-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Thursday, December 12

MNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: March Higher Core Yields Continues

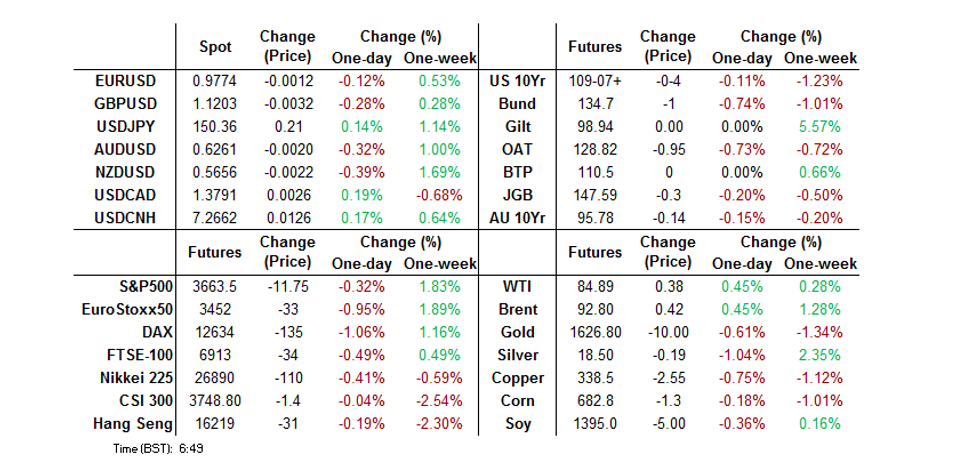

- Core FI markets extended their recent cheapening in Asia-Pac hours, with fresh cycle highs registered in U.S. Tsy yields, along with another round of steepening in JGBs and continued testing of the BoJ's will in the Japanese swap space.

- The BBDXY index crept higher and the U.S. dollar topped the G10 pile, with all three e-mini contracts having a look below yesterday's lows amid a risk-negative environment. The upswing in U.S. Tsy yields put a further bid into the greenback, with USD/JPY tagging a fresh cycle high as a result.

- Looking ahead, focus turns to UK retail sales, as well as comments from NY Fed Pres Williams, Chicago Fed Pres Evans & San Francisco Fed Pres Daly. Eyes are also on the potential for a delay to the release of the UK fiscal plan given the impending leadership change within the ruling Tory party. Finally, Moody's & S&P could give updates on the UK's sovereign credit rating after hours.

US TSYS: Another Round Of Fresh Cycle Cheaps

Cash Tsys saw fresh cycle highs in yields across the major benchmarks during Asia-Pac hours, with the cheapening aided by a couple of block sales in TY futures (-1.4K apiece) and spill over from weakness in the longer end of the JGB curve.

- Cash Tsys run 1.5-3.5bp cheaper across the curve, bear steepening into London trade. 10-Year Tsy yields have printed above 4.25% for the first time since ’08.

- TYZ2 is -0-06 at 109-05+, 0-02 off the base of its 0-11+ overnight range, on healthy volume of ~97K. The next level of meaningful technical support isn’t seen until 108-20, the 1.00 projection of the Oct 4-10-13 price swing.

- The space didn’t show much reaction to a BBG source report which suggested that “the Biden administration is exploring the possibility of new export controls that would limit China’s access to some of the most powerful emerging computing technologies,” only managing to register a modest bid in early Asia trade.

- Friday’s NY docket is thin, headlined by Fedspeak from Williams, Evans & Daly, ahead of the pre-FOMC blackout which goes into play this weekend.

JGBS: Cheaper As Test Of BoJ’s Will Ramps Up Again

JGB futures have stabilised after an aggressive pull lower in the early rounds of Tokyo afternoon trade, which saw the contract through Sep lows. It last deals -30 on the day, ~20 ticks off session lows. Bears will now look to the June cycle lows as the next meaningful point of technical support, although a move to those levels would require a somewhat serious challenge of the BoJ’s YCC settings ahead of next week’s monetary policy decision (with no change in policy settings from the BoJ expected until at least Spring ‘23).

- The move came as U.S. Tsys registered fresh cyclical highs in yield terms across the curve and after this morning’s upsized, and in one case unscheduled, BoJ Rinban operations did little to placate markets.

- The major cash JGB benchmarks run 1-7bp cheaper across the curve, bear steepening. 20- to 40-Year yields have registered fresh cycle highs.

- The move has been accompanied by fresh payside flow in 10-Year swaps, with the 10-Year swap spread pushing further above its mid-June peak, as participants use this channel as another method of testing the BoJ’s will.

- There was no reaction to virtually in line with exp. Japanese CPI data, given the BoJ’s insistence that it will not act on cost-push driven inflation.

- USD/JPY registered fresh cycle highs.

AUSSIE BONDS: RBA Terminal Rate Pricing Increases, ACGBs Pressured

The Aussie bond space came under pressure alongside the steepening in JGBs and as U.S. Tsys registered fresh cycle cheaps, with the major cash ACGB benchmarks running 12-15bp cheaper on the day ahead of the close, bear steepening, but operating a little above worst levels of the session. YM prints -12.0 & XM is -14.0, with the latter printing through its September lows, allowing bears to focus on the cycle lows which were printed back in June.

- The move accelerated as XM pressed through its September base.

- 3-Year yields registered fresh cycle highs on the move.

- Payside swap flows also helped, with EFPs pushing wider on the day.

- Local news flow saw Treasurer Chalmers outline the expected GDP & inflation impact from the recent floods, which will be manageable, but served as preparatory remarks ahead of the release of the Federal Budget (due next Tuesday).

- Bills run 3-25bp cheaper through the reds, with RBA terminal rate pricing extending above 4.40% in dated OIS.

- Outside of the Budget, next week will also bring the quarterly CPI data (Wednesday) and an address from RBA’s Kent (Monday). Flash PMIs (Monday), terms of trade data (Thursday) & PPI readings (Friday) will also cross.

NZGBS: Outperformance Noted, Index Inclusion Eyed

NZGBs richened on Friday, outperforming their major global counterparts, with focus on next month’s WGBI index inclusion seemingly at the fore.

- An element of short covering ahead of the long NZ weekend may also have been in play, with NZ markets closed on Monday as the country observes the Labor Day holiday.

- Note that a move lower in core global FI markets (higher yields) came after the local close.

- Swap spreads were generally a little wider across the curve, with some receiver side flows in swaps probably helping the bid in NZGBs in the second half of the day.

- RBNZ dated OIS continue to price a terminal rate of just over 5.40%.

- Local data had little impact on the space, with a marginal monthly uptick in credit card spending observed, while Sep trade balance data revealed a fourth consecutive monthly trade deficit, albeit narrowing a touch from the record deficit witnessed in August.

FOREX: General Risk Aversion Lingers, USD/JPY Moves Further Past Y150

Modest defensive feel lingered after Bloomberg reported that the White House is considering export controls to limit China's access to quantum computing and AI, another step in a series of measures designed to stifle Beijing's ability to use cutting-edge technology.

- The BBDXY index crept higher and the U.S. dollar topped the G10 pile, with all three e-mini contracts having a look below yesterday's lows amid risk-negative environment. An upswing in U.S. Tsy yields put a fresh bid into the greenback.

- USD/JPY advanced, adding 25 pips through the session, after the psychological Y150 level gave way Thursday. Intervention talk continued to do the rounds, with FinMin Suzuki noting that "right now we're in a firm confrontation with speculators in the market." The yen was resilient against most other currencies amid reduced appetite for risk.

- The BoJ conducted upsized & unscheduled bond-purchase operations in defence of its 10-Year JGB yield target, to little effect. The Bank's flagship YCC framework is put to a test ahead of next week's monetary policy review, which sent USD/JPY 1-week implied volatility soaring past 16% for the first time in a month.

- The Antipodeans went offered, only the NOK fared worse. AUD/NZD crept higher in tandem with Australia/New Zealand 2-year swap spread, with meeting-dated OIS pricing ~80bp worth of rate hikes at the next RBNZ policy review, down from the ~91bp peak from earlier this week.

- Focus turns to UK retail sales, as well as comments from NY Fed Pres Williams and Chicago Fed Pres Evans.

FX OPTIONS: Expiries for Oct21 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9595-00(E2.5bln), $0.9700(E2.0bln), $0.9725(E996mln), $0.9745-50(E997mln), $0.9770-75(E656mln), $0.9800(E1.8bln), $0.9845-50(E1.6bln)

- USD/JPY: Y147.50-55($1.1bln)

- AUD/USD: $0.6500(A$526mln)

- USD/CAD: C$1.3700-10($525mln), C$1.3750($675mln)

- USD/CNY: Cny7.1000($2.3bln), Cny7.2000($1.0bln)

ASIA FX: ADXY Back To Fresh Lows From Early 2000s

USD/Asia pairs are mostly higher. Note the J.P. Morgan ADXY index is sub 96.00, fresh lows back to the early 2000s. Weaker equities, coupled with a continued move higher in US and regional yields, has kept the USD in the driver's seat. Next week the focus will be on whether China Q3 GDP & September activity figures get released. Singapore CPI is also due.

- USD/CNH has spent much of the day on the front foot, this afternoon edging above 7.2650. Onshore spot also rebounded higher, but is yet to break above 7.2500. The CNY fixing has leaned against depreciation pressures more heavily this week. Onshore spot is also edging back closer to the top end of the daily trading band (+2% above the fixing).

- 1 month USD/KRW is back close to 1439, +0.60% for the session. Trade figures, for the first 20-days of October, showed a further loss in export growth momentum. The trade deficit was also slightly wider. Be mindful of verbal intervention on moves towards the 1445/50 region.

- Taiwan equities remain a laggard, weighed by weaker US tech futures. USD/TWD spot is close to 32.20, +0.20/0.25% higher on yesterday's levels.

- Spot USD/IDR has inched higher, in tandem with its regional peers. The spot rate last +41 figs at IDR15,614. A break above Apr 16, 2020 high of IDR15,754 would bring the IDR16,000 figure into view. Gains have been limited in the wake of yesterday's monetary policy decision from Bank Indonesia, but the rupiah remains the worst performer in the Asia EM basket on a weekly basis.

- PHP has outperformed, with USD/PHP sitting at 58.93 currently. There seems to be growing conviction that the BSP has drawn a line in the sand at 59.000, possibly to prevent USD/PHP from challenging the psychologically significant round figure above.

- Spot USD/THB has crept higher and last trades +0.20 at 38.355, with the baht pressured by risk aversion & broader USD gains. A clearance of yesterday's high of THB.38.465 would shift focus to the round figure of THB40.000. The BoT will release its weekly update on foreign reserves today. In the week through Oct 7, reserves printed at $199.8bn, staying near the lowest level since Nov 2017. The central bank attributed the recent drop to the revaluation in non-dollar assets in relation to the appreciating greenback.

SOUTH KOREA: Export Growth To China Continues To Weaken

South Korea's first 20-days trade data for October still points to a softening external demand backdrop. Exports for the first 20-days of the month were -5.5% y/y, a sightly improvement on last month's -8.7%. However, average daily exports were -9% lower in y/y terms. Note exports for the full month of September were +2.7% y/y.

- The detail showed on-going headwinds in the chips sector, -12.8% y/y, while exports to China fell -16.3% y/y, versus -14.0% in September (first 20 days). The chart below plots y/y exports to China & total, for the first 20-days of the month.

- Export momentum to the US held up better, +6.3% y/y, but weakened to Japan -16.1%, from -8.3% last month.

Fig 1: South Korea Export Growth - Total & China, y/y (First 20 Days Of The Month)

Source: MNI - Market News/Bloomberg

- Import momentum was better, +1.9%, but still slowed from last month (+6.0% y/y). The trade deficit came in at just under $5bn, a slight widening compared to September (first 20 days).

- The full month figures for the trade deficit should be slightly better (for September as a whole it was -$3.8bn), as that tends to be the trend. We appear to be away from worst levels in terms of the deficit, from mid this year, but a rapid turnaround/shift back to surplus is not evident.

EQUITIES: Modest Losses, As Weaker US Lead & Higher Yields Weigh

Asia Pac equities are mixed, although major bourses are struggling for a positive footing. US futures are lower, roughly -0.3% for the S&P, -0.70% for the Nasdaq at the time of writing. Weaker tech sentiment has been led by Snap, which again delivered a disappointing earnings update late in the US session.

- Higher yields, a continuation from the overnight session, has also added pressure. The US remains the focus point (10yr to 4.26%, +3bps for the session), but JGB futures have sold off sharply as well.

- A report the US is considering extended its tech ban to China to include quantum computing and AI has weighed on sentiment, although overall losses for HK stocks are modest at this stage.

- The HSI is down around 0.2%, while the tech sub index is around flat, still we are down a further 5% for the week, following last week's 10.30% dip.

- China tech names are lower, although aggregate indices are slightly higher. The CSI 300 +0.15%, the Shanghai Composite +0.50%. The property sub-index is up 1.50%, its first gain for the week. This came after the China regulator announced companies less involved in the real estate market can raise funds in the A-share market.

- The Kospi, Nikkei 225 and Taiex are all lower, with the latter off by 0.75%. South Korean export data for the first 20-days of October, showed a further deterioration in external demand, led by China.

- The ASX 200 is down 0.70%, with bank names the main drag.

GOLD: Range Bound In Asia Pac Session, But Outflows From Gold ETFs Persist

Gold has had a very quiet session so far today, sticking to tight ranges. The precious metal was last around $1626, down slightly on NY closing levels (-0.10%). This is in line with a modest uptick in the USD BBDXY (+0.10%).

- This follows a fairly volatile overnight session, where we spiked above $1645 only to close slightly lower for the session as a whole. Higher US yields and a rebounding USD weighed, particularly through the NY session.

- Some support is still evident ahead of the $1625.00 level, & we haven't breached yesterday's lows near $1622.50.

- Gold is keeping its inverse correlation with US real yields, although the rate of increase slowed overnight (the 10yr real yield only up 1bp to 1.73%).

- Outflows from gold ETF funds continue and are on track to be slightly larger this week, compared to last (-20.65 tons so far, versus -16.6 tons last week).

OIL: Tight Supply Keeps Dips Supported

Brent crude is modestly up on NY closing levels, last around $92.70/bbl (+0.30% for the session so far). We remain below overnight highs, near $95/bbl, with the simple 50-day MA also at 93.21/bbl likely offering some resistance. Some support is evident ahead of the $92/bbl though, while beyond that is the $89-$90//bbl lows from earlier in the week. For WTI, we were last just under $85/bbl.

- Overall supply conditions remain tight. The Brent prompt spread is back to +1.88, versus +1.48 this time last week.

- US refiner Phillips 66 also warned that 3 crude suppliers are at risk of breaching oil supply contracts for October. While Goldman Sachs analysts don't expect a large impact from further incremental SPR sales. The SPR is also likely to restock if oil prices reach the $67-72/bbl range (or lower).

- On the demand side, yesterday's spike in oil, started by reports China is considering lowering the quarantine period for international arrivals, hasn't had great follow through momentum.

- Higher frequency indicators of China domestic demand conditions (road and subway traffic volumes) remain off recent highs. We may also get China Q3 GDP released next week, after this week's delay. Note also US Q3 GDP is also out next week.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/10/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/10/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/10/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 21/10/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/10/2022 | 1310/0910 |  | US | New York Fed's John Williams | |

| 21/10/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/10/2022 | 1530/1130 |  | US | San Francisco Fed's Mary Daly | |

| 21/10/2022 | 1600/1200 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.