-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: RBA Holds Steady, USD Index Back To Early June Levels

- At Governor Lowe’s final meeting, the RBA left rates at 4.1% for the third consecutive time. The meeting statement was little changed from August and the tightening bias was retained as “some further tightening of monetary policy may be required” to return inflation to target. There remain considerable uncertainties around the inflation and growth outlook but the RBA continues to be data and forecast dependent and while the economy evolves as expected is unlikely to raise rates. But an imminent pivot to an easing bias is improbable.

- AUD/USD is the weakest performer in the G10 space, down 0.70%, back near 0.6400. The RBA didn't influence the currency greatly, with broader USD gains, higher yields and softer regional equities all contributing to the fall. ACGBs (YM flat & XM -3.5) sit slightly stronger.

- US cash tsys sit ~3bps cheaper across the major benchmarks, after markets returned from yesterday's holiday. The BBDXY is tracking higher, last near 1247.5, highs back to early June.

- Later there are European/US services and composite PMIs for August as well as US July factory orders and final July durable goods orders.

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 110-10, -0-08+, a 0-03 range has been observed on volume of ~60k today.

- Cash tsys sit ~3bps cheaper across the major benchmarks.

- Narrow ranges have been observed in Asia today, cash tsys re-opened cheaper after closing yesterday for the Labour Day holiday.

- There was little follow through on moves, and the space looked through a weaker than forecast Caixin PMI print and RBA holding the cash rate in Australia steady.

- Eurozone PPI and ECB CPI Expectations headline in Europe today. Further out we have Factory Orders and Durable Goods as well as the latest 1-Year Supply.

JGBS: Futures Cheaper But Above Worst Levels, 10Y Auction Sees Mixed Results

JGB futures are sitting just above session lows, -12 compared to settlement levels.

- In addition to July household spending that printed weaker than expected, the key domestic driver for the local market today was the auction of 10-year JGBs.

- The 10-year supply saw higher demand (the cover ratio lifted to 4.019x from 3.636x previously), but the low price failed to meet wider expectations and the tail lengthened to the longest since April. In short, it appears as though local investors will need a higher yield and/or more time to assess the new YCC framework and the BoJ policy outlook before significantly lifting allocations to the JGB market.

- Outside the domestic drivers, local participants have likely been on headlines and US tsys watch. Cash US tsys sit ~3bps cheaper across the major benchmarks. Narrow ranges have been observed in Asia today, as cash US tsys re-opened after yesterday's Labor Day holiday.

- Cash JGBs are cheaper across the curve, with yields 0.1bp (1-2-year) to 1.2bp (5- and 20-year) higher. The benchmark 10-year yield is 1.0bp higher at 0.654%.

- The swap curve has twist steepened, with rates 0.1bp lower to 0.8bp higher. Swap spreads are tighter across the curve.

- Tomorrow the local calendar is light, with a speech from BoJ Board Member Nakagawa as the highlight.

JAPAN DATA: July Household Spending Weaker Than Expected

Real July household spending was weaker than expected. We fell 5.0% y/y, versus a -2.5% estimate and -4.2% prior. This leaves the trend very much skewed lower, with this being the weakest pace of household spending since early 2021.

- In m/m terms we were down -2.7%, versus a 0.9% gain in June. We have only had two positives m/m outcome this year, with the other one being in January.

- The data continues to suggest households are struggling to maintain spending trends amidst higher inflation, although nominal spending was also weaker. We were down -2.5% m/m and -1.3% in y/y terms.

AUSSIE BONDS: Slightly Richer After The RBA Leaves The Cash At 4.10%, Q2 GDP Tomorrow

ACGBs (YM flat & XM -3.5) sit slightly stronger after the RBA leaves the cash rate at 4.10%, as widely expected. The market gave a 25bp hike today less than a 5% chance. Today’s RBA statement highlights are:

- Inflation has passed its peak but remains high, expected to persist for some time. Goods price inflation has eased, but service prices and rent continue to rise.

- Labour market conditions remain tight, though easing slightly, with a gradual rise in the unemployment rate expected. Wages have increased but remain consistent with the inflation target.

- The central focus is on returning inflation to the 2–3% target range and sustaining medium-term inflation expectations. There are uncertainties, especially in services price inflation and household consumption.

- Further monetary policy tightening may be necessary, depending on data and risks. The goal is to return inflation to target.

- Cash ACGBs are 1bp richer after the decision and flat to 3bp cheaper on the day. The AU-US 10-year yield differential is -9bp.

- Swap rates are 1-3bp higher on the day, with EFPs slightly tighter.

- The bills strip is little changed on the day, with pricing -1 to +2.

- RBA-dated OIS pricing is 1-2bp softer across meetings after the RBA decision.

- Tomorrow the local calendar sees Q2 GDP. The AOFM also plans to A$700mn of the Dec-34 bond.

RBA: Rates Held, Tightening Bias Retained, China Economy Area Of Concern

At Governor Lowe’s final meeting, the RBA left rates at 4.1% for the third consecutive time. The meeting statement was little changed from August and the tightening bias was retained as “some further tightening of monetary policy may be required” to return inflation to target. There remain considerable uncertainties around the inflation and growth outlook but the RBA continues to be data and forecast dependent and while the economy evolves as expected is unlikely to raise rates. But an imminent pivot to an easing bias is improbable.

- The reasons for leaving rates unchanged in September were the same as in July/August. There has been 4pp of tightening and it is “working” but there is still a lot of “uncertainty surrounding the economic outlook” and so the decision gives the Board more “time to assess the impact” of hikes to date.

- There were few statement changes but the main one was pointing out that there was “increased uncertainty” regarding China’s economic outlook due to problems in the property sector. The RBA continues to monitor global developments closely and this will be an important part of that.

- Inflation remains “too high” and it was noted that this will be the case “for some time yet” despite the lower-than-expected July CPI. The central bank continues to be “resolute” in returning inflation to target. It reiterated the warnings regarding the damage high inflation can do, and one change was that it is weighing on real incomes and thus consumption. It observed again the experience overseas re sticky services inflation, which in Australia is yet to turn down clearly, and the uncertainty re how wages and prices will respond to slower growth. Wages remain consistent with the inflation target as long as “productivity growth picks up”.

- See September meeting statement here.

AUSTRALIAN DATA: Q2 GDP Expected To Print Higher Than Q1 On Wednesday

The RBA reiterated in its September meeting statement that the “Australian economy is experiencing a period of below-trend growth and this is expected to continue”. Q2 GDP is released on Wednesday and consensus has been revised up 0.1pp to +0.4% q/q following the higher-than-expected net exports and public demand contributions published today. If this forecast is realised it would be stronger than Q1’s 0.2% q/q and result in annual growth of 1.8% down from 2.3% in Q1.

- Projections are in a broad range from flat to +0.8% q/q with most analysts between +0.2% and +0.5%. ANZ and Westpac are both forecasting +0.4% q/q and CBA & NAB +0.5% q/q. Macquarie Bank is an outlier expecting +0.8% q/q, which would be the strongest quarterly growth since Q2 2022.

- In terms of the Q2 data released so far, retail sales volumes fell 0.5% q/q, construction volumes rose 0.4% (Q1 was revised up sharply), machinery & equipment capex volumes +1.9% , inventory volumes fell 1.9% q/q, net export contribution to GDP +0.8pp and public demand +0.5pp.

- Productivity/unit labour cost data are also released with the national accounts tomorrow and given Australia’s very poor productivity performance and the RBA’s attention on this area, it is likely to be monitored closely. Given productivity fell 3% q/q in Q2 2022, base effects should mean that the 4.5% y/y drop in Q1 2023 should be the trough.

AUSTRALIAN DATA: Lower Commodity Prices Hit Current Account, Real Exports Strong

The last of the Q2 data before Wednesday’s national accounts are published signal some upside risk to the 0.3% q/q consensus forecast. The ABS estimates that total public demand will contribute 0.5pp and net exports +0.8pp compared with expectations of 0.3pp.

- The Q2 current account surplus came in close to expectations at $7.7bn down from an upwardly revised $12.5bn in Q1. The narrowing was due to lower commodity prices but the headline was helped by a smaller net income deficit ($23.4bn). The trade surplus narrowed $8bn to $31.4bn with the services deficit improving to $0.16bn as exports rose 12.8% q/q driven by the post-pandemic recovery in tourism and education.

- While exports of goods fell 7% q/q in nominal terms, volumes rose 2.5% q/q demonstrating the impact of lower prices for Australia’s main exports. The terms of trade deteriorated 7.9% q/q, the largest quarterly drop since 2009, to be down 12.7% y/y. While it is off its highs, the terms of trade remains elevated.

- The real trade surplus rose $4.5bn on the quarter after declining $1.67bn in Q1. The ABS estimates that this will result in a net export contribution to GDP of 0.8pp after it detracted 0.2pp in Q1. Real goods and services exports rose 4.3% q/q in Q2 whereas imports only 0.7%.

Source: MNI - Market News/ABS

Terms of trade

Source: MNI - Market News/ABS

NZGBS: Cheaper, Commodity Prices Lower, S&P Comfortable With Credit Rating

NZGBs closed on a weak note, with benchmark yields 4-7bp higher. The hasn’t been much in the way of domestic drivers to highlight other than the commodity price index (see below).

- Swap rates are 1-5bp higher, with implied swap spreads tighter.

- RBNZ dated OIS pricing is flat to 2bp softer across meetings.

- NZ Finance Minister Robertson has defended the central bank’s dual mandate as “normal” and not something that’s caused inflation or interest rates to be unnecessarily high. “The BoE, the US Fed and the RBA all have forms of mixed mandates,” Robertson said. (See link)

- NZ's commodity export prices fell 2.9% m/m (-14.2% y/y) in August versus -2.6% in July, according to ANZ. Dairy prices led m/m decline, falling 8.7%. Global demand for dairy products is weak, led by softer demand from China. At the same time, the supply of dairy products from NZ is lifting which is putting downward pressure on prices: ANZ.

- S&P Global Ratings is “reasonably comfortable” with NZ’s AA+ sovereign credit rating, Melbourne-based credit analyst Martin Foo said Tuesday in an interview broadcast by Newshub. (See link)

- Tomorrow the local calendar sees Volume of All Buildings. for Q2.

FOREX: Antipodeans Pressured In Asia

The Antipodeans have been pressured through the Asian session on Tuesday, the AUD is the weakest performer in the G-10 space however there has been little reaction thus far to the RBA leaving the cash rate at 4.10%.

- AUD/USD prints at $0.6420/25, the pair is ~0.6% lower today. The RBA noted some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe. Support comes in at $0.6365, low from Aug 17 and bear trigger, and $0.6285, low Nov 4 2022.

- Kiwi is also pressured, NZD/USD is down ~0.4% last printing at $0.5915/20. Firmer US Tsy Yields and a weaker than forecast Caixin Services PMI, as well as lower regional equities have weighed on sentiment. Bears now target the low from 25 Aug ($0.5886) which opens $0.5841 (low from 10 Nov 22).

- Yen is marginally weaker, USD/JPY is ~0.1% firmer however a ~30 pip range has persisted for much of the session and there has been little follow through on moves.

- Elsewhere in G-10, the Scandies are pressured although liquidity is generally poor in Asia.

- Cross asset wise; Hang Seng is down ~1.5% and e-minis are ~0.1% lower. US Tsy Yields are ~3bps higher across the curve. BBDXY is up ~0.1%.

- Eurozone PPI provides the highlight in Europe with the final read of August Services PMI from France and Germany also due.

EQUITIES: Regional Equities Tracking Lower, Higher USD/Yields Weigh

Regional equities are mostly tracking lower in the first part of Tuesday trade. Weakness has been fairly broad based, although there are some pockets of strength in South East Asia. US equity futures have ticked lower, but losses are modest at this stage. Eminis last near 4515, -0.15%, while Nasdaq futures are near 15502, off by around -0.10%.

- US cash Tsys trading has resumed post Monday's holiday, with yields continuing to rise, in a continuation of the post payrolls theme from Friday US trade. The 10yr is +3bps, near 4.21%. This has aided the USD and weighed on regional risk appetite, which has contributed to equity market losses.

- China stocks have unwound some of yesterday's rise. The CSI 300 sits 0.58% lower at the break. A weaker than expected Caixin services PMI print (51.8 versus 53.5 forecast and 54.1 prior) has weighed on the rebound theme.

- Country Garden has reportedly repaid coupons on two dollar bonds, within the allotted grace period. The HSI is down 1.51% at the break though, with the mainland properties index off by 2.73%, following yesterday's 8.21% rally.

- Japan stocks are modestly lower, the Topix off by near 0.40% at this stage, with Toyota losses weighing on sentiment. South Korean and Taiwan shares are down a touch, but largely tracking recent ranges.

- In SEA, most bourses are down modestly. Thai shares are trying to track higher after 3 sessions of losses, but the index is close to 1550 at this stage. Philippine shares have seen some support sub 6200, while August inflation data was noticeably stronger than expected due to higher rice prices.

OIL: Crude Holding Gains As Supply Cuts Expected To be Extended This Week

Oil prices have held onto their gains from recent sessions during APAC trading today. WTI is up 0.4% to $85.92/bbl, off its low of $85.65, but it has not been able to hold breaks above $86. Brent is down slightly hovering just under $89 which it hasn’t been able to breach clearly. Its intraday high was $89.11 and is currently at $88.93. The USD index is 0.2% higher.

- The supply outlook remains a key factor driving the market with Saudi Arabia and Russia expected to announce an extension of output cuts into October this week. Goldman Sachs has said that the reductions have resulted in a 2.3mbd shortfall in Q3. The US has also seen large crude inventory drawdowns and later today the API will release its latest stock data, which is likely to be monitored closely given last week’s huge 11.5mn drawdown.

- The gap between the two nearest contracts for Brent, the prompt spread, has widened this week to 75c/bbl up from 58c/bbl a week ago, according to Bloomberg.

- Later there are European/US services and composite PMIs for August as well as US July factory orders and final July durable goods orders.

GOLD: Weaker In Asia-Pac Dealing After a Steady Monday

Gold is 0.3% weaker in the Asia-Pac session, after closing within Friday’s range yesterday. With the US out for the observance of the Labor Day holiday, newsflow and market movements were limited.

- US tsy futures were weaker and European government bond yields were 2-4bp higher across benchmarks as the market wagered that the ECB will keep rates higher for longer, even as Governing Council member Mario Centeno warned his colleagues that there’s a risk of raising them too far.

- According to MNI's technicals team, the current uptrend remained intact with resistance at Friday’s high of $1953.0 after which lies $1963.3 (76.4% retrace of Jul 20 – Aug 21 bear leg).

- Nevertheless, the USD Index looks to have resumed the primary uptrend off the mid-July lows, a factor that should keep the precious metals subdued despite the OIS-implied Fed rate path softening recently.

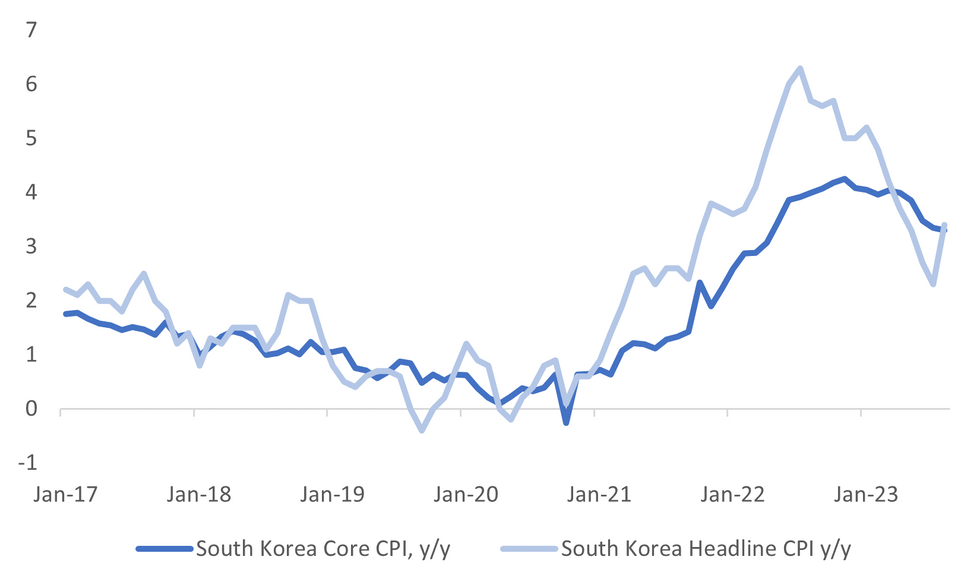

SOUTH KOREA DATA: August Inflation Surprises On The Upside

August CPI was stronger than expected, the m/m outcome was 1.0%, versus 0.6% expected and 0.1% prior. This took the y/y pace to 3.4%, against a 2.9% forecast and 2.3% prior. Core inflation was unchanged from July, printing at 3.3% y/y. GDP Q2 revisions were unchanged (0.6% q/q, 0.9% y/y).

- It was expected that the y/y pace would rebound, as 2022 inflation base effects became less favorable. Still, this was clearly stronger than expected.

- The m/m gain was led by food +2.9% and transport +3.8%, with both categories recording decent rises versus July. Other categories saw less inflation but mostly positive gains.

- In y/y terms, transport inflation was -2.5%, versus -10.7% prior. Food inflation rose to 4.9% y/y, versus 3.4% prior. Other trends were mixed, but most other categories saw their respective y/y pace hold close to July levels.

- Core inflation held steady at 3.3% y/y, ending the recent run of waning y/y momentum for this index.

- Food inflation trends may improve in the coming months, but today's data is likely to leave the BoK, at the very least, pushing back against rate cut expectations and potentially leaving the door ajar for further tightening.

Fig 1: South Korean Headline & Core CPI Y/Y

Source: MNI - Market News/Bloomberg

THAILAND DATA: Inflation Remains Subdued, BoT Close To Neutral

August headline CPI inflation rose a stronger than expected 0.9% y/y after 0.4%. Core was in line with forecasts at 0.8% down slightly from 0.9%. Both are below the central bank’s 1% to 3% inflation target range. Inflation remains very low in Thailand but headline appears to have troughed due to rising energy prices.

- Bank of Thailand Governor Sethaput said today that the central bank will revise down its inflation and growth forecasts later this month, thus policy is likely to be unchanged at the BoT meeting on September 27. He said that rates were close to neutral but he is concerned about the impact of El Nino on food prices and the inflationary impact of the new government’s stimulus measures.

- Food prices inflation eased to 0.7% y/y in August from 1.5% as all components moderated except for rice & cereal which rose 2.5% y/y from 1.7%. Non-food prices rose 1% y/y from -0.4% due to higher transport and energy prices. With India’s non-basmati rice export ban and continued tightening in the oil market, rice and energy prices are likely to rise further over the months ahead.

Source: MNI - Market News/Refinitiv

ASIA DATA: PMI Continues To Show Expanding Manufacturing Output In ASEAN

The ASEAN S&P Global manufacturing PMI showed slightly stronger growth in the sector with the index rising to 51 in August from 50.8 predominantly driven by Indonesia (PMI 53.9). There has been positive manufacturing activity in the region for two years. It is mixed though with four of the seven countries recording growth in the sector. Thailand and the Philippines fell below the 50-breakeven mark in August while Vietnam rose above it.

- The pickup in the ASEAN PMI was due to an increase in new orders and output growth rising to a 3-month high. Employment was steady after having fallen for the previous five months. Price and cost increases rose in August with the latter at its fastest pace since April but they remain below average. S&P Global sees a risk to growth in the region from higher rates and the slower global economy.

- Business confidence improved to its highest in four months as output is expected to grow over the coming year. It has been below average though this year.

- S&P Global report that supply chains continue to improve in ASEAN with average lead times decreasing for the sixth consecutive month.

- See S&P Global ASEAN PMI report here.

Source: MNI - Market News/Bloomberg/S&P Global

ASIA FX: Dollar Stronger Across The Board

USD/Asia pairs are higher across the board today, with a firmer USD backdrop against the majors, aided by higher US yields, boosting the dollar. Regional equity sentiment has also been somewhat weaker, weighed by the softer China Caixin Services PMI print. USD/CNH is back above 7.2900, while KRW and THB have been the weakest performers. Tomorrow, the data calendar is light with the Singapore PMI and Taiwan CPI on tap.

- USD/CNH has risen in sympathy with broader USD trends and a weaker onshore equity backdrop. The Caixin services PMI was also sub expectations. USD/CNH got to a high of 7.2961, after opening at 7.2755. We have settled back closer to 7.2900 in recent dealings. Late August highs rest just above 7.3100.

- 1 month USD/KRW is noticeably higher in the first part of trade today. The pair is +0.45% stronger, last near 1322.50. Earlier highs were at 1324.50. We are back above the 20-day EMA, which comes in close to 1320, while further support has been evident around the 50-day EMA, near 1311. Broader USD sentiment is weighing on the won, with all USD/Asia pairs higher at this stage. The won, along with the baht, are the weakest performers though. Earlier we had Q2 GDP revisions, which were unchanged, while August CPI was stronger than expected.

- USD/HKD spot sits above Monday lows. Yesterday we got to ~7.8320, but have tracked higher in the first part of Tuesday trade. Offers were evident on an earlier move above 7.8400, the pair last at 7.8385. HKD weakness is line with broader USD gains, although US-HK short term rates have rolled over. The 3 month differential back to +85bps. 3 month Hibor rose +8bps today to 4.525%, the 1 month spiked back above 4%.

- The Rupee has opened dealing marginally softer on Tuesday, and sits at its lowest level in one week. USD/INR is ~0.1% firmer this morning and last prints at 82.7578/8000, the pair is holding above its 20-Day EMA (82.7123) after rising above the measure yesterday. S&P Global Services PMI ticked lower in August to 60.1, the Composite measure also nudged lower to 60.9 from 61.9.

- USD/MYR sits at its highest level since mid July, the pair is ~0.1% firmer today and last prints at 4.6605/20. Broader USD trends continue to dominate flows in recent dealing, the pair is ticking higher however ranges do remain narrow. Rice importer Malaysia is planning measures to ensure it has sufficient supplies of the grain following Indian export curbs that rattled global markets and sent prices soaring.

- The SGD NEER (per Goldman Sachs estimates) has ticked lower on Tuesday as the measure continues to nudge away from late Augusts cycle highs. We now sit ~0.6% below the top of the band. Broader USD trends have dominated flows in recent dealing, USD/SGD sits at its highest level in one week and last prints at $1.3565/70. July Retail Sales printed at 1.1% Y/Y below the expected 2.1%. The prior read was revised lower to 1.0%.

- Like the rest of the region, USD/PHP is seeing upside pressure in the first part of dealing today. The pair last in the 56.75/80 region. This is 0.25% weaker in PHP terms versus yesterday's close. We remain within recent ranges, though the pair is threatening an upside test, with mid August highs at 57.00 in focus. The August spike in inflation pressures don't help. It weighs on Philippines real yields and leaves the risk of tighter policy. BSP stated risks to inflation remain skewed higher, given transport fare hikes and wage adjustments. It still expects inflation to be back within the 2-4% target range in Q4.

- USD/THB continues to track higher, last 35.40, above late August highs, but sub mid-August highs near 35.60. Local equities have struggled, while portfolio outflows are still evident from local equities and bonds. August headline CPI inflation rose a stronger than expected 0.9% y/y after 0.4%. Core was in line with forecasts at 0.8% down slightly from 0.9%. Both are below the central bank’s 1% to 3% inflation target range. Inflation remains very low in Thailand but headline appears to have troughed due to rising energy prices.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/09/2023 | 0700/0900 |  | EU | ECB's Lagarde Speaks at Legal Conference | |

| 05/09/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/09/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/09/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/09/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/09/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/09/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/09/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/09/2023 | 1230/1430 |  | EU | ECB's Schnabel speaks at Legal Conference | |

| 05/09/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/09/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/09/2023 | 1430/1630 |  | EU | ECB's de Guindos speaks at Legal Conference | |

| 05/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/09/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 05/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.