-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

RESEND: MNI EUROPEAN MARKETS ANALYSIS: Oil Firms On Pipeline Outage, Iron Ore Surges On Demand From China

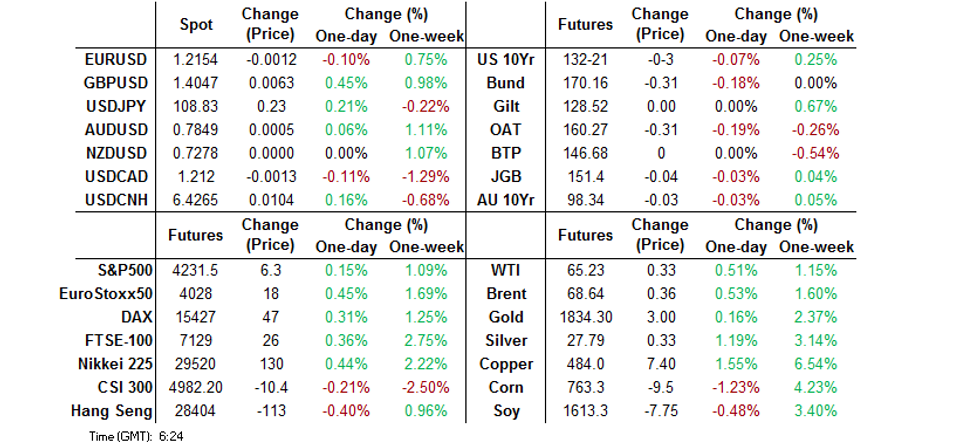

- S&P 500 e-mini futures & Australia's benchmark stock index print fresh all-time highs in broadly risk-on start to the week

- GBP outperforms as Tories emerge stronger from UK "Super Thursday" elections, while SNP falls one seat short of outright majority in Scottish parliament

- Commodities are buoyant as cyberattack on major U.S. fuel pipeline supports crude oil, gasoline & heat oil, while strong demand from China pushes iron ore to a record high

BOND SUMMARY: Risk-On Dynamics Keep Core FI At Bay

T-Notes turned their tail as Tokyo trade got underway this week and extended their post-NFP losses, albeit Friday's low remained intact. The contract last sits -0-04 at 132-20, after bottoming out at 132-18+, with participants watching upticks in U.S. equity index futures, with S&P 500 e-minis printing fresh record highs. Fed's Kashkari reinforced the broader post-NFP feel over the weekend, as he flagged that domestic labour market remains in a "deep hole" and needs continued aggressive stimulus to recover. Cash Tsy curve bear steepened a tad (yields last unch. to +1.6bp), while Eurodollar futures trade unch. to -2.0 ticks through the reds.

- Selling pressure hit JGB futures in early trade as local players reacted to Friday's NFP report. The contract now trades at 151.38, 6 ticks shy of last settlement. Cash JGB yields were mixed and showed little deviation from neutral levels. The BoJ left its 1-5 Year purchase sizes unchanged, with bid/cover ratios ticking higher vs. the previous round of Rinban ops covering these maturities.

- Cash ACGB yield curve steepened, with yields seen -0.6bp to +3.7bp as we type. YM trades unch., while XM has ground lower and last sits -3.5. Bills are broadly unch. through the reds, with just IRM1 & IRZ1 sitting 1 tick lower apiece. The space faced pressure as Australia's benchmark stock index surged to record highs, which was a function of buoyant commodity prices. The supply of A$1.0bn of ACGB 21 Dec '30 provoked muted mkt reaction, drawing bid/cover ratio of 2.46x (prev. 2.53x). The size of the auction was small by historical standard, with A$1.2bn allotted at the previous offering. Elsewhere, the RBA offered to buy A$2.0bn of ACGBs with maturities of Nov '24 to May '28, excluding Apr '26. Meanwhile, NAB Business Confidence rallied to an all-time high of 32 in Apr from 24 in Mar, with NAB dubbing the results of the survey as "simply stunning."

FOREX: Sterling Surges After Super Thursday Elections, Yen Loses Ground

Sterling caught a bid and led gains among the G10 pack as BBG trader sources cited interbank buying by Japanese bank, which squeezed weak short-stops in cable, while participants scrutinised the results of the UK's "Super Thursday" elections. The Tories made further inroads into traditional Labour strongholds, while Labour's Khan was re-elected as London Mayor by a slimmer margin than expected. Elsewhere, the SNP fell one seat short of an outright majority in Scotland's devolved parliament. Some may interpreted the SNP's sub-50% result as a positive, even as the party is expected to team up with pro-independence Greens in launching another bid to separate Scotland from the rest of the UK. Cable rallied to levels not seen since Feb 25.

- The yen went offered across the board amid a decent showing from regional equity benchmarks (ex-China), with e-minis printing fresh record highs. Local Covid-19 situation remained a source of worry, with questions re: implications for the Tokyo Olympics doing the rounds. USD/JPY roughly halved Friday's post-NFP losses.

- USD/CNH firmed a tad, with a weaker than expected PBOC fix helping keep the rate afloat. China's central bank set their USD/CNY mid-point at CNY6.4425, 55 pips above sell-side estimates, in a sign that officials are willing to reign in redback appreciation. The fixing came after post-NFP dollar sales took USD/CNH close to its three-year lows on Friday.

- Early trade saw commodity-tied FX draw some support from supply concerns linked to Friday's cyberattack on a critical U.S. fuel pipeline network. The initial impetus seemingly faded away as crude oil, gasoline & heating oil pulled back from their respective highs.

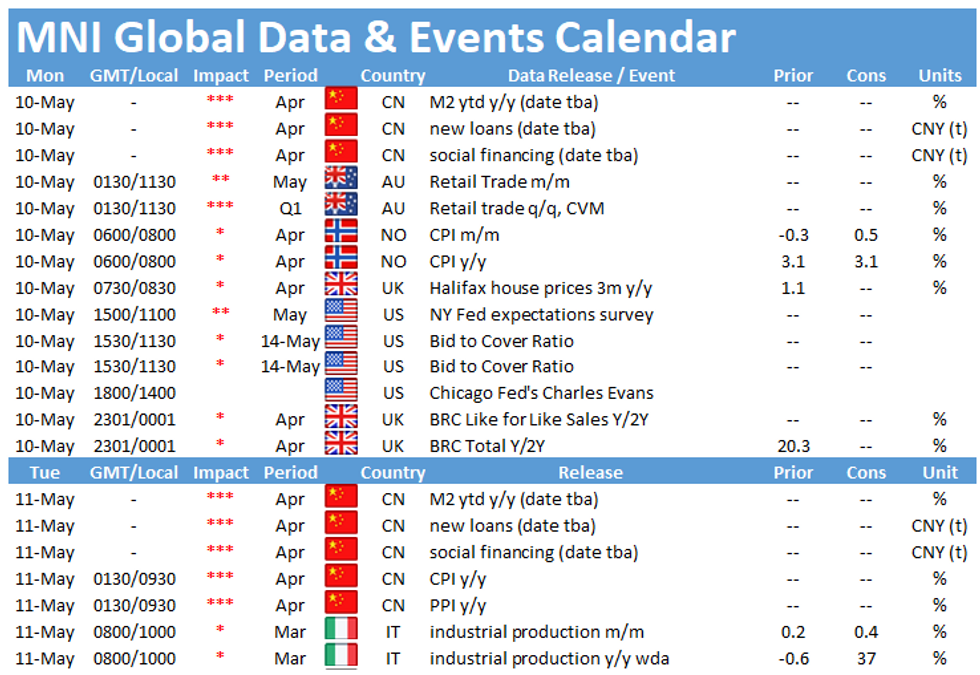

- Norwegian CPI, Rinksbank Apr MonPol meeting minutes as well as comments from Fed's Evans & Riksbank's Ohlsson headline today's thin economic docket.

FOREX OPTIONS: Expiries for May10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E685mln), $1.2040(E683mln)

- USD/JPY: Y109.00-05($587mln), Y110.00($740mln)

- GBP/USD: $1.3800(Gbp678mln)

- EUR/GBP: Gbp0.8760-80(E670mln)

- AUD/USD: $0.7900(A$639mln)

ASIA FX: Greenback Posts Small Rebound After Weak NFP

Risk assets were generally supported but a rebound in the greenback took the shine off most Asia EM FX.

- CNH: Offshore yuan is weaker, USD/CNH touched a low of 6.4147 before rebounding to highs just below 6.43.

- SGD: Singapore dollar is weaker, but has been more resilient than many of its Asia counterparts. The pair retraced just a small portion of its Friday decline.

- TWD: Taiwan dollar bucks the trend and is stronger, holding opening gains and touching the lowest since May 1997. Data on Friday showed exports continued to surge which saw the trade surplus double expectations.

- KRW: The won is stronger but of best levels seen at opening. Coronavirus cases in South Korea dropped below 500, while South Korean President Moon was upbeat on cooperation with the US in a speech.

- MYR: Ringgit is stronger, Malaysia's ban on all inter-state and inter-district travel take effect today and last until Jun 6. All eyes are on Malaysia's Q1 GDP & BoP current account balance, coming up Tuesday.

- IDR: Rupiah is higher, bank Indonesia April consumer confidence index came in at 101.5, while Danareksa Consumer Confidence improved to 80.1 in Apr from 74.9 recorded in Mar.

- PHP: Peso gained, Philippine agricultural output fell 3.3% Y/Y in Q1, after a 3.8% decline recorded in the final quarter of 2020. The negative reading in Q1 was "was due to the reduction in the livestock and poultry production," said the Philippine Statistics Agency.

- THB: Baht is stronger, late doors on Friday Thailand's Finance Ministry suggested that 2021 GDP growth may be faster than +2.3% Y/Y, owing to a suite of new stimulus measures prepared by the cabinet. Fiscal Policy Office chief said that the Ministry will seek cabinet approval for the first round of stimulus measures this week.

ASIA RATES: Mixed Picture

A mixed picture in Asia as South Korea strikes an upbeat tone while India struggles with further state lockdowns.

- INDIA: Yields mostly higher in early trade. Several states have extended existing lockdowns as the coronavirus situation continues to worsen, while New Delhi has announced additional restrictions. Yields rose on Friday after participants trimmed positions post auction, while contemplating the prospect of no central bank operations this week, instead looking ahead to SLTRO operations on May 17.

- SOUTH KOREA: Futures are lower in South Korea, dropping from the open as the won strengthened and equities rose. Coronavirus cases dropped below 500 while South Korean President Moon was upbeat on a number of subjects in his speech, emphasizing US cooperation and the domestic economic recovery as well as sounding positive on the battle against coronavirus.

- CHINA: The PBOC matched liquidity injections with maturities again, repo rates rose but the 7-day repo rate stayed below the 2.20% PBOC rate. Futures in China are higher, moving out of negative territory after gapping lower at the open as equity markets struggled to make decisive gains. There was some focus on an article from a PBOC official which said China needs to deepen reforms and make the financial sector more open and exchange rate market driven.

- INDONESIA: Yields lower across the curve as the rupiah hits the highest in two months, Bank Indonesia April consumer confidence index came in at 101.5, while Danareksa Consumer Confidence improved to 80.1 in Apr from 74.9 recorded in Mar.

EQUITIES: Broadly Positive

A broadly positive session for Asia-Pac equity markets, taking a positive lead from the US on Friday. Equity futures initially sold off on the miss in NFP data, before a fearsome rally set in, as concerns that the Federal Reserve could taper asset purchases and withdraw stimulus as soon as summer were rowed back, with markets seeing QE as here to stay. The post-payrolls rally put stock futures at new all-time highs. Markets in Japan and South Korea lead gains today, both higher by around 1%, in mainland China gains are smaller with major indices up around 0.3%. In Australia gains were supported by further upside in the commodity complex including iron ore. US futures are in the green, building on Friday's gains.

GOLD: Holds Gains

Gold moved in a tight range in Asia on Monday, holding near the top of its post-NFP range after jumping in the wake of an expectedly weak figure. The yellow metal is last up $1.33 at $1832.57. The jump higher at the end of last week capped the biggest weekly gain for gold since November as the greenback retreated and a raft of Fed speakers sought to reassure markets that policy normalization was still a long way off.

OIL: Crude Futures Higher But Off Best Levels

Oil gained in Asia-Pac trade on Monday, WTI up $0.19 from settlement levels at $65.10/bbl, while Brent is up $0.23 at $68.51. The benchmarks are off best levels, peaking early on and coming off highs as the greenback rose.

- Colonial Pipeline was subject to a cyberattack late Friday, which forced the company to temporarily shut its critical pipeline network supplying much of the East Coast of the U.S. with gasoline, diesel and jet fuel. Various source reports suggested that cybercriminal group DarkSide might be behind the attack, while official investigation is ongoing. The company said yesterday it is still working to full resume operations which could impact supply.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.