-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hang Seng Slips, BoJ YCC Band Breached

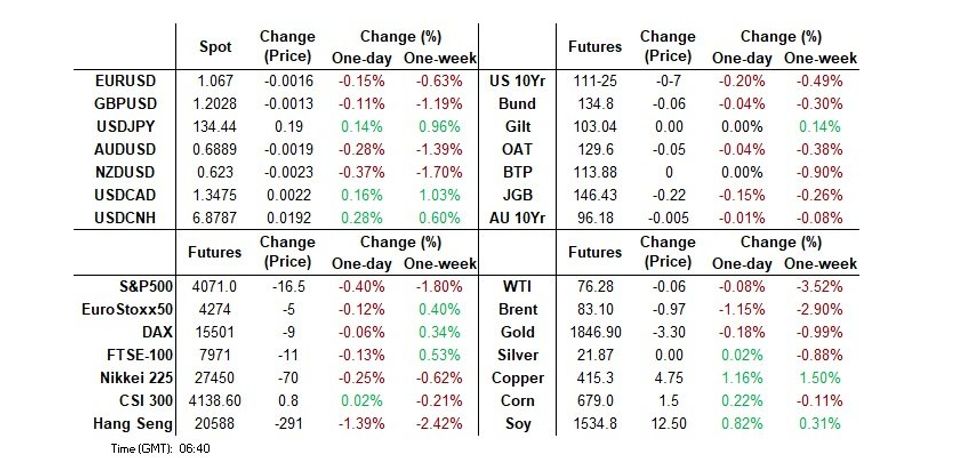

- Cash Tsys held onto the futures-implied cheapening after returning from the elongated weekend, while the latest round of rhetoric from an NZ government institution (the second such instance in under 24 hours) applied pressure to NZGBs. 10-Year JGB yields showed through the upper end of the range permitted by the BoJ's YCC into the Tokyo close. The Hang Seng traded on the defensive, with competition amongst Chinese tech giants and worries re: Sino-U.S. tensions evident.

- This mix allowed the USD to tick higher in Asia.

- Flash PMI data from across the globe is due today, while speeches from Russian President Putin & U.S. President Biden will also be eyed. Riksbank rhetoric headlines on the central bank speaker side.

US TSYS: Cheaper In Asia

TYH3 deals at 111-25, -0-07, a touch off the top of its 0-04+ range on volume of ~63K.

- Cash Tsys sit 2-4bps cheaper across the major benchmarks.

- Tsy yields firmed after the long weekend in early trade, catching up the moves seen in futures yesterday with recent hawkish repricing of the Feds tightening cycle still in focus.

- Losses extended as pressure in Antipodean rates spilled over. The weakness was fueled by NZ Treasury comments on RBNZ policy and RBA's Feb minutes showing that a pause in policy was not discussed.

- Weakness in the Hang Seng provided some marginal support, as did a bounce in ACGBs.

- Block sellers in FV futures (-3.5K & -1.9K) headlined flow wise, while selling in the FV & TY rolls kept broader volume ticking over.

- In Europe today flash PMI data cross, further out flash US PMIs, Philadelphia Fed Non-Manf Activity and existing home sales data is on the wires. We also have the latest round of 2-Year Tsy supply.

JGBS: Morning Moves Hold/Extend Into Close, Curve Twist Flattens, YCC Band Breached

Cross-market-driven flows observed across the wider core global FI space were in play in JGB futures, which extended on their marginal overnight cheapening during the Tokyo morning, before bouncing. The contract has come under light pressure into the bell and is -20, registering fresh session lows in the process.

- Cash JGBs are 1.5bp cheaper to 2bp richer, with 20s outperforming even with the presence of a tepidly received round of 20-Year JGB supply, as the curve twist flattens. 10-Year JGB yields are showing through the peak of the BoJ’s YCC cap at present.

- Domestic headline flow was fairly subdued, with Finance Minister Suzuki going over well-trodden rhetoric re: the FX market, while soon-to-be departing BoJ Governor Kuroda reaffirmed the Bank’s view on inflation.

- Services PPI data and a speech from BoJ’s Tamura headlines the local docket on Wednesday. Look out for off-schedule Rinban purchases if the upper end of the BoJ’s YCC parameters continues to be breached.

AUSSIE BONDS: Short-End Yields Higher Ahead Of Wages Data

The RBA's Feb meeting minutes added little new to the policy debate (there was confirmation that a pause in tightening was not discussed earlier this month, while a 50bp hike was), NZGB short-end weakness, fueled by NZ Treasury comments on RBNZ policy, was the dominant driver. Aussie rate futures closed YM -2.0 and XM -0.5, comfortably off their respective session bases. YM registered fresh intraday lows for '23 in the process, representing a 60bp+ sell-off from pre-RBA meeting levels. Cash ACGBs closed 1-3bp higher in yield with the 3/10 curve 2bp flatter.

- AU/U.S. 10-year yield differential closed at -4bp, 1bp higher than Friday’s close of -5bp.

- Swap flows added to the weakness with EFPs wider, led by the 3-year.

- Bills closed 4-5bp softer across the strip, also off session lows.

- RBA-dated OIS nudged higher to a 95% chance of a 25bp hike in March and firmed 3-4bp for meetings out to November. Terminal rate expectations moved higher to ~4.30%.

- Looking ahead, the resumption of cash Tsy trading after yesterday's holiday may provide fresh impetus, but the Aussie market will likely trade tentatively ahead of tomorrow’s Q4 WPI. With Q4 CPI signalling a shift in inflationary pressures from goods to services and wages closely linked to services inflation, wage data has quickly become a headline event on the local calendar.

AUSTRALIA: CBA Card Transactions Point To Resilient Consumer

CBA card transaction data showed that spending eased through to February 17 but it is currently being negatively impacted by Covid-related based effects and so the underlying is currently difficult to ascertain. CBA believes consumption remains resilient but is easing as it normalises after the post-Covid boom.

- Spending on services continues to drive overall consumption and is currently up about 21% y/y. Recreation and eating out were particularly strong.

- Goods spending is closer to pre-Covid levels at about 6% y/y but when inflation is taken into account it is probably closer to flat or even negative. Retail is up about 8% y/y.

NZGBS: NZ Treasury Comments On RBNZ Spark Short-End Sell-Off

NZ Treasury comments on the RBNZ policy outlook sparked a short-end led sell-off in NZGBs. By the close, 2-year yields were 10bp higher with the 2/10 cash curve 6bp more inverted.

- Swaps also delivered a 4bp flattening of the curve with the 2-year rate 7bp higher.

- Comments from the NZ Government over the past 24 hours have (1) pushed back against a ‘no hike’ option for tomorrow and (2) suggested that the RBNZ may have to keep rates ‘higher for longer’ given that the inflationary impact of the post-Cyclone rebuild.

- RBNZ-dated OIS pricing for tomorrow’s meeting closed unchanged at ~46bp, after being firmer during the session. Pricing for later meetings however bore the brunt of today's paying. Terminal OCR expectations moved to just below 5.40% and November pricing moved as much as 17bp higher. At yesterday's close the market had priced in 20bp of cuts by November. That has now been scaled back to ~15bp.

Fig 1: RBNZ-Dated OIS – Pre and Post NZ Treasury’s ‘Higher For Longer’ Comments

Source: MNI - Market News/Bloomberg

- Elsewhere, Q4 PPI managed to print at a slower Q/Q rate.

- Looking ahead, the resumption of U.S. cash Tsy trading after yesterday's holiday may provide fresh impetus, but the Antipodean markets will remain focused on Wednesday’s release of Australia’s Q4 WPI and the RBNZ decision.

MNI RBNZ Preview - February 2023: Another 50bp Amid Uncertainty

EXECUTIVE SUMMARY:

- The RBNZ hasn't met since it hiked rates 75bp in November. A step down to 50bp is expected this month given the tentative peaking in inflation and labour market tightness, the housing correction and lacklustre activity indicators. This would bring rates to 4.75% and cumulative tightening to 450bp. The NZD OIS market has 48bp priced in..

- There has been some talk that the central bank should hike only 25bp or even pause in the wake of Cyclone Gabrielle. But the RBNZ's responsibility is to contain inflation and look through short-term events. The government has even made comments to this effect.

- Given inflation remains so far above target and the labour market at capacity another hike in April is probable with a smaller 25bp possible given the cumulative tightening this cycle and the lags involved. The outcome of the end-May meeting is likely to depend on the Q1 CPI data on April 20 and the wages and employment on May 3.

- Click to view full preview: MNI RBNZ Preview February 2023.pdf

FOREX: Greenback Strengthens Amid Higher Yields, Weaker Equities

The USD is firmer in Asia as higher US Treasury Yields and Weaker Equities have weighed on risk sentiment.

- AUD/USD is pressured down ~0.2%. The pair is see-sawing around the $0.69 handle, despite a hawkish tilt in the RBA minutes which provided confirmation that the Board considered a 25bp or 50bp interest rate increase earlier this month, but not a pause. Support comes in at $0.6812, 16 Feb low.

- Yen is little changed from opening levels. USD/JPY has traded in a narrow ¥134.20/50 range today. Feb Jibun Bank Preliminary PMI prints crossed, the Composite read was 50.7, unchanged from the previous month. Manufacturing print remained in contractionary territory at 47.4 falling from last month's 48.9 read. Services printed 53.7 up from 52.3 prior.

- Kiwi is also softer, last printing at $0.6240/45. The NZ Treasury noted that the rebuild after Cyclone Gabrielle will support economic activity. They also noted that more demand will add to inflationary pressure and it may result in the RBNZ keeping rates higher for longer. Kiwi did firm in the aftermath of the comments however there was little follow through.

- The USD bid has weighed on EUR and GBP, both are down ~0.2%. NOK is down ~0.3%, Brent Crude futures fell by ~$1 in Asia.

- Cross asset wise: e-minis are ~0.4% softer, BBDXY is up ~0.2%. 10 Year US Treasury Yields are ~4bps firmer.

- In Europe today flash PMI data from cross as well as the latest ZEW Survey from Germany. Further out flash US PMIs and existing home sales data is on the wires.

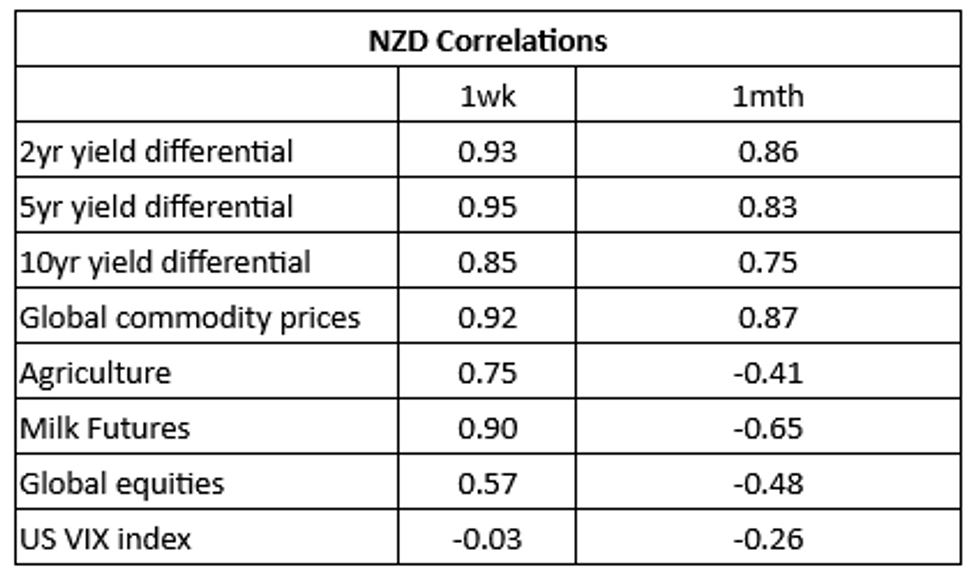

NZD: Rate Differentials, Commodities Driving Kiwi

NZD/USD was pressured last week, down ~1% through the week dealing in a 2 cent range. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Yield differentials and global commodities were the dominant macro drivers in NZD in recent dealing, agriculture and milk prices also weighed on the NZD.

- Over the longer term, yield differential and global commodities continue to be the main driver in NZD.

- NZD/USD still looks too high relative to yield spreads. The 2yr NZ-US spread is up slightly from recent lows near +20bps, last around +36bps. Near term sentiment is likely to be dictated by tomorrow's RBNZ decision, +50bps is the consensus.

- Longer term resilience in milk prices hasn't aided the Kiwi at this stage.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-90(E1.2bln), $1.0695-00(E577mln), $1.0800(E592mln), $1.0900(E1.2bln)

- USD/JPY: Y133.40-50($1.1bln), Y133.90-00($645mln)

- AUD/USD: $0.6730(A$1.1bln)

- USD/CNY: Cny6.7775($511mln)

ASIA FX: USD/Asia Recoup Some Of Monday's Losses

USD/Asia pairs are mostly higher, unwinding a proportion of yesterday's losses, as the USD finds some support and equity sentiment falters somewhat. Gains have been fairly uniform, although pairs remain within recent ranges. Tomorrow, South Korea manufacturing and non-manufacturing sentiment indices are due, along with short term external debt. Taiwan Q4 GDP revisions are also on tap.

- USD/CNH was sub 6.8600 in early trade, but now sits back closer to 6.8800, around 0.30% weaker versus Monday closing levels. The early equity bounce, on property sector optimism has faded somewhat, with aggregate indices back close to flat. The CNY fixing remained close to neutral.

- 1 month USD/KRW is close to unchanged, last around 1295, although spot is a little higher at 1296. First 20-days trade data for Feb didn't suggest a strong turnaround in export momentum, with chip exports still quite weak. Consumer sentiment edged down, but inflation expectations ticked higher for Feb. The BoK decision is due on Thursday.

- The SGD NEER (per Goldman Sachs estimates) is marginally softer today, NEER printed a cycle high on Friday before moderating in recent dealing. However, we do sit ~0.5% below the top of the trading band, slightly more elevated compared to early Feb levels. USD/SGD is slightly higher, in line with broader USD trends, last around 1.3375/80. Thursday's Jan CPI print is the next major event risk, with the market looking for stronger inflation pressures as the GST was hiked at the start of the year.

- USD/IDR is slightly higher, last sitting close to 15175/80 (+0.15%). This unwinds part of yesterday's fall of -0.30%. The pair remains very much within recent ranges though and wedged between key EMAs. Resistance appears above 15200, while the 20 and 200 day EMAs continue to drift higher (sitting 15144 for 20 day, 15132 for the 200 day). The data calendar is empty until the start of March. S&P noted that the distress in Indonesia's bond market is likely to be more a domestic issue, rather than offshore issue (see this link for more details), as most maturities are in IDR, rather than dollars. This follows onshore developer Waskita deferring bond payments.

- USD/THB has recouped yesterday's losses and printed at fresh highs YTD. We were last at 34.64, +0.60% higher for the session. There didn't appear a fundamental catalyst for the rebound higher, although portfolio outflows from offshore investors continue across both the bond (-$63.5mn) and equity (-$86.7mn) space for Monday's session.

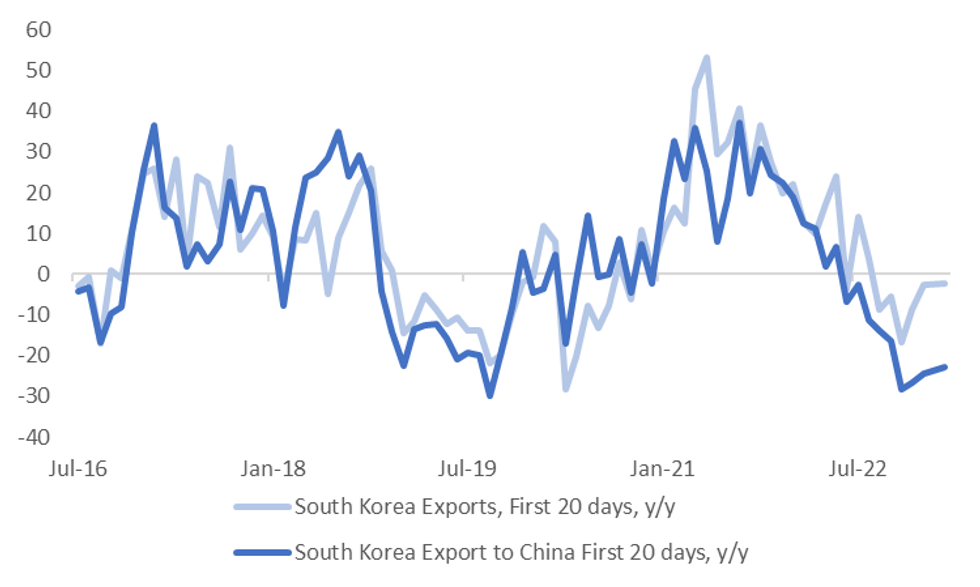

SOUTH KOREA: Trade Figures Point To Ongoing Growth Headwinds

The first 20-days trade data for February showed similar trends to recent months. Exports were only down -2.3% y/y in terms of the headline result, but average daily exports were still -14.9% y/y. Recall for the full month of January exports were -16.6% y/y.

- In terms of the detail, chip exports were -43.9% y/y, while exports to China remained fairly soft at -22.7% y/y. This is some improvement from the trends at the end of 2022, but only modestly so far, see the chart below.

- Imports remained firmer at +9.3% y/y, which left the trade deficit at close to -$6bn for the first 20-days of the month. At the margin this suggests some improvement on January's record wide trade deficit (-$12.69bn for the full month), albeit only at the margins at this stage.

Fig 1: South Korea Export Growth - First 20 days Total & To China

Source: MNI - Market News/Bloomberg

EQUITIES: Early Positive Impetus Not Sustained For China Markets

Early gains in China/HK equities have not been sustained as a more cautious tone has given way as the session progressed. US futures are generally lower (Eminis off by 0.40%, Nasdaq futures down by 0.34% at this stage), with US fixed income markets re-opening and yields mostly pressing higher (+2.9-4.7bps firmer across the curve), with some spill over from leads in AU/NZ bond markets.

- The CSI 300 is around flat currently, unwinding earlier gains, while the Shanghai index is +0.10%. The property sub-index is +0.44%, although away from earlier highs. Market sentiment was lifted by reports from late yesterday that the country is launching a private equity pilot program for the property sector. Weakness in consumer staples stocks has also provided an offset.

- The HSI is down around 1% at this stage, with tech sub index off by 2.50%. HSBC reported lower than expected net income for the full year.

- The Kospi and Taiex are close to flat, with range bound markets in play. Likewise for the Nikkei 225.

- NZ stocks are down a further 0.90%. This followed comments by the NZ Treasury around higher for longer interest rates post Cyclone Gabrielle. The RBNZ decision is due tomorrow.

GOLD: Bullion In A Tight Range As Market Waits For Wednesday’s Fed Minutes

Gold prices traded sideways on Monday given that the US was closed for the Presidents Holiday. During APAC trading they have also been in a tight range and are only 0.2% lower at $1838/oz, close to the intraday low of $1837.20. It reached a high of $1843.80 earlier. The market is waiting for Wednesday’s FOMC minutes and Fed speakers for direction.

- Bullion has moved further below its 50-day simple moving average. Initial support for the yellow metal is at $1819, the February 17 low, and resistance is at $1892.10, the 20-day EMA.

- There are no Fed speakers in today’s US calendar but in terms of data preliminary PMIs for February print and are expected to improve. A reading above 47.5 for the composite index could weigh on gold prices. There is also January existing home sales, which are projected to rise after declining the previous month.

OIL: Crude Eases On Concerns Fed Tightening Will Weigh On Demand

Oil prices rose on Monday due to demand optimism but have retreated during APAC trading but remain in a narrow range. The market is waiting for Wednesday’s Fed minutes to gauge how much tightening will weigh on demand. Brent is down 1.1% to $83.15/bbl, close to the intraday low of $83.12. It reached a high of $83.94 earlier in the session. WTI is around $76.40. The USD index is 0.2% higher.

- Brent is trading between resistance at $86.95, the February 14 high, and support at $75.06, the February 17 low. It has moved below its 50-day simple moving average again.

- Kazakhstan has created its own oil brand as an attempt to disentangle itself from Russia and sanctions. But since Kazakh oil is pumped through Russian pipelines, its price is still under pressure.

- API inventory data is scheduled, which are likely to be watched closely given recent large builds. There are no Fed speakers in today’s US calendar but in terms of data preliminary PMIs for February print and are expected to improve. There is also January existing home sales, which are projected to rise after declining the previous month. Canadian inflation is expected to ease slightly.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/02/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 21/02/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/02/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/02/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/02/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/02/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/02/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/02/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/02/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/02/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/02/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/02/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/02/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/02/2023 | 1330/0830 | *** |  | CA | CPI |

| 21/02/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/02/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/02/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/02/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.