-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Japan CPI Eases But JGB Yields Hold Close To Recent Highs

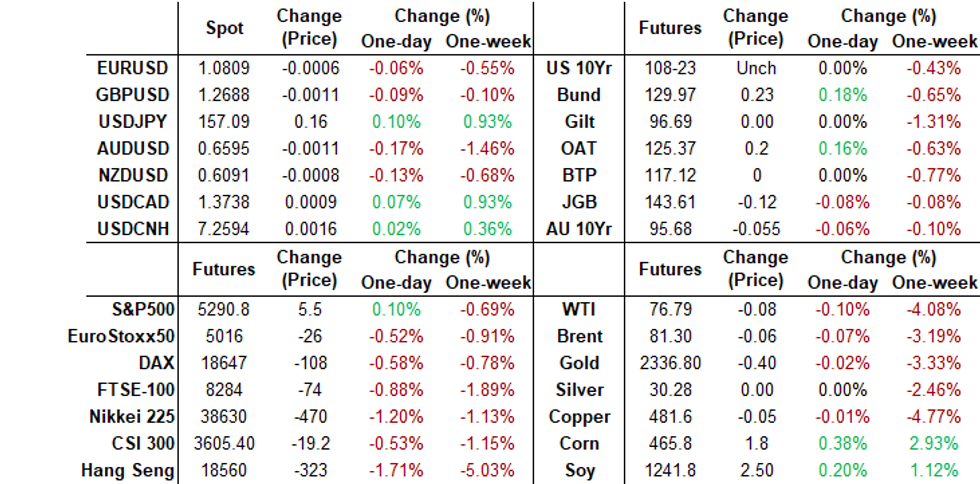

- A firmer USD backdrop continued, albeit with modest gains against the G10. Asian FX is also weaker, weighed by a softer equity tone for the region, which were weighed by US losses from Thursday trade.

- Japan April CPI was close to expectations, although services inflation cooled. Cash JGBs are little changed. The benchmark 10-year yield is 0.4bp higher at 1.006% versus the YTD high of 1.011%.

- In the commodity space both gold and oil hold near Thursday lows.

- Looking ahead, UK Retail Sales and The Fed's Waller to speak later today.

MARKETS

US TSYS: Treasury Futures Edge Higher On Increased Volume, 2s10s Near Ytd Low

- Treasury futures have edged higher throughout the day, volumes have also picked up the TU is up (+ 00.375) at 101-16.25, while TY is (+ 01) at 108-24. Futures are now on track for their biggest weekly drop in 5 weeks as rate cut projections get pushed back and the 2s10s curve trading near ytd lows.

- Volumes: TU 47k, FV 102k, TY 119k

- Tsys Flows: Block Flatter FV-US, DV01 160k

- Treasuries traded lower Thursday on the back of strong PMI data, extending the pullback from the recent 109-31+ high on May 16. Support to watch lies at 108-15 (May 14 lows), on the upside initial resistance is 109-07 (50-day EMA).

- The treasury curve has slightly bear-flattened throughout the trading session with yields now 1-1.5bps lower, the 2Y yield -1.3bps at 4.922%, 10Y -1.2bp to 4.465%, while the 2y10y +0.319 at -45.962

- Regionally: ACGBs are 5bps higher, NCGBs are 3-4bps, JGBs are +/- 1bp, the 10Y touched 1%.

- Rate cut projections have receded vs late Wednesday levels (*): June 2024 at -0% w/ cumulative rate cut 0.0bp at 5.328%, July'24 at -10.0% (-16.0%) w/ cumulative at -2.5bp (-5.2bp) at 5.302%, Sep'24 cumulative -14.2bp (-17.8bp), Nov'24 cumulative -21.2bp (-26.2bp), Dec'24 -34.8bp (-40.6bp).

- Looking ahead: Durables/Cap Goods and the latest UofM Sentiment, Fed's Waller to Speak while June Treasury options expire as well.

JGBS: Cash Bonds Little Changed, BoJ Ueda and Uchida At BoJ-IMES Conference On Monday

JGB futures are weaker, -9 compared to the settlement levels, and sit in the middle of the day’s range.

- Outside of the previously outlined National CPI, there hasn't been much in the way of domestic drivers to flag. Department Sales data is due along with a Liquidity Enhancement Auction for OTR 5-15.5-year JGBs.

- According to MNI’s technicals team, a bear trend in JGB futures persists, erasing the corrective bounce last week. The contract is for now trading just above key support and bear trigger at 143.44, the Nov 1 low. A stronger reversal higher is required to signal the end of the recent downward phase. Key resistance is at 145.95, the Mar 28 high. A break would signal scope for a climb towards the bull trigger at 147.74, the mid-January high.

- Cash US tsys are dealing ~1bp richer in today’s Asia-Pac session after yesterday’s sell-off.

- Cash JGBs are little changed. The benchmark 10-year yield is 0.4bp higher at 1.006% versus the YTD high of 1.011%.

- The swaps curve has slightly bull-flattened, with rates flat to 1bp lower. Swap spreads are mostly tighter.

- On Monday, the local calendar will see BoJ Governor Ueda and Deputy Governor Uchida deliver remarks/speeches at the BoJ-IMES Conference. Leading and Coincident Indices are also due on Monday.

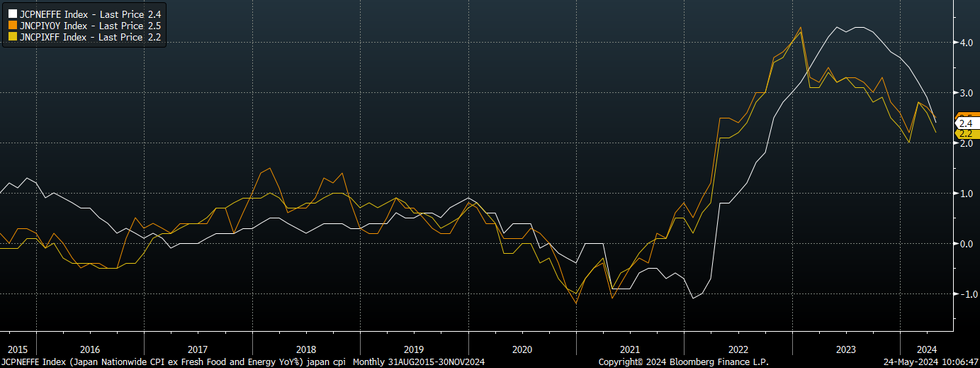

JAPAN DATA: April National CPI Close To Expectations, Education Dip Weighs On Services

National CPI for April was fairly close to expectations. The headline printed at 2.5%y/y, versus 2.4% forecast and 2.7% prior. The ex fresh food measure was 2.2%y/y in line with estimates and versus 2.6% prior. The ex fresh food and energy measure was 2.4% y/y, also in line with expectations and against a 2.9% read in March. These measures are trending back towards earlier 2024 lows.

- The measure which excludes all food and energy was 2.0% y/y, versus 2.2% in March.

- In m/m terms we were up 0.2% for the headline, flat for the core measures (seasonally adjusted). Good prices rose 0.5% m/m, but services prices fell 0.1% (against flat last month).

- The sub-categories were mixed, food and fresh food prices higher in y/y terms. Household goods and clothing also rose in m/m terms at a faster pace compared with March.

- A big drag came from education, down -1.2% m/m, while medical care fell -0.3%. Both of these sub categories were up in March in m/m terms.

- Our policy team noted: "Services CPI, a key BOJ focus, were 1.7% y/y in April, slowing from 2.1% in March and indicating that the rise in services prices is weaker than the Bank expected and the corporate price revisions in April were limited. " (see this link).

- Focus going forward may be on whether the education and medical sub-categories reverse April weakness, which weighed on aggregate services inflation. Note next week we get Tokyo CPI for May.

Fig 1: Japan CPI Y/Y

Source: MNI - Market News/Bloomberg

ACGBS: Cheaper, Narrow Ranges, CPI Monthly Next Wednesday

ACGBs (YM -6.0 & XM -6.0) remain cheaper after dealing in narrow ranges in today’s Sydney session.

- The local calendar was empty today apart from Nov-28 supply, which showed firm pricing but with a less aggressive bid.

- Cash US tsys are dealing ~1bp richer in today’s Asia-Pac session after yesterday’s sell-off.

- Cash ACGBs are 5-6bps cheaper with the AU-US 10-year yield differential at -15bps.

- Swap rates are 5bps higher, with EFPs tighter.

- The bills strip has bear-steepened, with pricing -1 to -7.

- RBA-dated OIS pricing is 3-5bps firmer for 2025 meetings. Only 5bps of easing is priced by year-end.

- Next week, the local calendar will see Retail Sales on Tuesday, CPI Monthly, Westpac Leading Index and Construction Work Done on Wednesday, and Private Capital Expenditure and Building Approvals on Thursday. RBA's Hunter will conduct a Fireside Chat on Thursday.

- Next week, the AOFM plans to sell A$600mn of the 1.50% 21 June 2031 bond on Wednesday and A$700mn of the 2.75% 21 November 2029 bond on Friday.

- Looking ahead to Friday's US data calendar, the focus will be on Durables/Cap Goods and the latest UofM Sentiment.

NZGBS: Cheaper, Narrow Ranges, NZ Govt. Budget Next Thursday

NZGBs closed 3-4bps cheaper after dealing in narrow ranges in today’s session. Outside of the previously outlined ANZ Consumer Confidence and Trade Balance data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are dealing ~1bp richer in today’s Asia-Pac session after yesterday’s sell-off.

- Swap rates closed 5-6bps higher, with the 2s10s curve unchanged.

- RBNZ dated OIS pricing is 3-6bps firmer for meetings beyond October, with Mar-25 leading. A cumulative 21bps of easing is priced by year-end.

- (AFR) The New Zealand central bank is leading the world with its unalloyed and politically independent commitment to crushing inflation by imposing a recession and driving up unemployment to put downward pressure on wage growth and rampant services costs. (See link)

- Next week, the local calendar will see Filled Jobs on Tuesday, ANZ Business Confidence on Wednesday, and Building Permits and the NZ Government Budget on Thursday.

- Looking ahead to Friday's US data calendar, the focus will be on Durables/Cap Goods and the latest UofM Sentiment.

FOREX: NZD Tests 0.6100, JPY Continues To Slide, Fed Waller To Speak Later

The BBDXY sits slightly higher for the first part of Friday trade, last trade just above Thursdays highs at 1,253.08. The NZD has been the outperformer again today as the hawkish RBNZ continues to provide support for the currency, while the CHF and AUD are the worst performers, although ranges have been tight.

- NZD/USD hovers just below 0.6100 today, and unchanged for the session. We are still comfortably below the post RBNZ high of 0.6150, however is maintaining the kiwi outperformance theme.

- Earlier, ANZ ANZ Consumer Confidence rose to 3.4% m/m from -5.0% in March, while the trade balance surplus narrowed to $91m from $588m in March.

- AUD/USD is down 0.10% and struggling to break back above 0.6600. The pair is down 1.39% for the week, with AU CPI next week.

- USDJPY has ticked higher throughout the session and holds above 157.00 at 157.09, although slightly below Thursday highs of 157.20. 10Y JGBs rose to 1.005%, the highest level since 2012.

- Looking ahead, UK Retail Sales and The Fed's Waller to speak later today

ASIA STOCKS: HK & China Property Slump On Worries Recent Measures Are Not Enough

Hong Kong & Chinese equities are lower today. HK markets have continued their four day losing streak as investors off-load stocks as US rate cut expectations are pushed back out to December from November, property is the worst performing as investors grow concerned that the most recent measures to support the struggling sector are not enough, while tech stocks are lower on concerns around Alibaba's convertible bond issuance. The calendar was empty for the region today.

- Hong Kong equities are lower today, with property the worst performing sector. The Mainland Property Index is down 4.22%, while the HS Property Index is down 2.98%, HStech Index is down 1.82% while the wider HSI is down 1.24%. In China, the CSI300 is down 0.50%, while the small-cap CSI1000 and CSI2000 Indices have recovered some of the mornings losses to trade down 0.30% and 0.05% respectively, while the growth focus ChiNext Index is down 0.75%

- (MNI) Copper Prices To Fall, Chinese Demand To Remain Flat - (See link)

- (MNI) China Press Digest May 24: Reforms, Tech Listing, Tariffs - (see link)

- Alibaba is aiming to raise $4.5 billion through a convertible bond sale to fund stock buybacks. The sale includes a greenshoe option to increase the deal by $500 million. The proceeds will also support Alibaba's core e-commerce and cloud businesses, which have lost market share due to regulatory crackdowns and internal issues. Alibaba's stock fell 1.2% after the announcement. The bonds will have an annual coupon of 0.25% to 0.75%, a 30%-35% conversion premium, and mature in seven years.

- President Xi has called for deeper reforms in key sectors such as property, employment, and childcare to boost the weakening economy. Xi emphasized that reforms should enhance livelihoods and promote Chinese-style modernization. Xi's comments raise expectations for significant policy measures to be unveiled soon.

- Next week, Hong Kong has Trade Balance data on Monday, Retail Sales on Friday, while China has PMI on Friday.

ASIA PAC STOCKS: Equities Head Lower, US Rate Cut Expectations Are Pushed Out To Dec

Asia markets have tacked US equities lower, following higher than expected US PMIs which caused US yields to push higher as rate cut expectations get pushed out to December from November. Earlier, Japan's CPI beat estimates although it did fall from the month prior, the 10Y yield continues to trade near 1% while the market prices about a 10bps hike for the July meeting, there is little else on the regional calendar today.

- Japanese equities have opened lower today, inflation eased for the second month falling to 2.5% from 2.7% in March, while the yield on 10-year government bonds exceeded 1% as markets anticipate a possible rate hike by the BoJ in July. Despite cooling prices, speculation on further policy tightening persists, with some experts expecting the BOJ to wait until October to raise rates again, potentially increasing pressure on the yen which has slipped back above 157. The Topix is down 0.30%, while the Nikkei 225 is down 1.03%.

- Taiwan equities have followed global markets lower this morning, TSMC lead the decline, although it's off opening lows. China commenced its most extensive military drills in a year around Taiwan on Thursday, increasing pressure on President Lai Ching-te just days after his inauguration. Despite this, markets have remained calm. The Taiex is down just 0.08%

- South Korean equities are lower today amid board risk-off sentiment in the region, Samsung Electronics has been the biggest contributor to the losses and the Kospi is now on track for its worst weekly performance for the month. The Kosdaq is down 0.70%, while the Kospi is down 1%.

- Australian equities are tracking global markets lower, all sectors are in the red other than energy stocks. The ASX200 is down 1%, and is now testing the 50-day EMA, a break below here could signal a move to 7,636 and the 100-day EMA.

- Elsewhere in SEA, New Zealand equities closed down 0.60%, earlier the trade Balance surplus narrowed, Singapore equities have fallen 0.47%, Malaysian equities are down 0.65%, while the Philippines PSEi are down 0.70%, while Indian equities are down 0.20%

ASIA EQUITY FLOWS: Asian Equity Flows Benefit From Nvidia Earnings

- South Korean equity markets were little changed on Thursday after initially opening lower and testing the 20-day EMA for the 2nd straight day. Flows over the past 5 session have been mixed, flows turned positive around Nvidia's sales forecast announcement with the past 5 sessions have seeing a total inflow of $107m. The 5-day average is now just $21m, below the 20-day average of $122m, and well down on the longer term 100-day average at $172m.

- Taiwan equities were a touch higher on Thursday, outperforming other regional markets, as investors bought up Nvidia related stocks in particular supplier TSMC. Foreign investors bought $550m of equities, with the past 5 session seeing a total inflow of $1.4b. Industrial Production was higher than consensus at 14.61% vs 11.25%. The 5-day average now sits at $279m, below the 20-day average at $338m however both are well above the longer term 100-day average at $93m.

- Thailand equities were lower on Thursday, are the SET is now trading below all moving averages, flows over the past 5 session have been mixed with a total inflow of just $10m. Later today we have Gross International Reserves. The 5-day average is now $2m, slightly above the 20-day average at $0.2m and the 100-day average at -$20m.

- Indian equities were higher again on Thursday, making new all time highs. Equity flows have been negative recently, with just a single positive day over the past 13 sessions for a total outflow of $620m for the past 5 sessions. The 5-day average is now -$123m, below both the 20-day average at -$192m and the 100-day average at $21.02m.

- Philippines equities were higher on Thursday equity flow momentum has been mixed recently we have seen a net outflow of $11.10m over the past 5 sessions. The 5-day average is -$2.3m, above the 20-day average at -$14m, while slightly below the 100-day average of -$2.8m

- Malaysian equities were higher on Thursday, and made new all-time-highs. Flows over the past week have been positive, although Tuesday saw a small outflow of $5.6m. Today we have CPI, consensus is at 1.9%, a touch higher than 1.8% in March. The 5-day average now $35m, now above the 20-day average at $33m and well above the longer term 100-day average at $0.65m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 305 | 107 | 15607 |

| Taiwan (USDmn) | 551 | 1396 | 5773 |

| India (USDmn)* | -225 | -319 | -3307 |

| Indonesia (USDmn)** | 0 | -33 | -37 |

| Thailand (USDmn) | -28 | 10 | -1938 |

| Malaysia (USDmn) * | -6 | 177 | 19 |

| Philippines (USDmn) | 4 | -11.8 | -289 |

| Total | 602 | 1328 | 15829 |

| * Data Up To Apr 21st | |||

| ** Public Holiday |

GOLD: Down Sharply Again On Stronger US PMI Data

Gold is little changed in the Asia-Pac session. This comes after bullion slid 2.1% to $2329.27 on Thursday, following the stronger-than-expected US PMI data, which saw markets push back expectations again for the first Fed rate cut later this year.

- US Treasury yields finished up 4-6bps across benchmarks. The 10-year rate was up 5bps at 4.48%.

- US STIR is back to pricing just 35bps of cuts this year, with November no longer fully priced.

- The yellow metal is now around $130 below the record high reached on Monday.

- Although gold has pulled back from its recent high, the medium-term trend structure remains bullish and short-term weakness is considered corrective, according to MNI’s technicals team.

- On the upside, attention remains on $2,452.5 next, a Fibonacci projection. The 50-day EMA, at $2297.2, represents a key support.

- Silver has also pulled back more than 7% from Monday’s high, with the precious metal down another 2.0% yesterday to $30/oz.

ASIA FX: Most USD/Asia Pairs Higher On Broader Dollar Gains, Equity Weakness

USD/Asia pairs are mostly higher. KRW and THB spot weakness has again been evident. USD/CNH has been unable to move above the 7.2600 level in any convincing fashion. Regional equity sentiment is mostly weaker, while the USD is higher against the majors, which have been headwinds for Asia FX. Next week we have China industrial profits on Monday, while official PMI prints are out on Friday. India GDP also prints on Friday next week.

- USD/CNH has been very steady, the pair unable to build on an earlier breach above 7.2600. Onshore USD/CNY spot is around 7.2450, so slightly weaker in yuan terms for the session. This leaves us at marginal fresh highs for May. Yield differentials remained skewed in favor of the USD local equities continue to weaker, with property and tech names weaker.

- 1 month USD/KRW has pushed higher, getting above 1369 before selling interest emerged. May 13 highs rest near 1371, beyond that lies earlier May highs north of 1380. Weaker onshore and regional equities have weighed on the won today. Onshore spot is off around 0.60%, last near 1370.

- USD/THB has continued to gravitate higher, playing catch up with recent USD gains. We were last around 36.70/75, with upside focus on a potential retest of the 37.00 level. We couldn't sustain moves above this level through late April/early May.

- Malaysia CPI was close to expected and remains sub 2% y/y. USD/MYR has risen back to 4.7200 today, around 0.30% weaker in MY terms. Outside of broader USD trends, the softness in oil/commodity prices is likely weighing at the margins for MYR.

- Indonesian markets remain closed today.

ASIA RATES: Cheaper With Global Bond Market Trends

Asian Government Bonds are cheaper in line with recent global market developments.

- China Government Bonds are dealing ~1bp cheaper across benchmarks after onshore media urged local investors to be cautious around speculative trades in the recent ultra-long bond issuance (per BBG).

- Chinese President Xi Jinping urged deeper reforms for some of the country’s key sectors as investors look for hints on major policy shifts designed to prop up a weakening economy. Xi said areas including property, employment and childcare are in need of reform breakthroughs at a symposium in Shandong province on Thursday, according to a report by the Xinhua News Agency. (See link)

- The firmer US yield backdrop is pushing US-CH 2yr yield differentials back close to late April cyclical highs (last +313bps). The 2yr CGB yield yesterday broke below 1.80%, which had marked recent lows. It is currently 1.79%.

- South Korean Sovereign Bonds are also heavy, with yields 1-4bps higher as the market continues to digest the recent BoK policy decision.

- Most sell-side analysts look for BoK easing to commence in H2, albeit with varying views on the timing of the first cut.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 24/05/2024 | 0600/0800 | *** |  | DE | GDP (f) |

| 24/05/2024 | 0600/0800 | ** |  | SE | PPI |

| 24/05/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/05/2024 | 0700/0900 | ** |  | ES | PPI |

| 24/05/2024 | 0700/0900 |  | EU | ECB's Schnabel speech at Germany PhD conference | |

| 24/05/2024 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/05/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/05/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/05/2024 | 1335/0935 |  | US | Fed Governor Christopher Waller | |

| 24/05/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 24/05/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.