-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: HK/China Equity Rebound Aids Broader Risk Appetite Ahead Of US NFP

- ACGBs sit weaker (YM -7.0 & XM -3.0), near Sydney session cheaps as local participants focus on the possible implications of the Australian Fair Work Commission’s decision to lift the minimum wage by 5.75%. RBA dated OIS is 4-10bp firmer across meetings with a 56% chance of a 25bp hike in June priced. It was a 40% chance at the opening of trade today.

- AUD/USD is back to 0.6615, +0.65% above NY closing levels from Thurs, with the above yield moves supporting, along with a stronger regional equity backdrop. The HSI is around 4% higher, the China Enterprise Index near 4.5%. There didn't appear a single catalyst for this strength. The China Dragon Index did gain 4% in US trade.

- Elsewhere the US Senate passed the debt-ceiling agreement. US NFPs is the main focus coming up later.

MARKETS

US TSYS: Weaker, Debt Ceiling Bill Passes The Senate, Awaiting Non-Farm Payrolls

TYU3 is currently trading at 114-20+, -3 from NY closing levels after the US Senate passed the US debt-ceiling bill, by 63-36 votes. The legislation now goes to US President Biden to be signed into law, which the White House has stated will happen as soon as possible. Biden will address the American people tomorrow.

- The Senate voted on 11 proposed amendments, but none were adopted. Senate Leader Schumer stated earlier on Thursday that approving any of the amendments would require the bill to go back to the House, which would almost certainly lead to default.

- Cash tsys are 0.6-1.8bp cheaper across benchmarks in Asia-Pac trade ahead of May Non-Farm Payrolls later today. BBG consensus expects an increase of 195k after +253k in April with the unemployment rate expected to rise to 3.5% from 3.4%.

- There are no major data releases in Europe today.

JGBS: Richer, Mid-Range, Light Local Calendar, Awaits US Non-Farm Payrolls

JGB futures are sitting in the middle of the Tokyo session range at 148.83, +9 versus settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined comments by BoJ Governor Ueda in parliament re: not being able to say when the BOJ will achieve its 2% price goal.

- Consequently, local participants were likely closely monitoring headlines and keeping an eye on US Treasury yields leading up to the release of the US Non-Farm Payrolls data later today.

- In line with this, cash tsys are trading 0.6-2.0bp cheaper in Asia-Pac trade after the US Senate passed the US debt-ceiling bill, by 63-36 votes. The legislation now goes to US President Biden to be signed into law, which the White House has stated will happen as soon as possible.

- The cash JGBs are richer across the curve, apart from the 40-year zone, which is 0.5bp cheaper. The benchmark 10-year sees its yield 0.7bp lower at 0.417%, below the BoJ's YCC limit of 0.50%. The 2-3-year zone is the outperformer with yields 1.0-1.3bp lower despite this morning’s BoJ operations seeing a higher spread and a slightly higher offer cover ratio for the 1-3-year bucket.

- Swap rates are however lower across the curve with swap spreads narrower.

- The local calendar sees Jibun Bank PMIs (May F) on Monday.

AUSSIE BONDS: Weaker, At Session Cheaps, Awaits US Payrolls

ACGBs sit weaker (YM -7.0 & XM -3.0), near Sydney session cheaps as local participants focus on the possible implications of the Australian Fair Work Commission’s decision to lift the minimum wage by 5.75%.

- Cash ACGBs are 2-7bp cheaper with the 3/10 curve 5bp flatter and the AU-US 10-year yield differential +7bp at +3bp.

- Swap rates are 3-6bp higher.

- The bills strip bear flattens with pricing is -9 to -4.

- The local calendar is heavy next with the focal point likely to be RBA Policy Decision on Tuesday. BBG consensus is expecting a no-change outcome although it is not unanimous.

- While not expecting a hike until August, ANZ today announced an increase in its terminal cash rate forecast to 4.35% from 4.10% (link). They join several other sell-side economists who have turned more hawkish in terms of the RBA outlook (link).

- RBA dated OIS is 4-10bp firmer across meetings with a 56% chance of a 25bp hike in June priced. It was a 40% chance at the opening of trade today.

- On Monday, the local calendar is scheduled to release Judo Bank PMIs (May F), MI Inflation Gauge (May), Inventories (Q1), Company Profits (Q1) and ANZ Job Ads (May).

- The AOFM announced plans to sell A$700mn of the 3.75% 21 May 2034 bond on Wednesday.

AUSTRALIAN DATA: Minimum Wage/Award Wage Increased By 5.75% From July 1

The Australian Fair Work Commission has announced that the Australian minimum wage will be increased by 5.75%, effective from July 1. Whilst this is lower than local unions had wanted (who had been arguing for a 7% increase), it still affects around 25% of all Australian employees (per ABC reports), via the award system.

- Note that the Australian Treasury assumed a 6.9% minimum wage rise in the budget with 4% for another 2mn award workers.

- At the same time, from last weekend, the AFR reported that the RBA warned the government in a recent meeting not to allow large wage increases ahead of June’s announcement of the size of the minimum wage rise. Governor Lowe said that increases above 2%-3% plus any productivity growth would be inflationary (see this link for more details).

- Note RBA forecasts have the Wage price index peaking at 4.00% in Q4 of this year.

- So, whilst the headline was lower than the 7%, which had been discussed, it still may create concerns of a higher wages peak than the RBA is projecting and force further RBA action.

- A number of sell-side economists have turned more hawkish in terms of RBA outlook, see here and here for more detail.

NZGBS: Richer, Off Bests, Pressured By US Tsys & ACGBs

NZGBs closed flat to 1bp cheaper, well off the local session’s best levels despite NZ trade data adding to signs the economy may have been in a recession. The economy shrank 0.6% q/q in the final three months of 2022.

- Import volumes jumped 6.7% q/q, the most in two years in Q1, while export shipments increased just 1% q/q. However, construction work, another input in Q1 GDP calculations, rose 0.6% q/q (estimate -2.0%) in 1Q.

- The decline in NZGBs during the session seemed to be driven by the overall weakness in bonds during Asia-Pac trading. This weakness was particularly evident in ACGBs, which were influenced by economists adopting a more hawkish stance ahead of the RBA decision next Tuesday. Additionally, the announcement of a minimum wage increase of 5.75% by the Australian Fair Work Commission also contributed to the bond market reaction.

- NZ/US 10-year yield differential closes +6bp at +71bp, with the NZ/AU differential unchanged at +68bp.

- Swap rates closed flat with the 2s10s unchanged.

- RBNZ dated OIS closed little changed.

- The local calendar is light next week with ANZ Commodity Prices (Tue) and Mfg Activity (Wed) as the only releases. The NZ Government is also scheduled to release its 10-month Financial Statement on Wednesday.

EQUITIES: Hang Seng Tech & HS China Enterprises Index Rebound +4%

Asian stocks are tracking higher in the first part of Friday's dealings. Much of the focus remains on gains for Hong Kong stocks, the HSI up over 3.6% at the break. The tech sub index is tracking more than 5% higher. The HS China Enterprise index is +4.2%.

- China mainland shares are also firmer, albeit with a lower beta, the CSI 300 +1.3% at the break. Japan stocks are +1.3% for the Topix. Taiex +1.4%, the Kospi +1.0%, while SEA markets are more muted.

- In terms of drivers of these moves, there doesn't appear to be a single catalyst. As we noted earlier the Golden Dragon rallied 4% in US trade on Thursday, so some positive spillover is clearly evident. This was amidst broadly positive gains in US/EU bourses, with the viewpoint of a Fed pause in June helping sentiment.

- Goldman Sachs is keeping its MSCI China OW but lowering the price target, is another positive. Value buyers may also be emerging given the extent of recent sell-offs (i.e the HSI and HS China Enterprise Index both moving 20% off Jan highs).

- Possible stimulus expectations could also be driving market sentiment, it the aftermath of this week's mixed PMI data.

- We have seen some positive spillover to US equity futures, Eminis last close to +0.20% (4235/36), while Nasdaq futures are +0.25%. The US Senate passed the debt-ceiling agreement, which is expected to be signed by President Biden. This didn't bring any meaningful shift in equity sentiment though.

FOREX: USD Lower, A$ Rallies On RBA Expectations/Minimum Wage Hike

The BBDXY is tracking lower, last close to 1236.40, -0.15% lower versus NY closing levels. The dollar has seen broad based losses, with the index down through Thursday lows. AUD and NZD have outperformed, with the A$ slightly stronger at the margins. Risk appetite has been much stronger in HK/China equities, which has also weighed on USD sentiment.

- AUD/USD is back to 0.6615, +0.65% above NY closing levels. Sell-side names adding RBA rate hikes before and after the 5.75% minimum/wage hike that was announced this morning. This has been a clear support point (see this link). Pricing is slightly above 55% for a 25bps hike next week.

- AUD/NZD firmed in the first part of trade, getting to fresh highs of 1.0866, but we now back at 1.0835/40, as the firmer risk backdrop has seen NZD/USD play catch up. NZD/USD is back above the 0.6100 handle this afternoon.

- The US Senate passed the debt-ceiling legislation. The market impact was minimal. US yields have ticked higher, the 10yr back above 3.61%, (~+2bps). but this hasn't aided USD sentiment.

- USD/JPY sits slightly below NY closing levels, last 138.70/75. Yen has lagged the antipodeans though. BoJ Governor Ueda appeared before parliament, stating that the central bank didn't have a set time frame for achieving to the 2% inflation target.

- Looking ahead, all focus is on the NFP release where Bloomberg consensus looks for further moderation in payrolls growth in May to +195k versus a prior read of +253k.

OIL: Brent Builds On Thursday Gains, But Still Tracking Lower For The Week

Brent crude has drifted higher in the first part of Friday trade. We were last at $74.70/75/bbl, which is 0.60% above Thursday closing levels. This comes after Thursday's 2.23% gain, amid broadly stronger risk appetite in the equity space and a weaker USD. Still, we are tracking lower for the week, off nearly 3% at this stage. WTI is back to $70.50/bbl, following a similar trajectory.

- For Brent, recent lows come in near $71.40/bbl, while on the topside, the simple 50-day MA sits close to $78.85/bbl.

- Crude’s gains come ahead of this weekend's OPEC+ meeting which many analysts thought would lean more heavily towards extending cuts if Brent goes sub-$70/bbl this week – a move now looking less likely.

- EIA weekly data showed a 4.5mn bbl increase in crude stocks – which were supported by a net 1mn bbl increase in imports. Gasoline stocks saw a small decline while implied demand on a four-week average reached 9.2mn bpd - the highest four-week average since late 2021 and on a seasonal basis since 2019. This still points to a challening supply backdrop for oil bulls.

GOLD: Higher For Three Consecutive Days

Gold is 0.3% higher in the Asia-Pac session, after closing higher for the third day in a row at 1977.61 (+0.8%).

- The bipartisan agreement, which aims to suspend the debt limit until Jan. 1, 2025, has been approved by the House and the Senate and now goes to US President Biden to be signed into law. This eliminates a significant risk to financial markets that had provided support to gold in early May.

- ADP private employment data exceeded expectations, aligning with the strength seen in the JOLTs data on Wednesday. This initially fueled speculation that the Federal Reserve may need to take further measures to cool down the labour market and control inflation. However, subsequent comments from central bank officials and weaker-than-expected unit labour costs data eased concerns of an imminent interest rate hike, which provided support to non-yielding gold.

- Attention now turns to May Non-Farm Payrolls later today. BBG consensus expects an increase of 195k after +253k in April with the unemployment rate expected to rise to 3.5% from 3.4%.

ASIA FX: Regional FX Buoyed By Equity Rebound

USD/Asia pairs are lower across the board. The won has been the best performer, hitting fresh multi week lows near 1300. USD/CNH is also lower, back to the 7.0800/7.0900 region, amid surging HK and China related equities. Softer USD sentiment has helped amid expectations the Fed will hold steady in June. Next Mon the main focus is likely to rest on the Caixin services PMI print in China. Indonesian markets also return from a 2 day break (Thur/Fri of this week).

- USD/CNH sits slightly above session lows, last near 7.0900 (earlier lows were at 7.0825). Highs for the session sit at 7.1149. The equity market rebound has clearly aided sentiment, with strong moves across China related shares in HK and on the mainland. A clear catalyst wasn't evident for the shift in sentiment but we did see a 4% gain for China traded shares in US trade on Thurs.

- 1 month USD/KRW got to fresh lows near 1300, buoyed by the better equity tone. Won bulls could target the simple100-day MA, back close to 1298.50. We haven't been sub this resistance point since mid March this year. The 200-day MA sits at 1326.65 on the topside. Earlier, May inflation slowed further, while Q1 GDP y/y was revised a touch higher. The South Korean FinMin stated the export growth trend should improve. A BoK board member noted the structural headwinds for the won, but this hasn't impacted FX sentiment today.

- USD/TWD is also lower, but hasn't been able to test sub 30.60. The pair was last at 30.65. Onshore equities have resumed their uptrend, the Taiex gaining a further 1.1% so far today.

- Other markets have seen USD losses, to varying degrees, with broader macro trends driving sentiment rather that local drivers. USD/THB is back to 34.60, 0.60% strong for the session in baht terms. USD/PHP is back to 55.90/95, posting a similar gain.

- USD/INR is lower, but displaying a weaker beta to these moves, last at 82.30/35.

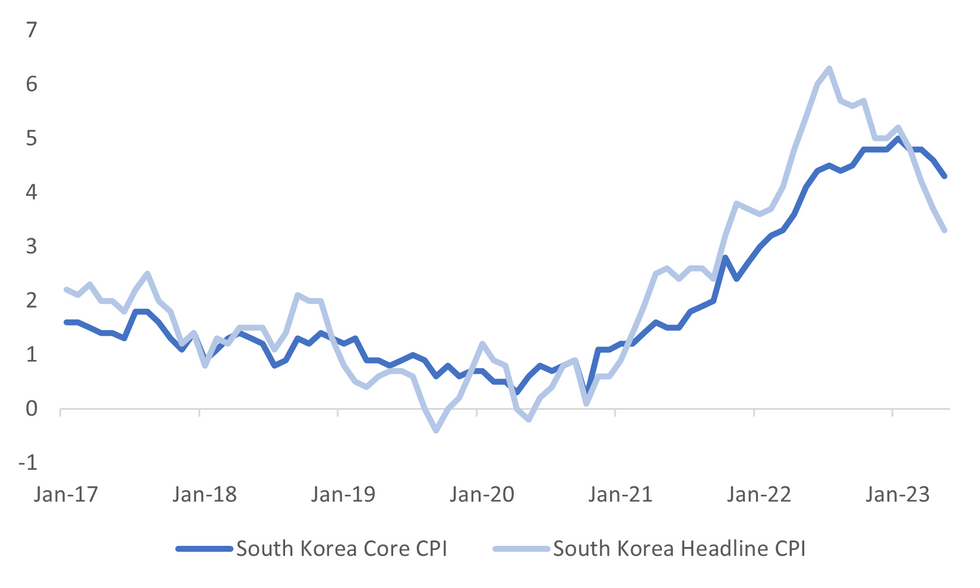

SOUTH KOREA: Inflation Momentum Easing But Core Still Elevated

South Korea headline May CPI came in a touch weaker than expected in y/y terms, 3.3% versus 3.4% forecast and 3.7% prior. Y/Y momentum is now back to late 2021 lows. The m/m was in line with expectations, 0.3%, versus 0.2%. Encouragingly for the authorities, core inflation stepped down to 4.3% y/y, from 4.6% prior (there is no consensus estimate for core). This measure is comfortably off Jan highs of 5.00%, although base effects likely aided the move.

- Core prices which exclude both food and energy prices eased to 3.9% in y/y terms, a 10 month low, but only slightly below the 4.0% pace in April.

- Looking at the detail, agricultural prices rose 0.5% m/m, utility prices surged 2.2%, but offset came from petrol related products down 1.4%.

- At face value this data may temper the need for further BoK action, with last month's policy meeting holding rates steady, but with a hawkish bias. A critical issue is likely to be whether core inflaiton is cooling fast enough.

- Other data showed Q1 GDP revisions were nudged up to 0.9% y/y, (0.8% expected), while the initial q/q estimate was left unchanged at 0.3%. Slightly better consumption and construction investment, offset a larger drag from business investment.

Fig 1: South Korea CPI Continues To Trend Lower

Source: MNI - Market News/Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 02/06/2023 | 1230/0830 | *** |  | US | Employment Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.