-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Familiar Themes Headline, DC Fiscal Issues Reappear

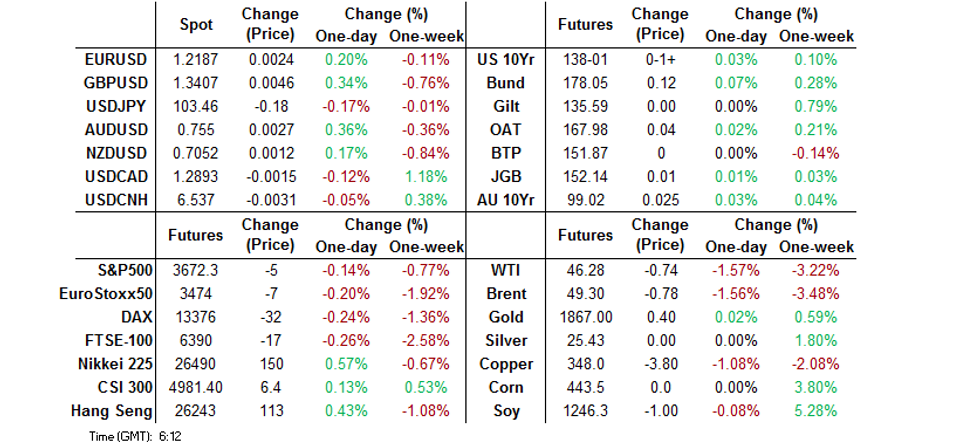

- Trump clouds fiscal picture in the U.S. with demands for larger stimulus checks for individuals.

- Reports generally point to lingering Brexit issues surrounding fish, although ITV's Peston outlines potential for a deal on Wednesday, allowing GBP to outperform.

- Crude softens on continued COVID worry.

BOND SUMMARY: Trump Throws A Spanner In The Works

Activity has cooled after the Trump-inspired uptick seen during Asia-Pac hours, which centred on fiscal matters. Ultimately, Trump is seeking larger stimulus checks for individuals ($2,000/person vs. the current $600) and this may create some issues owing to the government funding timeline. If Trump fails to sign off on the current spending Bill stimulus measures could be delayed by weeks owing to a government shutdown, while some existing unemployment support schemes would lapse. Still, the reaction was muted in the grand scheme of things, with focus on when fresh stimulus will be passed, not if (although GOP reaction to Trump's move will be eyed). T-Notes sit a little shy of best levels, last +0-02+ at 138-01+, operating within a 0-04 range, while the light twist flattening of the cash curve has held, with 30s ~1.0bp richer on the day. On the flow side, there was a 3750 block buyer of the TYG1 137.00 puts. Eurodollar futures sit unch. to +0.5 through the reds, with a 20K block seller of EDH1 providing the highlight on the flow side thus far.

- The broader offshore market dynamic witnessed since Tuesday's Tokyo close and lack of impending long dated JGB issuance made for some outperformance for the longer end of the Japanese curve on Wednesday, although futures still held to a narrow range, closing +1, with the belly of the cash curve experiencing some underperformance. There has been a lack of local news flow to drive matters.

- The Aussie curve pushed flatter in early Sydney trade, but the space then edged away from richest levels, with YM +1.0 and XM +2.5 at the bell, with focus on the U.S. fiscal backdrop, not local data releases. 3-Month BBSW fixed at an all-time low of 0.010% today, as a result of the RBA's ultra-loose monetary policy settings (we gave some deeper colour on the matter yesterday). Bills finished unch. to +1 through the reds, running flatter vs. settlement.

FOREX: Greenback Underperforms, Familiar Themes In Play

Familiar themes continued to grab attention, as U.S. fiscal matters, Brexit & global Covid-19 situation provided the main talking points. Price action across G10 FX space was subdued, with USD underperforming ahead of the Christmas break & with DXY moving away from Tuesday highs. U.S. Pres Trump's demand to rewrite certain parts of the Covid-19 relief bill inspired little in the way of immediate, material reaction in the greenback.

- Sterling firmed up a tad as Brexit news flow remained front and centre, with EU Chief Negotiator Barnier noting that both sides were ready for a "final push." A tweet from ITV's Peston citing a UK gov't source as seeing a deal on the table today added to hopes for a positive resolution to the dragged-out talks.

- AUD climbed to the top of the G10 scoreboard in thin, pre-holiday trade, despite familiar risks. AUD/NZD moved through the NZ$1.0700 mark and consolidated just above there, ahead of today's expiry of A$684mn worth of options with strikes at that round figure.

- Bank Indonesia stepped in to shore up the rupiah for the second consecutive day, intervening on spot FX interbank market & via brokers. The Bank cited the need to maintain IDR stability amid global risk-off environment.

- THB was rangebound ahead of the monetary policy decision from the BoT, with policymakers expected to express discomfort with the baht strength.

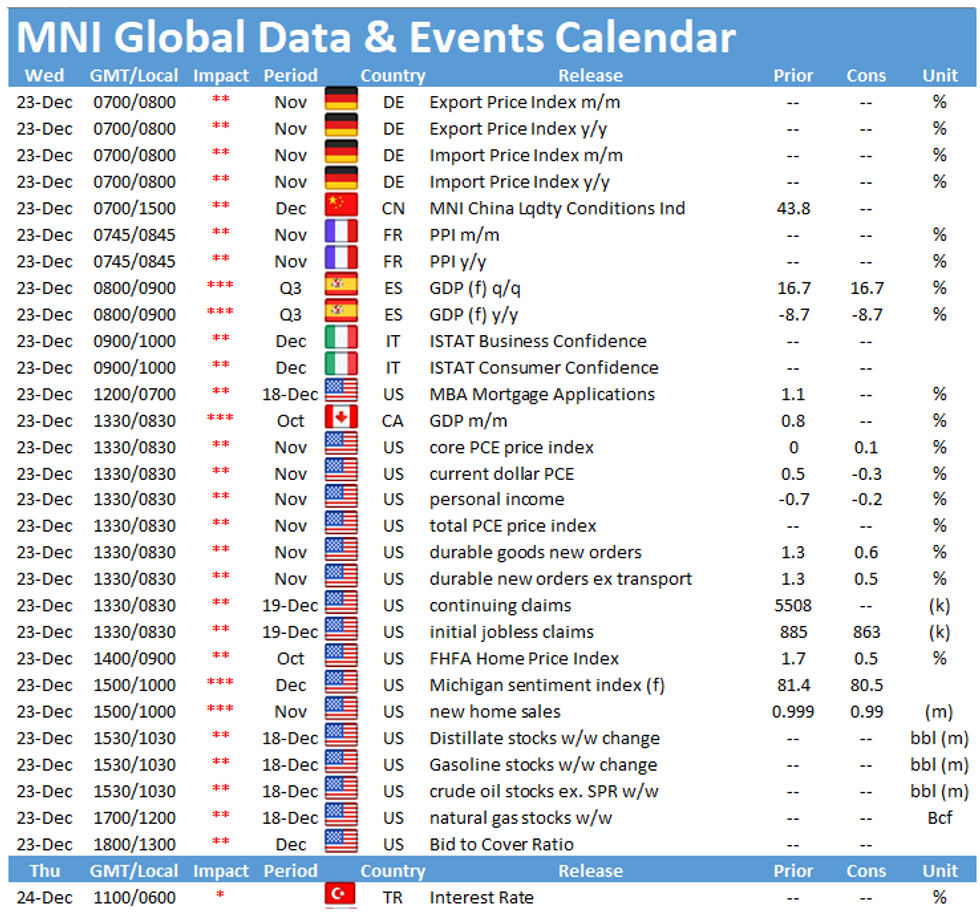

- U.S. initial personal income/spending, jobless claims, flash durable goods orders, new home sales & final U. of Mich. Sentiment, Canadian GDP & Italian confidence gauges take focus today.

FOREX OPTIONS: Expiries for Dec23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E749mln), $1.2200-10(E1.1bln), $1.2250(E951mln-EUR puts), $1.2275-80(E955mln-EUR puts)

- USD/JPY: Y101.00($780mln), Y103.00($1.57bln-USD puts)

- GBP/USD: $1.3600(Gbp638mln)

- EUR/GBP: Gbp0.8800-15(E630mln-EUR puts), Gbp0.9145-50(E656mln-EUR puts)

- AUD/NZD: N$1.0700(A$684mln-AUD puts)

- ----------------

- Larger Option Pipeline

- EUR/USD: Dec24 $1.2200-20(E1.4bln)

- USD/JPY: Dec24 Y100.20($1.3bln-USD puts)

EQUITIES: Slight Divergence

A slight degree of divergence crept in during Asia-Pac hours, with e-minis ticking lower on the back of the well-documented U.S. fiscal issues, as President Trump pushed for more substantial stimulus checks for individuals (he is looking for $2,000 per person vs. the $600 per person that was seen in the Bill that recently passed through Congress). E-minis have recovered from worst levels, with questions re: the timeliness of the fiscal support at the fore i.e. a case of when, not if, support will come.

- Meanwhile, the major Asia-Pac indices edged higher.

- The PBoC continues to add liquidity to the system to account for the upcoming calendar new year.

- There was little else in the way of meaningful macro headline flow.

- Nikkei 225 +0.4%, Hang Seng +0.4%, CSI 300 +1.0%, ASX 200 +0.5%.

- S&P 500 futures -5, DJIA futures -27, NASDAQ 100 futures -12.

GOLD: Monday's Range Holds

Spot has stuck within the range established on Monday, with the dynamic in the USD the more dominant driver over the last 24 hours or so. Bullion last deals around the $1,865/oz mark, a handful of dollars higher on the day and within the confines of the previously outlined technical parameters.

OIL: Struggling

WTI and Brent sit ~$0.75 below settlement levels, with questions surrounding the potential for timely implementation of the U.S. fiscal support package evident in the wake of U.S. President Trump's well-documented lambasting of the current Bill.

- Another surprise headline crude stock build in the latest round of weekly API inventory estimates was also seen ahead of Asia-Pac hours, which applied pressure to the space in post-settlement trade and was accompanied by mixed product metrics and fairly flat Cushing inventory levels.

- Continued worry re: the recent COVID mutation centring on the UK and its knock-on impact for fuel demand pressured crude on Tuesday.

- The weekly DoE inventory data headlines on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.