-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JGB Futures Hit Fresh Cycle Lows, Aust Retail Sales Miss

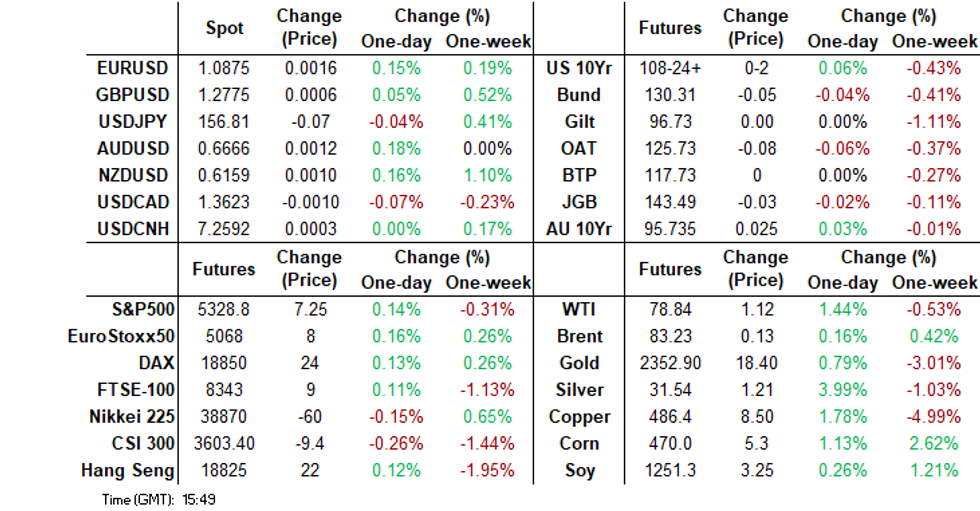

- The USD has remained on a softer trend, albeit amidst a light news day, as US and UK markets return after yesterday's respective holidays. US Treasury futures have traded in tight ranges today, TU is + 00.875 at 101-15+, while TY is + 02+ at 108-25.

- Japan yields have continued to climb, with JGB futures hitting fresh cycle lows. Tomorrow, we have BoJ speak.

- On the data front, Japan's services PPI was stronger. In Australia retail sales missed - the level of retail spending has been moving sideways for a year and half supported by higher prices but in real terms or per person it is contracting.

- Looking ahead, the Fed's Kashkari, Cook and Daly speak later on. In terms of data, US March house price and May Conference Board consumer confidence data are released.

MARKETS

US TSYS: Treasury Futures Steady, Fed's Mester & Bowman Speaking In Tokyo

- Treasury futures have traded in tight ranges today, TU is + 00.875 at 101-15+, while TY is + 02+ at 108-25.

- Tsys Flow: Block seller of FV at 105-28

- Cash treasury curve is slightly steeper today with the 2y -1.1bps at 4.935%, while the 10Y is -0.6bp at 4.459%, the 2y10y remains below the trend line and the 200-day EMA, but 1bps higher than recent lows at -47.75bps, vs Dec lows of -56bps

- Across local rate markets: ACGB curve is flatter, yields are 0.5-1.5bps lower, NZGB curve is little changed, yields are about 3bps higher, while JGB curve is slightly steeper, yields are flat to 2bps higher with the 10Y now 1.031%.

- Currently, The Fed's Bowman & Mester, and the ECB's Schnabel are speaking at the BOJ-IMES event in Tokyo

- Today, FHFA House Price Index, Conf. Board Consumer Confidence & Dallas Fed Manf. Activity

JGBS: Another Cycle High For The 10yr JGB Yield, BoJ Speak On Tap Tomorrow.

JGBs fell post the lunchtime break, getting to fresh cycle lows of 143.38. We sit slightly higher now, last at 143.43, -.09 versus settlement levels.

- The 10yr climate bond auction saw a yield slightly higher than the BBG surveyed outcome (1.04%, versus 1.035%), which may have applied some downside pressure post the lunch time break.

- 143.44 is the bear trigger for JGB futures per the MNI technical team. A convincing break sub this level could see 141.65, a Fibonacci projection, targeted.

- In the cash JGB space, we ticked up in terms of the back end of the yield curve. The 10yr holds close to 1.04%, the 30% yr is above 2.19%. The 10yr swap rate is nearing 1.07%.

- News flows has been fairly light, with FinMin Suzuki crossing the wires earlier, with comments on FX and wage growth outpacing inflation the major focus points. Earlier we had stronger than forecast PPI services data for April.

- Tomorrow, we just have the May consumer confidence index on tap. Also note BoJ Board member Kumamoto speaks in the morning.

- The latest from our MNI policy team on the BOJ can be found at this link.

AUSSIE BONDS: ACGBs Little Changed, Retail Sales Miss Estimates

ACGBs (YM +0.0 & XM +0.5) are little changed today as we trade near session lows. the yield curve is slightly flatter this morning. Earlier today, retail sales missed estimates while tomorrow we have Westpac Leading Index.

AUSTRALIAN DATA: Retail Sales Continue Moving Sideways

Retail sales were slightly weaker than expected in April rising 0.1% m/m after falling 0.4%. Annual sales growth improved to 1.3% y/y from 0.9% as retail spending fell 0.3% m/m in April 2023. The level has been moving sideways for a year and half supported by higher prices but in real terms or per person it is contracting. The April data hasn't altered this trend and so is unlikely to affect the RBA's stance.

- April’s positive result was driven by a 1.6% m/m bounce in other retailing, household goods +0.7% and restaurants +0.3%. Food retailing fell 0.5% m/m but is still up 2% y/y and clothing -0.7% m/m to be down 2.5% y/y.

- The ABS noted that there was added volatility over March/April due to the early Easter, which impacted food & beverage purchases, and different timing of school holidays between states.

Source: MNI - Market News/ABS

RBA: Consensus Expects First Rate Cut In Q4 And 100bp In 2025

With the RBA maintaining its neutral stance and “not ruling anything in or out” and significant uncertainty over when inflation will return to the band, it is not surprising that there is a variety of views as to when the easing cycle will start (see table). The RBA has made it clear that it is still too early to discuss rate cuts and very few in Bloomberg’s May survey expect a move before end-2024.

- The median forecast in Bloomberg’s May 22 survey is for the first 25bp RBA cut in Q4 2024 with another 100bp by Q4 2025. There is a range of projections with Q4 2024’s 3.6-4.6%, but only one forecasting a hike, and Q4 2025’s 2.85-3.85%. 5/35 analysts expect the first rate cut in Q3 this year.

- The major local banks are forecasting the first rate cut in November this year, which will be a meeting with updated projections. They are not in agreement though as to how much easing there will be in 2025 with CBA, Westpac and NAB all expecting 100bp but ANZ thinking it will be 50bp and Macquarie 75bp.

- A number of major international banks are not forecasting the first rate cut until Q1 2025, including UBS, Morgan Stanley and JP Morgan. HSBC is more hawkish timing easing for Q2 and noting that there is a risk that the next move will be a tightening.

- The federal election is due by May 2025 and the timing of that may impact the start of the easing cycle so the RBA maintains its independence.

Source: MNI - Market News/Bloomberg

NZGBS: Slightly Cheaper, Business Confidence Wednesday

NZGBs closed slightly cheaper, with the curve flatter ranges were narrow and yields finish near session highs. There was little in the way of local headlines today, we the market focused on the NZ Budget and US GDP on Thursday.

- The NZGB curve is flatter, the 2Y +3.2bps at 4.909%, 10Y is +2.8bps at 4.800%. While the US-NZ 2Y swap 3bps lower at -24bps, off yearly highs -5.5bps made earlier this month.

- Swap rates are 1-4bps higher

- The RBNZ will implement Debt-to-Income (DTI) restrictions starting July 1, limiting high-DTI lending by banks. The restrictions apply to new residential property loans for both owner-occupiers and investors.

- Filled jobs rose 0.1% m/m in April, vs a revised 0.3% rise in March down from 0.4%. Filled jobs rose to 2.404m from a revised 2.402m

- RBNZ dated OIS pricing is little changed today. A cumulative 20bps of easing is priced by year-end.

- Looking Ahead: ANZ Business Confidence & Activity Outlook On Wednesday

NEW ZEALAND DATA: Filled Job Growth Lagging Population Increase

NZ filled jobs rose 0.1% m/m in April to be up 1.4% y/y down from 0.3% m/m and 1.8% y/y in March. The pickup was driven by goods-producing industries with services flat and primary industries falling. Filled jobs have continued to rise even though total employment fell 0.2% q/q in Q1 but layoffs have been limited to date. With SEEK job ads down almost 30% y/y in April, labour demand is cooling sharply. Filled job growth is running well below working population at 3.1% y/y signalling that unemployment is likely to rise further thus continuing to ease capacity pressures. Q1 was the sixth consecutive quarterly rise and it is now up 30.1% y/y.

NZ labour market y/y%

Source: MNI - Market News/Stats NZ/Refinitiv

*Q2 filled jobs is the April outcome

FOREX: USD Remains Softer, Higher Beta FX Outperforming Marginally

The USD BBDXY index sits down around 0.10% in the first part of Tuesday trade, back close to the 1246.4 level. USD weakness has been fairly uniform against the majors, albeit with high beta FX outperforming modestly.

- NZD/USD was the early outperformer but AUD gains have caught up as the session progressed. The AUD/NZD appeared to find some support ahead of the 1.0800 level (now back at 1.0825/30).

- We had Aust, NZ and Japan data, but nothing that shifted the sentiment needle materially. Aust April retail sales were a touch below expectations (up 0.1% m/m), while April PPI services for Japan rose 2.8y/y% (against a 2.3% forecast).

- AUD/USD was last near 0.6670, while NZD/USD is around the 0.6160 level, still a fresh multi month high for the Kiwi back to mid March.

- USD/JPY sits slightly lower, last near 156.70, but well within recent ranges. FinMin Sukuzi was on the wires earlier, with familiar rhetoric around FX markets.

- In the cross asset space, we have had firmer US equity futures (a USD negative), although the regional equity tone is more mixed. US yields sit slightly lower, led by the front end.

- Looking ahead, we currently have Fed’s Bowman and ECB Schnabel headlines (who are speaking in Japan) crossing. Then later Kashkari, Cook and Daly appear. In terms of data, US March house price and May Conference Board consumer confidence data are released.

ASIA STOCKS: China & Hong Kong Equities Mixed, Property Pares Gains

Hong Kong & Chinese equities are mixed today, while ranges have been tight. Property stocks initially opened higher on the back of Shanghai announcing relaxation of lending and down payments although we have since given up those gains on the back of Logan delaying a vote to suspend repayment on some onshore bonds, Citi say's gaming stocks look cheap as they are trading at 9x 1yr forward EV/EBITDA while China has setup a semiconductor funds after the US imposed tariffs on the sector.

- Hong Kong equities are mixed today, property names are now the worst performing sector with the Mainland Property Index down 0.80%, while the HS Property Index is down , while the HS Property Index is down 0.5%, HStech Index is up 0.40%, while the wider HSI is up 0.30%. In China, the CSI300 is down 0.25%, while the small-cap CSI1000 and CSI2000 Indices are both down 0.40%, and the growth focus ChiNext Index is down 0.75%

- MNI China Press Digest May 28: Housing, FTA, Integrated Circuit - (See link)

- in the property space, Logan has postponed the deadline for voting on its proposal to halt repayment on certain yuan bonds. The new deadline is June 3, extended from May 27, to gather more support. The company has already secured backing from creditors for suspending repayments on other bonds. Initially, on May 10, Logan requested bondholders to vote on a plan to suspend payments on all of its onshore public debt for 10 months

- Shanghai has lowered down payment ratios and minimum mortgage thresholds to support its property sector, reducing down payments to 20% for first-time buyers and 30% for second-home buyers. This follows a central government initiative, including a 300 billion yuan funding package, to aid the property market after April saw the steepest home price decline in a decade. The central government has empowered local authorities to adjust down-payment ratios and mortgage rates. In September, Shanghai had already eased the minimum down-payment requirements and mortgage thresholds for certain housing types, as per BBG

- China has established its largest semiconductor investment fund, Big Fund III, with 344 billion yuan to boost its domestic chip industry amidst escalating US restrictions. This fund underscores Beijing's push for technological self-sufficiency, with significant contributions from the central government and state-owned enterprises, as tensions with the US over advanced chip access continue to rise.

- Looking ahead: China PMI on Friday, for Hong Kong we have Trade Balance later today, and Retail Sales of Friday

ASIA PAC STOCKS: Asian Equities Mixed As Markets Seek Direction

Asia markets are mixed today, it has been a very quiet session ranges have been very tight with the US and UK out on Monday as markets look for some direction. Shortly the Fed's Mester and Bowman will speak at a BoJ events, while earlier today Australian Retail sales came in below estimates, Japan April PPI Services was higher than estimates. Taiwan markets are the top performing in the region, as they continue to see the greatest inflows in the region.

- Japanese equities are mostly lower today, the yen is a touch stronger at 156.78 largely on the back of a weaker USD. Earlier we had PPI Services was 2.8% vs 2.3% est, there is little else in the way of economic data today or market headlines. Focus will turn to the BoJ-IMES Conference where Fed speakers are about to speak. The Topix is unchanged while the Nikkei 225 is down 0.15%

- Taiwan equities are slightly higher today, while Taiwan was the only market in the region to see inflows on Monday. This week focus will be on GDP data due out on Thursday. The Taiex continues to make new all time highs, and is up 0.36% today.

- South Korean equities are higher today. We just had store sales data out with department store sales were -2% y/y in Apr, vs a 8.9% rise in March, discount store sales were -6.7% y/y in April, vs a 6.2% rise in March, while retail sales were 10.8% y/y vs 10.9% in March. Equity flows continue to slow, with just $143m of inflows over the past 5 sessions. The Kospi is 0.05% higher today and now trades back above all major moving averages.

- Australian equities are lower today, earlier Retail sales missed estimates coming in at 0.1% vs 0.2% est. Financials and Health care stocks are the worst performing, offsetting gains made in Materials, with the ASX200 down 0.25%

- Elsewhere in SEA, New Zealand equities are down 0.55%, Singapore equities are 0.36% higher, Indonesian equities are 1.15% higher, Malaysian equities are down 0.15%, while the Philippines PSEi is down 0.70%

ASIA EQUITY FLOWS: Regional Equity Flows Turn Negative

- South Korean equity markets were higher on Monday along with the KRW as strong demand and sales forecasts from chip makers help support the local market. Today we have Store Sales and Retail Sales data due out, but that is unlikely to move markets. Equity flows have been mixed recently, and have significantly underperformed Taiwan's in a sign the recent rally and inflows on the back of the policy announcements around the "Corporate Value-Up" program may have run out of steam. The 5-day average is now just $28.5m, below the 20-day average of $86m, and well down on the longer term 100-day average at $165m.

- Taiwan equities were higher on Monday, flows remain positive but Monday did see a decent drop from the days prior, with just a $90m inflow, taking the prior 5 trading sessions to a total inflow of were positive with a $316m inflow, Foreign investors have been better buyers recently, with the past 5 session seeing a total inflow of $1.93b. Focus this week will be on GDP on Thursday. The 5-day average now sits at $387m, below the 20-day average at $372m however both are well above the longer term 100-day average at $91m.

- Thailand equities were slightly higher on Monday, are the SET has been trading directionless since mid October. Equity flow momentum has been negative in the short-term, over the past 5 session have been negative for a total outflow of -$163m. Focus this week will be on BoP Current Account Balance on Friday. The 5-day average is now -$32m, below the 20-day average at -$5m and the 100-day average at -$19m.

- Indian equities were a touch lower on Monday, and just off recent all time highs. Equity flows have been mixed recently, although we are positive for the past 5 trading sessions for a total inflow at $556m. The 5-day average is now $111m, below both the 20-day average at -$126m and the 100-day average at $21m.

- Philippines equities were lower on Monday, the local market has been marking lower highs and higher lows over the past month, while equity flow momentum has been mixed recently we have seen a net outflow of $13m over the past 5 sessions. The 5-day average is -$2.6m, above the 20-day average at -$15.5m, while slightly below the 100-day average of -$2.9m

- Malaysian equities were slightly lower on Monday, and just of recent all time highs, equity flows have been positive recently with the past 5 trading sessions netting an inflow $140m, It's a quiet week for economic data in the region. The 5-day average now $28m, now above the 20-day average at $35m and well above the longer term 100-day average at $1.4m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -56 | 143 | 15319 |

| Taiwan (USDmn) | 91 | 1939 | 6180 |

| India (USDmn)* | -113 | 557 | -2712 |

| Indonesia (USDmn)** | -82 | -114 | -119 |

| Thailand (USDmn) | -29 | -164 | -1990 |

| Malaysia (USDmn) * | -16 | 140 | 104 |

| Philippines (USDmn) | -8 | -12.9 | -294 |

| Total | -214 | 2488 | 16489 |

| * Data Up To Apr 24th |

OIL: Crude Stronger As Commodities Higher & Geopolitical Jitters Resurface

Oil prices are stronger again today rising with most other commodities on a weaker US dollar (USD index -0.1%). Tensions between Israel and Egypt on the Rafah border have supported crude in particular. WTI has approached $79/bbl and is 1.6% higher at $78.92 after an intraday high of $78.95. Brent has held above $83 and is up 0.3% to $83.32, close to the intraday high.

- Geopolitics came into play again with an Egyptian soldier killed in an unusual altercation with Israel on the Gaza border. Israel took control of the Rafah border crossing three weeks ago. An investigation is now taking place. Although geopolitical tensions are never far away, the conflict in Gaza has not disrupted oil flows although Houthi attacks on shipping in the Red Sea have resulted in increased shipping times as vessels go around southern Africa.

- Today the Fed’s Mester & Bowman and ECB’s Schnabel speak from Japan and then later Kashkari, Cook and Daly appear. In terms of data, US March house price and May Conference Board consumer confidence data are released.

GOLD: Holding Monday Gains As USD Weakness Continues

Bullion hasn't spent too much time outside of the $2350/$2355 range so far today, largely tracking sideways. This keeps us reasonably close to Monday session highs ($2358.55) and holding gains seen from that session (+0.73%).

- We last tracked near $2351.4, which is close to the 20-day EMA ($2354). Lows from last week rest near $2325.5. Upside focus will remain on recapturing the $2400 handle.

- Cross asset moves have been supportive in terms of weaker USD backdrop since the start of the week, with the BBDXY down a further 0.15% in the first part of Tuesday trade. US yields also sit off recent highs.

- These moves haven't translated into further gold gains today, but have likely kept dips supported

ASIA FX: CNH & IDR Lag Softer USD Trend, KRW & PHP Outperform

USD/Asia pairs sit lower across the board for the most part. USD/CNH has been relatively steady, while USD/IDR has risen a touch (being the main exceptions). KRW and PHP spot gains have been the outperformers. Support has come from a weaker USD trend against the majors, while regional equity sentiment has been mixed. The regional data calendar remains fairly light tomorrow.

- The USD/CNY fix rose back above 7.1100, but didn't breach recent highs. USD/CNH probed above 7.2600 post the outcome, but there was no follow through. The pair last tracked around 7.2590, little changed for the session. Property shares opened higher, following an easing of restrictions in Shanghai yesterday, but we sit away from session highs.

- 1 month USD/KRW got to lows of 1353.56 before finding some support. We last tracked near 1356.5, still 0.20% stronger for the session in won terms. The won has seen support from higher beta FX gains in the G10 space. Local equities are down slightly.

- USD/PHP is back sub 58.00, the pair last in the 57.90/95 region. We are up around 0.30% in PHP terms so far today. Only KRW is up more in terms of Asia FX gains against the USD. Recent highs in the pair rest in the 58.25/30 region. Outside of broader USD softness and some decline in yields, PHP gains may be reflective of increased focus from the central bank. Senior BSP Assistant Governor Sicat stated yesterday the weakness was only likely to be temporary, while the broad range expected for USD/PHP was 55.00-58.00 (the central bank said in its monetary policy report for May). Still, a sense that the BSP may ease before the Fed, with Finance Secretary Recto stating yesterday the first cut may come in Q3, could keep USD/PHP dips supported.

- USD/IDR has firmed back towards 16100, around 0.20% weaker in IDR terms. There hasn't been a clear catalyst for rupiah weakness so far today. Some catch up after markets were shut in the latter half of last week may be a factor, particularly ahead of month end.

- Elsewhere, USD/THB sits around 0.20% weaker, last near 36.55.

INDONESIA: INDON Sov Curve Flattens, Spread Little Changed, IDR Bond Auction Shortly

The INDON sov curve has flattened today, it has been a quiet day, later today Indonesia will sell 5yr-30yr IDR bonds.- The INDON curve has twist-flattened yields are -/+ 1bps, the 2Y yield is -1bps at 5.27%, 5Y yield is 1bp higher at 5.10%, the 10Y yield is 1bps lower at 5.20%, while the 5-year CDS is unchanged at 72bps.

- The INDON to UST spread diff the 2Y is now 35.5bps, 5yr is 59bps, while the 10yr is 73bps.

- In cross-asset moves, USD/IDR is 0.17% higher at 16,093, the JCI is up 0.99% Palm Oil is 1.86% higher, while US tsys yields are about flat to 1bps lower.

- Indonesia's state budget had a surplus of 75.7 trillion rupiah (0.33% of GDP) in April. State revenue fell by 7.6% year-on-year to 924.9 trillion rupiah, with tax revenue down 9.3% and non-tax revenue down 6.7%, while customs and excise revenue increased by 1.3%. State expenditure rose by 10.9% to 849.2 trillion rupiah, and budget financing dropped by 68.3% to 71.1 trillion rupiah. The government is preparing for global risks including prolonged high interest rates, commodity price volatility, and geopolitical issues.

- Looking ahead, calendar is empty for the week

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/05/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 28/05/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 28/05/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/05/2024 | 1355/0955 |  | US | Minneapolis Fed's Neel Kashkari | |

| 28/05/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/05/2024 | 1400/1000 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/05/2024 | 1400/1000 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 28/05/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/05/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/05/2024 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 28/05/2024 | 1705/1305 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.