-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

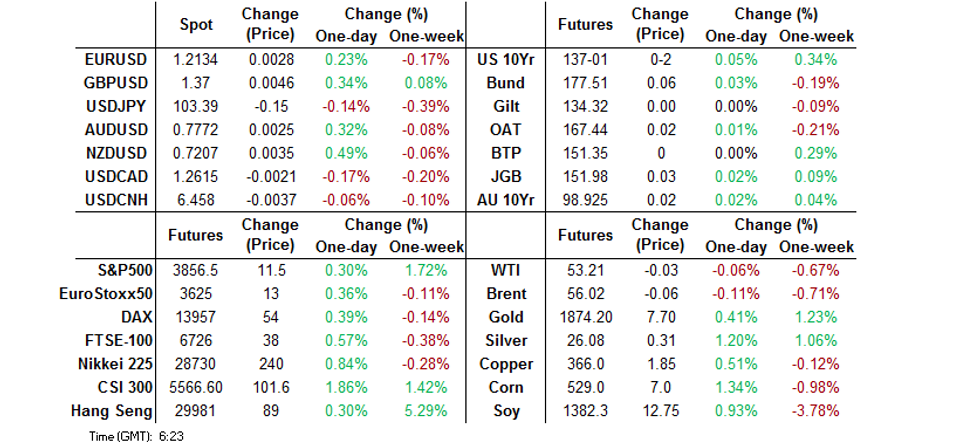

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Offered & Fresh Highs For E-Minis In Asia

- A lack of notable macro headline flow was evident during Asia-Pacific hours, as the DXY tested Wednesday's lows & S&P 500 e-minis punched a fresh all-time high.

- The BoJ failed to move the needle in a placeholder meeting, while Westpac became the latest sell side name to unwind their call re: further RBNZ rate cuts.

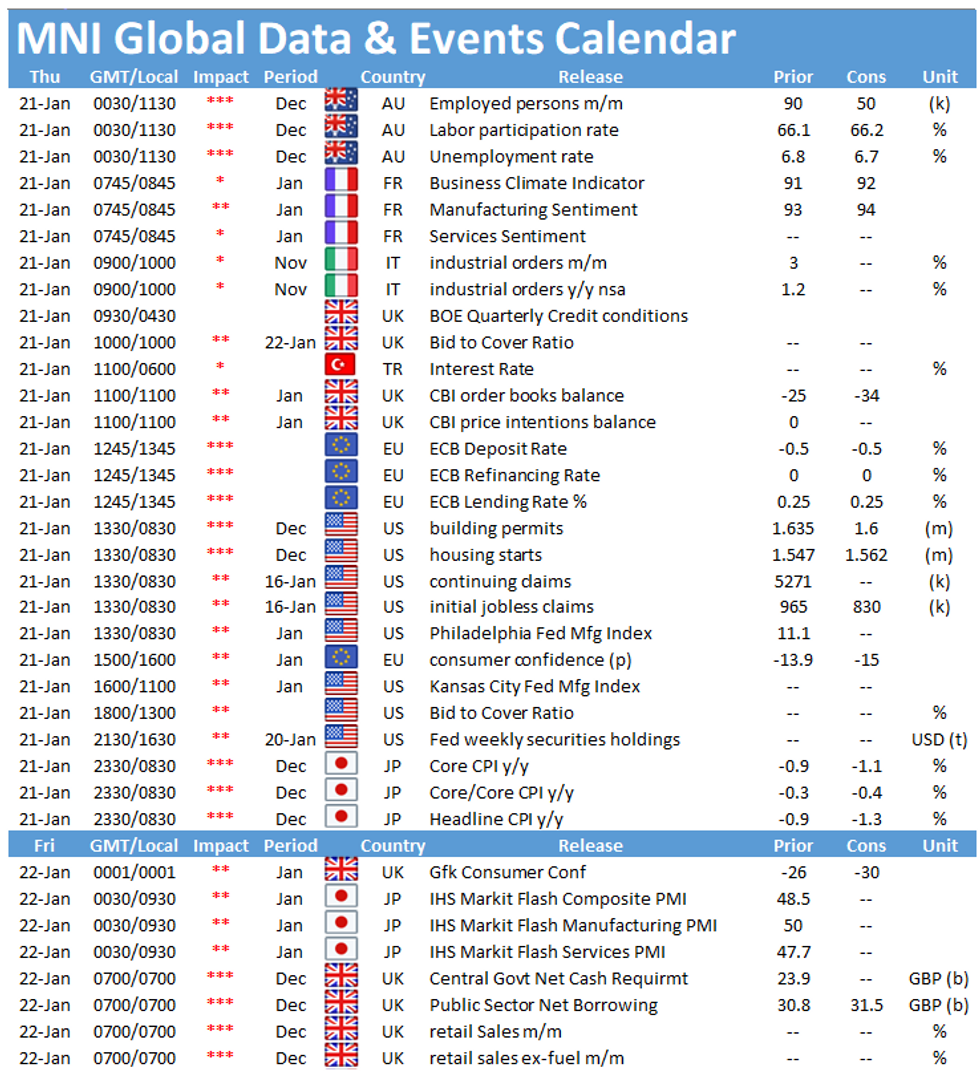

- A slew of central bank decisions headline the macro docket on Thursday.

BOND SUMMARY: Sedate Overnight Trade, With A Light Bid Tone Seen In Core FI

T-Notes operated in a narrow 0-02+ range during Asia-Pac hours, sticking to the upper end of Wednesday's range, after the late richening that was seen during NY hours. Macro headline flow was light, with fresh highs for S&P 500 e-minis keeping a lid on the space. That contract last prints +0-01+ at 137-00+. Cash Tsys trade at virtually unchanged levels across the curve, with a ~6.9K block seller of the TYG1 137.00 puts providing the highlight on the flow front. Eurodollar futures are virtually unchanged through the reds, with a ~12K seller of EDM1 seen, with activity in that space otherwise light during Asia-Pac hours. Weekly claims data and the Treasury's announcement re: end of month issuance headline locally on Thursday.

- JGB futures added 3 ticks on the day come the close, initially on catch up to the late NY move in U.S. Tsys, although the contract then ticked back to more neutral levels ahead of the lunch break. There was then a fresh bid which took the contract to best levels of the day during afternoon trade, as the BoJ's latest monetary policy decision failed to move the needle in any way, before a fade back below the 152.00 level into the close.

- Aussie bonds were immune to a solid round of local labour market figures, outside of some contained chop around the data release itself. YM unchanged, XM +2.0 at the bell, while the cash curve saw some light bull flattening. Elsewhere, the RBA conducted its latest round of ACGB purchases, while IADB launched a A$300mn minimum round of Aug '28 A$ issuance.

JAPAN: Little To Discuss In Weekly International Security Flow Data

There was little in the way of major headline net flow in the latest round of weekly Japanese international security flow data. The only point of note saw the 4-week net weekly foreign flows surrounding Japanese stocks flip into positive territory after 3 consecutive weeks in negative territory.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 272.4 | 736.2 | 156.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -37.7 | 282.9 | 321.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 548.4 | -267.1 | -2520.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 169.9 | 512.5 | 634.0 |

Source: MNI - Market News/Japanese Ministry Of Finance

FOREX: Familiar Dynamics In Play, Westpac's RBNZ Call Change Supports NZD

Familiar dynamics remained in the driving seat amid the absence of any fresh macro flow of note. Commodity-tied FX outperformed safe havens, with USD landing at the bottom of the G10 pile following the smooth presidential transition in the U.S. The DXY faltered and USD/JPY ground towards yesterday's low, but neither managed to punch through the worst levels of the prior day.

- NZD led gainers among its high-beta peers after Westpac said that they don't expect any further OCR cuts in the foreseeable future, scrapping their earlier forecast of two 25bp cuts in May & August. Positive signals surrounding NZ labour market helped keep the kiwi buoyant, with NZD/USD moving through the $0.7200 mark amid broad-based greenback weakness.

- AUD also caught a bid, albeit AUD/NZD shed a handful of pips and moved under yesterday's low. BBG trader sources flagged demand for Antipodean currencies from offshore funds. Australian unemployment rate declined 0.1pp more than expected, while employment growth matched projections.

- PBOC fixed USD/CNY at CNY6.4696 and injected CNY 248bn, another day of large injections ahead of scheduled tax payments and Lunar New Year.

- Cable advanced on dollar weakness, even as the Times reported that UK residents may face EU entry bans under a proposed German plan.

- The BoJ kicked off a series of today's MonPol decisions, with the ECB, Norges Bank, BI, SARB & CBRT yet to make announcements. Japan's central bank left its main policy settings unch. & implemented some inconsequential tweaks to its economic forecasts.

- On the data front, U.S. initial jobless claims, building permits/housing starts & Philly Fed Survey take focus from here.

FOREX OPTIONS: Expiries for Jan21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E1.7bln), $1.2100-05(E992mln)

- USD/JPY: Y102.00($580mln), Y103.25($940mln-USD puts), Y103.50-60($1.5bln-USD puts), Y103.65-75($1.4bln), Y104.00-10($1.2bln), Y104.20-25($860mln)

- AUD/USD: $0.7750(A$751mln-AUD puts)

- USD/CAD: C$1.2550($612mln-USD puts), C$1.2600($555mln-USD puts), C$1.2675-85($767mln-USD puts), C$1.2700-15($2.5bln-USD puts)

- USD/MXN: Mxn19.50($1.3bln), Mxn19.70($616mln), Mxn20.00($650mln)

ASIA FX: Most USD/Asia EM Crosses Lower For Third Day

Safe haven assets sagged as US President Biden's inauguration went without any hiccups and markets hope the administration will place a greater emphasis in pushing through fiscal stimulus, and in tackling the pandemic situation including faster vaccine roll outs. As a result Asia EM FX gained, with equity markets in the region also hitting records.

- USD/CNH is lower, some of this can be attributed to a weaker USD, but some CNH strength has stemmed from China's decision to sanction outgoing secretary of state Mike Pompeo and 27 other officials from the Trump administration.

- USD/TWD lower on the session, last down 0.248 at 27.958, retreating from the 28.00 handle after gravitating higher towards the level yesterday. Data yesterday showed export orders rose over 10% to an all time high in 2020, boosted by demand for chips and smartphones.

- USD/KRW lower as the won strengthens on positive trade data. Exports continued to rise in January, up 11% in the first 20 days of the year. The won continues to benefit from foreign equity flows.

- USD/MYR consolidates after Wednesday's monetary policy decision from BNM. The rate operates -0.125 at MYR4.0325. The board left its OPR unchanged at a record low 1.75%

- USD/PHP sits at 48.046 marginally below neutral levels. BSP said in a statement that Gov Diokno was discharged from the hospital Wednesday and will be ready to chair the Monetary Board meetings from next week.

- USD/IDR trades flat at 14,035 ahead of Bank Indonesia's announcement. The rate has faded its modest opening losses, with bulls looking for further gains past the 50-DMA, intersecting at 14,093

- USD/SGD last down 9 pips at 1.3238, USD/HKD last flat at 7.7517, still flirting with lower barrier of the policy band at 7.75.

EQUITIES: Indices Higher Again

Equities in Asia have risen for the third consecutive session on Thursday, risk appetite boosted by expectations that Biden, now inaugurated as US President, will place a greater emphasis in pushing through fiscal stimulus, and in tackling the pandemic situation including faster vaccine roll outs.

- In a familiar narrative this week the Hang Seng has posted gains, the index creeping over 30,000 for the first time since May 2019. In Taiwan the Taiex is the best performer after data yesterday showed exports saw record orders in 2021. Tech stocks are the outperformers again, TSMC, Tencent and SoftBank were standout performers.

- US futures are higher, building on gains seen in the wake of Biden's inauguration yesterday.

GOLD: Through Resistance

Lower U.S. real yields and the DXY's retest of Wednesday's Asia-Pac lows have supported gold since a blip lower in early NY trade on Wednesday, with bullion now trading around the $1,870/oz mark. Consolidation above the 50-EMA will allow bulls to focus on mounting a challenge of the psychological $1,900/oz level.

OIL: Benchmarks Decline After Stockpile Data

Crude oil futures ticked lower during Asia trade on Thursday, with WTI & Brent sitting $0.10-0.20 worse off on the day at typing.

- The decline came as API data showed an unexpected build in US crude inventories. Data showed a 2.56m bbl build in US crude inventories in the latest survey period, the increase in stocks was contrary to predictions by analysts who expected a 2.5m bbl draw. The data also showed builds in stockpiles in downstream product; US gasoline and distillate inventories rose by 1.13m bbls and 816k bbls, respectively. The market will now be looking towards more comprehensive inventory data from the DOE which will be released Jan. 22.

- The decline in crude prices was tempered by expectations that Biden, now inaugurated as US President, will place a greater emphasis in pushing through fiscal stimulus, and in tackling the pandemic situation including faster vaccine roll outs.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.