-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA Doesn't Rule Out Further Tightening

- The main macro focus today has been resurgent China equities. Multiple headlines have been out in support of the markets, most notable surrounding the nations Sovereign wealth fund vowing to increase their holdings in ETFs, while the securities watchdog is encouraging more share buy backs. President Xi is also set to be briefed by the Chinese regulators on Financial Markets, raising hopes of further support/stimulus measures.

- This has spilled over into weaker USD sentiment, with the A$ outperforming in the G10 space, while USD/CNH is back close to 7.2000. The AUD was also boosted by the RBA not ruling out further tightening, although the subsequent press conference was fairly balanced.

- US Tsy futures have regained some ground, but news flow in the space has been light.

- Later the Fed’s Mester speaks on the economic outlook and Kashkari and Collins also make appearances. There is no US data of note but euro area December retail sales are released.

MARKETS

US TSYS: Find Support, As Outright Buyers Emerge

TYH4 is trading at 111-02, + 09+ from NY closing levels.

Treasuries have had an uneventful day, trading off US session lows in early Asia trading and have been in a holding pattern for the remainder of the day, trading in a tight range.

- Futures have pushed to a intraday high of 111-02 post Asia lunch, although still trade below pre ISM data levels of 111-04+ from Monday. Outright buyers have been seen as fueling the push higher, outside of any notable news.

- Cash yields have are 2-4bps lower today, with the 2Y yield is 3.9bps lower at 4.432%, while the 10Y is 3.5bps lower at 4.123%. The 2y10y is currently -30.70, off the lows post Jobs data Friday of -40.198.

- Stronger than expected US data and Fed speakers' cautious tones around cutting interest rates have seen projected rate rates continue to retreat in recent sessions: March 2024 chance of 25bp rate cut is currently -16.4% vs. -18.3% from yesterday w/ cumulative of -4.1bp at 5.283%, May 2024 at -56.2% vs. -57.1% w/ cumulative -19.1bp at 5.133% while June 2024 -81.9% from -82.4% w/ cumulative -39.6bp at 4.930%.

- Tuesday focus: no data, but several Fed speakers are scheduled: Cleveland Fed Mester economic outlook at 1200ET, MN Fed Kashkari moderated Q&A, livestreamed at 1300ET, Boston Fed Collins open remarks labor conference, livestreamed, no Q&A at 1400ET, Philly Fed Harker on Fed role in the economy, text, Q&A at 1900ET.

JGBS: Little Changed, BoJ Gov. Ueda In Parliament Soon, 30Y Supply Tomorrow

In afternoon dealings, JGB futures have pushed back into negative territory, -11 compared to settlement levels, after almost paring overnight weakness back to flat by lunch following weaker-than-expected wages and household spending data for December.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Labour Cash & Real Earnings and Household spending data.

- BoJ Governor Ueda is scheduled to appear in Parliament from 1.41 pm JT - BBG

- (MNI) Market participants will focus on Bank of Japan Deputy Governor Shinichi Uchida's presentation to business leaders Thursday for any shift in tone that could quell expectations of a March policy shift. Policymakers' positive views on the removal of negative rates, published in the recent January meeting opinions, have fuelled speculation the Bank could adjust policy in March. (See link)

- Cash JGBs are dealing slightly mixed across the curve, with yields -0.3bp lower (5-year) to 1.5bp higher (30-year). The benchmark 10-year yield is 0.6bp higher at 0.731% versus the Nov-Dec rally low of 0.555%.

- Swap rates are lower across the curve, with rates 0.6bp to 1.4bps lower (10-year). Swap spreads are tighter across maturities.

- Tomorrow, the local calendar will release Leading and Coincident Indices for December (Preliminary), along with 30-year supply.

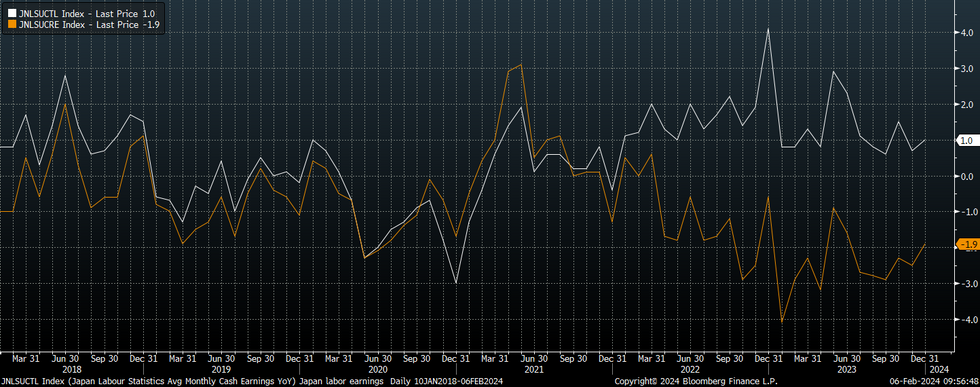

JAPAN DATA: Wages Data Below Expectations, But Some Signs Of Improving Trends

Japan Dec wages and household spending data was weaker than the consensus forecasts. Labor cash earnings rose 1.0% y/y for Dec, against a 1.4% forecast and 0.7% prior. Real earnings were -1.9% y/y, versus -1.5% forecast and -2.5% prior. Scheduled full time pay (same base) in y/y terms rose 2.0% in line with the consensus and the prior outcome. Cash earnings, measured on an equivalent basis were +1.5% y/y (prior 2.0%).

- Houshold spending was down -0.9% m/m and -2.5% y/y (against a projected -2.0% and prior -2.9%).

- The detail on wages showed sequential improvement versus the Nov outcome, albeit remaining within broad ranges, see the chart below for real and nominal wage trends in y/y terms.

- Bonus payments were +0.5% y/y, but remain volatile. Hours worked also slipped to -0.6% y/y.

- We saw steadier trends on the same sample base y/y figures, albeit again with outcomes remaining within recent ranges. At the margin this may encourage the authorities that underlying wages trends are improving.

- Household spending was slightly higher in nominal y/y terms, while the real y/y trend improved, albeit remaining comfortably in negative territory.

- Feb/Mar shape as key months around wage outcomes, as the government and unions push for firm increases, while the BoJ watches for gains that can help achieve a sustainable 2% inflation target.

Fig 1: Japan Wage Trends - Y/Y

AUSSIE BONDS: Cheaper, RBA Leaves Policy Unchanged, Doesn't Rule Out More Hikes

ACGBs (YM -7.0 & XM -8.0) are 2-4bps weaker and at Sydney session lows after the RBA left the cash rate unchanged at 4.35%, as widely expected. However, the statement was at the hawkish end of the spectrum. From the concluding paragraph of the statement:

- "Returning inflation to target within a reasonable timeframe remains the Board’s highest priority.”

- “The Board needs to be confident that inflation is moving sustainably towards the target range. To date, medium-term inflation expectations have been consistent with the inflation target, and it is important that this remains the case.”

- “While recent data indicate that inflation is easing, it remains high.”

- In terms of forecast details and assumptions: the cash rate is at its peak and holds there till June; assumes a 3.9% cash rate in Dec‘24, 3.4% Dec’25; Unemployment Rate peaking at 4.4% in mid-25; and Inflation at 2-3% target in 2025.

- There will be a press conference at 1530 local time.

- Cash ACGBs are 5-6bps cheaper on the day, with the AU-US 10-year yield differential unchanged at +2bps.

- Swap rates are 5-7bps higher on the day, with the 2s10s curve steeper.

- The bills strip has bear-steepened, with pricing -1 to -8.

- RBA-dated OIS pricing is 1-4bps firmer across meetings after the RBA decision.

RBA: Tightening Bias Retained, Cuts Not Expected Until H2 2024

The RBA kept rates at 4.35% at its February meeting as expected. It also maintained its tightening bias and caution regarding services inflation and the labour market. Updated forecasts show that inflation is expected to return to close to the top of the target band in Q2 2025, as was the case with the August forecasts, and the mid-point in Q2 2026. Governor Bullock will give a press conference at 1530 AEDT.

- A shift to an easing bias is going to need not only further inflation moderation to give the Board confidence it is returning to target, especially in the services component, but also a significant easing in labour market pressures. It revised up its unemployment rate forecast to 0.2pp to 4.2% in Q2 2024.

- Even though inflation is now forecast to return to around 3% 6 months earlier, the tone of the meeting statement remained cautious given that it is still around 18 months away and close to the edge of the RBA’s “reasonable timeframe”.

- The Board kept its options open by stating that “a further increase in interest rates cannot be ruled out”. In contrast, there was no suggestion that easing was considered and we will need to wait for the minutes to find out what was discussed. But the OCR was included in the new forecasts, which given the difficulties this has caused in the past was interesting, and there is around 50bp of cuts projected for H2 2024 but nothing before then.

- Also on a more hawkish note, the RBA noted that the more gradual decline in services inflation was “consistent with continuing excess demand … and strong domestic cost pressures, both for labour and non-labour inputs”. They will continue to monitor services trends overseas.

- It was also observed that the labour market is “tighter than is consistent with sustained full employment and inflation at target”.

- The same uncertainties clouding the outlook were catalogued in February as in December.

AUSTRALIAN DATA: Discounts Drive Increase In Retail Volumes

Q4 real retail sales were stronger than expected rising 0.3% q/q but Q3 was revised down 0.3pp to -0.1% and Q2 to -1.1%. Discounting around the end of the year simultaneously encouraged spending and weighed on prices. Consumption remains weak but people are able to spend at the right price.

- This data may mean household consumption in the Q4 national accounts released on March 6 may be stronger than the rest of 2023, but services spending in the quarter remains unknown and has the larger share of the total.

- The ABS notes that real sales per person fell 0.3% q/q, the sixth consecutive drop, to be down 3.5% y/y. Price pressures have resulted in households cutting back on their spending but per person it is still above pre-Covid levels.

- Retail prices rose only 0.1% q/q and 2.4% y/y after a peak of 7.6% y/y in Q4 2022.

- The pickup in real retail sales was driven by household goods rising 2.3% q/q. Other retailing rose 0.4%, food +0.5%and department stores +0.2%. Clothing and footwear were weak contracting 1.6% and so were cafes & restaurants falling 2.1%, the third straight drop.

Source: MNI - Market News/Refinitiv

FOREX: A$ Higher On RBA Statement, China Equity Gains

The USD is mostly lower in after Tuesday Asia Pac dealings as we approach the London/EU crossover. The BBDXY is down a little over 0.10%, last near 1243.2. Lower US yields, and firmer China equities have weighed on the USD.

- AUD/USD has been the strongest performer. The pair rose above 0.6500 as the RBA stated it couldn't rule out further rate hikes. Still, the subsequent press conference from RBA Governor Bullock stated the risks are fairly balanced around the next direction for policy rates.

- The A$ last tracks near 0.6515, around +0.50% firmer for the session.

- An additional support has come from a rebound in China equities, which are comfortably in the green. The sovereign wealth fund will boost states in local equities, while the regulator will also look to curb activities around securities lending. President Xi is expected to be briefed by the regulator potentially today (BBG).

- NZD/USD has been dragged higher by the A$, the pair last near 0.6070/75, around +0.30% firmer for the session.

- The AUD/NZD cross has bounced again from the low 1.0700, to track near 1.0730 in recent dealings.

- USD/JPY has drifted lower, last near 148.40, around 0.20% stronger in yen terms. US yields have pulled back by 2-4bps across the benchmarks, unwinding some of the strong gains seen in the past 2 sessions.

- Looking ahead, the Fed’s Mester speaks on the economic outlook and Kashkari and Collins also make appearances. There is no US data of note but euro area December retail sales are released.

CHINA EQUITIES: China Equities Surge Higher After Supportive Policies Announced

It has been another volatile trading session for China equities, with multiple headlines out in support of the markets, most notable surrounding the nations Sovereign wealth fund vowing to increase their holdings in ETFs, while the securities watchdog is encouraging more share buy backs. President Xi is also set to be briefed by the Chinese regulators on Financial Markets, raising hopes of further support/stimulus measures.

Markets initially opened lower this morning, however a sharp reversal occurred after multiple market supporting headlines printed. In Hong Kong the HSI is 3.100% higher while the Tech index is higher by 5.20% and mainland property index trades3.30% higher. China Mainland Equities are all higher today, the CSI 300 is 3.00% higher, while the ChiNext index is 5.20% higher after being down 1.30% on the open, CSI 1000 also reversed the morning move lower to trade 4.5% higher.

ASIA PAC EQUITIES: Asia Equities Lower As Higher Yields Weigh On Markets

Regional Asia Equities are lower today, however off their lows of from earlier in the day, the initial move lower was largely a continuation post US ISM data and hawkish signals from the fed.

- Japan equities indices were down as much as 0.90% during Asia morning, however we have reversed most of that move as US yields move lower and positive sentiment coming out of Chinese Equities pushes the market higher. Currently the Nikkei is lower by .30%, while the Topix is off 0.50%

- Australia closed lower today as the RBA kept rates on hold, however didn't rule out any further rate hikes in the future. Earlier today Q4 real retail sales numbers were out, showing stronger than expected rising 0.3% q/q but Q3 was revised down 0.3pp to -0.1% and Q2 to -1.1%. Currently the ASX 200 is 0.58% lower, led by Miners and Tech stocks

- Taiwan semi conductor names should benefit from the bullish outlook of the US SIA forecast for this year.

- South Korea stocks are lower again today, further giving up gains it made last week as real money continue to take profit after last weeks gains. SK Financial Services Commission also laid out three goals for their capital market polices, with improving short-selling systems a major importance to recover investor trust. Currently the Kospi trades 0.80% lower.

- Elsewhere in SEA, there are some pockets of strength, most notably from Thailand stocks, up nearly 1%, which comes ahead of tomorrow's BoT meeting. Philippine shares are also higher with the lower than expected CPI print likely helping at the margins.

OIL: Crude Little Changed As Geopolitics Offset By Fundamentals & Stronger USD

Oil prices are off their intraday highs to be little changed during APAC trading as heightened geopolitical risks are offset by the Fed suggesting rate cuts aren’t imminent, which has driven the US dollar higher. WTI rose to $72.99/bbl and is now around $72.82. Brent increased to $78.21 and is now hovering around $78.00. The USD index is 0.1% lower.

- Any news that shows progress in ceasefire talks between Hamas and Israel is likely to weigh on oil prices given that non-OPEC supply is robust and OPEC members are producing above their quotas. There is also continued concern re the strength of demand from China, the world’s largest importer.

- Saudi kept is main crude price steady for March but it needs oil prices to average at least $90/bbl for it to balance its 2024 budget, according to Fitch. This increases the chance that its output cuts will be extended into Q2.

- US crude output and refining has been normalising since a cold snap caused some disruptions. Later API inventory data is released which should provide information on if that process is complete.

- Later the Fed’s Mester speaks on the economic outlook and Kashkari and Collins also make appearances. There is no US data of note but euro area December retail sales are released.

GOLD: Battered By Higher Yields & A Stronger USD

Gold is little changed in the Asia-Pac session, after closing 0.7% lower at $2025.11 on Monday.

- Bullion was under persistent pressure from a mostly appreciating USD index on Monday as US Treasury yields climbed strongly for a second day after Friday's booming payrolls figures.

- Carryover weakness following Fed Chairman Powell's 60 Minutes interview on Sunday underscored a more cautious view regarding rate cuts.

- US Treasuries extended weakness after stronger-than-expected ISM Services across all items, especially prices. ISM Services bounced more than expected in January to 53.4 (cons 52.0) after 50.5 in Dec – joint highest since Sept. Prices paid far stronger than expected 64.0 (cons 56.7) after 56.7 – highest since Feb’23 after the strongest monthly increase since mid-2012. It builds on a +7.7pt jump in manufacturing prices paid to the highest since Apr’23.

- According to MNI’s technicals team, the low of $2015.09 cleared support at $2022.3 (20-day EMA) to open $2001.9 (Jan 17 low).

BOT: MNI Bank of Thailand Preview – February 2024: BoT Not In A Hurry To Ease

- The Bank of Thailand (BoT) is unanimously expected to keep rates at 2.5% at its February 7 meeting. It has said that policy is currently “appropriate” and “broadly neutral” and as it doesn’t see policy as restrictive, it has the option for a prolonged hold while keeping its options open.

- January CPI inflation was lower than expected falling to -1.1% y/y from -0.8% and core easing 0.1pp to +0.5% y/y. The government expects it to weaken further in February but BoT is not viewing this as deflation as the downtrend has been driven by subsidies and structural factors. It believes that reform and not rate cuts is needed to address low inflation.

- There is a lot of uncertainty around the timing and impact of the digital wallet scheme. BoT is likely to wait for a clearer picture on the impact and timing of the scheme before shifting to rate cuts, as it is unlikely to want to risk easing monetary policy simultaneously with fiscal policy given its potential effects on inflation and household debt.

- See full preview here.

PHILIPPINES DATA: Jan CPI Weaker Than Forecast, But M/M Details Still Resilient

Jan inflation data was weaker than expected. The headline rose at 2.8% y/y, versus 3.1% expected and 3.9% prior. In m/m terms we were +0.6%, versus 0.8% forecast and 0.2% prior. Core inflation was 3.8% y/y, down from 4.4% in Dec and the slowest y/y pace since mid 2022.

- In terms of the detail, for the m/m outcome we had reasonable inflation momentum across the board. Food was 0.8% a slight uptick on last month, while housing and utilities were +0.8%, and restaurants rose 0.7%. Only one sub-category saw a lower m/m pace compared to Dec last year.

- In was the opposite story in y/y terms, with only one sub category seeing stronger y/y momentum versus Dec. Also noteworthy was the continued rise in rice inflation pressures to 22.6% y/y, the strongest pace since 2009.

- Jan 2023 marked the y/y peak in terms of headline pressures for the CPI, so base effects will have no doubt played a role. This, and still positive m/m momentum may be what the BSP highlights in terms of preventing a near term policy pivot.

- Still, parts of the government may argue for easier policy settings with headline CPI now sub the mid point of the BSP's 2-4% target band and core inflation back below the upper end of this band.

ASIA FX: USD/CNH Testing 7.2000 Downside Support, As Onshore Equities Surge

USD/Asia pairs are mostly lower. The stronger tone to China equities has helped, with USD/CNH back close towards 7.2000. KRW has also performed well, up nearly 0.5% for the 1 month NDF. Gains have been a little more muted elsewhere. Still to come today is Taiwan CPI figures. Tomorrow, we have South Korea current account figures early, then we have the Philippines unemployment rate. Later on, the BoT decision is due, with no change expected.

- USD/CNH is testing below 7.2000 in recent dealings around 0.3% stronger in CNH terms. Focus remains on the rebound in local equity sentiment, with multiple headlines crossing, most notable surrounding the nations Sovereign wealth fund vowing to increase their holdings in ETFs, while the securities watchdog is encouraging more share buy backs. President Xi is also set to be briefed by the Chinese regulators on Financial Markets, raising hopes of further support/stimulus measures.

- 1 month USD/KRW has fallen in sympathy, the pair last under 1325, around 0.60% stronger in won terms. The Kospi is down 0.75%, but lower USD levels against the majors, coupled with positive spill over from CNH gains is evident.

- USD/THB probed above 35.80 in earlier trade, as comment from the PM pointed to scope for a BoT rate cut of 25bps. There was no follow through and we sit back at 35.66 in recent dealings, around 0.40% stronger in baht terms. Our base case is for no change at tomorrow's policy meeting, which is also the market consensus.

- USD/PHP is lower as well, in line with broader USD trends, the pair last near 56.20. CPI Data for Jzn was weaker than expected, but the BSP didn't suggest a near term policy pivot was imminent post the data outcome.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2024 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 06/02/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 06/02/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 06/02/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2024 | 1200/1200 |  | UK | Asset Purchase Facility Quarterly Report | |

| 06/02/2024 | 1330/0830 | * |  | CA | Building Permits |

| 06/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/02/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/02/2024 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 06/02/2024 | 1745/1245 |  | CA | BOC Governor speech/press conference in Montreal | |

| 06/02/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 06/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/02/2024 | 1900/1400 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 2145/1045 | *** |  | NZ | Quarterly Labor market data |

| 06/02/2024 | 0000/1900 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.