-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: NZD Hit On Softer Than Expected Headline NZ CPI

- Kiwi is the weakest performer in the G-10 FX space. New Zealand CPI for Q1 printed below market expectations and also below the RBNZ's forecasts.

- A positive bias has been evident in most USD/Asia pairs today, although follow through USD gains have been limited.

- Thursday's broader docket sees second tier data supplemented by central bank speak from both sides of the Atlantic.

US TSYS: Little Changed In Asia

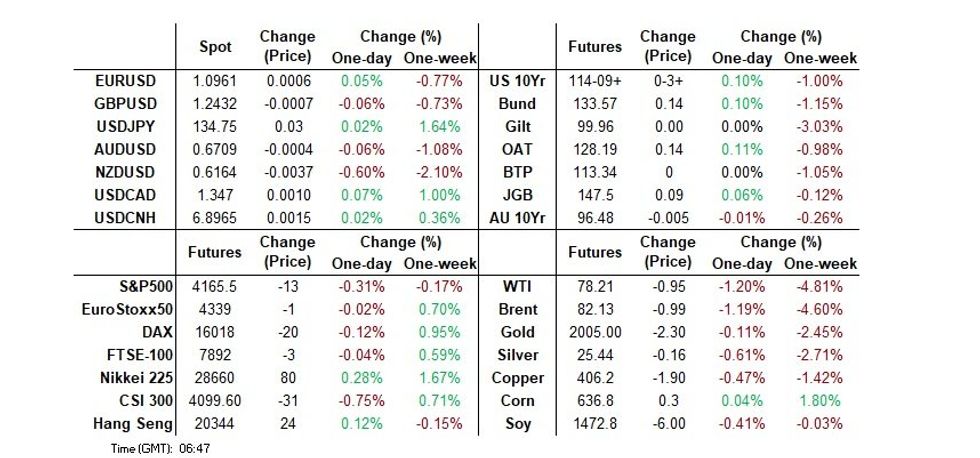

TYM3 deals at 114-09, +0-03, with a narrow 0-03+ range observed on volume of ~45k.

- Cash tsys sit little changed across the major benchmarks

- Tsys have traded in narrow ranges in today's Asian session with little follow through on moves.

- The space looked through weaker than expected CPI from New Zealand. The headline and non-tradeable components were both below the RBNZs's forecast.

- Fedspeak from NY Fed President Williams crossed early in the session. He noted that the US economy remains overheated and policymakers have more tightening to do.

- FOMC dated OIS price ~23bp hike into the May meeting with a terminal rate of ~5.13% in June. There are ~60bps of cuts priced for 2023.

- In Europe today German PPI headlines, further out we have Initial Jobless Claims, Existing Home Sales and Philadelphia Fed Manf Index. There are a number of Fedspeakers including Governor Waller and Cleveland Fed President Mester. We also have the latest 5 Year TIPS supply.

JGBS: Futures Holder Stronger Despite Poor 20-Year Auction

JGB futures sit off session bests, +9 versus settlement levels, after a soft auction of 20-year JGBs. In terms of auction specifics, the cover ratio barely topped the level seen at the previous 20-year auction, which represented the lowest level seen at a 20-Year auction going back to 2012.

- Nonetheless, JGB futures (147.51) sit comfortably in the range of 147.40-147.92, which it has generally traded in since early April, barring a few probes through the lower limit over the past few days. According to MNI's technical analyst, if prices break below this week’s low of 147.27, it may indicate a deeper retracement to 145.80, the March 13 low.

- Cash JGBs curve steepened after the 20-year auction unwinding the morning session’s twist flattening. Yields are -1.4bp to +0.8bp across the curve, pivoting around the 20s.

- Swap spreads are tighter out to the 30-year zone, with swaps also twist steepening.

- Looking ahead, March CPI and Jibun Bank PMIs for April are scheduled for release tomorrow.

- Friday will also see BoJ Rinban operations covering 1- to 25-Year JGBs.

JAPAN: Foreign Capital Continues To Pour Into Japanese Equities

Weekly international security flow data from the Japanese MoF revealed that Japanese investors were net buyers of international bonds in the week ending 14 April, breaking a run of two consecutive weeks of net sales, although net purchases weren’t exactly sizable. As we have flagged before, investment intentions from the major Japanese life insurers and pension funds should filter out over the next couple of weeks and could provide some loose steer for this metric going forward.

- Elsewhere, Japanese investors were small net sellers of international equities last week, although net flows were minimal.

- International investors were marginal net buyers of Japanese bonds last week, registering a third consecutive week of net purchases in the process.

- Finally, international investors were net buyers of Japanese equities for a third consecutive week, with net purchases easing back a touch from the record levels registered in the week prior, but still sitting at the second highest level on record. This run of strong net purchases comes after Berkshire Hathaway’s Warren Buffett and Man Group flagged optimism re: Japanese equities in recent days.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 500.2 | -788.7 | 411.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -65.3 | 29.3 | 312.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 9.4 | 1310.6 | 587.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 1876.4 | 2368.9 | 3010.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: Sits Flat, RBA Review Fails To Move The Market

ACGBs sit flat after the formal release of the review of the RBA and the widely accepted recommendations fail to provide any reason for market participants to change views on the near-term outlook for interest rates. The decline in Q1 NAB Business Confidence also failed to provide a domestic catalyst for the market. US Tsys have been trading little changed versus the NY close in Asia-Pac trade.

- Cash ACGBs are unchanged on the day with the AU-US 10-year yield differential +2bp at -8bp.

- Swap rates are 2-3bp lower with EFPs 2bp tighter.

- Bills strip twist flattens with pricing -4 to flat.

- RBA dated OIS pricing is 2-6bp firmer across meetings with 27bp of cumulative tightening priced by August.

- With no domestic data on the calendar, the local participants will likely be guided by US Tsys as they navigate a raft of second-tier data releases. US earnings season results and Fedspeak are also likely in play.

NZGBS: Sharply Richer, At Bests After CPI Miss

NZGBs closed at session bests with benchmark yields 7-9bp lower as Q1 CPI surprised on the downside. The 2/10 cash curve steepened 2bp after the data.

- Overall demand for today's supply was good, with cover ratios ranging from 3.02x to 4.27x, consistent with last week's auction. However, the bid for the May-26 bond fell short of the robust demand (cover ratio of 6.25x) seen at the April 6th auction when the bond was last offered. Short-term bonds were in particularly high demand in early April, possibly reflecting concerns over potential over-tightening by the RBNZ, which unexpectedly raised interest rates by 50bp the day before. Today’s CPI data may allay some of those concerns.

- Swap rates are 7-9bp richer.

- RBNZ dated OIS closed flat to 7bp softer across meetings with 22bp of tightening priced for the May meeting versus 24bp pre-data. Easing expectations for Feb-24, off the expected terminal OCR of 5.56% (July), are currently 42bp.

- With the Antipodean calendar light for the rest of the week, the local market will likely be guided by US Tsys as they navigate US earnings season, Fedspeak and a raft of second-tier data releases. US jobless claims and April Philly Fed Index are today’s highlights.

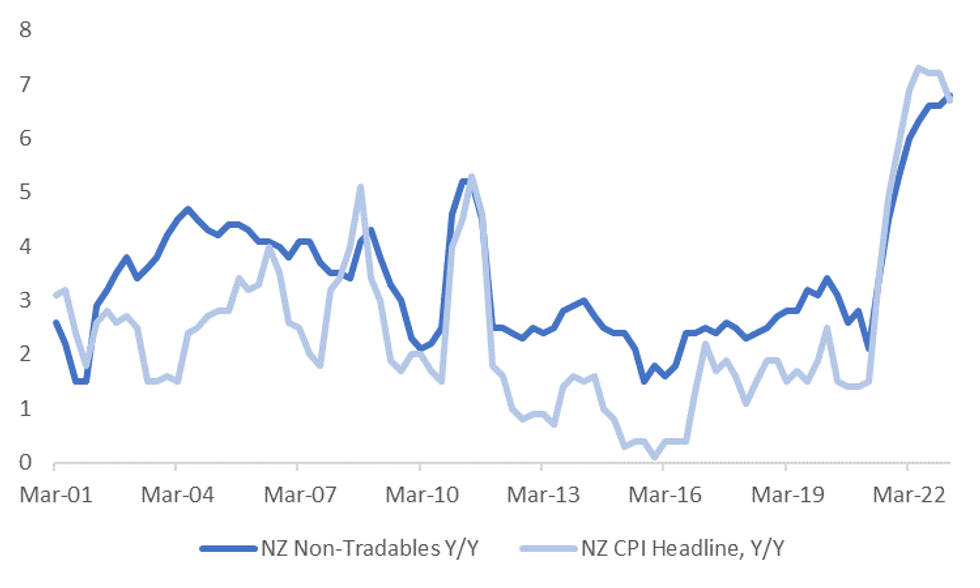

NEW ZEALAND: Q1 CPI - Decent Downside Suprise, But Non-Tradable Inflation Still Trending Higher

Q1 CPI came in below both the RBNZ and market expectations. The q/q was 1.2%, versus 1.5% market consensus (RBNZ at 1.8%), while the y/y was 6.7% (6.9% market consensus, RBNZ 7.3%). Non-tradables inflation still rose 1.7% q/q, versus 1.5% in Q4, but this was also below the 2.0% expected from the RBNZ. In y/y terms non-tradables still firmed to 6.8% y/y (from 6.6% in Q4). Tradables was 0.7% q/q, versus 1.4% prior, bringing the y/y pace down to 6.4%.

- Whilst the RBNZ will take some comfort from the lower outcomes, relative to their own forecasts, non-tradable inflation in y/y terms is still at fresh record high, see the chart below.

- Looking at the detail, most of the move lower in the tradable component owed to transport, which moved down to 3.7% y/y from 8.4%, as petrol costs came down. Food prices were elevated at 11.3%, from 10.7% (up 3.7% q/q). This reflected broad increases across the sub-categories.

- Prices for building a new home eased back to 11% y/y from 14% y/y in Q4. The RBNZ may be mindful of renewed pressures in this sector as the cyclone rebuild gets underway.

Fig 1: NZ Non-Tradable Inflation Still Trending Higher in Y/Y Terms

Source: MNI - Market News/Bloomberg

FOREX: NZD Pressured In Asia After CPI Below Expectations

Kiwi is the weakest performer in the G-10 space at the margins today. New Zealand CPI for Q1 printed below market expectations and also below the RBNZ's forecasts.

- NZD/USD prints at $0.6150/55, the pair is down ~0.7% and printed its lowest level since 16 March. Bears now target year to date lows at $0.6085. AUD/NZD is ~0.6% firmer, printing its highest level since early March. The 200-Day EMA ($1.0871) was breached after the CPI print and we have held above the measure through the Asian session.

- AUD is marginally pressured. Spillover from the New Zealand CPI print and weaker US equity futures have weighed on AUD/USD, however support has been seen below $0.67. The pair sits at $0.6705/10 ~0.1% softer today.

- Yen is little changed from yesterday's closing levels, ranges have been narrow with little follow through on moves. Japans Mar Trade Balance printed narrower than expected at -Y754.5bn.

- Elsewhere in G-10 EUR is little changed and GBP is marginally pressured.

- Cross asset wise; US equity futures are lower. E-minis are down ~0.2%. BBDXY is a touch firmer and US Treasury Yields are little changed across the curve.

- In Europe today German PPI headlines, further out we have Initial Jobless Claims, Existing Home Sales and Philadelphia Fed Manf Index.

FX OPTIONS: Expiries for Apr20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0870-85(E1.6bln), $1.0895-00(E1.1bln), $1.0920-25(E1.9bln), $1.0975-80(E948mln), $1.1000-10(E1.3bln), $1.1100(E1.1bln)

- GBP/USD: $1.2350(Gbp865mln)

- USD/JPY: Y132.00-15($1.4bln), Y134.30($738mln)

- EUR/JPY: Y142.65-75(E1.1bln)

- AUD/USD: $0.6695-00(A$1.2bln)

- AUD/NZD: N$1.0800(A$602mln)

- USD/CAD: C$1.3290($550mln), C$1.3510($668mln)

ASIA FX: Dollar Supported, But Limited Follow Through Gains

A positive bias has been evident in most USD/Asia pairs today, although follow through USD gains have been limited. USD/CNH couldn't hold a move above 6.9000, while USD/KRW found selling interest above 1330. Recent PHP underperformance continued. Still to come is Taiwan export orders for March and RBI policy minutes. Tomorrow, we get the first 20-days trade data in South Korea (for April) along with the PPI.

- USD/CNH got to 6.9030, but we now sit back closer to 6.8980. As expected, the LPRs were left unchanged, while the CNY fixing was close to neutral. Onshore China equites have weakened further but we are still seeing northbound flows via the stock connect.

- 1 month USD/KRW saw selling interest close to 1330, but hasn't been able to sustain breaks sub 1325 on the downside, which also coincides with the 200-day MA. Onshore equities are weaker, while offshore investors have sold over $200mn of local shares so far today. Tomorrow's first 20-days trade data for April will present a timely update on external demand.

- USD/INR is relatively steady (last 82.20/25), leaving the rupee outperforming at the margins. USD/INR firmed through the 20-Day EMA (82.17) yesterday and sits a touch off its highest level since early April. On Tuesday Global Investors sold ~$67mn in Indian equities, this was the first outflow since late March. The RBI Minutes of the April policy meeting where the bank unexpectedly kept interest rates on hold are on tap today.

- USD/PHP has continued to push higher, +0.25% to the 56.35/40 region. Comments from Socioeconomic Secretary Balisacan stated the country wants to achieve a stable exchange rate, with too much weakness a financial stability risk. Still, the Secretary stated weakness can improve export competitiveness. PHP is comfortably the weakest performer within EM Asia month to date.

- USD/MYR is down a touch to 4.4360, meeting resistance above 4.4400 in recent sessions. March CPI printed a short time ago at 3.4%Y/Y below the expected 3.6%. CPI fell from 3.7% Y/Y seen in February. Today's release is the lowest print since June 2022. Core also continued to edge down from recent highs, coming in at 3.8% y/y. The prints are likely to add to view that BNM remains on hold for now.

EQUITIES: Major Indices Mostly Lower Or Close To Flat

Regional equities are mixed, albeit with the markets in the red outweighing those bourses which are higher. China shares are tracking lower, while HK is proving more resilient. US futures have stayed in the red through the session, with tech slightly weaker. This has likely kept a cap on markets around the region that have tried to push higher.

- The CSI 300 is off by 0.64%, the Shanghai Composite by 0.70% at this stage. Lower banking stocks are weighing, while the CSI 300 has pulled back from a test of the 4200 level.

- Still, Northbound stock connect flows remain positive at this stage, +2.72bn yuan.

- The HSI is +0.19% at this stage, so outperforming at the margins.

- The Topix is around flat, while South Korean (-0.50%) and Taiwan (-0.12%) shares are tracking modestly lower. This is line with weakness in tech related indices through US trade on Wednesday. Offshore investors have sold -$226.5mn of local Korean shares today.

- Indian shares are a touch higher, but lower in Malaysia, Singapore and Thailand. Philippines shares are one of the few bright spots, +0.59%. Shares of BDO, the nation's largest bank continued to rally after strong Q1 results yesterday.

GOLD: Bears Target Another Test Of the 20-Day EMA

Gold is down a touch in the first part of Thursday trade, although has largely been range bound. We are just near $1994 currently, versus a NY close to $1995. For Wednesday's session we got near $1969 amid broad USD strength. Whilst we stabilized from there, it was still a fresh low going back to the start of April. This has arguably dented the technical backdrop for the precious metal to some degree.

- The 20-day EMA comes in at $1985.45, so bears will target a renewed break of this level. Bulls will aim to recapture the $2000 handle, although may have to wait until US yield momentum cools.

OIL: Loses Further Ground

Brent crude has continued to slip, down nearly 1% so far today, to be back at the $82.30/40/bbl region. This follows Wednesday's near 2% loss. We are very close to the simple 50 and 100-day MAs, which come in between $82.00 and $82.40/bbl. A move below these levels would traget a test of the $80/bbl handle.

- WTI is following a similar trajectory, albeit underperforming Brent at the margins. The WTI benchmark was last in the $78.30/40/bbl region.

- These moves come despite a further run down in US oil inventories, as reported by EIA during Wednesday's session. Demand fears seemingly outweighing supply concerns at this stage.

- There have also been reports of weaker demand conditions out of Asia, stockpiles of distillates in Singapore at highs going back to 1995. Increased fuel exports out of China are also easing supply concerns.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/04/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/04/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/04/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 20/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/04/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/04/2023 | 1415/1015 |  | US | Secretary Yellen on U.S.-China economic relationship | |

| 20/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/04/2023 | 1530/1130 |  | CA | BOC Governor testifies at Senate committee | |

| 20/04/2023 | 1530/1630 |  | UK | BOE Tenreyro Panels National Bureau of Economics Research Conf | |

| 20/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/04/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 20/04/2023 | 1620/1220 |  | US | Cleveland Fed's Loretta Mester | |

| 20/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/04/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan | |

| 20/04/2023 | 1900/1500 |  | US | Fed Governor Michelle Bowman | |

| 20/04/2023 | 2015/2215 |  | EU | ECB Schnabel Lecture at Stanford Graduate School of Business | |

| 20/04/2023 | 2100/1700 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.