-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: NZD Pummelled By Slew Of Housing Curbs

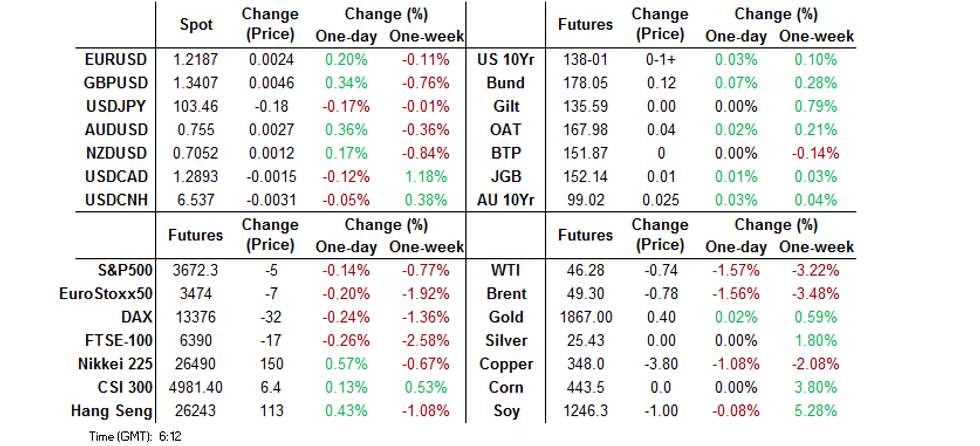

- Risk aversion takes hold as German Chancellor Merkel says Germany will impose a hard lockdown over Easter

- Reports surrounding U.S. President Biden's spending plan do the rounds, testimonies from Fed Chair Powell & Tsy Sec Yellen eyed

- New Zealand cracks down on domestic housing bubble, putting a bid in NZGBs and sending NZD through key support levels

BOND SUMMARY: Core FI Catch Bid On Risk Aversion, ACGBs Rally On Coattails Of NZ Peers

After a broadly lacklustre start for core FI space outside of the Antipodeans, participants grew cautious as German Cll'r Merkel announced that Germany will go into a radical lockdown for five days over the Easter period. Merkel's comments helped T-Notes move away from their session low of 131-14 and the contract last sits +0-03+ at 131-21. Cash Tsy curve bull flattened, yields last seen 0.2-3.5bp lower. Eurodollar futures trade unch. to -0.5 tick through the reds. Snips from Fed Chair Powell's & U.S. Tsy Sec Yellen's upcoming testimony did the rounds, but provided little in the way of fresh insights. Fed's Bowman reiterated familiar lines from Powell's recent addresses, stressing that the Fed is "likely to continue supporting the economy for some time," as it is "still a long way" from meeting its employment & inflation goals.

- Slightly erratic price action in JGB futures saw the contract re-open at a session high of 151.38 after the Tokyo lunch break, before paring gains. JGB futures last trade at 151.27, -3 ticks vs. settlement. Cash JGB yields sit lower across a flatter curve, with 20s outperforming again. Japan's FinMin Aso noted that the gov't doesn't plan to raise taxes anytime soon, but remains committed to its goal of balancing the budget in FY2025. The MoF held an enhanced liquidity auction for off-the-run JGBs with 1-5 years until maturity.

- ACGB space found itself under the influence from across the Tasman, as NZGBs picked up a bid after NZ gov't announced a slew of measured designed to curb house prices. The broader risk-off impetus provided a fresh tailwind for ACGBs, helping them extend gains later in the session. YM +1.0 & XM +4.0 as we type, with 10-year futures printing session highs. Cash ACGB curve bull flattened, with yields sitting 0.2-3.9bp lower, albeit belly still outperforms on a lead from NZ, where 5s lead the way. Bills trade unch. to +2 ticks through the reds. The AOFM auctioned A$150mn of the 0.75% 21 Nov '27 linker.

FOREX: Kiwi Shot Down By New Zealand's Salvo Against Housing Bubble

The kiwi fell prey to New Zealand gov't's bold plan for tackling the "dangerous" housing market bubble, with some steps due to take effect as soon as this weekend. NZD/USD pierced several key support levels, including its 100-DMA & Mar 5 low of $0.7100, as it slid smoothly towards worst levels since the final days of 2020. The rate printed a session low after punching through the $0.7100 mark, with some pointing to the execution of sell-stops upon the breach of that level, which triggered broad-based NZD sales.

- The suite of measures unveiled by PM Ardern included the removal of tax incentives for investors, an extension to the "bright-line" test (an effective capital gains tax on investment property), more accessible support for first home buyers, and NZ$3.8bn for new infrastructure around new housing developments.

- NZD weakness spilled over into AUD, with further headwinds emerging for the broader high-beta FX space as risk aversion took hold. A bout of risk-off flows was seen as German Cll'r Merkel & German regional leaders agreed to impose a radical five-day lockdown over Easter, but EUR remained relatively buoyant.

- AUD/NZD hit best levels sine early Oct, despite today's expiry of A$2.2bn worth of options (mostly AUD puts) with strikes at NZ$1.0785-90.

- JPY was the best G10 performer amid safe haven demand, while the DXY advanced but held yesterday's range.

- The PBOC fixed the USD/CNY mid-point at CNY6.5036, around 10 pips below sell side estimates. USD/CNH wobbled around neutral levels, as participants scrutinised a piece in China's financial press opined that the PBOC unlikely to tighten policy quickly.

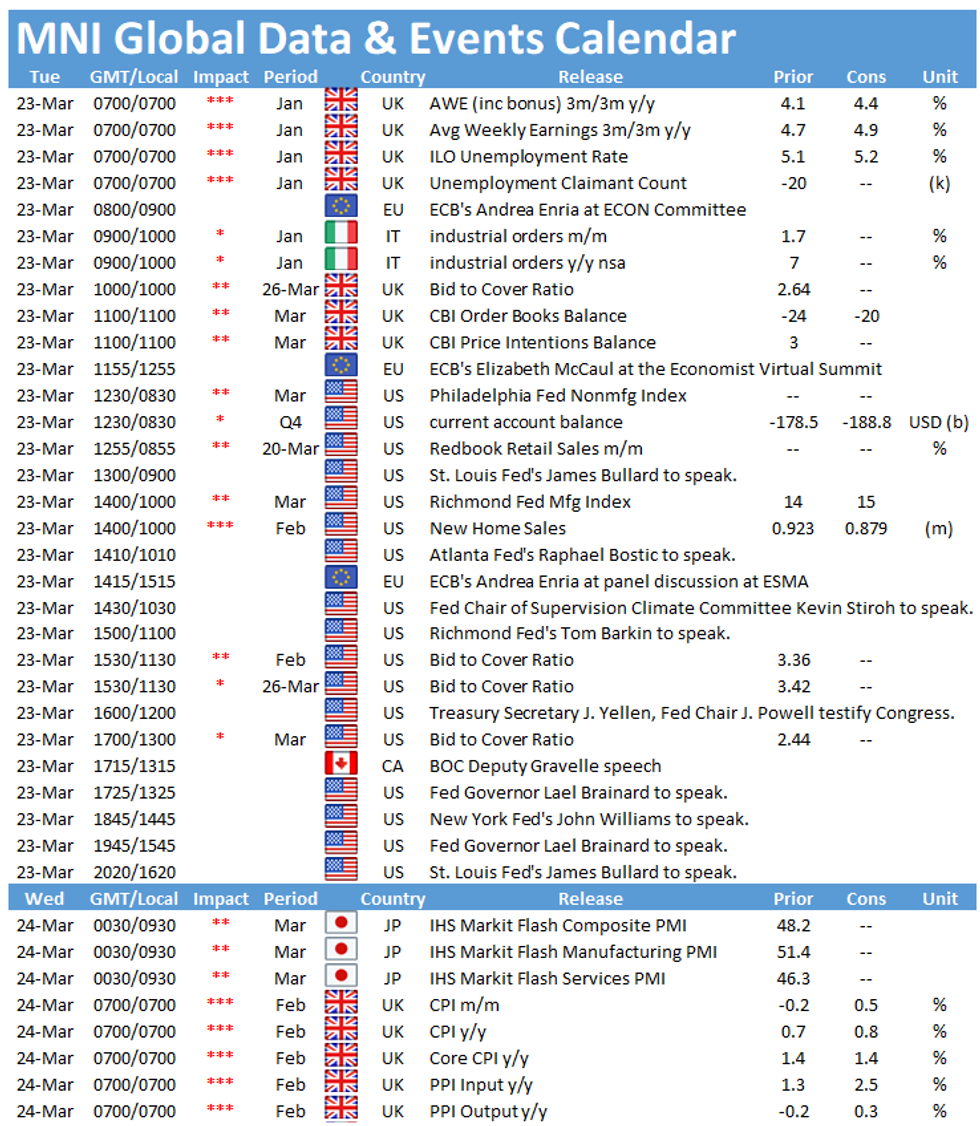

- Focus turns to the House testimony from the Powell/Yellen duo, as well as comments from around a dozen G10 central bank members. The data docket features UK labour market report & U.S. new home sales.

FOREX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1895-1.1900(E638mln), $1.2000-05(E617mln)

- USD/JPY: Y107.95-108.05($2.45bln), Y108.12($1.8bln)

- EUR/GBP: Gbp0.8600(E556mln-EUR puts), Gbp0.8620-30(E887mln-EUR puts)

- EUR/CHF: Chf1.0978-80(E780mln-EUR puts)

- AUD/USD: $0.7750(A$1.3bln)

- AUD/JPY: Y83.10-15(A$587mln)

- AUD/NZD: N$1.0785-90(A$2.2bln - A$2.1bln of AUD puts)

- NZD/USD: $0.6850(N$759mln-NZD calls)

ASIA FX: USD-Asia Crosses Higher Amid Risk Off

The greenback gained, and risk assets took a hit after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter.

- CNH: Offshore yuan hovered between gains and losses; China's PM Li said yesterday that China's economic growth could exceed target this year while ex-PBOC adviser Li said China faces the threat of foreign outflows later in the year as rising borrowing costs in the US drives investors out of emerging markets.

- SGD: Singapore dollar is flat, treading water through the session ahead of the inflation report.

- TWD: Taiwan dollar is weaker, USD/TWD challenging the 28.50 level. The pair has risen for six straight days. Some of the decline in TWD is attributed to outflows from local stocks. Markets await industrial production data.

- KRW: The won is flat, South Korea has said it will take steps to stabilize the bond market if needed while President Moon said he expects "faster and stronger" economic recovery this year than previously expected.

- INR: Rupee is flat in early trade, yesterday the government announced an increase in its FDI ceiling in insurance in a bid to spur investment.

- IDR: The rupiah is weaker, Q1 GDP growth is seen at -1% to -0.1% at the release of the budget. Full 2021 growth outlook is kept at 4.5% to 5.3%.

- MYR: Ringgit is slightly weaker, PM Muhyiddin has proposed setting a deadline for Covid-19 vaccination registration.

- PHP: Peso is weaker, Philippine Pres Duterte & Econ Planning Sec Chua signalled their preference for smaller and more targeted restrictions, as the country grapples with the escalating outbreak of Covid-19.

- THB: Baht is weaker, PM Prayuth chairs a Cabinet meeting, with ministers expected to consider a revised soft loan programme & setting up an asset warehouse.

ASIA RATES: Yields Decline As Governments Declare Support

Bonds mostly higher as risk assets lose some luster after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter.

- INDIA: The RBI has announced that the government has cancelled this Friday's (March 26) auctions on review of cash balances. This saw bonds advance on the prospect of reduced supply, 10-year yield 2.6bps lower.

- SOUTH KOREA: Futures higher after the government said it will take steps to stabilize the bond market if needed. Vice Finance Minister Kim said financial authorities will flexibly adjust the sale volumes of Treasury bonds. "If volatility increases, the government will focus on stabilizing the bond market by taking timely actions through close cooperating with related agencies," said Kim. 20-year auction was fairly well received given increased size as the government aims to address yield curve inversion.

- CHINA: The PBOC matched liquidity injections with maturities, the twelfth straight day of matching maturities while the bank hasn't injected funds since February 25. The overnight repo rate is 7.5bps higher, but below last weeks peak. 7-day repo rate has declines 2.2bps to 1.98% after jumping as high at 2.75% yesterday. Bonds are higher, 10-year future up 2 ticks, a piece in China's financial press opined that the PBOC unlikely to tighten policy quickly.

- INDONESIA: Markets await the IDR 12bn sukuk auction later today, the government raised IDR 16.7tn from a retail sukuk auction yesterday, well above the IDR 10tn target despite the lowest return on record at the auction. Elsewhere Fitch affirmed Indonesia's long-term foreign-currency issuer default rating at BBB with a stable outlook. Yields mostly lower, some flattening seen.

EQUITIES: Decline After Shaking Off Positive Lead

Most Asia-Pac equities lower on Tuesday, taking out early gains as risk sentiment took a hit after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter. Bourses in China and Hong Kong lead the way lower as markets digest stricter regulations on e-cigarette makers. Markets in Japan took a hit on reports that the government is planning to extend lockdown measures that are currently slated to expire at month-end. Taiwan is managing to squeeze out small gains, buoyed by strong export data after market yesterday, while markets in South Korea have also managed to limit downside as the tech sector remains resilient.

- Futures in Europe and the US are lower, markets await comments from Fed Governor Powell and US Tsy Secretary Yellen in a Fed heavy week, while US bond auctions will also provide direction.

GOLD: Lower, But Off Worst Levels

The yellow metal has added to its declines on Tuesday, erasing the recovery from yesterday's lows. Last trades at $1734.73/oz, down $4.28, it has come off lows at $1731.79 after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter which saw a bid in safe haven assets. Markets await comments from Fed Governor Powell and US Tsy Secretary Yellen in a Fed heavy week, while US bond auctions will also provide direction.

OIL: Demand Concerns Weigh

Crude futures are lower again on Tuesday, casualties of the broad risk off theme. WTI is $0.64 lower at $60.93/bbl, Brent is $0.64 lower at $63.98/bbl.

- Demand concerns weigh on oil after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter. France and Poland have already announced new lockdown measures to combat rising COVID-19 infections, while UK PM Johnson warned the UK was at risk of a third wave. There are also demand concerns emanating from an increase in cases in India, while demand in South East Asia is said to have plateaued as lockdowns drag on and vaccination programmes proceed slower than expected.

- Markets await comments from Fed Governor Powell and US Tsy Secretary Yellen in a Fed heavy week, while participants will also look to API inventory figures later on Tuesday

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.