-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: U.S. Equity Index Futures Climb Ahead Of FOMC

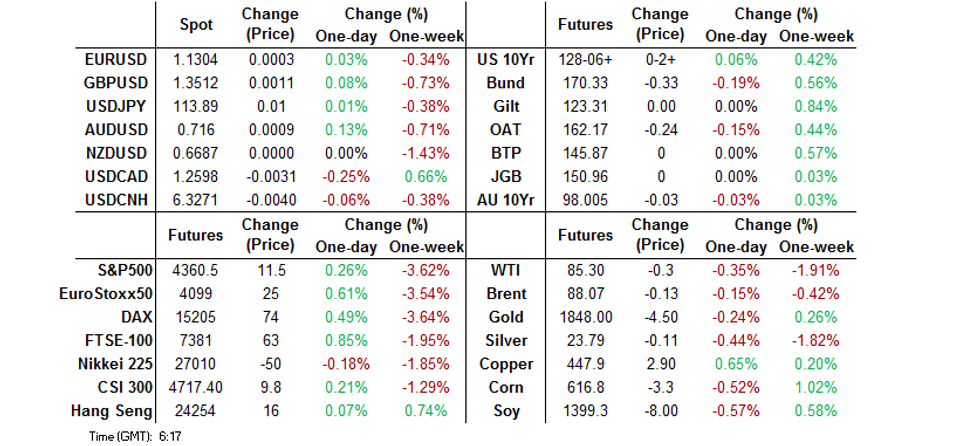

- Asia-Pac markets stabilise ahead of Wednesday's monetary policy decisions from the Fed and BoC. Australian markets are closed in observance of a federal holiday.

- Regional equity benchmarks are mixed, while U.S. e-mini futures gain amid subdued volatlity.

BOND SUMMARY: Core FI In Standby Mode, Fed Decision Looms Large

There was little movement across core FI space in Asia hours, with an Australian holiday limiting activity. All eyes were on the imminent policy decision from the Fed, who are expected to pave the way for a rate hike in March.

- T-Notes edged higher, while staying comfortably within the confines of Tuesday's range. TYH2 last trades +0-02 at 128-06, amid very subdued volatility. Eurodollar futures sit 0.5-1.5 tick lower through the reds. The Tsy curve flattened at the margin, with yields last seen 0.5-1.2bp higher.

- JGB futures slipped into the Tokyo lunch break but regained poise in afternoon trade. JBH2 sits at 150.95, just shy of previous settlement. Cash JGB curve runs slightly steeper on the back of some marginal weakness in the super-long end. The space looked through the summary of opinions from the BoJ's monetary policy meeting held last week. A couple of members stressed the need to clearly communicate the Bank's intention to keep powerful monetary easing in place to the public, which Governor Kuroda did during his press conference.

- Daytime trading was closed in Australia owing to a public holiday down under.

FOREX: Major FX Pairs Rangebound On Fed Decision Day

Major currency pairs held tight ranges in muted Asia-Pac trade, with Australia off for a national holiday. Regional headline flow was fairly lacklustre, providing some breathing space ahead of the Fed's monetary policy decision today. The DXY moved sideways in Asia, with the FOMC expected to set the scene for a rate hike in March.

- The BoC will also deliver their monetary policy decision, but in the grand scheme of things, it will be understandably overshadowed by the Fed's announcement. The loonie led gains in G10 FX space amid potential for the BoC to hike rates today, even as crude oil futures showed some weakness.

- The NZD underperformed at the margin ahead of the release of New Zealand's CPI data on Thursday. A former RBNZ official told MNI that the current rate-hike cycle may peak lower than the previous ones.

FOREX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1225-40(E1.4bln), $1.1280-00(E978mln), $1.1350(E619mln)

- USD/CNY: Cny6.2800($500mln), Cny6.2855($590mln), Cny6.3500($830mln), Cny6.40($642mln)

ASIA FX: Asia EM FX Await Fed Decision In Quietude

Most Asia EM currencies held steady in the lead-up to the Fed's policy announcement, while another in-line yuan fixing may have helped promote broader stability.

- CNH: Spot USD/CNH slipped under yesterday's low and approached the CNH6.3249 cycle trough printed earlier this week. The PBOC fix matched expectations, despite current redback strength and the approaching Lunar New Year holidays, which will keep the PBOC side-lined.

- KRW: The won started on a firmer footing, before giving away some gains. South Korea's consumer confidence improved this month, despite rising Covid-19 cases. The daily case count hit a fresh all-time high today.

- IDR: Spot USD/IDR clawed back its initial losses. The IMF advised Bank Indonesia to permit more FX volatility, which would preserve monetary policy space. Separately, Bank Indonesia Dep Gov Waluyo said that the central bank will conduct a "pre-emptive, ahead-of-the-curve, front-loading policy mix," although interest rates will remain low until there are signs of building inflationary pressure.

- MYR: The ringgit held steady. Malaysia's PM Ismail Sabri said that the gov't is looking into easing curbs on foreign arrivals.

- PHP: Spot USD/PHP moved further away from the key PHP51 resistance level. The Philippine Statistics Authority revised down Q3 GDP growth to +6.9% Y/Y from +7.1% ahead of the publication of Q4 data on Thursday.

- THB: Spot USD/THB slipped to a new weekly low amid thin local news flow.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2022 | 0700/0800 | ** |  | SE | PPI |

| 26/01/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 26/01/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 26/01/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/01/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 26/01/2022 | 1500/1000 |  | CA | BOC Monetary Policy Report | |

| 26/01/2022 | 1500/1000 | *** |  | US | new home sales |

| 26/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/01/2022 | 1600/1100 |  | CA | BOC Governor press conference after rate decision | |

| 26/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/01/2022 | 1900/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.