-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: The Makings Of A Volatile Month End?

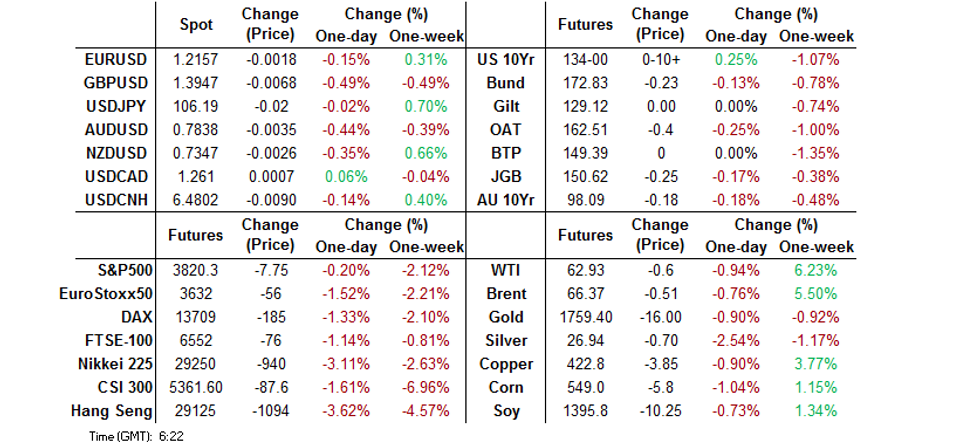

- U.S. fiscal matters created plenty of chop in Asia-Pac trade, allowing Tsys to regain some posie and adding further pressure to global equity markets.

- The RBA chose to conduct off-schedule bond purchases, while the BoJ refrained.

- Month-end matters eyed after a volatile week.

BOND SUMMARY: Some Chop Evident Overnight

Core FI was subjected to some volatility during Asia-Pac hours, with news that U.S. Democrats cannot include a $15/hour minimum wage in their COVID relief package, per the ruling of a Senate official (high ranking Dem senators are seemingly trying to come up with a workaround), allowing the space to unwind some early/overnight weakness, although trade continued to be choppy and active, with the space operating shy of best levels at typing. Continued weakness in equity markets and the aforementioned fiscal news provided an underlying bid on ensuing pullbacks. TYM1 last +0-08+ at 132-27+, with the belly of the curve seeing some light outperformance after yesterday's dramatic cheapening (5s sit ~5.0bp richer at typing). Activity was comfortably above average, with T-Note volume nearing 350K ahead of European hours. PCE & Chicago PMI data headline locally today.

- JGB futures also followed the broader swings, finishing 25 ticks softer vs. yesterday's settlement, with 7s underperforming in cash trade, cheapening by ~2.0bp. The broader core FI dynamic helped the contract off its early Tokyo lows, with the Nikkei 225 shedding 4.0% as global equities continued to struggle. The BoJ chose not to step in to protect the upside of its permitted trading band for 10-Year JGB yields (highs of ~0.18%, limit of ~0.20%), despite some speculation that it may do so. Elsewhere, BoJ Governor Kuroda flagged that the BoJ doesn't want to raise the midpoint of the permitted 10-Year JGB yield trading band, although that was never really seen as a point of debate for markets. We also saw a mixed 2-Year JGB auction, with the tail a touch narrower than prev. alongside a softer cover ratio, while the low price comfortably topped broader dealer estimates (BBG dealer poll 100.380).

- Aussie bonds saw a light boost in early trade, before the broader bid in core FI came into play, with some fresh interest in establishing cross-market AUD longs seemingly apparent after the open, although a repeat A$3.0bn round of unscheduled RBA purchases covering ACGB Apr '23 & Apr '24 did little for the space, with some weakness kicking in, before U.S. Tsys led core FI away from Asia session cheaps, leaving Aussie bond market participants to take cues from broader price action for much of the session. Fresh weakness then showed up into the close leaving YM -6.5 and -18.0 at the bell, with month-end extension flows somewhat insignificant owing to both recent issuance dynamics and the magnitude of the recent sell off (as some sell side names flagged earlier this week). We should also highlight that the AOFM has yet again pulled back re: weekly ACGB issuance, with the recent volatility meaning that it will only offer A$1.0bn of ACGB Jun '31 at auction next week. The recent bond market volatility has stirred keen interest in next week's RBA decision, after it seemed set to be a non-event just a few short weeks ago.

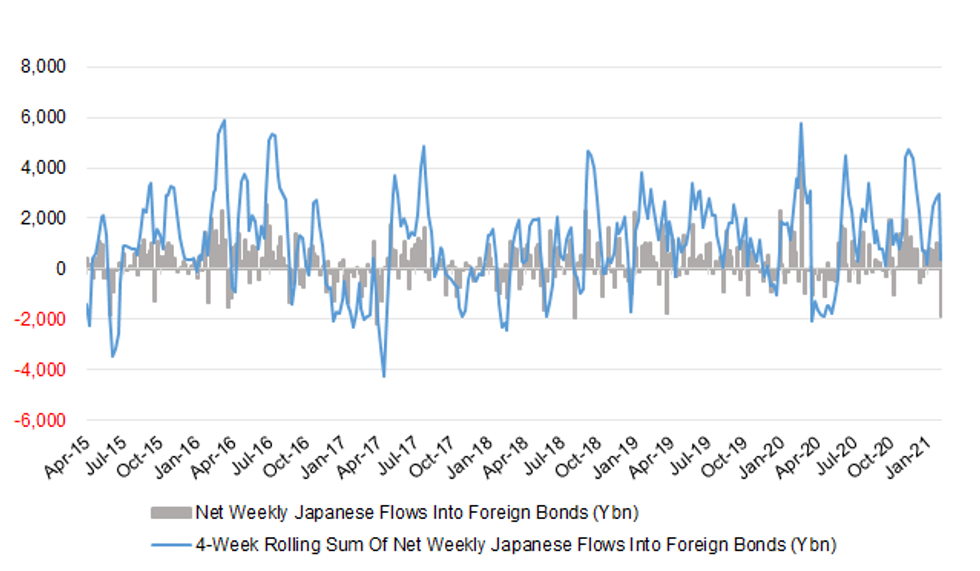

JAPAN: Heavy Selling Of Foreign Bonds In Most Recent Week

The standout round of flow in the weekly Japanese international security flow data came in the form of Japanese investors shedding the largest net amount of foreign bonds over a one-week period since August 2018. The data covers the period until February 19, so excludes the latest round of cheapening witnessed in global core bond markets and may have represented some caution ahead of the Japanese FY end (which falls at the end of March).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1893.0 | 478.2 | 341.6 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -394.8 | -23.8 | -1497.2 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 316.6 | -748.4 | 219.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 94.1 | 339.5 | 709.2 |

Source: MNI - Market News/Japanese Ministry Of Finance

Fig.1: Net Weekly Japanese Flows Into Foreign Bonds (Ybn)

Source: MNI - Markets News/Bloomberg

FOREX: Choppy End To The Week In Asia

Risk aversion lingered on as regional equity benchmarks tumbled on a negative lead from Wall Street. Commodity-tied FX traded on the back foot, with a bout of risk-off flows and broad-based greenback strength seen as USD/CNH had its first look above CNH6.5000 this lunar year. The rate swung to a loss but G10 FX space remained in a risk-off mode. The PBOC fixed its USD/CNY mid-point at CNY6.4713, just 5 pips above sell side estimates.

- NZD went offered as a spill-over from USD/CNH price action conspired with a speech from RBNZ Gov Orr, who sought to brush away any hawkish interpretations of this week's MPS/remit tweak. BBG trader sources flagged NZD sales by funds exiting core long positions as Orr reiterated the need for prolonged monetary stimulus, signalled potential for deploying a negative OCR if needed and noted that the RBNZ doesn't target house prices. The kiwi knee-jerked lower on the mention of negative interest rates.

- Reported AUD purchases by large exporters helped the currency move away from session lows before it turned its tail again. AUD is the worst G10 performer alongside NOK, with some sizeable AUD/USD option expiries coming up today. A$1.7bn of AUD puts with strikes at $0.7850 will expire at the NY cut, with a A$5.3bn put strike at $0.7900 rolling off as well.

- USD/JPY had a brief look above yesterday's multi-month high before reversing losses, but yesterday's low proved resilient. The pair bounced off there and returned toward neutral levels.

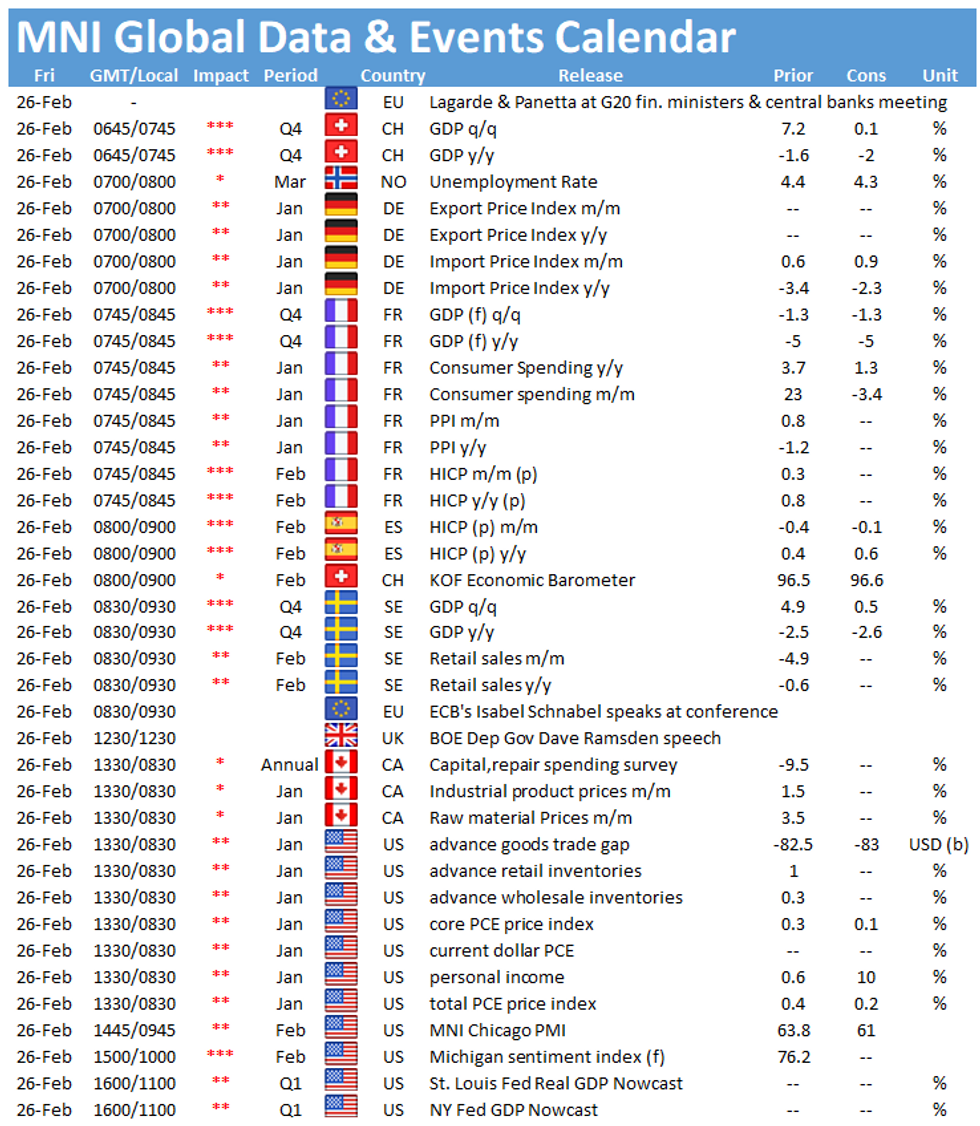

- U.S. personal income/spending, MNI Chicago PMI & final U. of Mich. Sentiment, French GDP (f) & CPI (p), Swedish GDP, trade balance & retail sales as well as Norwegian unemployment take focus on the data front. ECB's Schnabel & Visco and BoE's Haldane & Ramsden are set to speak.

FOREX OPTIONS: Expiries for Feb26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E682mln), $1.2150(E698mln), $1.2175(E1.6bln-EUR puts), $1.2200(E792mln), $1.2235-50(E694mln), $1.2275(E786mln)

- USD/JPY: Y105.25($750mln), Y105.80-00($1.2bln), Y106.25-35($602mln), Y106.50($655mln)

- GBP/USD: $1.3900(Gbp1.3bln), $1.3930(Gbp614mln), $1.4000(Gbp607mln), $1.4030(Gbp2.3bln-GBP puts), $1.4060(Gbp1.2bln-GBP puts), $1.4120(Gbp879mln)

- EUR/GBP: Gbp0.8600-20(E2.4bln), Gbp0.8650(E854mln), Gbp0.8665-75(E1.8bln-EUR puts), Gbp0.8750-65(E1.2bln-EUR puts)

- AUD/USD: $0.7590-0.7600(A$1.2bln), $0.7770-80(A$1.6bln-AUD puts), $0.7850(A$1.7bln-AUD puts), $0.7900(A$5.2bln-AUD puts), $0.7975(A$2.2bln-AUD puts)

- NZD/USD: $0.7400(N$676mln)

- USD/CAD: C$1.2500($1.9bln), C$1.2530($1.8bln), C$1.2630($1.5bln)

- USD/CNY: Cny6.41($550mln), Cny6.44($680mln). Cny6.45($1.1bln)

- USD/MXN: Mxn19.70($1.2bln)

ASIA FX: Greenback Puts The Cat Among The Pigeons

Most USD/Asia crosses opened sharply higher after USD spiked higher on the back of a jump higher in US yields after a weak auction.

- CNH: USD/CNH briefly looked over 6.50 for the first time since January before dropping back, bulls looking for a break of the Jan 28 high at 6.5151. The PBOC fixed USD/CNH at 6.4713, just 5 pips above sell side estimates, which is well within range given the sizable moves in the pair earlier.

- SGD: Singapore dollar weakened sharply as the greenback spiked, USD/SGD touching 1.3296 before offers ahead of 1.33 saw the rate drop back. Bulls look for a break above 1.3301, the 38.2% retracement from 2021 low to high. Last at 1.3288

- TWD: Taiwanese dollar surged higher in early trade, defying its peers and strength in the USD. The move higher is due to "smoothing" by the central bank, there was chatter of intervention during the session. Moves focus on the 28 handle

- KRW: Won is lower, the weakest performer in Asia, USD/KRW last at 1122.00, the BOK outlined a dovish stance yesterday, and announced today it would purchase between KRW 5 – KRW 7tn to support the market

- INR: Rupee weakened sharply at the open and has moved in a narrow range since. Market awaits GDP data as well as fiscal deficit figures and a raft of supply.

- IDR: Rupiah weaker but off its worsts, BI initially offered 1-month DNDF at IDR14,295 through brokers and then offered 1-month and 3-month DNDFs via auctions at IDR14,295 and IDR14,491 respectively. It then said it is conducting triple interventions to ensure rupiah stability.

- MYR: Ringgitt was weaker from the starting whistle, showed little reaction to trade data which showed exports rose above estimates.

- PHP: Peso weakened, but moves were less pronounced than other pairs due to a local holiday on Thursday. Philippine vaccine czar Galvez suggested that Manila will prioritise vaccine supply over price, the Philippines is only South-East Asian nation not to receive Covid jabs yet.

- THB: Markets in Thailand are closed for Makha Bucha day.

ASIA RATES: Central Banks In Focus

Fixed income pressured by global bond rout, but auctions, OMOs (and the promise of more) also factored into price action.

- INDIA: Mixed across the curve, short end sees some buying after RBI Gov Das committed to at least 3tn of OMOs in the next fiscal year, similar to this one, and the RBI announced it would hold another twist operation on March 4 at the larger size of INR 150bn. Belly sees some selling ahead of supply later in the session.

- CHINA: The PBOC matched maturities with injections again today which saw overnight repo rates rise 40bps, China's bonds were seemingly immune to the global bond rout with market commentators positing this is because a recovery is already priced in.

- SOUTH KOREA: The Bank of Korea have pledged to purchase KRW 5tn-KRW 7tn in government bonds from the market in the first half of 2021, the bank bought KRW 5tn of government securities from the market in Q4 2020 to combat a rise in yields after a year of bumper issuance. 10-year futures picked up from lows at the open, but are still down on the day.

- INDONESIA: Indonesia's biggest lenders expressed scepticism re: ability of lower interest rates and looser borrowing rules to immediately boost loan growth, yields sharply higher. Global funds were net sellers for the fifth straight session yesterday.

EQUITIES: Red On The Screens

Asia-Pac equities hemorrhaged on Friday, taking a negative lead from the US after a day of heavy losses as US yields spiked, with U.S. fiscal matters adding further pressure.

- US futures are lower, the S&P 500 closed yesterday with a 2.5% with tech shares leading losses, this bled over into the Nasdaq 100 which tumbled 3.6%, the biggest one day drop since October, with market participants adjusting portfolios to favour companies poised to benefit from an end to lockdowns.

GOLD: Pressured By U.S. Real Yields, But Tech Support Remains Untouched

U.S. real yield dynamics (outside of the retracement in 30s), a firmer USD and another modest reduction in ETF holdings have combined over the last 24 hours, resulting in a weaker gold price. Bears haven't forced a meaningful break of the Feb 19 low at $1,760.7/oz in spot, despite a brief show below. Bullion last deals around $1,765/oz.

OIL: Crude On Track For Fourth Monthly Gain

WTI & Brent sit around $0,60 softer into European hours. Markets will look ahead to an OPEC+ meeting next week with chatter that Saudi Arabia and Russia are again heading into the meeting on opposite sides of the supply debate.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.