-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: Fresh Lows For USD/CNH, BoJo Set For Brexit Deal Dinner

- USD/CNH hits fresh cycle lows while e-mini S&Ps see new all-time highs in Asia. Chinese CPI moves into deflationary territory, although that was driven by pork prices and doesn't change things for the PBoC.

- The Trump administration proposed a slightly larger fiscal package vs. the bipartisan offering, although familiar sources of discord remain evident.

- BoJo is off to Brussels for the most important dinner of his life.

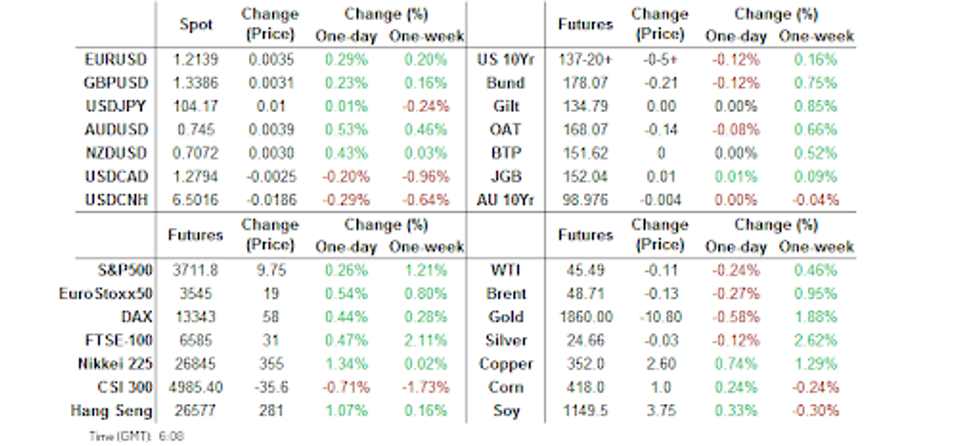

BOND SUMMARY: Mixed Performance For Core FI Amid Tight Ranges

T-Notes sit around worst levels of the session, with the contract -0-06+ at 137-19+, holding to a narrow 0-04+ range in Asia-Pac hours. The proposed fiscal package outlined by the Trump administration has dominated Asia-Pac headline flow, resulting in some bear steepening of the Tsy curve, as 30s trade 2.9bp cheaper on the day. House Speaker Pelosi issued a pushback statement, stressing that Mnuchin's proposal was unacceptable, based on familiar areas of dispute. It is also worth noting that the admin's proposal is not in line with Senate Majority Leader McConnell's slimmed down ideals. Still the slightly larger than baseline $916bn size of the proposed package was the driving influence for markets in Asia, with S&P 500 e-minis lodging another all-time high.

- JGB futures also held to a narrow range, finishing unchanged on the day, while the cash curve twist flattened as the super-long end continued to benefit from an in line with exp. supplementary fiscal package, which was outlined on Tuesday. Participants continue to look for details re: JGB financing requirements surrounding the latest supplementary budget. The Nikkei has suggested that new debt issuance for FY ending Mar '21 will move to over Y100tn vs. the current plan of Y90.2tn. The Nikkei also suggested that tax revenues during the current fiscal year will likely fall Y8tn short of initial estimates, which would represent the largest shortfall seen since fiscal 2009. Elsewhere, Asahi noted that Japan is set to spend about Y300bn on the Go-To-travel campaign.

- The Aussie bond curve saw some early chop, unwinding the overnight flattening move and more, although futures closed little changed on the day, YM -0.1, XM -0.4. 10-Year+ cash ACGBs are unchanged to a touch firmer on the day, with swap spreads wider across the curve. Pressure in the space came around the pricing of A$2.0bn of NSWTC supply, which took the form of a new Feb '32 line. Elsewhere commentary from Westpac's Bill Evans, calling into question the longevity of the RBA's forward guidance if unemployment evolves in line with Westpac's exp., also garnered attention. Selling of the XM roll has also been highlighted, with over 500K lots trading since Tuesday's Sydney close (~350K lots of which were given). Sino-Aussie tensions continue to garner attention, with SCMP sources noting that "Chinese trade officials are unlikely to reassess their bilateral free-trade agreement with Australia this month at the five-year review point."

FOREX: Risk Remains Firm With All Eyes On Deal-Making

Sentiment was buoyed by U.S. fiscal developments and renewed yuan strength, inspiring risk-on flows across the broader FX space. U.S. Tsy Sec Mnuchin outlined a $916bn economic relief proposal and House Speaker Pelosi welcomed progress, even as she deemed parts of the draft "unacceptable." Hopes that remaining gaps could be bridged provided support to risk appetite, allowing AUD, NZD & NOK to outperform their G10 peers, with USD, JPY & CHF helping bring up the rear in the space. Risk barometer AUD/JPY narrowed in on key cycle high of Y77.57, but fell short of testing the level.

- Last-ditch attempts to strike a Brexit accord provided another point of note ahead of today's Johnson/von der Leyen meeting aiming to break the current deadlock. Sterling ground higher early on, with cable extending gains as broader USD weakness kicked in. The pair last sits +25 pips, with yesterday's extremes still intact.

- China unexpectedly posted the first negative CPI reading since 2009, but the redback showed a muted response to the release. PPI deflation moderated slightly more than forecast.

- The yuan led its regional peers higher vs. the greenback, with USD/CNH, USD/KRW and USD/THB all printing fresh cycle lows. The baht drew support from the approval of Thai gov't's stimulus plan, while liquidity in THB crosses remained thin as Thailand is set to observe another long weekend, starting tomorrow. Indonesia was off for a local holiday.

- AUD/USD was initially in a holding pattern, but saw a bid as the session wore on last up 29 pips at 0.7440. The pair briefly touched lows of 0.7405 early in the session.

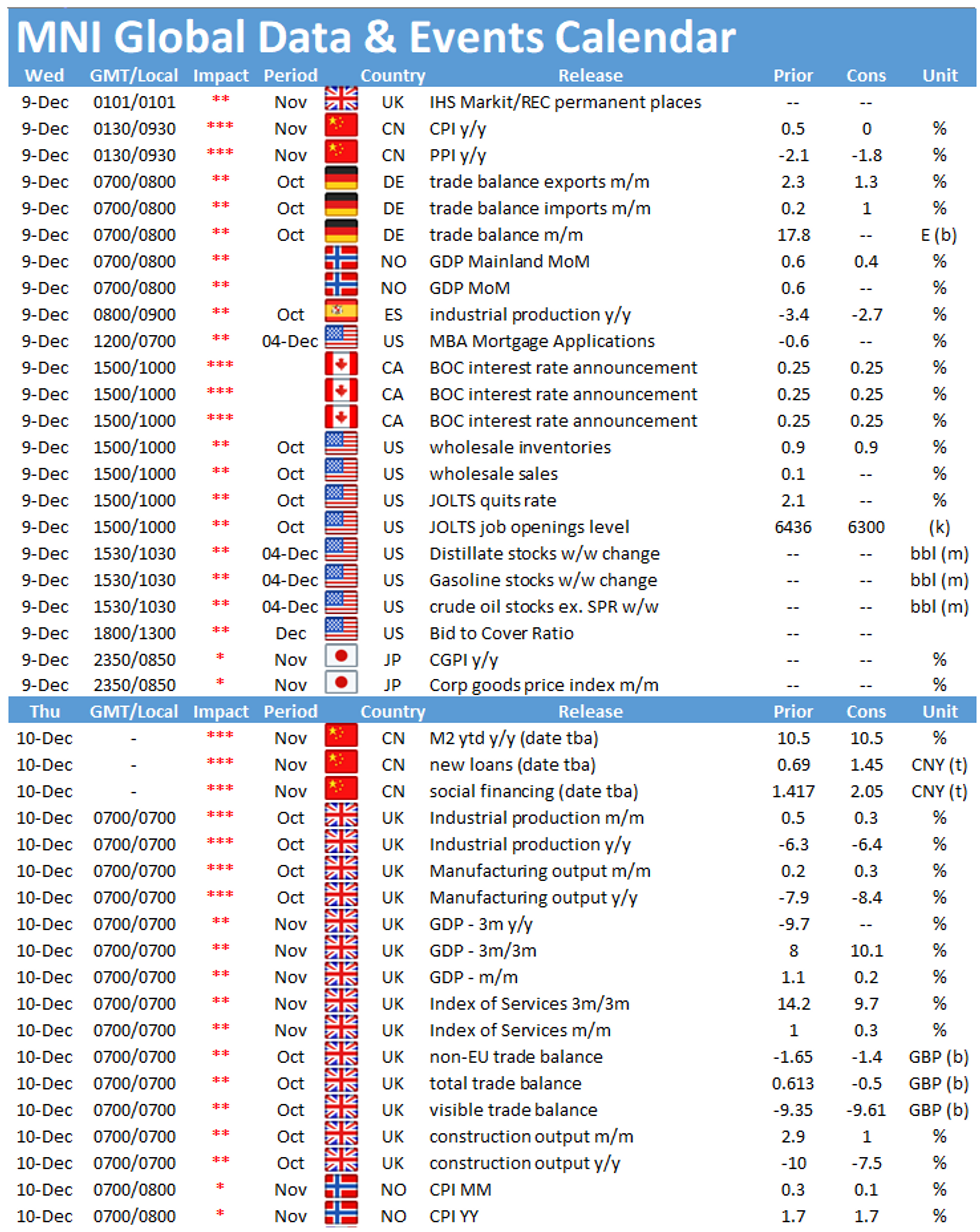

- Later today, focus moves to the aforementioned Chinese inflation figures, BoC MonPol decision, German trade balance & Norwegian GDP.

FOREX OPTIONS: Expiries for Dec9 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2130-40(E567mln), $1.2190-00(E544mln)

- USD/JPY: Y104.65-80($1.1bln)

- USD/CAD: C$1.2900($561mln)

EQUITIES: Fiscal Hope

Most of the major regional equity indices traded on the front foot during Asia-Pac hours, with the latest fiscal developments in DC supporting broader risk appetite overnight, even with the Democratic Congressional leadership pushing back against the latest offering from the Trump administration.

- E-minis also nudged higher, with the S&P 500 contract registering another fresh all-time high during the process, building on Tuesday's marginal Wall St. gains.

- Nikkei 225 +1.2%, Hang Seng +1.3%, CSI 300 -0.1%, ASX 200 +0.7%.

- S&P 500 futures +8, DJIA futures +85, NASDAQ 100 futures +7.

GOLD: Holding

Spot deals in familiar territory, $10/oz or so softer on the day, printing $1,860/oz at typing, with U.S. real yields little changed over the last 24 hours after recovering from yesterday's lows, while the DXY has nudged lower.

- Technically, bulls look to $1,888.9/oz, the 61.8% retracement of the Nov 9-30 sell-off.

- It is also worth noting that Tuesday saw total known gold ETF holdings rise for the first time since Nov 20.

OIL: API Inventory Estimates Provide Pressure

WTI & Brent sit ~$0.15 below their respective settlement levels at typing, after the latest API crude inventory estimates revealed a surprise build in headline crude stocks, alongside a much larger than expected build in gasoline stocks, deepening demand-side worry. Still, the latest uptick in e-minis and downtick for the USD will have provided a light cushion.

- Tuesday also saw the EIA trim its '21 forecasts surrounding an expected fall in U.S. crude oil production, to 240K bpd from 290K bpd in its previous estimate.

- The weekly DoE inventory data and continued focus on the global COVID dynamic will be at the fore on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.