-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JGB Futures Continue Squeeze Higher

- JGB futures extend higher into the Tokyo close after breaching last week’s high, with the contract now erasing the bulk of the cheapening observed since the BoJ’s surprise YCC tweak. Futures are also through their 6 Dec base, and now look to the Nov 16 high as the next area of meaningful resistance, +67 on the day. The presence of the BoJ’s initial 5-Year offering through its Funds-Supplying Operations was the catalyst for the bid in the belly to intermediate area of the space.

- Asia-Pac liquidity was majorly impacted by LNY holidays.

- Another round of comments from ECB President Lagarde headline today's limited global docket.

US TSYS: Early Richening Holds In Asia

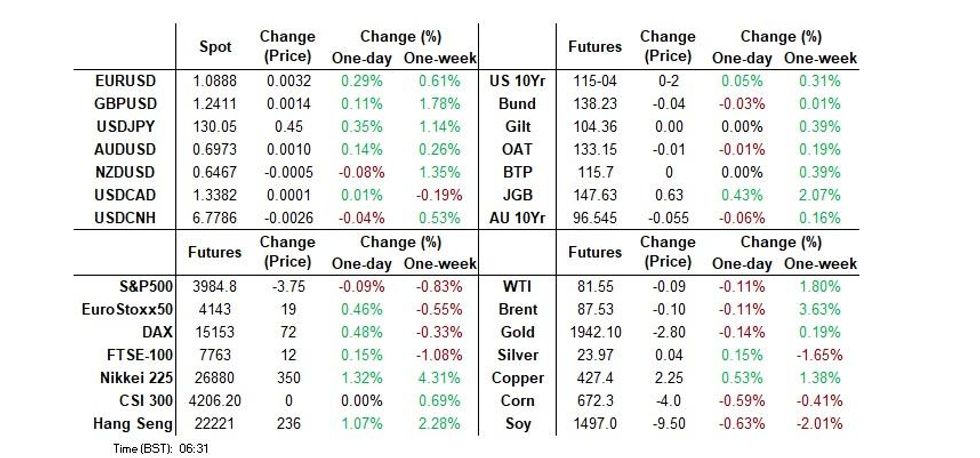

TYH3 deals at 115-05, +0-03+, off the top of its 0-06+ range on volume of ~45K.

- Cash Tsys 1-2 bps richer across the major benchmarks, with the belly leading the bid.

- Tsys were marginally cheaper to start before reversing to deal richer as a bid in JGB futures and a rally in the intermediate zone of the JGB curve spilled over.

- The richening held through the session, a thin data calendar and limited liquidity due to Lunar NY holiday saw early ranges respected.

- Note that WSJ Fed watcher Timiraos' latest piece (released after the start of the Fed blackout period) noted that "Federal Reserve officials are preparing to slow interest-rate increases for the second straight meeting and debate how much higher to raise them after gaining more confidence inflation will ease further this year."

- ECB speak from Lagarde and the U.S. leading index headlines an otherwise thin docket today. Further out, PCE, Jan Preliminary PMIs and Q4 GDP provide the U.S. highlights this week.

JGBS: Futures Push Higher Again, Leaning On BoJ Collateral Operations

JGB futures extend higher into the Tokyo close after breaching last week’s high, with the contract now erasing the bulk of the cheapening observed since the BoJ’s surprise YCC tweak. Futures are also through their 6 Dec base, and now look to the Nov 16 high as the next area of meaningful resistance, +67 on the day.

- The major cash benchmarks are mixed, with the 3- to 10-Year zone running 1-6bp richer, led by 7s. While the super-long end struggled all day, with 30+-Year paper failing to get anywhere near unchanged, sitting 1.5-3.5bp cheaper into the bell.

- Swaps rates were lower as that curve flattened, shedding 1-2bp across the major benchmarks.

- The presence of the BoJ’s initial 5-Year offering through its Funds-Supplying Operations was the catalyst for the bid in the belly to intermediate area of space, There was good demand at the operations, with over Y3tn of bids tendered and ~Y1tn allotted (as prescribed in the announcement of the ops).

- The weekend saw Japanese PM Kishida note that he will nominate a new BoJ Governor next month, while he stressed that it is too early to discuss a potential revision to the government-BoJ accord.

- The minutes of the Dec BoJ meeting, which saw the surprise YCC tweak, revealed that there was a 30 to 40-minute recess of the meeting, at the request of a government official (unusual, but not unprecedented).

- Flash PMI data and a liquidity enhancement auction for off-the-run 1- to 5-Year JGBs headline tomorrow’s domestic calendar.

AUSSIE BONDS: Futures Hold Overnight Losses, ACGBs Look Through Uptick In JGBs

Aussie bonds futures were happy to trade around levels seen late in the final overnight session of last week, looking through some richening in JGBs & U.S. Tsys after outperforming vs. their U.S. equivalents after Friday’s Sydney close (the Asia rally in Tsys chipped away at that outperformance).

- That left YM -4.0 & XM -5.5 at the bell. Meanwhile, wider cash ACGBs were 4-6bp cheaper, with some light bear steepening observed.

- EFPs dealt either side of unchanged through the session, finishing little changed.

- Bills finished 3-4bp cheaper through the reds, in a parallel shift, once again lacking anything in the way of real traction during Sydney hours.

- RBA dated OIS is still showing ~20bp of tightening for next month’s meeting, while terminal cash rate pricing shows just above 3.55% mark, a touch firmer on the day.

- A reminder that the LNY holiday period will thin out broader liquidity during Asia-Pac hours to varying degrees throughout the week.

- Wednesday’s Q4 CPI data headlines this week’s domestic docket, and will be supplemented by PPI, terms of trade, the monthly NAB business survey, Westpac leading index and Judo Bank flash PMIs.

- It is also worth noting that Australian markets will be closed on Thursday for the Australia Day holiday.

NZGBS: Early Cheapening Holds, CPI Eyed

There was little to move the needle for the NZ rates space during Monday’s session, leaving participants to adjust to Friday’s moves in wider core global FI markets.

- That presented a cheapening bias in early trade, with those moves essentially maintained across the curve as the major benchmarks finished the session 9.5-11.0bp cheaper, holding a light steepening bias.

- Swap rates displayed a similar steepening bias, although the moves there were more muted, as the major benchmarks finished 4-6bp higher.

- Liquidity was thinned by a regional holiday in Wellington.

- The key short-term RBNZ dated OIS measures are flat to incrementally higher to start the week, showing 65bp of tightening for next month’s gathering, alongside a terminal OCR of just over 5.45%.

- The Labour party’s Chris Hipkins was chosen to replace outgoing PM Ardern. He is due to be sworn in as PM on Wednesday. Hipkins, Police and Education Minister, was the only one to stand for the position. He has already pointed to a focus on the economy given the well-documented challenges, lining up the potential scrapping of some of Ardern’s policies.

- Looking ahead, Q4 CPI data (Wednesday) provides the highlight of the domestic economic calendar this week, with the latest PSI survey, credit card spending data, trade balance and the monthly ANZ business survey set to supplement the headline release throughout the week.

FOREX: USD Off Lows, JPY Remains A Laggard

The USD has started the week off on the back foot, but dollar indices are up from session lows. The BBDXY last around 1222.90 (-0.15%), versus a low of 1221.10. US cash Tsy yields were firmer at the open but have reversed course through the session, now -1-2bps weaker across the curve. Regional equities, for those markets that are open, are mostly higher, but US futures are slightly down (-0.10%).

- USD/JPY remains somewhat volatile, with dips in the pair supported. We got close to 129.00, but now sit higher at 129.75/80. There was interest in the BoJ 5-yr loan operation, although it looks as though the rate remained positive. The Dec BoJ minutes didn't cause sentiment to shift. US-JP 10yr swap spreads remain skewed in favor of higher USD/JPY levels.

- Yield momentum remains in favor of EUR/USD tough. The pair broke above 1.0900 and sits just below this level currently. This is highs back to April last year. GBP/USD has also firmed, last around 1.2425, also multi-month highs.

- AUD/USD is back within sight of 0.7000, last around 0.6985/90. Metal commodities are higher, but no doubt liquidity is impacted by LNY holidays for China and other markets like Singapore.

- NZD/USD outperformed early but is now back at 0.6475/80, highs for the session were at 0.6500.

- Coming up, there is some ECB speak, including Lagarde, while on the data front its second tier released.

FX OPTIONS: Expiries for Jan23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-25(E1.3bln), $1.0800-25(E1.0bln), $1.0900-25(E1.3bln)

- USD/JPY: Y135.65($526mln)

USD: Yield Momentum & Global Growth Expectations Weighing On The USD

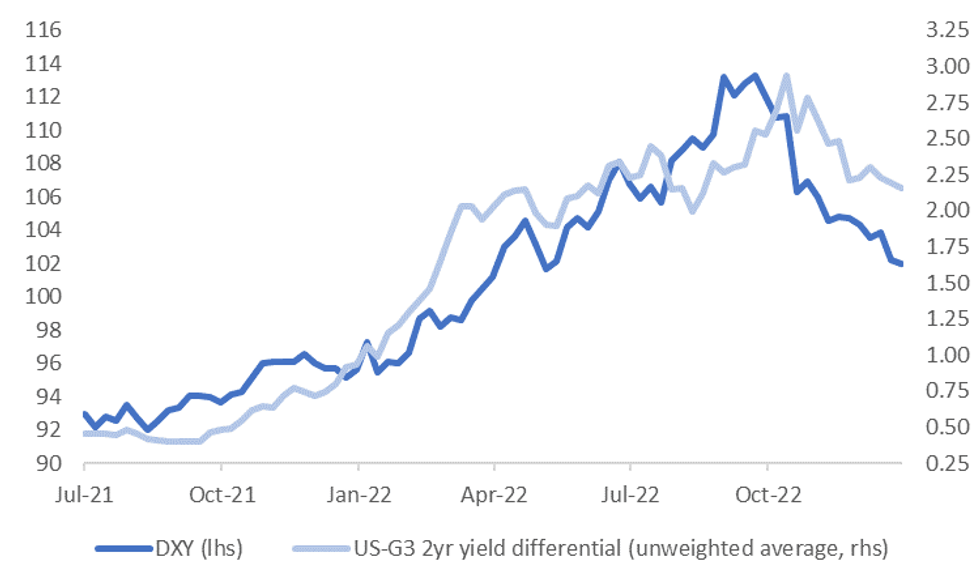

The USD is starting the week off on the back foot. The BBDXY remains off by 0.20% at this stage, around the 1222.40 level, the DXY is off by slightly more, -0.30%, due to the higher EUR weigh in the index. Broadly the USD continues follow yield momentum lower. The first chart below plots the DXY against the unweighted 2yr government bond yield differential with the G3.

- Visually, the DXY looks to have moved too much off its 2022 peak relative to yield trends, although trends in the series continue to match up with each other reasonably closely.

- The most notably compression has been in US-EU spreads, which have fallen by nearly 100bps in the 2yr government bond yield space since the USD peaked. For Japan, moves have obviously been more evident at the back end.

- The other positive for the EUR has been the continued recovery in the terms of trade proxy. Both this factor and yield momentum still point to higher EUR levels from here.

Fig 1: DXY & US-G3 Yield Differential

Source: MNI - Market News/Bloomberg

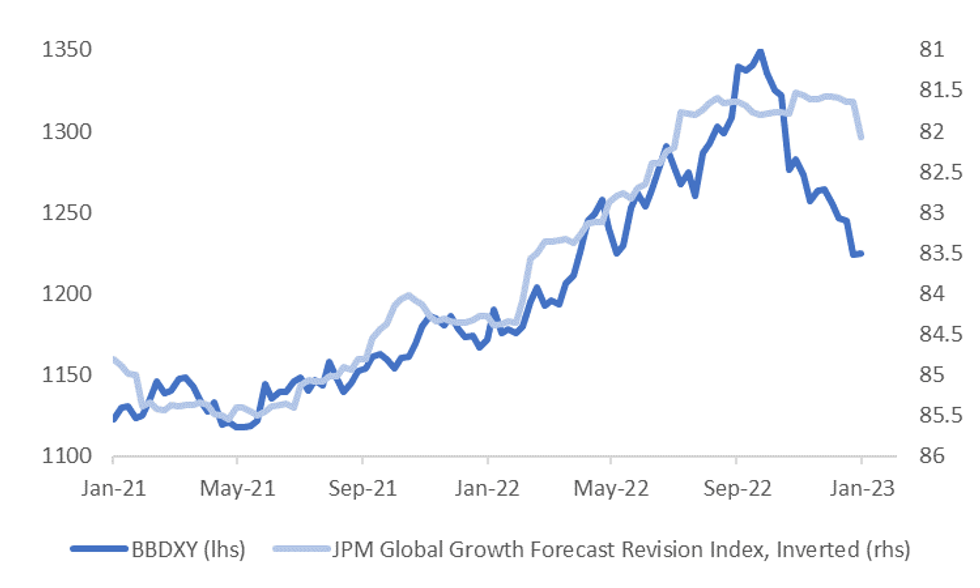

- The other factor to be mindful of is the improvement in global growth sentiment. Last week the J.P. Morgan Global Growth Forecast Revision Index (FRI) rose noticeably. The second chart below plots this index (inverted on the chart) against the BBDXY index.

- Downward revisions to global growth expectations were a USD positive through 2021 and 2022.

- Whilst US growth expectations were nudged higher last week, so too were China and EU prospects. Indeed, the consensus for China growth this year sits at 5.0%, up from 4.8%.

- China markets are closed this week, however, we will get fresh updates on the global outlook in terms of preliminary PMIs for January for the EU and the US.

Fig 2: J.P. Global Growth FRI (Inverted) & BBDXY

Source: J.P. Morgan, MNI/Market News/Bloomberg

NZD: Bullish Trend Intact, Consolidating Gains Above $0.64

NZD/USD is up ~5% from lows seen in early January. The pair has consolidated gains above $0.64, a level we had previously flagged earlier this month.

- The pair now looks for a close above $0.6468, the high from August 2022. Bulls have had several tests above this level last week, but have struggled to hold gains, however we are trading above this level today.

- A bullish technical trend remains in place, a close above current levels opens the Jan 18 high at $0.6530 and the 123.6% Fibonacci projection of the Oct-Dec rally at $0.6752.

- Bears look to break the 20-day EMA at $0.6378, a break through here opens the 200-day EMA at $0.6275.

- The 2 year NZ US Govt bond yield spread is a touch off levels seen last week as the spread continues to moderate after breaching +60bps in mid December. NZD/USD is outperforming relative yield spread trends over this period. The better tone to global equities is providing an offset though.

- The relative rates outlook remains mixed for both NZD and USD. OIS markets show NZ OCR peaking at ~5.4% in mid 2023, with ~35 bps of cuts priced in for H2 2023. Fed Funds Target Rate is priced to peak at ~4.9% in OIS markets with ~40bps of cuts priced in for H2 2023.

Source: Market News International (MNI)/Bloomberg

ASIA FX: USD/Asia Pairs Lower, But Limited Follow Through

USD/Asia pairs have had a relatively quiet start to the week with many markets closed for LNY celebrations. The tone has been a softer USD one, in line with the majors, although moves have reversed somewhat this afternoon.

- USD/THB got sub 32.60, but is now tracking back above 32.70. This is back above Friday lows and lows seen on Jan 16. Friday saw decent portfolio outflows, although mainly from offshore holders of local bonds. The market has been happy to sell USD/THB upticks this year, we saw recent resistance around 33.00/33.20.

- USD/INR fell in early trade, down sub the 81.00, but we sit slightly higher now, back at 81.16. Reuters reported that state banks were suspected of buying USDs, which has likely curbed INR gains. The data calendar is empty this week.

- Elsewhere, USD/PHP spot is sub 54.50, but ran into support around the 54.30 level. this is still fresh lows back to June last year.

- USD/CNH dipped amid broader USD weakness (low of 6.7633), no doubt in reduced liquidity, but we stayed within recent ranges and are back at 6.7750/60 now.

EQUITIES: Firmer Bias Amid LNY Impacted Markets

For those markets that are open in the region, the trend has mostly been a positive one today. This follows a firmer end to the week for US/EU markets on Friday. US futures are lower, but not far from -0.10% at this stage.

- A lot of major markets remain closed tomorrow for LNY, including China, Hong Kong and Singapore.

- Japan equities are higher, with the Nikkei 225 up 1.3%, as tech shares continue to outperform, amid expectations of a slower pace of Fed hikes.

- The ASX200 is slightly higher, +0.10% at this stage.

- Indian markets are higher, last around 0.70/0.75% higher. Better earnings in the financial sector have buoyed momentum.

- Philippines stocks are bucking the firmer trend, with the main bourse off -0.65% at this stage.

EQUITIES: MNI US EARNINGS CALENDAR - Quarter of S&P500 Market Cap Due in Coming Week

EXECUTIVE SUMMARY

- Pace of earnings picks up in the coming week, with just under a quarter of the S&P 500's market cap set to report

- Microsoft, Chevron, Tesla, Johnson & Johnson make up the highlights

- Earnings season reaches critical mass in the first week of February, during which over half the index's market cap will have reported.

- Full Schedule including timings, EPS & revenue expectations here: MNIUSEARNINGS200123.pdf

GOLD: Can't Break To Fresh Highs, ETF Positioning Remains Stagnant

Gold threatened fresh highs in the early part of trade as the USD was on the back foot. The precious metal breached $1935, but is now back sub $1930, as USD sentiment has stabilized somewhat. We are still higher for the session, but only modestly at +0.15%.

- The technical backdrop still looks supportive, even if the rate of gains have slowed. Moves back to $1900 should still generate some support, while the rising 20-day EMA sits back at $1873.

- CFTC net non-commercial longs rose further but at a more modest pace compared to the first half of January (+2.7k).

- Gold ETF positions also remain stagnant.

OIL: Prices Ease On Thin Trading, Attention On Russian Supply

Crude has been supported by increased purchases by China and the expected end of outsized Fed hikes. Both Brent and WTI are above their 50- and 100-day moving averages. Oil prices have eased today by around 0.3% to $81.37/bbl for WTI and $87.33 for Brent but have remained in a tight range of less than a dollar on thin trading due to Lunar New Year holidays. DXY has eased 0.2%.

- Brent traded at a high of $87.82 during today’s session, testing key short-term resistance of $87.85, the January 18 high. WTI also approached its resistance at $82.38. On the downside attention is on $77.75, the 20-day EMA.

- There is attention on Russian fuel exports as the February 5 deadline approaches for the implementation of the G7 & EU price cap. Russia has said that oil companies will need to monitor the rules surrounding the cap. International sanctions are expected to weigh on Russian drilling this year. In addition, US Treasury Secretary Yellen said that she believes it’s possible for restrictions to be extended to Russian refined products, although it would be more complicated.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2023 | 1430/1530 |  | EU | ECB Panetta Into at ECON Hearing | |

| 23/01/2023 | 1500/1000 | ** |  | US | leading indicators |

| 23/01/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2023 | 1745/1845 |  | EU | ECB Lagarde Speech at Deutsche Boerse |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.