-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: Tsys Drift Lower Into Europe

- U.S. Tsy weakness seen into European hours but no overt driver, with equities mostly higher overnight.

- 30-Year supply rounded off a solid enough round of mid-month U.S. auctions.

- Eyes turning to Fed after a busy weak.

BOND SUMMARY: Core FI Softer In Asia

Pressure crept into the Tsy space as we moved through Asia-Pac trade, T-Notes last -0-12 at 132-07+, tapping fresh session lows into European hours, with the move accelerating on a break below yesterday's low. Cash Tsys now run as much as ~4.0bp cheaper across the curve, with 10s providing the weak point. Little in the way of overt headline flow was apparent in Asia, with the USD seeing an uptick, while equity markets ticked higher in the main. Headlines re: the disbursement of U.S. stimulus checks, which will start to hit as soon as the weekend, were re-aired, this time via Tsy Secretary Yellen, but that was already a known. Eurodollar futures sit unchanged to 1.5 ticks lower through the reds, with overnight flow headlined by ~30K of sales in EDU2. PPI data and the flash UoM sentiment survey headline locally during the final NY session of the week.

- The wings of the cash JGB curve firmed during the Tokyo morning, while the 3- to 10-Year zone of the curve saw some modest cheapening. It was once again the long end of the curve that outperformed, with super-long paper firming by ~3.0bp vs. yesterday's closing levels during morning trade, before that strength unwound during the early part of the Tokyo afternoon as local equity markets firmed further and U.S. Tsys softened. JGB futures (M1) finished 6 ticks lower on the day. The latest round of BoJ Rinban ops saw the respective purchase sizes of each bucket left at unchanged levels, while the offer to cover ratios revealed little in the way of notable selling pressure ahead of next week's BoJ decision. Longer dated swap spreads widened, during the afternoon, with paying there potentially leading to some long end weakness for JGBs. The BoJ decision and results of its monetary policy review headline the local docket next week.

- The Aussie bond space looked through the weekly AOFM issuance announcement, with the weekly ACGB issuance task upsized to a more normal A$2.0bn level after 2 weeks at A$1.0bn. The AOFM is seemingly comfortable enough with the calming of bond market volatility that has been witnessed over the last week or so. Still, the AOFM held off from the syndication of the new ACGB Nov '32, which could come in the coming weeks if the bond market continues to act in an orderly manner. YMM1 -0.8 at the close, with XMM1 -5.0, mostly in the wake of U.S. Tsy market gyrations both overnight and during Sydney hours. Looking to next week, RBA Governor Lowe will give the opening remarks at the Melbourne Business Analytics Conference on Monday, with the local weekly economic docket headlined by the labour market report (Thursday) and preliminary retail sales data (Friday). Elsewhere, RBA Assistant Governor Kent will make a couple of appearances.

FOREX: Greenback Takes Lead

USD regained poise in thin, pre-weekend Asia-Pac trade. The DXY crept higher as the greenback outperformed all of its G10 peers, even as a safe haven peer CHF faltered across the board, while JPY was mostly weaker. USD/JPY advanced, though its upswing may have been limited by today's expiry of $2.2bn worth of options with strikes at Y108.30-35.

- The PBOC fixed its USD/CNY mid-point at CNY6.4845, 8 pips below sell side estimates and a third straight lower fix, a rarely seen occurrence amid the PBOC's unspoken preference for a weaker yuan.

- AUD/NZD printed a fresh monthly high after a "golden cross" pattern materialised on the intraday chart. Looking ahead, $1.3bn of AUD puts with strikes at NZ$1.0730 will roll off at today's NY cut.

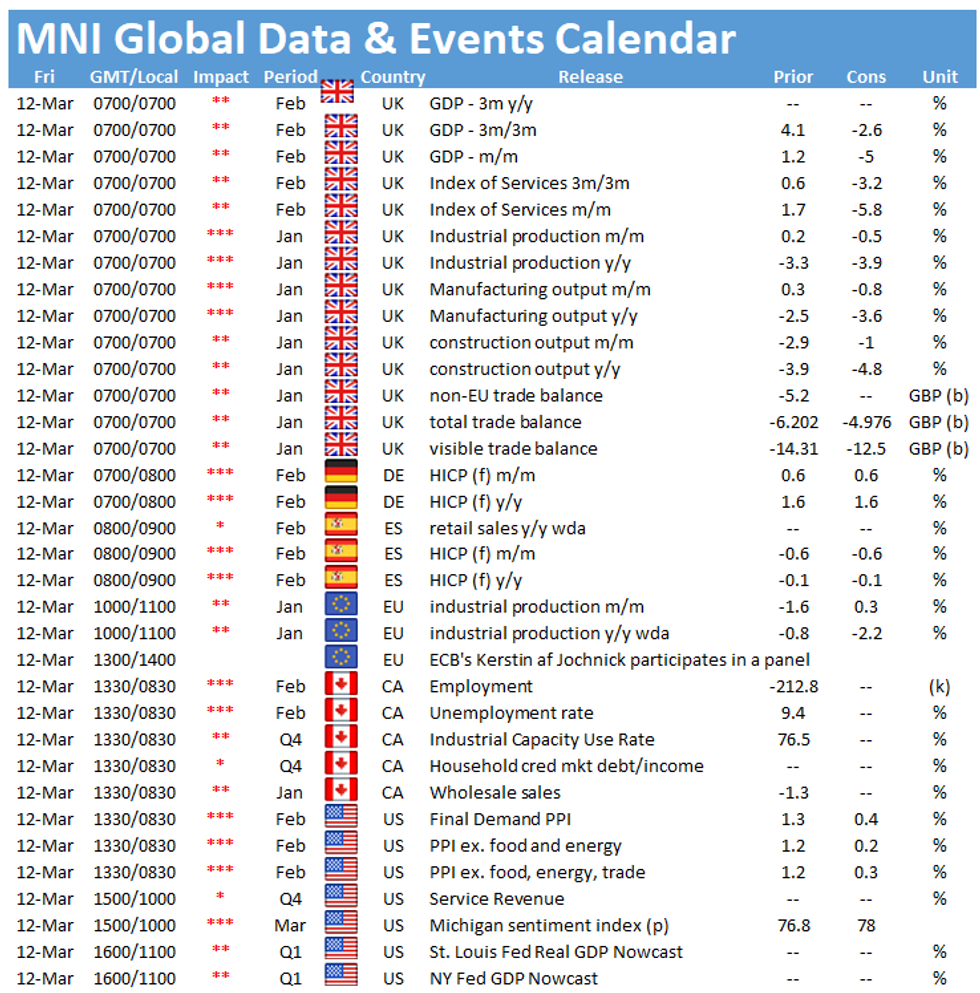

- On the radar today: U.S. PPI & flash U. of Mich. Sentiment, EZ industrial output, final German CPI, UK monthly economic activity indicators & Canadian unemployment.

FOREX OPTIONS: Expiries for Mar12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E574mln), $1.1925-30(E1.1bln), $1.1995-1.2000(E2.4bln), $1.2100-10(E1.2bln)

- USD/JPY: Y108.30-35($2.2bln)

- AUD/USD: $0.7720-25(A$1.1bln-AUD puts), $0.7745-60(A$1.1bln)

- AUD/NZD: N$1.0730(A$1.3bln-AUD puts)

- USD/MXN: Mxn20.30($1.1bln)

ASIA FX: Mixed As Risk On Battles Greenback Bid

The greenback regained some poise in thin Asia-Pac trade, offsetting general risk on mood after Wall Street hit a record high.

- CNH: The PBOC fixed USD/CNY at 6.4845, 8 pips below sell side estimates and a third straight lower fix, a rarely seen occurrence amid the PBOC's unspoken preference for a weaker yuan. USD/CNH is higher, up 65 pips at 6.4850 as tensions simmer between the US and China.

- SGD: Singapore dollar is weaker, giving up ground after initially moving below 1.34. The outlook is positive for SGD after the latest Monetary Authority of Singapore forecasts. 2021 GDP forecast was lifted to 5.8% from 5.5%.

- TWD: Taiwan dollar is stronger, USD/TWD still above 28.00. Markets will watch to see TWD moves now that Taiwan is at risk of being labelled a currency manipulator.

- KRW: Won is stronger, playing catch up after underperformance earlier this week. Equity markets have risen strongly, even as the government extend social distancing measures for two weeks.

- INR: The rupee is stronger, markets are focused on CPI data later on where risks are to the upside, as illustrated by a jump in interest rate swaps. Industrial production data will also be released.

- IDR: Rupiah is stronger after reopening from a public holiday yesterday Reuters reported that Indonesia's new sovereign wealth fund is looking into investments in dozens of projects, including toll road concessions worth $2.6bn.

- MYR: Ringgit is weaker, industrial output rose 1.2% Y/Y in Jan, faster than expected (1.0%) but slower than in Dec (1.7%), as growth in the m'fing sub-index outweighed losses in the mining & electricity sub-indices.

- PHP: Peso is stronger, trade deficit widened more than exp. to $2.421bn in Jan from December's $2.149bn. The headline figure was underpinned by a deeper than forecast fall in imports. Pres Duterte said he is mulling reopening the economy within several weeks.

- THB: Baht has lost ground during the session, PM Prayuth and some of the cabinet members who were due to receive vaccinations with the AstraZeneca jabs have postponed their appointments, in the wake of the decision by some European countries to halt inoculations with the AstraZeneca product.

ASIA RATES: Elevated Yields

Yields continue to rise in India and South Korea, while Chinese bonds retain a degree of immunity to machinations in global bond markets.

- INDIA: Yields are higher across the curve, some steepening seen as markets play catch up after being closed for a local holiday yesterday. The RBI will conduct INR 2tn 14-day reverse repo auction today, but there could be some concession ahead of the auctions later, while there is also expected to be some disappointment after the RBI announced a smaller Operation Twist next week, offset by a switch operation.

- INDONESIA: Yields lower across the curve in Indonesia, markets playing catch up after being closed for a local holiday yesterday. Maybank have raised the outlook on Indonesia's bonds to bullish on the basis that yield concession has cheapened the issues, while the BI's willingness to mop up supply is also supportive.

- CHINA: The PBOC matched injections with maturities in today's OMOs, the fifth straight day of no injections, with CNY 30bn drained last week and no fresh cash injected since Feb 25. The overnight repo rate has dropped, down 2bps at 1.7803% - still some 55bps higher than its post-LNY lows, the 7-day repo rate up 8.5bps at 2.0868%. Bonds lower as equities rise.

- SOUTH KOREA: Futures are lower, in the cash space the 10-year yield is 1.6bps higher at 2.034%, up around 40bps from the turn of the year. This could help participation from domestic investors, with foreign buying of South Korean bonds already high – there have only been three days of net selling 2021. The sell-off comes as equity markets rise, while the government announced it would extend social distancing measures by two weeks.

EQUITIES: Mixed Day In Asia

Asia-Pac bourses are mostly in the green on Friday, major markets opened in the green after US markets hit record highs, but were dragged lower as mainland China gave up early gains. The move lower reversed as the session wore on which helped lift regional indices. In Hong Kong Xiaomi rose up to 8% after announcing a HKD 10bn buyback.

- Futures in Europe and the US are mixed, Dow Jones and S&P500 futures both higher, but the Nasdaq in negative territory. The Dax is in negative territory after the ECB inspired rally yesterday.

GOLD: Pausing

Spot sits a handful of dollars lower on the day, to last deal around $1,715/oz, a little lower than it was 24 hours or so ago, with U.S. yields and the DXY ticking higher in Asia. The technical picture is little changed vs. what has been outlined previously, while ETFs have extended their run of shedding gold holdings.

OIL: On Track For Weekly Loss

Crude futures are lower in Asia on Friday, with WTI & Brent sitting ~$0.30 softer on the day.

- Yesterday OPEC lowered its forecasts for demand in its MOMR. The coalition reduced its oil demand forecast for Q1 and Q2 by 180k bpd and 310k bpd, respectively. "Oil requirements in H1 2021 are adjusted lower, mainly due to extended measures to control COVID-19 in many key parts of Europe. In addition, elevated unemployment rates in the US slowed the recovery process," OPEC said in the report. For the medium term, the group remained optimistic. It said that oil demand recovery would be backloaded in the second half of the year and it raised its estimates for Q3 and Q4 by 400k bpd and 970k bpd, respectively.

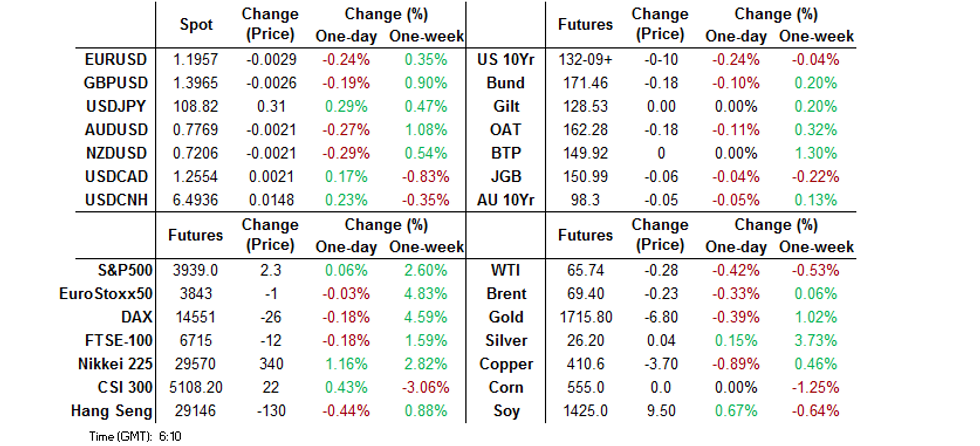

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.