-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI EUROPEAN MARKETS ANALYSIS: Equity Block Sale Matters Headline, Suez Canal Blockage Refloated

- Fallout from Friday's sizeable equity block sales headlined in Asia, with some banks outlining potential losses stemming from unwind of fund positions.

- Ever Given refloated in the Suez Canal, pressuring crude oil prices.

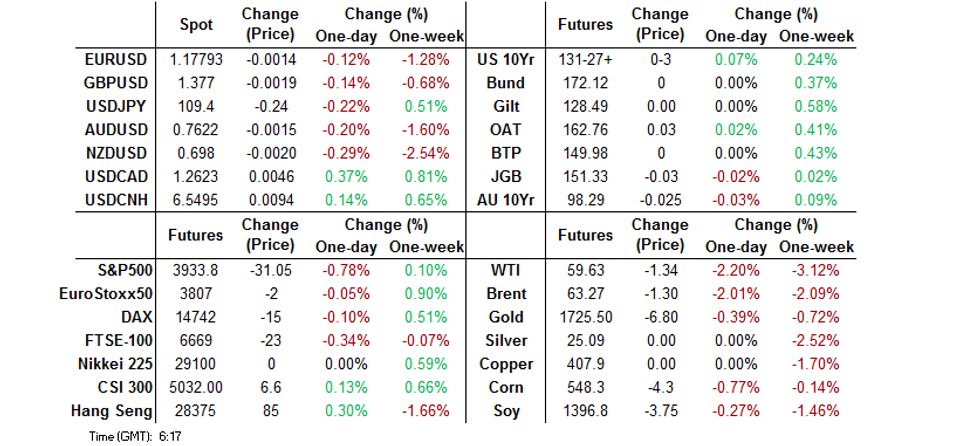

- DXY a touch firmer with U.S. Tsy yields a little lower on the day.

BOND SUMMARY: A Touch Firmer On Equity Block Sale Unease & Crude Dip

T-Notes last +0-02 at 131-26+, just shy of Asia highs (holding to a 0-06+ range since the re-open, working away from late Friday lows on limited volume under 100K), the cash curve has bull flattened, with 30s sitting ~3.0bp richer on the day. Continued focus on the knock-on impact of Friday's block sale frenzy in the equity space & talk of continued potential flow on that front (see earlier bullets for more details on that matter) provided modest support for core FI early this week, although there has been little in the way of broader market spill over, even as banks start to outline potential losses (which were seemingly driven by one, or maybe two, funds). A downtick for crude oil on the back of the refloating of the well-documented stranded ship in the Suez Canal provided another source of support for core global FI as we moved through overnight trade. Elsewhere, a 4,600 block buyer of FVM1 was seen ahead of European hours. Dallas Fed m'fing activity data and Fedspeak from Waller headline locally on Monday. Domestic focus continues to fall on fiscal/infrastructure spending matters, with President Biden set to make an address re: the latter on Wednesday.

- JGB futures -4 vs. Friday's settlement as we work towards the Tokyo close, after briefly unwinding overnight losses during the Tokyo morning. Cash JGBs are marginally mixed out to 7-Years, firming further out, with 30s leading the way, richening by ~2.5bp, as the longer end benefitted from the bid in Tsys outlined elsewhere. The summary of opinions from the BoJ's March meeting revealed little in the way of fresh information (as expected), while the JPY supply pipeline built as Berkshire Hathaway mandated for a potential round of benchmark bond issuance.

- The downtick in e-minis and local COVID-related lockdown in the city of Brisbane have provided support to the Aussie bond space, although the bid can't be described as particularly firm, with Aussie 10s still printing 1.0bp or so wider vs. U.S. 10s in cash trade. Meanwhile, futures have failed to unwind their overnight session losses, YM -0.5, XM -3.5 ahead of the bell. A (what many would deem overdue) cabinet reshuffle at the top of the ruling coalition government had no impact on the space. Weekly ABS payroll and ANZ consumer confidence data headline locally on Tuesday. Re: the former, a quick reminder that the Australian Government's JobKeeper scheme expired over the weekend. Most do not expect much in the way of a meaningful impact from the expiry of the scheme (at least in terms of the recent progress on the unemployment front), although the cessation of the programme will likely introduce a non-linear ebb and flow to job market developments in the coming weeks/months.

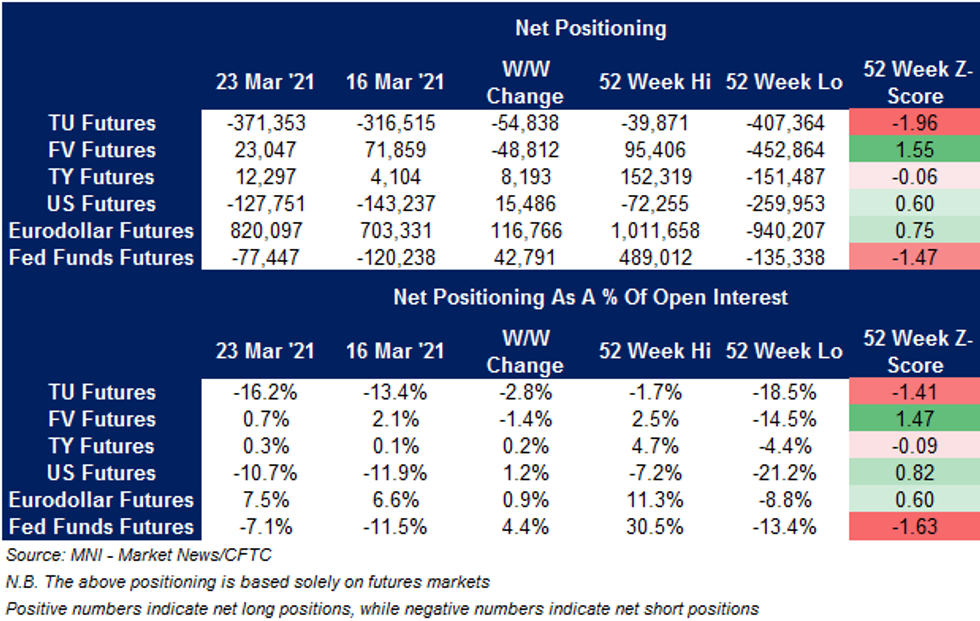

US TSY FUTURES: Twist Flattening Seen In CFTC CoT Positioning

Some modest twist flattening-like positioning swings were seen across the benchmark U.S. Tsy futures contracts in the latest CFTC commitment of traders report (covering the week ending 23 Mar '21). Positioning remains off of recent extremes across those contracts.

FOREX: Caution Prevails In Asia

JPY led the way in thin Asia-Pac trade, as caution prevailed after Friday's well-documented stock market developments, with Nomura seen issuing a warning against "significant" potential loss from a U.S. name (which BBG sources linked to the unwinding of trades by Archegos). USD/JPY ticked away from multi-month highs registered last Friday, even as the greenback fared well against its other G10 peers.

- The Antipodeans paid little attention to local headlines, with AUD/NZD narrowing in on Mar 23 cycle high. Brisbane was placed under a three-day lockdown to curb the spread of the UK coronavirus variant, while NZ gov't said it will monitor the rental market's reaction to its housing policy package.

- CAD and NOK posted marginal downticks in sync with a dip in crude oil, as Inchcape said the Ever Given was successfully refloated.

- The PBOC fixed its USD/CNY mid-point at CNY6.5416, just 3 pips below sell side estimates. USD/CNH edged higher as geopolitical tensions between China and its Western adversaries continued to simmer.

- Speeches from Fed's Waller & ECB's de Cos headline today's uninspiring economic docket.

Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-15(E610mln), $1.1800(E367mln-EUR puts), $1.1935(E1.1bln), $1.1950(E728mln), $1.2000(E910mln)

- USD/JPY: Y107.00($841mln), Y107.80($708mln), Y108.70-75($1.9bln),

Y108.95-109.10($671mln) - EUR/GBP: Gbp0.8585-90(E1.2bln-EUR puts), Gbp0.8595-0.8600(E835mln-EUR puts), Gbp0.8605-10(E840mln-EUR puts)

- AUD/USD: $0.7700-05(A$519mln)

- USD/CNY: Cny6.51($645mln), Cny6.55($880mln)

- USD/ZAR: Zar15.40($538mln)

ASIA FX: Slide Gathers Steam Through Session

A cautious start to the week for Asia EM FX, more weakness creeping in as US equities sell off during the session.

- CNH: Offshore yuan is weaker, creeping towards the 2021 highs set last week. Geopolitical tensions simmer, the US said it is in no rush to remove China sanctions while Australia threaten China with the WTO after wine sanctions.

- SGD: Singapore dollar weaker, data on Friday showed manufacturing output rose again last month, higher for a fourth straight month on robust demand for semiconductors and related equipment

- TWD: Taiwan dollar strengthened, but stalled at the 28.50 level, said to be an important level for the central bank. The Bloomberg monitoring indicator rise to 40 in February, the highest since 1989.

- KRW: The won is weaker, President Moon Jae-in dismisses his chief policy secretary Kim over property indiscretions. Moon appointed Lee Ho-seung, senior secretary for economic affairs, to replace Kim

- INR: Market closed for Holi festival.

- IDR: Rupiah is lower, The World Bank maintained its forecast for Indonesian GDP growth this year at +4.4% Y/Y. A refinery owned by Indonesia's state energy holding company Pertamina caught fire after an explosion this morning, injuring 20 people.

- MYR: Ringitt is lower amid political turmoil. During its general assembly meeting held over the weekend, Umno decided to sever its ties with PM Muhyiddin's Bersatu and its allies, with Umno Pres Zahid noting that their the PM's party "have ill intentions to replace and destroy Umno."

- PHP: Peso has strengthened, Pres Duterte's spokesman announced that Metro Manila and adjacent provinces would be placed under a strict week-long lockdown from today as the spread of new Covid-19 infections continued to gain pace.

- THB: Baht is weaker for a tenth session, Phuket businesses welcomed the gov't's decision to allow entry by vaccinated tourists from Jul 1. Phuket Chamber of Commerce noted that as a result the local tourism industry will see the cash inflow equivalent to THB84bn.

ASIA RATES: No Discernable Trend Across Geographies

Bond markets in Asia mixed as local events take precedence over prevailing themes.

- INDIA: Market closed for Holi festival.

- INDONESIA: Bonds are lower in Indonesia, declining after an attack from a suspected suicide bomber at a Cathedral during Palm Sunday celebrations. The attack hurt sentiment and saw a sell off of Indonesian assets.

- CHINA: The PBOC matched maturities with injections again today, the sixteenth straight day of matching maturities, while the bank hasn't injected funds since February 25. The market appears sanguine about liquidity, the overnight repo rate is last at 1.8017%, from around ~2.00% last week while the 7-day repo rate last at 2.1704%, below the prevailing PBOC repo rate of 2.20% Bond futures are under pressure with stocks in positive territory, despite some simmering geopolitical tensions. Over the weekend US Trade Representative Tai says the US isn't ready to lift tariffs on Chinese imports soon.

- SOUTH KOREA: Futures are higher in South Korea, the 10-year contract opened lower but has gained as equity markets have lost favour. South Korea reported 482 new daily new coronavirus cases in the past 24 hours, back below 500, a day after reaching a 36-day high of 505.

EQUITIES: Block Trade Reports Weigh On US Futures

Most markets in the Asia-Pac region are in the green, Australia's ASX 200 is the laggard at the time of writing, down around 0.25%. Most markets are taking a positive lead from a record close in the US, markets in Japan are around 1% higher, shrugging off a loss warning from Nomura. Markets in mainland China and Hong Kong rebound from early losses as markets shrug off concerns about stock dumping. US futures couldn't manage to do the same though, and are currently in negative territory, grinding lower through the session. Archegos Capital are said to be behind the block trades seen on Friday which totalled over $20bn in value, with the liquidations forced upon the fund as existing positions moved against them.

GOLD: As You Were

Bullion continues to coil within the confines of the recently observed range, spot last dealing little changed, just below the $1,730/oz mark, with slightly lower nominal and real U.S. yields observed during Asia-Pac hours, while the broad USD (proxied by the DXY) trades a touch firmer on the day.

OIL: Suez Matters & Renewed Lockdown Concerns Weigh

WTI & Brent print ~$1.50 softer into European hours.

- The major crude benchmarks knee jerked lower on the previously flagged BBG story which noted that the Ever Given has been refloated in the Suez canal, per reports from maritime service providers. A reminder that timing re: the clearing of the waterway still remains up in the air.

- Elsewhere, Brisbane, Australia's third most populated city, has declared a three-day lockdown from Monday 29 March due to four confirmed community cases of the UK variant of the virus.

- Market participants will also look to Abu Dhabi where futures contracts for its oil will be available, the country will then ship the barrels from Fujairah. This is the first move in creating a new regional benchmark and will challenge pricing for around 20% of the world's crude supply.

- Elsewhere, Indonesia's Pertamina said that an incident has caused a fire at its 125k Balongan refinery but its fuel supply was not affected.

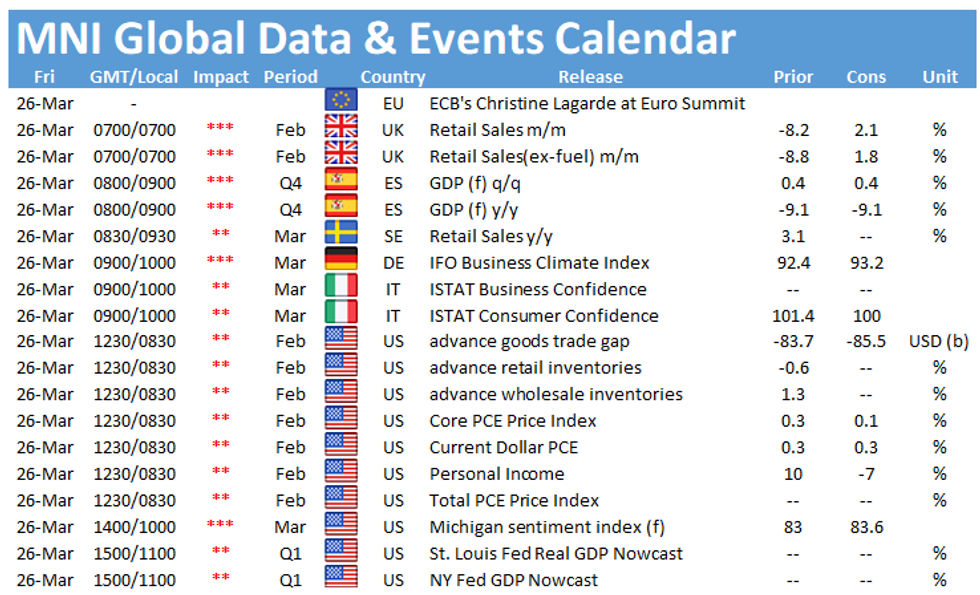

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.