-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI EUROPEAN MARKETS ANALYSIS: Rice & Oil Prices Likely To Push Asian Inflation Up Again In September

- US Tsys firmed in early trade as local participants digested yesterday CPI print. TYZ3 has breached its post CPI highs, resistance comes in at 110-10, the 20-Day EMA. The USD has been marginally pressured in Asia, BBDXY has breached the post CPI low, last down 0.20%. USD/Asia pairs are weaker, although CNH has lagged.

- August employment rose a stronger-than-expected 64.9k and the July drop was revised higher to only -1.4k from -14.6k. The data continue to show a strong labour market but the strong gain in part-time jobs though may be suggesting that the job market is starting to cool. ACGBs (YMZ3 +4.0 & XMZ3 +5.5) sit at Sydney session highs despite the jobs data.

- Our estimate of non-Japan Asian inflation saw an increase in August to 2.2% y/y from 2% as all countries except India saw a rise in headline driven by higher rice and fuel prices, see below for more details.

- Later today the ECB decision is announced followed by a press conference. It is expected to be a close call (see MNI ECB Preview - September). August US retail sales print and excluding autos & gas are expected to fall slightly. There are also jobless claims, August PPI and July business inventories.

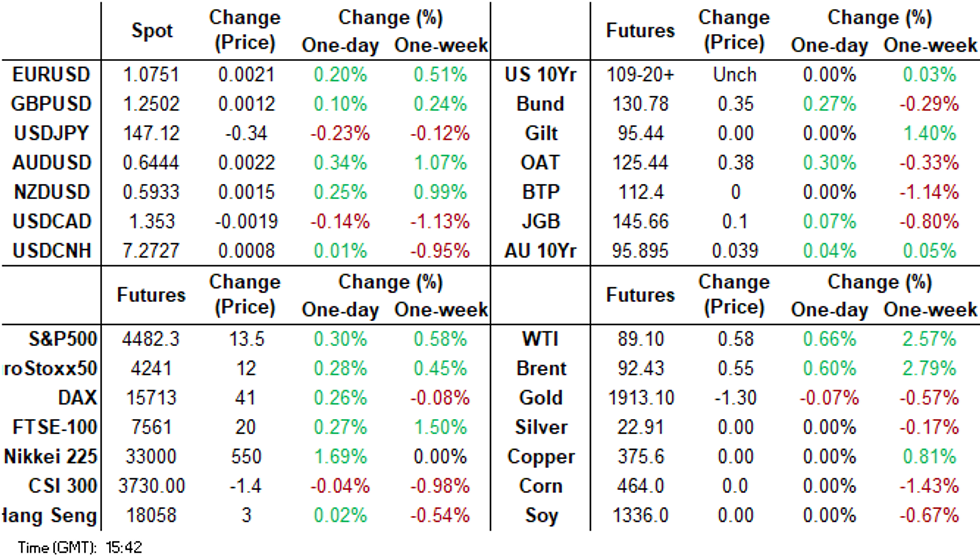

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 110-05, +0-04+, a 0-06 range has been observed on volume of ~76k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys firmed in early trade as local participants digested yesterday CPI print, there was little follow through on the early moves higher and tsys consolidated in a narrow range.

- TYZ3 has breached its post CPI highs, resistance comes in at 110-10, the 20-Day EMA.

- Flow wise a block buyer of TY (2,319 lots) was the highlight.

- In Europe today the latest monetary policy decision by the ECB headlines. Further out we have Initial Jobless Claims, Retail Sales and PPI.

JGBS: Futures Holding In Positive Territory But Off Post-20Y Auction Highs

JGB futures are maintaining a positive stance, +10 compared to settlement levels, albeit slightly off the session's peak reached in the afternoon session. JBZ3 initially gapped higher after the lunch break, hitting a new high for the Tokyo session at 145.75. This upward momentum followed a well-received 20-year bond auction.

- Several factors contributed to the success of this month's 20-year auction, including the near-highest outright yield since January, the steepest 10/20 yield curve since March, and the favourable pricing of the 20-year bonds relative to the 10/20/30-year butterfly.

- Outside of the previously outlined international investment flows and core machine orders data, the local calendar also saw July (F) data for industrial production and capacity utilisation. IP printed -1.8% m/m versus -2.0% prior, while capu showed -2.2% m/m versus +3.8% prior.

- The cash JGB curve has twist-flattened, pivoting at the 3s, with yields 0.4bp higher to 4.0bp lower. The benchmark 10-year yield is 0.6bp lower at 0.707%.

- The 20-year benchmark is 2.4bp lower on the day at 1.425% versus 1.443% prior to the auction results.

- The swaps curve bull flattens, with swap spreads generally wider beyond the 3-year.

- Tomorrow the local calendar is light with the Tertiary Industry Index as the sole release.

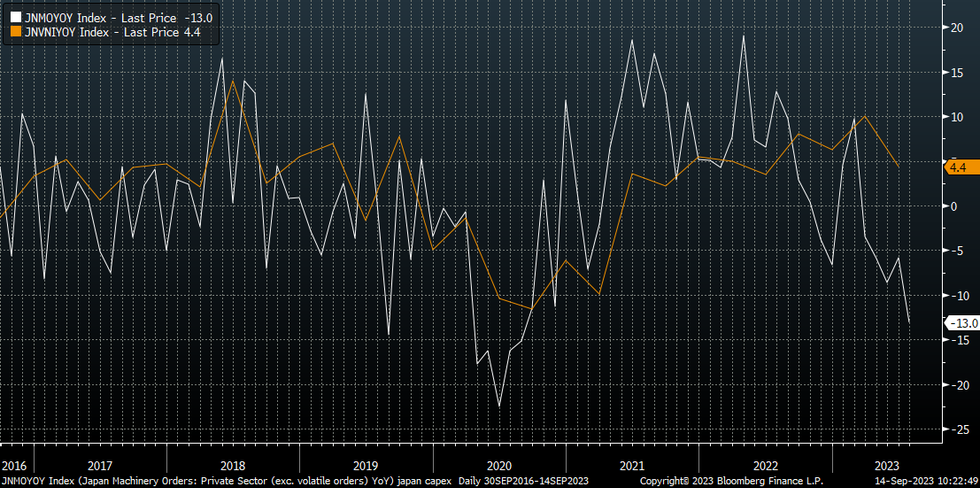

JAPAN DATA: Weakening Core Machine Orders Points To Slower CAPEX

Japan's July core machine orders came in a touch below expectations. In m/m terms we printed at -1.1%, versus -0.8% projected and +2.7% in June. In y/y terms we were at -13.0%, versus -10.3% forecast and -5.8% prior.

- This continues the downtrend in core machine orders in y/y terms, albeit with a volatile trend since the start of the year. The y/y pace is now the lowest going back to Q3 2020.

- The chart below overlays core machine orders y/y (the white line) against capital spending (ex software), also in y/y terms. It suggests a further slowdown in capex as we progress through H2.

- Later on, we get the final July Japan IP data, along with capacity utilization.

Fig 1: Softening Core Machine Orders Suggests Weaker Capex Growth

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Richer, At Sydney Session Bests, Despite Employment Beat

ACGBs (YMZ3 +4.0 & XMZ3 +5.5) sit at Sydney session highs despite employment data surpassing expectations (+64.9k jobs versus +25k est.). A contributing factor was the composition of the data that leaned towards the weaker side. Most of the increase in employment was part-time (+62.1k), with the unemployment rate unchanged at 3.7%.

- (AFR) A stronger-than-expected lift in employment has pushed labour force participation to a record high as the jobs market shows continued resilience in the face of high interest rates. (See link)

- ACGB strength was also assisted by US tsys and JGBs, which displayed strength during the Asia-Pac session. US tsys extended their post-CPI gains, resulting in benchmark yields decreasing by 1-2bps. JGBs also exhibited a robust performance, bolstered by a successful 20-year bond auction.

- Cash ACGBs are 4-5bp richer on the day, with the AU-US 10-year yield differential unchanged at -12bp.

- Swap rates are 3-5bp lower on the day, with 3-year EFP wider.

- The bills strip bull flattens, with pricing +1 to +5.

- RBA-dated OIS pricing is flat to 2bp softer across meetings, with terminal rate expectations unchanged at 4.19%.

- Tomorrow the local calendar is empty, with the next release of note being the RBA Minutes for the September meeting on Tuesday.

AUSTRALIAN DATA: Strong Jobs Growth But Small Cracks Appearing

August employment rose a stronger-than-expected 64.9k and the July drop was revised higher to only -1.4k from -14.6k. The data continue to show a strong labour market but the strong gain in part-time jobs though may be suggesting that the job market is starting to cool and that businesses are more uncertain about the outlook. The underemployment rate edged higher too, which the RBA has been monitoring.

- Job growth remained solid at 3% y/y up from 2.8% and has averaged 37.7k this year not far off 2022’s 43k, signalling that labour demand remains robust. Increased labour supply is helping to meet this.

- Full-time employment rose a sedate 2.8k after falling an upwardly revised 18.7k in July but the level remains 0.2% below June. After underperforming full-time jobs, part-time is now taking the lead with strong momentum and rising 62.1k in August after +17.3k to be up 2.2% y/y after falling 0.1%. The employment ratio returned to 64.5%, it has been around this rate since March.

- The labour force rose 0.4% m/m to be up 3.2% y/y driven by an increase in the working age population of 0.3% m/m and 2.8% y/y and drove a 0.1pp increase in the participation rate to 67%. The moderate 2.7k drop in the unemployed meant that the unemployment rate was steady at 3.7%.

- While the number of employed rose strongly, hours worked fell 0.5% m/m, with full time down 0.7% m/m, the second consecutive fall. Hours are 3.7% higher on the year though and still above jobs growth. But the decline in full-time hours is reflected in the underemployment rate rising to 6.6% from 6.4%. The level remains low but the 3-month average is now 0.5pp above its November trough.

Source: MNI - Market News/ABS

NZGBS: Closed At Best Levels, Tracking Richening In Global Bonds

NZGBs closed at the session’s best levels, with benchmark yields 2-5bp lower. Given the absence of significant domestic events, local market participants appeared to turn their attention overseas for guidance. US tsys, JGBs and ACGBs all displayed strength during the Asia-Pac session.

- US tsys extended their post-CPI gains, resulting in benchmark yields decreasing by 1-2bps. JGBs also exhibited a robust performance, bolstered by a successful 20-year bond auction.

- Meanwhile, ACGBs strengthened despite employment data surpassing expectations, with a contributing factor being data related to composition that leaned towards the weaker side.

- NZ-US and NZ-AU 10-year yield differentials closed largely unchanged on the day.

- Today’s weekly auction saw mixed results, with the May-31 bond seeing a cover ratio of around 3.00x, while the May-26 and May-41 bonds saw cover of around 2.00x.

- Swap rates are 1-4bp lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 1bp firmer across meetings, with terminal OCR expectations steady at 5.62%.

- The RBNZ’s total assets increased for a second month in August led by foreign currency investments and cash balances, according to an update on the central bank website. (See link)

- Tomorrow the local calendar sees BusinessNZ Manufacturing PMI for August.

EQUITIES: Mostly Positive Trends Post The US CPI Print

Regional Asia Pac equity market trends are mostly positive, with Hong Kong and China markets the main exceptions. US equity futures are tracking higher in the first part of Thursday trade. This follows modest gains for the S&P and Nasdaq in Wednesday trade post the US CPI print. Eminis are +0.30%, last near 4532, while Nasdaq futures are outperforming, +0.44%.

- Broader risk signals have aided the equity backdrop, with US yields -1 to -2.5bps lower across the curve today. The USD is also generally tracking softer (BBDXY -0.15%).

- In line with the firmer tone to US tech futures, Japan, Taiwan and South Korean markets are all outperforming. The Topix is 0.9%, Taiex +1.1% and Kospi +1.0% (with the Kosdaq outperforming, +1.60%). Offshore investors are modest buyers of South Korean shares (+$33mn).

- China and Hong Kong shares are bucking the broader positive trends. At the break, the HSI is down 0.22%, the CSI 300 off 0.09%. The HSI was +1% firmer in earlier trading. EV names have struggled after the EU opened an investigation into subsides provided by China for the sector.

- The HS mainland properties index is down 1.92%, as Country Garden approaches another bond vote deadline. HS banks are higher though providing some offset.

- In SEA markets are mostly firmer, with Malaysian stocks, down 0.20%, the only negative at this stage.

FOREX: Greenback Marginally Pressured In Asia

The USD has been marginally pressured in Asia, BBDXY has breached post CPI lows, as Asia digests yesterday inflation data from the US.

- The Yen is the strongest performer in the G-10 space; weaker US Tsy Yields have weighed on USD/JPY. The pair sits a touch above the ¥147 handle. Technically the trend condition remains bullish, resistance is at ¥147.87 high from Sep 7 and bull trigger. Support is at ¥145.91, low from Sep

- AUD/USD is firmer, the pair has not yet been able to breach the 20-Day EMA ($0.6445). The August Labor Market Report saw the Unemployment Rate hold steady as expected, there was an increase in the number of jobs and in the participation rate.

- Kiwi is firmer, NZD/USD is up ~0.2%. The pair was unable to sustain a break of the 20-Day EMA ($0.5936) and sits a touch below the measure.

- Elsewhere in G-10; EUR and GBP are both ~0.1% firmer.

- Cross asset wise; e-minis are up ~0.3% and BBDXY is down ~0.2%. 10 Year US Tsy Yields are 2bps lower.

- The latest monetary policy decision from the ECB provides the highlight in Europe.

JAPAN DATA: Japan Purchases Of Offshore Bonds At Highest Levels Since Early 2020

Offshore investors resumed selling of Japan equities last week. We saw -¥854.7bn in outflows, more than reversing the inflows seen in the prior week. We have now seen outflows from Japan equities in 4 out of the past 6 weeks. Inflows into local bonds continued, but were quite modest at just ¥79.3bn, well down on the pace of the prior week.

- Japan domestic outflows to offshore bonds surged last week to ¥3631.9bn. This is the strongest weekly outflow since February 2020. Prior to last week's outflow, the trend was for Japan investors to be modest net sellers of offshore bonds back to the start of July.

- Japan investors continued to buy offshore stocks, but at a much more modest pace of ¥96.6bn compared to the prior week.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending September 8 | Prior Week |

| Foreign Buying Japan Stocks | -854.7 | 532.1 |

| Foreign Buying Japan Bonds | 79.3 | 926.6 |

| Japan Buying Foreign Bonds | 3631.9 | 90.7 |

| Japan Buying Foreign Stocks | 96.6 | 749.5 |

Source: MNI/Bloomberg

OIL: Crude Continues Rally On Market Tightness But Overbought

Oil prices have risen further during APAC trading today on the back of the IEA report showing a 1.2mbd deficit in H2 2023. The market has looked through EIA data showing that US crude inventories rose strongly in the latest week. WTI is up 0.5% to $88.95/bbl but has failed to break above $89 with the peak at $88.99. Brent is also 0.5% higher at $92.33 and has traded above $92 throughout the session. The USD index is down 0.2%.

- While JP Morgan and RBC don’t expect prices to reach $100, ANZ said today that they do it will reach this level by year end given that the market is “decidedly tight” over the coming two to three quarters. ANZ expects a deficit of 2mbd in Q4 and that Saudi cuts will be extended into Q1 2024.

- In terms of LNG, Australian unions have said that there has been a “significant escalation” in industrial action at Chevron facilities today but whether to engage in full 24 hour strikes is being decided separately at each of the three facilities impacted. Chevron has said that it will manage the uncertainties the action is creating. Exports are yet to be affected.

- Later today the ECB decision is announced followed by a press conference. It is expected to be a close call (see MNI ECB Preview - September). August US retail sales print and excluding autos & gas are expected to fall slightly. There are also jobless claims, August PPI and July business inventories.

GOLD: Another Decline Despite Lower US Treasury Yields

Gold is little changed in the Asia-Pac session, after seeing further weakness, down -0.3% at $1908.12, on Wednesday. It appeared to be an outsized loss considering US Treasury yields pushed lower after US CPI with only minimal USD strength on balance.

- US tsys bull steepened, with yields 1-5bp lower, as market participants parsed the latest CPI data with details, bolstering the case for a pause at next week’s Fed policy meeting while keeping the door open to an increase in November. FOMC dated OIS was stable, a terminal rate of 5.45% was seen for December with ~50bps of cuts by July 2024.

- Headline CPI rose 3.7% on an annualised basis, up from 3.2% in July and the above consensus forecast of 3.6%. The increase was primarily driven by a 10.6% jump in gasoline prices. On a monthly basis, the core reading of +0.3% m/m was above the +0.2% consensus estimate.

- From a technical standpoint, bullion’s low of $1905.69 took another step closer to support at $1903.9 (Aug 25 low), according to MNI’s technicals team.

ASIA: Rice & Oil Prices Likely To Push Headline Inflation Up Again In September

Our estimate of non-Japan Asian inflation saw an increase in August to 2.2% y/y from 2% as all countries except India saw a rise in headline driven by higher rice and fuel prices. This is reflected in core being stable to down across the region with the aggregate steady at 1.4% and down 0.1pp to 3% excluding China. Central banks will be monitoring for second round effects but for now will be pleased that core continues to moderate. Some governments have already introduced policies to reduce the impact of higher oil prices at the pump.

Asian core CPI y/y%

Source: MNI - Market News/IMF/Refinitiv

- Non-Japan Asian ex China CPI inflation moderated to 4.8% from 4.9% in August due to the drop in India’s inflation to 6.8% from 7.4%. The series assumes that inflation in HK, Malaysia and Singapore is constant at the July rates as the data has not yet been released.

- Rice prices have become a problem for the region since India decided to ban exports of non-basmati varieties to bring food price inflation down domestically. Processed rice prices have risen 19.1% since the June trough and rose 8.6% in August alone. In September to date they are up another 5.8% and so are likely to add to the food CPI again after rising in many Asian countries in August.

- Crude oil prices can lead Asian inflation and Brent rose 6.3% in August and the September average is up a further 7.3%. The impact was felt in the August Asian CPIs and is likely, along with rice prices, to push inflation higher again in September.

Source: MNI - Market News/IMF/Refinitiv

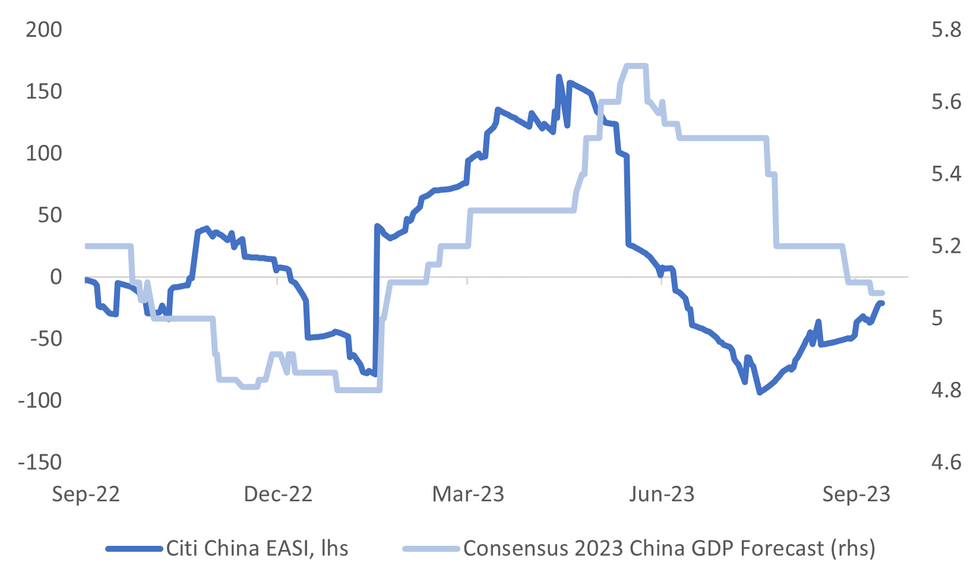

CHINA DATA: August Activity Prints & 1yr MLF On Tap Tomorrow

A reminder that China activity prints for August are due tomorrow, along with the 1yr MLF outcome. China data outcomes have been more mixed in the past month, with manufacturing PMIs more resilient, although services PMIs have continued to moderate. Inflation has improved modestly, while August credit data was better than expected.

- The Citi China EASI is up off recent lows, but remains in negative territory at -21. The chart below plots the EASI against 2023 China GDP growth expectations.

- The 1yr MLF is expected to be held steady at 2.50%, with a forecast range of 2.40-2.50%, although only Bloomberg economics is forecasting a cut. In terms of MLF volumes, the projection is 412.5bn yuan, versus 401bn prior.

- On the activity side, IP for August is projected at 3.9% y/y, prior 3.7% (forecast range 3.4-4.4%).

- Retail sales are forecast at 3.0%, prior 2.5% (forecast range is 1.0%-4.0%).

- Fixed asset Invesment is forecast at 3.3% ytd y/y, prior 3.4% (forecast range is 2.9%-3.6%)

- Property investment is forecast at -8.9% ytd y/y, prior -8.5% (forecast range is -8.4% to -14.2%).

- Residential property sales will also print, no consensus estimate is out, with the prior being 0.7% ytd y/y. New home prices data for August are also due, prior was -0.23% m/m.

- Finally, the jobless rate is projected at 5.3% in August, unchanged from July.

Fig 1: Citi China EASI Versus China 2023 Growth Expectations

Source: Citi/MNI - Market News/Bloomberg

THAILAND: Consumer Confidence Highest Since Before Covid

August consumer confidence rose to 56.9 from 55.6 to be its highest since February 2020, before the pandemic. The confidence in the economy rose to 51.6 from 50.3 and is signalling that spending should remain solid going forward. Private consumption grew 6.8% y/y in July. The formation of a new government and thus an end to the political impasse seen since the May election boosted sentiment generally. The policy agenda was released this week including the THB 10k digital wallet, minimum wage rise, debt solutions for small business, reducing energy costs, and waiving visas for tourists from China.

Thailand consumer confidence economic vs consumption y/y%

Source: MNI - Market News/Refinitiv

ASIA FX: USD/Asia Pairs Lower Amid Broad USD Weakness, CNH Lags

USD/Asia pairs are lower in line with broader USD/US yield softness post the CPI print from Wednesday. Regional equity markets have also generally been positive, driving outperformance from the likes of KRW and TWD. CNH is the clear exception, holding steady against the USD. Still to come today is Indian wholesale inflation data. The focus tomorrow is China's August activity data prints and the 1yr MLF decision (no change expected).

- CNH is underperforming broader USD softness. After hitting earlier lows close to 7.2600 the pair rebounded to 7.2866, before settling back under 7.2800. We last tracked near 7.2740. headlines crossed from Reuters that large China banks are being asked to stagger USD purchases. CNH deposit rates in Hong Kong have ticked up further, the 1 month to 5.14%, highs back to 2018. The 3 month surged to 4.42%, also fresh highs back to 2018. CNH implied yields are a touch below recent highs.

- USD/TWD has moved away from recent highs. The pair last near 31.88, against earlier highs in the week near 32.07. This puts us under the 20-day EMA, (around 31.90). We haven't breached this support point in any meaningful way since mid July. The 50-day EMA sits further south around 31.65. TWD is benefiting from the pull back in USD/CNY. The local equity back drop is also on the improve, the Taiex +1.25% amid broad Asia Pac gains (ex HK/China).

- 1 month USD/KRW is tracking to fresh lows for the week, last near 1321. The +1% equity gains have helped, while the BOK has warned of financial imbalances emerging again. This follows yesterday's rise in household debt levels.

- USD/INR has opened dealing little changed from yesterday's closing levels, the pair has held below the 83 handle in recent dealing however the 20-Day EMA (82.8760) has supported the pair as narrow ranges are observed. The RBI is said to have asked some foreign banks about operational aspects of handling increased custodian flows into the country ahead of JPMorgan’s bond index review, The Economic Times reported. On tap today we have August Wholesale Prices, a fall of 0.60% Y/Y is expected.

- The Ringgit continues to observe narrow ranges with little follow through on moves. USD/MYR is consolidating after rising ~4% since the beginning of August. Palm Oil has firmed off a 2-month low seen on Tuesday, front month future currently sits ~2.5% above Tuesday's session low. Palm’s discount to soybean oil expanded to $542 a ton, compared with $515 on Friday and an average of $488 in the past year.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing on Thursday, the measure sits well within recent ranges and is ~0.7% below the top of the band. USD/SGD has again been supported below $1.36, broader USD flows pressured the pair below the handle before support came in and losses were pared. A reminder that the local docket is empty this week. The next data of note is Monday's August Export data.

- USD/PHP continues to track recent ranges, the pair last at 56.70, similar to closing levels from yesterday. Current USD/PHP levels continue to look a little elevated relative to BBDXY trends, but the divergence is not large. The pair remains comfortably within broad recent ranges of 56.50/57.00. The next big domestic focus point is likely to be next Thursday's BSP decision. No change is expected in the policy rate at this stage (currently 6.25%).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/09/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/09/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/09/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/09/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/09/2023 | 1230/0830 | *** |  | US | PPI |

| 14/09/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/09/2023 | 1415/1615 |  | EU | ECB's Lagarde speaks at Podcast | |

| 14/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.