50.0 from 50.9, owing to the Wednesday dip in the manufacturing PMI to 49.5.

- The downside surprise for the Caixin services PMI caps off a week of weaker than expected data outcomes for China. This is keeping focus on additional stimulus from both the fiscal and monetary sides. Note next week we get October trade and inflation figures and potentially aggregate finance/new loans data.

- In terms of the detail from the Caixin services print (from RTRS):

- New orders rose at the weakest pace in 10 months, although there was some improvement in new export orders. Employment conditions were subdued, which was in line with the official PMI prints from earlier in the week. Output prices rose compared to the prior read, but input price inflation cooled back to Dec 2022 levels.

ASIA FX: KRW & PHP Surge Against The USD, Firm Gains Elsewhere (ex CNH)

USD/Asia pairs are once again uniformly lower across the board, although CNH gains remain very modest. KRW (+1.9%) and PHP (+1.4%) have been the standouts, as regional risk appetite continues to recover in the equity space and local FX welcomes the lower US real backdrop. IDR has also performed strongly, up a further 0.60%. INR, along with CNH, has been a laggard.

- USD/CNH has drifted a little lower, but dips sub 7.3200 have been supported. The Caixin services PMI missed expectations but remained in expansion territory.

- 1 month USD/KRW is down a further 1.25% so far in Friday trade, last near 1316. Spot is up almost 1.9% against the USD. The 1 month NDF is now down through the 200-day EMA, riding the wave of positive equity sentiment amid hopes we have seen the last of the Fed tightening cycle. Early Sep lows in the 1 month around 1310 is the next possible downside target.

- USD/PHP has collapsed today back to fresh multi-month lows. After spending the pair few months wedged into the 56.50/57.00 region, we now track sub 56.00. This is a 1.40% PHP gain (as onshore markets were closed in the previous two sessions). A good chuck of this represents catch up to recent USD weakness, but the authorities may not mind a rebound in local FX to help curb imported inflation pressures.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early trade this morning and sits a touch off the touch of recent ranges. The measure sits ~0.5% below the top of the band. USD/SGD fell ~0.3% yesterday breaching the 20-Day EMA ($1.3676) as the greenback extended its post-FOMC losses. In early trade this morning we print at $1.3640/45. S&P Global PMI ticked lower to 53.7 in October from the prior read of 54.2 marking the 8th consecutive month of expansion.

- The Rupee has opened dealing little changed from yesterday's closing levels and last prints at 83.23/24. On Thursday USD/INR could not sustain its fall through the 20-Day EMA (83.2184) which was seen in early trade as onshore participants digested Wednesday's FOMC meeting. The pair ticked away from session lows as Oil held onto its gains in Asia. S&P Global Services PMI ticked lower in October printing at 58.4, the prior read was 61.0.

- USD/IDR sits back in the 15765/70 region, down sharply from recent highs. IDR is more than 0.50% stronger so far today in spot terms, up over 1% in the past week. The pair is back sub the 20-day EMA (~15792). We haven't been sub this level for a number of months. Outside of the continued risk-on cross asset supports for IDR today, it is also noteworthy comments made by FinMin Sri Mulyani Indrawati "Going forward, rupiah exchange rate stabilisation measures will be strengthened so that it is in line with its fundamentals and it supports efforts to control imported inflation," she said at a press conference (RTRS).

- The Ringgit is steady in early dealing, ranges are narrow on Friday morning with little follow on moves. Yesterday USD/MYR held onto its early losses finishing trade down ~0.5% breaching the 20-Day EMA (4.7524) as the dovish tilt from the FOMC meeting pressured the USD. A reminder that yesterday the BNM held the Overnight Policy Rate steady at 3.00%. The bank noted that the current OPR level is supportive of the economy and is consistent with the current assessment of the inflation and growth prospects.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/11/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/11/2023 | 0900/0900 |  | UK | BoE's Hauser speech at Watchers' conference | |

| 03/11/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2023 | - |  | UK | BoE APF Q3 Report | |

| 03/11/2023 | 1200/0800 |  | US | Fed's Michael Barr | |

| 03/11/2023 | 1215/1215 |  | UK | BoE's Pill MPR National Agency Briefing | |

| 03/11/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 03/11/2023 | 1230/0830 | *** |  | US | Employment Report |

| 03/11/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2023 | 1600/1600 |  | UK | BoE's Haskel panellist at Watchers' Conference | |

| 03/11/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/11/2023 | 1930/1530 |  | US | Fed's Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.