-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: CAD, MXN Weaken On Tariff Threat, JPY Firms

MNI EUROPEAN MARKETS ANALYSIS: Lack Of Deals A Concern, DXY Lower Again

- Brexit worry and the lack of fiscal movement in DC headline, with caution surrounding both matters deepening since European markets closed on Thursday.

- Core bond and equity markets drift through Asia-Pac trade.

- DXY edges back towards cycle lows during a macro-light Asia-Pac session.

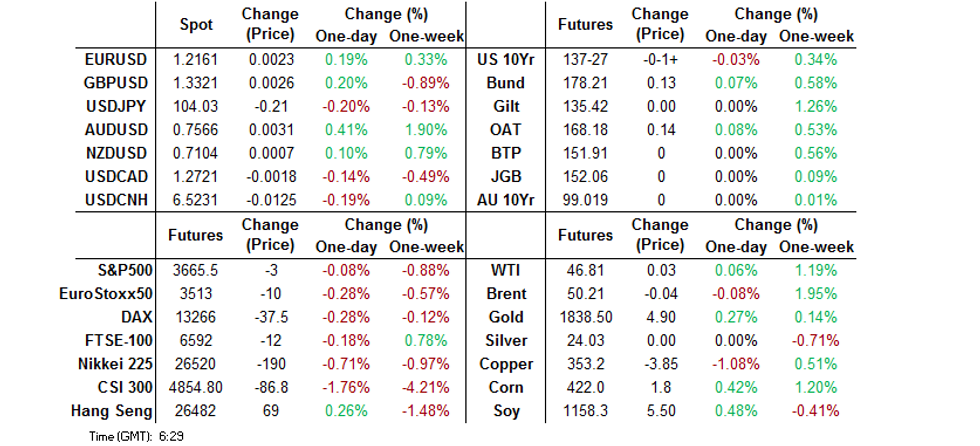

BOND SUMMARY: Another Narrow, Mixed Asia Session For Core FI

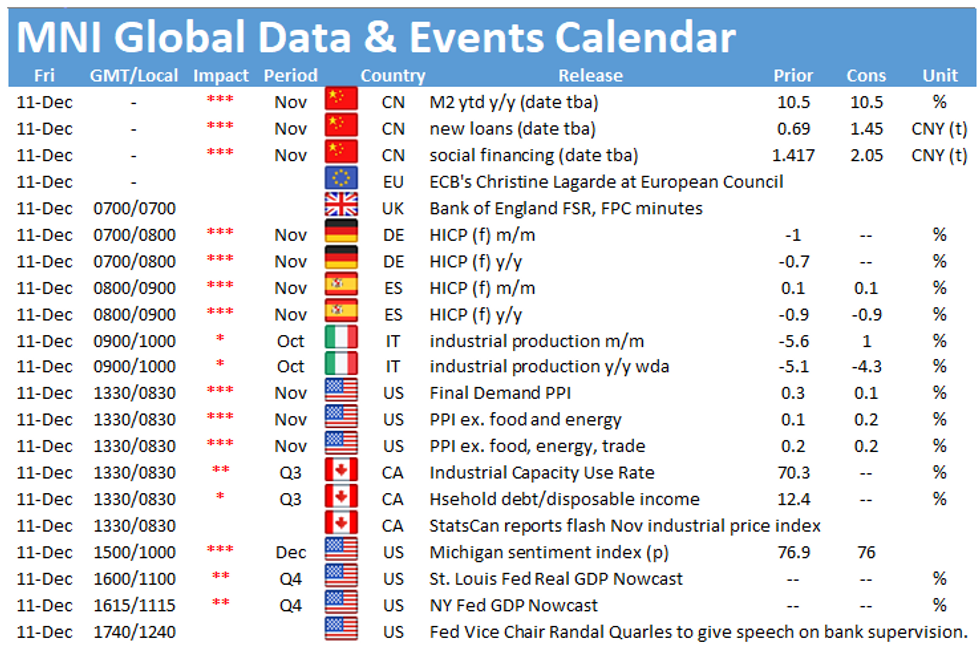

Very modest twist steepening was seen in Asia-Pac cash Tsy trade, although 30s only sit 0.7bp cheaper vs. Thursday's closing levels. Macro headline and market flow was light, with participants seemingly happy to await developments surrounding the well-documented headline risk factors in play at present. T-Notes last -0-01 at 137-27+, with the contract holding to a narrow 0-02 range thus far, on volume of 41K. Eurodollar futures are little changed vs. settlement through the reds, with a 15K screen seller of EDH1 providing the highlight on the flow side overnight. PPI & UoM sentiment data headline the local docket on Friday, with one eye on whether the Senate manages to pass a vote on the stopgap funding measures that would prevent a government shutdown (they were expected to vote on Thursday, but some last minute objections have created some issues).

- JGB futures held a narrow range during the morning session, before nudging higher in early afternoon trade/backing off into the close, with futures closing +3. Cash trade saw the long end of the cash curve continue to benefit from expectations surrounding a lower JGB issuance burden vs. what some had feared, before some modest cheapening into the close. The BoJ left the size of its 1-10 Year JGB purchases unchanged, with the following offer/cover ratios seen: 1-3 Year: 2.33x (prev. 2.77x), 3-5 Year: 1.67x (prev. 2.82x), 5-10 Year: 2.03x (prev. 2.51x). The moderation in the cover ratios seemed to be the supportive factor for futures and paper out to 10 Years in early afternoon trade.

- The long end of the Aussie cash curve backed off firmest levels of the day, but outperformed for most of the session. More broadly, continued focus falls on the negative net supply picture promoted by RBA ACGB purchases, while the AOFM issuance hiatus until calendar '21 provides further fuel to that fire (albeit with some semi-government bond issuance sprinkled in thus far). YM finished -0.6, with XM unch. Local COVID-19 vaccine issues headlined on the news flow front, but the government tried to play down any worry, pointing to a fresh order of offshore vaccines.

FOREX: USD Extends Losses After Mixed Asia Session

Asia saw little in the way of market-moving headlines, with the U.S. fiscal stalemate and looming Brexit deadline providing the main albeit familiar points of interest. The greenback landed at the bottom of the G10 scoreboard, while the DXY traded through Thursday lows and seems poised to finish the week on the back foot. A round of USD/JPY sales into the Tokyo fix may have inspired some broader greenback weakness early on.

- AUD and NOK remained buoyant in the wake of yesterday's strong showing from the commodity space. AUD surged to its best levels vs USD in almost two and a half years, while also easily outperforming its Antipodean cousin. NZD struggled for any topside impetus, so did CHF, reflecting the mixed character of the session.

- In Asia, CNH firmed up even as the PBoC set its central USD/CNY mid-point slightly above the BBG estimate. KRW was the worst performer in the region, despite a strong exports print in South Korea's early trade report. USD/MYR slipped and found itself within touching distance from YtD lows, shrugging off an unexpected downtick in Malaysia's industrial output. Thai markets were closed for a public holiday.

- Key data releases today include flash U. of Mich. Sentiment out of the U.S., final German CPI and Italian industrial output. Speeches are due from ECB's Holzmann & de Cos as well as Fed's Quarles & George. The European Council resumes, with leaders due to take stock of progress on the banking union and the capital markets union.

FOREX OPTIONS: Expiries for Dec11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1720-30(E675mln), $1.1875-95(E552mln),

$1.2100-10(E1.3bln) - USD/JPY: Y102.00($865mln), Y102.90-00($512mln), Y104.50($601mln), Y105.95-00($514mln)

- GBP/USD: $1.3600(Gbp767mln)

- EUR/GBP: Gbp0.8800(E510mln)

- AUD/USD: $0.7420-25(A$609mln)

- USD/CAD: C$1.3060-65($582mln), C$1.3190($542mln)

EQUITIES: Mostly Lower In Asia

Most of the major regional equity indices were biased lower during Asia-Pac hours, with a softer round of dealing for USD/JPY applying some pressure to the Nikkei 225, while the CSI 300 extended on yesterday's losses, building on the pullback from YtD highs after bulls failed to force a test of the all-time highs earlier this month.

- It was a macro-light Asia-Pac session, with the fiscal impasse in the U.S. and the continued worry surrounding Brexit presenting the two most distinctive sources of pressure at present.

- Some of Hong Kong's dual-listed banks (namely HSBC and Standard Chartered) drew support from the PRA's announcement re: UK banks being allowed to resume the payment of limited dividends.

- Nikkei 225 -0.4%, Hang Seng +0.3%, CSI 300 -1.6%, ASX 200 -0.6%.

- S&P 500 futures -3, DJIA futures -14, NASDAQ 100 futures -32.

GOLD: Holding

Gold has been relatively limited over the last 24 hours, even as the DXY softens back towards cycle lows and U.S. real yields sit little changed to lower (across the curve) on net over the same period. Spot last deals little changed on the day, a little shy of $1,840/oz, with no movement in the technical lines in the sand.

- Known ETF holdings of gold have flattened out over the past few days, stopping the proverbial rot, at least for now.

OIL: A Little Shy Of Thursday's Cycle Highs

WTI & Brent last print around unchanged levels, with the early Asia bid fading.

- A softer USD and wider sense of the need to embed a deeper geopolitical risk premium (centred on the Middle East) into crude prices allowed the major benchmarks to extend to fresh cycle highs on Thursday, before backing off from best levels. Still, the supportive factors allowed both WTI & Brent to settle over $1.00 higher on the day, as traders put the sizable crude, gasoline and distillate builds witnessed in Wednesday's weekly DoE inventory data behind them.

- OPEC+ production matters and COVID-19 vaccine developments are set to be the major driving forces for crude in the coming months.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.