-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk Sentiment Shaky Ahead Of Long Weekend

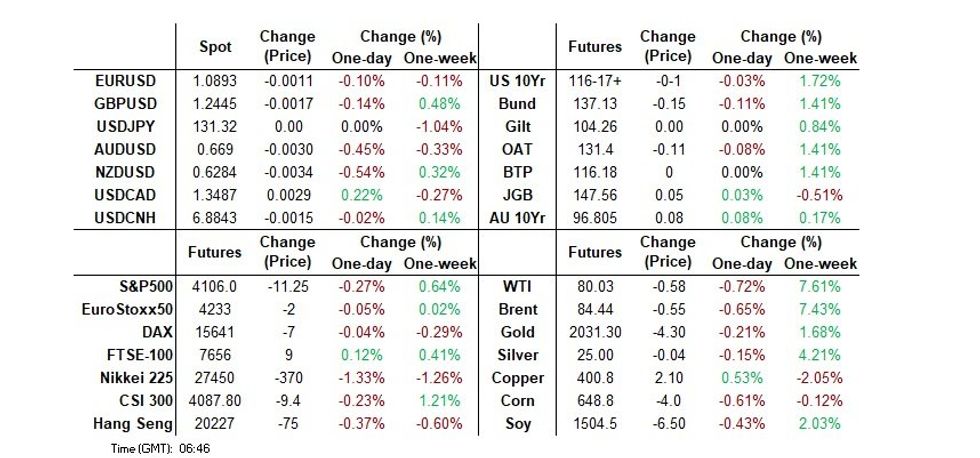

- The greenback is on the front foot in Asia today, an early offer in the USD/JPY saw the USD briefly pressured however the move retraced and the USD firmed. Softer US and regional equities have weighed on risk sentiment.

- Core global FI markets saw some light richening.

- Weekly jobless claims and challenger job cuts data provide the final labour market reads ahead of Friday's NFP release. Comments from Fed's Bullard headline the central bank speaker slate.

MARKET INSIGHT: World Can Benefit From China Recovery, But U.S. May Dominate If Historical Correlations Hold

A clear trend was evident in terms of China's March PMI prints. The services, or non-manufacturing side, clearly outperformed the manufacturing side. This was most evident in terms of the Caixin PMI: 57.8 for services, versus 50.0 for manufacturing. For the official PMIs it was 58.2 for services, 51.9 for manufacturing.

- At face value, the rest of the world may prefer to be seeing the reverse holding, that is manufacturing outperforming services. A better manufacturing backdrop in China compared to services may have more spill-over effects to the rest of the world. However, historical correlations don't suggest this is the case.

- The table below presents long run correlations (2008 to present) for the y/y changes in China manufacturing and service PMIs (we use the official prints due to longer time series), against the y/y change in global IP, trade volumes and EM exports.

- If anything, the services correlations sit slightly higher. Correlations can shift of course, but even looking at shorter run correlations for the past year, similar trends are evident. This still suggests some positive spill over from the surging China services recovery to the rest of the world. Indeed, the WTO revised higher its global trade forecast, albeit still with downside risks (see this link).

- Interestingly though, the bottom 2 rows replicate the same correlations but for the US ISM manufacturing and services PMIs. Similar results unfold in terms of correlations being roughly similar for manufacturing and services.

- There is a clear levels difference though, relative to the China PMI correlations. This suggests how the US cycle evolves, proxied by ISM trends, may dominate the global outlook as we progress through 2023.

Table 1: China PMI & US ISMs Y/Y Correlations With Global Trade, IP, & EM Exports (2008-To Present)

| Correlation with: | |||

| Global IP | Global Trade | Global EM Exports | |

| China PMI Manufacturing | 0.20 | 0.16 | 0.32 |

| China PMI Services | 0.26 | 0.24 | 0.37 |

| US ISM Manufacturing | 0.52 | 0.54 | 0.61 |

| US ISM Services | 0.60 | 0.64 | 0.63 |

Source: MNI - Market News/Bloomberg

US TSYS: Richer In Asia

TYM3 deals at 116-18+ unchanged from Wednesday's settlement level, a touch off the top of the observed 0-08 range on volume of ~77k.

- Cash tsys sit 1.5-4bps richer across the major benchmarks, the curve has bull steepened.

- Tsys were marginally firmer in early dealing as Asia-Pac participants reacted to the softer than expected US data on Wednesday.

- Firmer than forecast Caixin services PMI saw the bid moderately extend. Lower WTI futures, down ~0.7%, and US Equity futures, e-minis sit ~0.3% softer, also added a level of support.

- Pockets of screen buyers in FV and TY saw tsys marginally extend gains late in the Asian session. There was no headline catalyst observed on the move.

- In Europe today Swiss unemployment and German Industrial Production headline. Further out we have initial jobless claims and Fedspeak from St Louis Fed President Bullard will cross.

JGBS: Firmer, But Lacking Meaningful Follow Through

JGB futures struggled to detach themselves from late overnight session levels for any meaningful period of time during Thursday’s Tokyo session, with the contract +7 as we move towards the close. Cash JGBs are 0.5-3.0bp richer, with the super-long end outperforming. Swap rates are flat to lower across the curve, lagging the move in JGBs, leaving swap spreads wider.

- A relatively well-received round of 30-Year JGB supply, Sino-U.S. tension re: Taiwan, weakness in crude oil markets & the Nikkei 225/U.S. e-minis, as well as adjustments to Wednesday’s wider moves in core global FI markets, underpinned JGBs for much of the session, although the space has traded away from best levels into the bell.

- Comments from Finance Minister Suzuki & outgoing BoJ Governor Kuroda failed to introduce anything in the way of meaningful, fresh soundbites.

- The weekly international security flow data from the Japanese MoF revealed that international investors were net buyers of Japanese bonds for the second time in 3 weeks, although the record net purchases seen 3 weeks ago continue to dominate when it comes to the assessment of recent dynamics in that metric (as a reminder, the record purchases observed in that week likely represented notable short cover surrounding the most recent BoJ decision and the banking sector tumult).

- Wage and household spending data headline the local docket on Friday.

JAPAN: Quite Limited International Net Security Flows Last Week, Some Trends Come To An End

The weekly international security flow data released by the Japanese MoF reveals that Japanese investors broke a run of 3 consecutive weeks of net purchases of international bonds last week, although the 4-week rolling sum of the measure continues to operate comfortably in positive territory, with last week’s net sales representing a relatively paltry amount.

- Last week also saw Japanese investors lodge the largest round of net weekly purchases of international equities since January, although the net amount was relatively limited in the grander scheme of things.

- International investors were net buyers of Japanese bonds for the second time in 3 weeks, although the record net purchases seen 3 weeks ago continue to dominate when it comes to the assessment of recent dynamics in that metric (as a reminder, the record purchases observed in that week likely represented notable short cover surrounding the most recent BoJ decision and the banking sector tumult).

- Finally, international investors were marginal net buyers of Japanese equities, ending a streak of 5 consecutive weeks of net sales.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -483.4 | 1183.0 | 4951.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 390.3 | -42.2 | 296.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 944.1 | -1676.6 | 3217.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 62.2 | -1296.8 | -3150.4 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: Stronger, At Bests, Narrow Range

ACGBs sit at or near session highs (YM +7.0 & XM +9.0) after a relatively narrow range. Trade Balance data and the RBA Financial Stability Review (FSR) failed to spark a market reaction with later session strength seemingly tied more to the richening in US Tsys (yields 2-3bp lower) in Asia-Pac trade.

- Cash ACGBs are 7-9bp stronger on the day with the 3/10 curve 2bp flatter and the AU-US 10-year yield differential -2bp at -10bp.

- Swap rates are 6-8bp lower with EFPs 1bp wider.

- Bills pricing is +1 to +7 with reds leading.

- RBA dated OIS pricing is 1-5bp softer across meetings beyond May with a 22% chance of 25bp tightening priced for May. 27bp of easing is priced by year-end.

- On the local data front, February’s trade balance printed a much larger-than-expected surplus of A$13.87bn (versus A$11.22bn expected) as imports dropped 9.1% M/M.

- The FSR stated that households and firms were well-placed to cope with higher interest rates. RBA also noted that about 40% of home loans have less than 3-months buffer.

- With the global calendar light ahead of US Non-Farm Payrolls on Friday, the direction in the local market will likely be guided by risk appetite and US Tsys.

NZGBS: Bull Steepens After Well-Received Supply

NZGBs closed 7-15 richer at session bests after weekly supply received a strong bid (cover 3.08-6.25x), with NZGB May-26 demand the strongest.

- Following the RBNZ’s 50bp hike yesterday, it seems that market participants are now taking the central bank's commitment to bring inflation back to its target range more seriously. However, this move has also raised concerns about over-tightening and a recession. The NZGB cash 2/10 curve steepened 5bp post-supply to be +8bp on the day. NZ/US and NZ/AU 10-year yield differentials were respectively 2bp and 4bp tighter on the day.

- 2s10s swap curve also bull steepened with rates 5-13bp lower, implying wider swap spreads.

- After shunting 20bp higher across meetings yesterday, RBNZ dated OIS pricing today closed 2-9bp softer across meetings with Feb-24 leading. 19bp of tightening was priced for the May meeting. 45bp of easing is priced for Feb-24 off a terminal OCR expectation of 5.45% (July).

- ANZ Commodity Price Index rose 1.3% M/M in March with the Meat, Skins and Wool category the star performer (+5.9%).

- With the global calendar light ahead of US Non-Farm Payrolls on Friday, the direction in the local market will likely remain a tussle between lower global rates and a hawkish RBNZ.

FOREX: USD Firms In Asia

The greenback is on the front foot in Asia today, an early offer in the USD/JPY saw the USD briefly pressured however the move retraced and the USD firmed. Softer US and regional equities have weighed on risk sentiment.

- Kiwi is the weakest performer in the G-10 space as falls in equities and commodities weigh. NZD/USD prints at $0.6290/95 down ~0.4% today.

- AUD/USD is also softer, down ~0.3% last printing a touch under $0.67. Iron Ore continues to slide now down ~6.5% through the week.

- Yen is a touch firmer, benefiting from marginally softer US Treasury Yields. USD/JPY printed a low at ¥130.78 in early trade before paring losses. The pair now sits at ¥131.15/25.

- Elsewhere in G-10 weaker oil prices have weighed on NOK, USD/NOK is ~0.3% firmer with the pair breaking its 20-day EMA today. Note though Asia Pac liquidity is likely to be fairly poor for this pair.

- Cross asset wise, WTI futures are down ~1%. E-minis are ~0.3% softer. BBDXY is ~0.2% firmer.

- In Europe today Swiss unemployment and German Industrial Production headline. Further out we have initial jobless claims and Fedspeak from St Louis Fed President Bullard will cross.

ASIA FX: CNH Outperforms, RBI Surprises Keeping Rates On Hold

Most USD/Asia pairs are firmer, in line with broader USD indices tracking higher. Dollar gains haven't been large though, likely helped by a steady USD/CNH. Weaker regional equities, as global recession fears persist, are aiding USD sentiment. Tomorrow will be quieter given the start of the Easter holidays for a number of countries. Hong Kong and Singapore will be out. There is still some data out though with South Korean goods balance and current account for Feb due, while China FX reserves for Mar will also print.

- USD/CNH has largely stuck to a 6.8800/6.8900 range. The better than expected Caixin services PMI helped us test below 6.8800 but this proved to be short lived. We now sit basically unchanged at 6.8840/50, still the currency is outperforming generally strong USD trends elsewhere.

- Spot USD/KRW is higher, last near 1320. This is close to highs from earlier in the week, but we haven't breached these levels yet. Onshore equities are down over 1.2% and offshore investors are strong net sellers of local equities (-$510.4mn so far). If global recession fears intensify the won will likely fall, all else equal.

- Taiwan markets have returned today, with USD/TWD pushing back above 30.50, around +0.20% versus closing levels from the end of last week. Local equities are off by around 0.50%.

- USD/SGD is higher, back above 1.3300, along with a slight weakening in the SGD NEER. Next week's MAS meeting slated for Friday the 14th is coming into focus. On balance the market sees risks of further tightening, although it remains a close call.

- The RBI surprised the market somewhat by keeping rates on hold at 6.50%. The majority of economists expected a 25bps hike, which was also our bias. Financial stability concerns prompted the pause. USD/INR initially spiked higher, but found selling resistance above 82.00, last near 81.90/95. The move higher in local equities post the on hold call likely helping rupee sentiment.

EQUITIES: Still Tracking Lower Amid Recession Fears

Regional equities are mostly on the back foot, following US/EU losses from Wednesday's session. US futures are also tracking lower through the first part of Thursday's session. Eminis are down ~0.30% at this stage, Nasdaq futures off by 0.40%. Lingering US recession fears are still a driver of sentiment, following progressive US data downside surprises this week.

- Hong Kong equities have been in positive territory today but have struggled to maintain gains. Markets were closed yesterday, so this may reflect some catch up, while the better than expected Caixin services PMI aided sentiment earlier. The HSI is currently around flat at the lunch break.

- Onshore China shares aren't faring as well, the CSI 300 down around 0.30% at this stage. US-China tensions potentially weighing, post the Tsai-McCarthy meeting, but don't look to be a key driver.

- Japan markets are once again close to the worst performers in the region. The Topix off by over 1.2% at this stage. Once again, the cyclically sensitive electric appliances sector is driving the weakness.

- The Kospi has shed just over 1% in line with weaker Tech trends from Wednesday's US session. Net outflows from locals are -$450.1mn so far. Taiwan markets have returned after a 3 day break, off by 0.40% at this stage.

- SEA markets are also tracking lower, but losses are less than 0.5% for the most part.

GOLD: Prices Ease But Remain Supported By Weaker US Economic Outlook

Gold prices have eased during APAC trading today after moving higher since Friday. After reacting to Wednesday’s US data, bullion in the end looked through it. Prices are down 0.5% to $2011.50/oz just off the intraday low of $2008.14. They reached a high of $2021.08 earlier. The USD has provided headwinds with the index higher again today.

- The uptrend in gold continues to dominate. Wednesday’s high of $2032.07 broke through resistance of $2031.88 and opened up $2034 as the next level to watch.

- Despite some stabilisation in bullion today, it has been able to hold above the $2000 mark, as this week’s US data has generally disappointed and supported expectations of a less hawkish Fed. The key release is Friday’s March payrolls, which are expected to post a 235k rise with the unemployment rate staying at 3.6%.

- The only US data of note today are the jobless claims and Challenger job cuts for March. The Fed’s Bullard will discuss the economic outlook later.

OIL: Crude Nervous About Demand Again

Oil prices are down today and WTI has broken through yesterday’s low but found support there. Disappointing data from the US over the last few days has reignited demand concerns following the boost to prices from OPEC’s latest output cut decision. The USD index is higher again today.

- Oil prices have been volatile during the APAC session but have been trading in a range of less than a dollar. Crude bounced around the time of the RBI’s announcement that it was on hold after 6 consecutive hikes. Brent is currently down 0.4% to $84.56/bbl after reaching a low of $84.05. WTI is down 0.6% to $80.11 after an intraday low of $79.67. Both are now around their 200-day moving averages.

- The only US data of note today are the jobless claims and Challenger job cuts for March. The Fed’s Bullard will discuss the economic outlook later. There is also German IP and Canadian employment. The key release is Friday’s March US payrolls, which are expected to post a 235k rise with the unemployment rate staying at 3.6%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 06/04/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/04/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/04/2023 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/04/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/04/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/04/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2023 | 1400/1000 |  | US | St. Louis Fed's James Bullard | |

| 06/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.