-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN MARKETS ANALYSIS: US Tsy Futures Edge Lower, Dollar Steady, NFP Ahead

- US Treasury futures edged lower during the morning session, and have since held of session since, although still trade well within Thursday's ranges. The USD is mostly steady against the majors and Asia FX. China and Hong Kong equities continue to weaken, but this hasn't impacted broader sentiment.

- China trade figures were mixed, with exports rising but imports cooling. As expected, the RBI held rates steady. The RBA’s new deputy governor Hauser from the Bank of England spoke publicly for the first time today in a fireside chat. Hauser reiterated that central banks are targeting a particular rate of inflation rather than interest rate, as it is important to contain the former as it is “toxic”.

- Later US May payrolls are released and a 180k rise is forecast with the unemployment rate stable at 3.9% (see MNI Payrolls Preview).

- The Fed’s Cook gives a commencement speech and the ECB’s Lagarde and Schnabel speak. German trade and IP for April and Canadian May employment also print.

MARKETS

US TSYS: Tsys Futures Edge Lower Ahead Of US NFP later

- Treasury futures edged lower during the morning session, and have since held of session since, although still trade well within Thursday's ranges. The front-end is slightly underperforming with TU is -0-01⅛ at 102-05⅝, while TY is -0-03+ at 110-08.

- Volumes: TU 35k, FV 45k & TY 75k, down on previous sessions.

- Looking at TYU4 technical levels, initial support is at 109-14 (50-day EMA), with the 109-07 (20-day EMA) the next target. While to the upside initial resistance is at 110-12+ (June 5 high), a break here would see a test of 110-17 (April 4 highs)

- Cash treasury curve slightly flatter today with yields about 1bpd higher. The 2Y +1.2bp to 4.736%, the 10Y +1bp at 4.297%, while 2y10y is -0.281 at -44.398.

- APAC Rates: ACGB curve has steepened, with yields +/- 1bp, NZGB yields 0.5-1.5bps lower, ANZ now calling for a rate cut in Feb from May, while JGBs are 1-3bps higher, reversing earlier moves, the 20y was -8bp lower at one point and now trade +2.3bps higher.

- Looking ahead; NFP and Wholesale Inventories

STIR: BoC Leads The $-Bloc Into An Easing Cycle

STIR markets within the $-bloc have shown varied performances over the past two weeks. The US and Canada have outperformed, softening by 12-13bps in year-end expectations, while Australia and NZ remain virtually unchanged.

- This week's key event was the BoC Policy Decision on Wednesday, which delivered the first rate cut in the $-bloc for this cycle.

- (MNI) BoC Governor Tiff Macklem lowered the key lending rate for the first time in four years on Wednesday, moving ahead of G7 peers and saying measured further cuts are likely needed amid growing confidence that restrictive policy is returning inflation to target. (See link)

- The next policy meetings for the remainder of the $-bloc are FOMC (June 12), RBA (June 18), and RBNZ (July 10). Market pricing assigns a low probability of any moves at these meetings.

Figure 1: $-Bloc STIR: Terminal Rate Expectations & ’24 Pricing

Source: MNI – Market News / Bloomberg

JGBS: Yields Higher Lead By 10Y, Q1 GDP On Monday, BoJ Decision On Friday

JGB futures are weaker and at session cheaps, -28 compared to the settlement levels.

- Outside of the previously outlined real household spending, there hasn't been much in the way of domestic drivers to flag. Leading and Coincident Indices have just printed flat to slightly stronger than expectations.

- Cash JGBs are cheaper across benchmarks, with yields 0.5bp (1-year) to 2.2bps higher (5- & 10-year). The benchmark 10-year yield is 0.986% versus the cycle high of 1.101% set last week.

- Consistent with the results of today’s BoJ Rinban operations, which saw positive spreads across all buckets and higher offer cover ratios for the 1-3-year and 5-10-year buckets, JGBs out to the 10-year have been pressured in the early rounds of the afternoon session.

- The swaps curve has bear-steepened, with rates 1-3bps higher. Swap spreads are mixed.

- On Monday, the local calendar will see Q1 GDP (Final), May Bank Lending and April Trade Balance data alongside the Eco Watchers Survey.

- Further out, we do not expect any change at next week’s monetary policy meeting on June 13-14, i.e., we expect the policy rate to remain at 0-0.1%. However, we do expect the BoJ to likely reduce JGB purchases, which are currently around ¥6 trillion per month, similar to the levels before the Bank ended yield curve control in March.

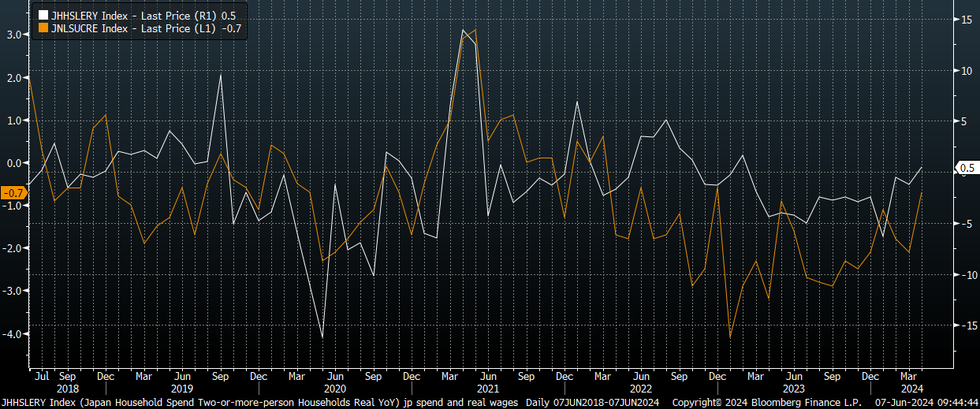

JAPAN DATA: Household Spending Back In Positive Y/Y Territory

Japan real household spending rose 0.5% y/y in April. This was in line with consensus expectations and against a -1.2% dip in March. This is the first y/y rise in household spending since February last year.

- The authorities/BoJ will be hoping this is the start of more positive real spending trends. The chart below overlays household spending against real wages growth (the orange light on the chart).

- Base effects will remain favorable over coming months, with spending troughing in July last year at -5.0%y/y.

- Nominal spending rose +3.4%, while nominal incomes were +2.3% y/y, but real incomes were -0.6% y/y (versus -0.1% in March). Still, income growth is away from late 2023 lows.

- By category spending trends were mixed, Education rose 26y/y., while food and transport were negative in y/y terms.

Fig 1: Japan Household Spending & Real Wages Y/Y

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Little Changed, Participants On Sideline Ahead Of US Payrolls, RBA Hauser Speaking

ACGBs (YM +1.0 & XM -0.5) are dealing little changed, with ranges narrow and volumes light, in a typical pre-US Non-Farm Payrolls Friday session. The report is expected to show that the US added 180,000 jobs in May, while the unemployment rate remained steady.

- Today's local calendar highlights are Foreign Reserves data (due later) and RBA Deputy Governor Andrew Hauser’s Fireside Chat at Australia’s Economic Outlook event (underway, watch here).

- Cash ACGBs are 1bp richer to 1bp cheaper, with the 3/10 curve steeper and the AU-US 10-year yield differential at -6bps.

- Swap rates are flat to 1bp lower.

- The bills strip is little changed, with pricing +/- 1.

- RBA-dated OIS pricing is 1-2bps softer for 2025 meetings. A cumulative 9bps of easing is priced by year-end.

- Next week’s local calendar is empty on Monday, with most states celebrating the King’s Birthday holiday. On Tuesday, we see the release of NAB Business Confidence followed by the Employment Report on Thursday.

RBA: New RBA Deputy Governor Hauser Reiterates Inflation “Toxic”

The RBA’s new deputy governor Hauser from the Bank of England spoke publicly for the first time today in a fireside chat. He said that Australia is in a better economic position than much of the OECD, including the euro area and the UK, but is also different to Canada and the euro area where rates were cut for the first time this week. He said the most important message is that the central bank will bring inflation down rather than signalling where rates are going.

- Hauser reiterated that central banks are targeting a particular rate of inflation rather than interest rate, as it is important to contain the former as it is “toxic”. A central bank doesn’t want economic participants to believe that it won’t return inflation to target as that will boost inflation expectations, which are still well anchored in Australia.

- He said that the “narrow path” plan to bring inflation gradually back to target to retain recent job gains is working. It is better to be cautious rather than rapidly closing the output gap and creating a deflation problem instead.

- Supporting productivity growth is a job for governments and business not the central bank.

AUSTRALIAN DATA: Supply/Demand Imbalance Driving Housing Affordability Deterioration

The Australian housing market continues to look robust driven by strong demand and lacklustre new supply. Depressed housing affordability is currently not weighing on the market with the number of new first time home buyer loans rising 10.8% y/y. The RBA doesn’t seem concerned and has not mentioned the risks from positive wealth effects and dropped dwelling investment from the May statement. When easing starts, it is likely to have limited impact on housing affordability given current imbalances.

- The RBA revised down dwelling investment projections to -3.2% y/y for Q2 2024 but Q4 was higher at +0.2% y/y for Q4. 2025 and 2026 were revised down.

- May CoreLogic house prices rose 0.8% m/m to be up 9% y/y and 24% above trend. They are now 13.8% above the January 2023 trough. The smaller capitals are seeing stronger rises due to “extremely low levels of available supply”, according to CoreLogic.

- Strong demand is also reflected in the rental market with vacancy rates very low and Q1 rents rising 7.8% y/y. It is also seen in strong sales growth, which was 39.3% y/y in April across the 5 states.

Source: MNI - Market News/Refinitiv

- On the supply side, Q1 real dwelling investment fell 0.5% q/q, second consecutive quarterly fall, to be down 3.4% y/y. Building approval data is not signalling the needed recovery with the number of April approvals 19% below pre-pandemic levels and up only 3.5% y/y.

- As a result, housing is now around 10% overvalued based on the house price-to-rents ratio and affordability (HAI) is its worst since our series began in 1980. Higher mortgage rates have contributed to deteriorating affordability but they have been stable over 2024 and Q1 nominal disposable income rose 1.1% q/q, yet there has been a 2pp deterioration in our HAI since Q4 reflecting higher home prices.

Source: MNI - Market News/Refinitiv

NZGBS: Slightly Richer, Focus On US Payrolls Data Later Today

NZGBs closed slightly richer, with yields 1-2bps lower. With local news flow relatively light, trading ranges were narrow and volumes light ahead of the much-anticipated US Employment Report.

- The report is expected to show that the US added 180,000 jobs in May, while the unemployment rate remained steady.

- NZ Treasury sold $15.8bn worth of bonds this year as of June 6, according to Bloomberg calculations using official data. Issuance was up 63% compared to the same period last year.

- Swap rates closed little changed.

- RBNZ dated OIS pricing is little changed across meetings. A cumulative 25bps of easing is priced by year-end.

- This week's key event for stir markets was the BoC Policy Decision on Wednesday, which delivered the first rate cut in the $-bloc for this cycle.

- The next policy meetings for the remainder of the $-bloc are FOMC (June 12), RBA (June 18), and RBNZ (July 10). Market pricing assigns a low probability of any moves at these meetings.

- Next week’s local data calendar is empty on Monday and Tuesday ahead of Net Migration on Wednesday, Card Spending on Thursday and REINZ House Sales, BusinessNZ Manufacturing PMI and Food Prices on Friday.

FOREX: USD Mostly Steady As Market Awaits US NFP

USD trends have mostly been range bound in the first part of Friday trade. Markets no doubt mindful of the US NFP print later. The USD BBDXY index was last near 1252.3, close to end Thursday levels from NY Trade.

- USD/JPY is little changed, last around 155.60. Unchanged BoJ buying ops and comments from FinMin Suzuki that FX intervention should only be used on a limited basis weighed on yen at the margins. This propelled us towards 156.00, but selling interest emerged.

- We had April household spending data show a rise in y/y terms for the first time since Feb last year. The outcome was in line with forecasts though.

- Japan implied vols and risks reversals for the 1 week tenor are starting to shift as next week's BoJ meeting comes into view.

- AUD/USD is higher, last near 0.6680. We have RBA Deputy Governor comments soon, but the central bank seems intent to wait for further inflation data. China import figures were weaker than forecast, but commodity import volumes held up.

- NZD/USD also sits marginally higher, last back above 0.6200.

- Looking ahead the main focus is the upcoming NFP print. This release is expected to partially rebound in May from April’s surprisingly low 175k, with 188k in headline gains per MNI’s sell-side analyst median. While still an acceleration from the prior month, the consensus outcome if realized would be seen as reinforcing the view that the labor market has shifted into a softer but still-solid phase of growth.

ASIA STOCKS: China & Hong Kong Equities Head Lower, Trade Surplus Widens

Hong Kong & Chinese equities are mostly lower today, tech stocks are the worst performing although well within recent price ranges. It has been a slow week for equities in the region, with Caixin China PMI data out, which showed an increased from April with the Composite 54.1 vs 52.8, while in Hong Kong PMI for May was 49.2 down from 50.6 in April. Earlier, we Chinese Trade Balance data out which show the surplus had widened to $82.62b from $72.15b, with exports rising rising than expected at 7.6% vs 5.7% est.

- Hong Kong equities are lower today, tech stocks are the worst performing sector today with the HSTech Index is down 0.63%, Property Indices are slightly higher with the Mainland Property Index up 0.65%, the HS Property Index is little changed, while the HSI is down 0.10%. It has been a decent week for Hong Kong Listed stocks, with the HSI up 1.90% for the past five sessions vs a 0.42% fall by the CSI300.

- China onshore equities are mixed today, the CSI300 Reals Estate Index is up 1.50%, followed by gains in small-cap indices the CSI1000 up 0.30% & CSI2000 up 1.20%, while large-cap CSI300 is down 0.50%.

- In the property space, China's property market faces increasing challenges as buyers question the value of paying off loans on properties with negative equity. Despite government efforts to address unsold housing and liquidity issues among major developers, investor confidence remains low, with Chinese property stocks down ~20% from their May high. Indicators of distress include a four-year high in residential mortgage delinquencies, record foreclosed property auctions in 2023, and banks issuing a record 24.7 billion yuan in financial instruments backed by non-performing mortgages.

- (MNI) China Press Digest June 7: Insurance, NEVs, Trade-In (See link)

- Looking ahead: China Trade Balance and Hong Kong Foreign Reserves are due later today

ASIA PAC STOCKS: Regional Asian Equities Higher, Led By Gains In South Korea

Asian stocks remained steady and are on track for their best week in a month, with a rally in South Korean shares balancing out declines in other markets. The MSCI Asia Pacific Index saw fluctuations between gains and losses and now trade little changed. South Korean equities emerged as top gainers after reopening from a holiday, driven by foreign investment in local chipmakers. Although trading has remained cautious ahead of the US non-farm payroll data due later today with heightened expectations of Fed rate cuts following softer-than-forecast US data and recent policy easing by the Bank of Canada and the ECB.

- Japanese stocks have fluctuated between gains and losses today as investors stayed on the sidelines ahead of the US employment data on Friday and the Bank of Japan’s policy decision next week. The Topix is down 0.18% and the Nikkei has slipped 0.20%. Meanwhile, the USD/JPY has been range-bound recently and after initially trading higher this morning we have pared gains to trade down 0.10% at 155.52.

- South Korea’s Kospi surged as much as 1.5% this morning we now trade up 1.30%, while the Kosdaq is up 1.65%, driven by foreign fund inflows, particularly into chipmakers such as SK Hynix, Samsung Electronics, and LG Energy Solution. The Kospi Index rose 3.2% over the past week, and the South Korean won strengthened by 1.3% against the dollar to 1,367.85.

- Taiwan equities are a touch lower today, moves today have largely been capped by lower semiconductor prices overnight, after the Philadelphia SE Semiconductor Index fell 0.86% and ahead of US NFP . Later today we have Trade Balance data last month the trade balance surplus missed estimates as exports to China & HK fell 11.3%.

- Australian equities are slightly higher today with the ASX200 up 0.36% bolstered by gains in miners and consumer discretionary stocks. The benchmark is on track for its biggest weekly gain since February 2. Traders are now focusing on a key US jobs report, which is expected to influence the Federal Reserve’s policy outlook.

- Elsewhere in SEA, New Zealand Equities are 0.40% lower, Singapore equities are 0.30% higher, Malaysian equities are 0.35% higher, Indian equities are 0.50%, Philippines Equities are 0.15%, while Indonesian equities are 0.60% lowe.

OIL: Crude Slightly Higher As Waits For US Employment Data

Oil is off the intraday lows to be up about 0.2% during the APAC session today as it trades in narrow ranges ahead of US May payroll data out later. WTI is 0.2% higher at $75.73/bbl up from the low of $75.41 earlier. Brent has struggled to hold above $80 today where it started the session. It is currently up 0.2% to $80.01/bbl after falling to $79.73. The USD index is little changed.

- Crude found some support later this week as OPEC members reassured markets that they will alter their plan to begin a reduction in output cuts from October if it looks like there will be excess supply. The initial news drove markets lower and prices are currently down around 1.5% this week.

- Some OPEC members have already been overproducing and quota compliance has been a problem, but Russia said it would reduce output to make up for its previous overproduction.

- Later US May payrolls are released and a 180k rise is forecast with the unemployment rate stable at 3.9% (see MNI Payrolls Preview). Oil markets will watch this closely and likely react to any changes in Fed Fund expectations. The FOMC meets on June 12.

- The Fed’s Cook gives a commencement speech and the ECB’s Lagarde and Schnabel speak. German trade and IP for April and Canadian May employment also print.

GOLD: On Track For A Weekly Gain Ahead Of US Payrolls Data

Gold is on track for another weekly gain, up 0.2% in the Asia-Pacific session, following a 0.9% increase to $2376.06 on Thursday.

- Gains were supported by slightly lower US yields.

- However, today’s US employment report, combined with the upcoming CPI data release and the FOMC meeting are likely to be the key drivers of short-term sentiment.

- The report is expected to show that the US added 180,000 jobs in May, while the unemployment rate remained steady.

- This could bolster the case for rate cuts, as US officials have emphasized the need for more evidence of inflation easing toward the central bank’s 2% target before reducing borrowing costs.

- According to MNI’s technicals team, the medium-term trend structure for gold remains bullish and the recent move down appears to be a correction that is allowing an overbought condition to unwind.

CHINA DATA: Export Rise More Than Forecast, Imports Slow, But Commodity Volumes Hold Up

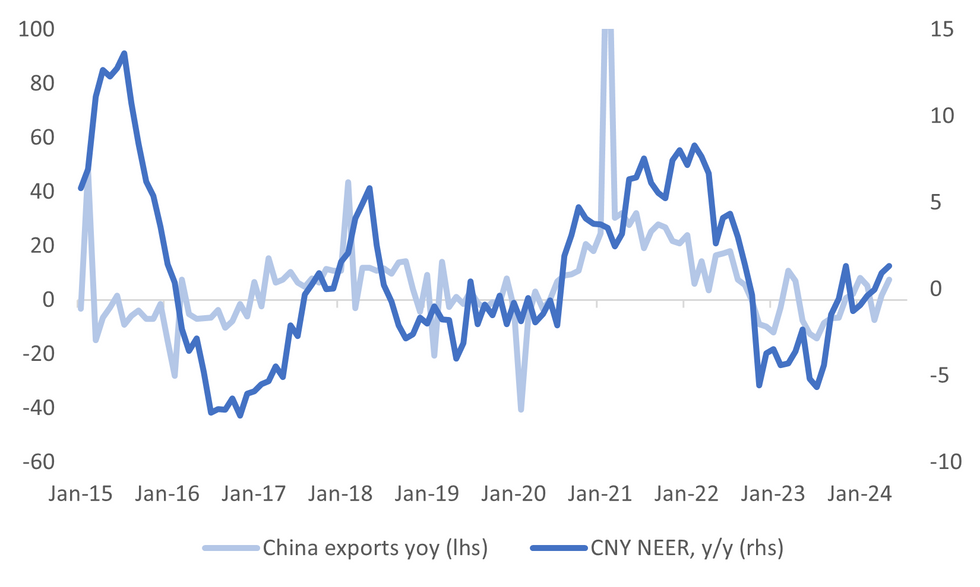

China May trade figures were mixed. Export growth improved more than forecast, printing at +7.6% y/y, versus 5.7% forecast and 1.5% in April. Imports were weaker than forecast though at +1.8%y/y, versus 4.3% forecast and 8.4% in April. This aided a better than expected trade surplus at $82.62bn ($72.15bn was the forecast).

- The export bounce is generally consistent with trends with other North East Asia economies. It should be also source of support for growth in the near term.

- The chart below plots export growth against the CNY NEER (in y/y terms). A better export picture is not inconsistent with firmer NEER levels, although much focus for USD/CNY remains in terms of domestic capital outflow pressures.

- Processing exports were down -1.2% y/y, but other details showed an improved y/y trend.

- Looking forward, base effects remain favorable for y/y momentum in the next few months. Trade tensions are in focus though (with both the US and EU,) and will likely remain so as we get closer to the US November election. China's trade surplus with the US rose to $30.8bn, but we remain below 2023 highs.

Fig 1: China Export Growth Versus CNY NEER Y/Y

Source: MNI- Market News/Bloomberg

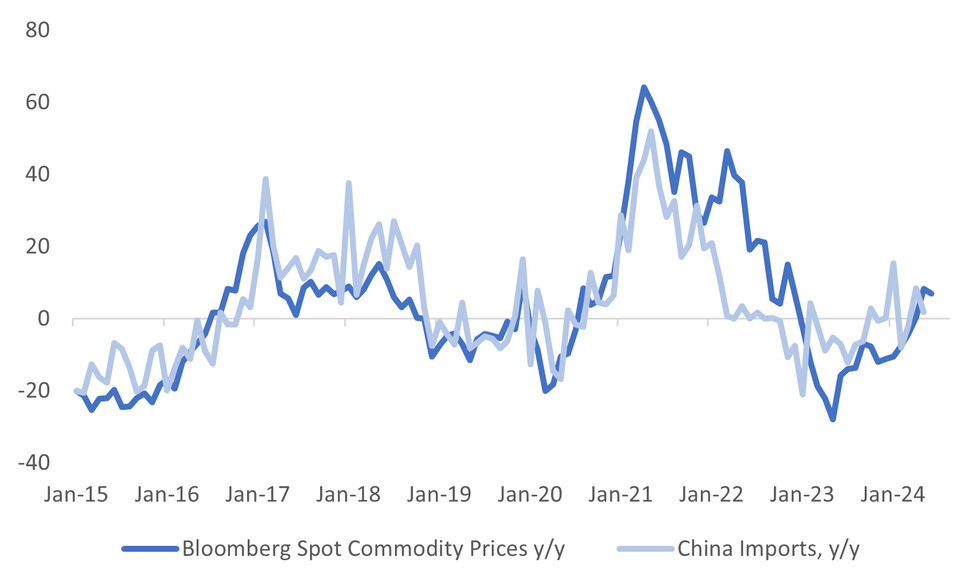

- On the import side, the headline miss suggests at face value some domestic demand pressure. Still, commodity import volumes held up quite well in m/m terms. Crude oil rose +5%, while iron ore was up a touch. Natural gas import volumes were also stronger.

- Coal imports fell in the month but are still up 12.6% y/y ytd. Hence, we remain elevated from a levels standpoint.

- The second chart below overlays China imports y/y against the Bloomberg spot commodity index.

Fig 2: China Import Growth Versus Commodity Prices Y/Y

Source: MNI - Market News/Bloomberg

RBI: Rates Steady, Likewise for Policy Stance, Growth Forecast Nudged Higher

The RBI kept rates on hold at 6.50%, which was widely expected by the market. The central bank also maintained its bias on the withdrawal of accommodation.

- On both counts the RBI MPC voted 4 to 2, which was a shift from the prior meeting where the vote count was 5-1 on both counts.

- This may be construed as a dovish outcome, although the tone of RBI Governor Das's press conference doesn't suggest a near term policy shift is likely.

- Most notably the 2025 FY growth forecast was revised up to 7.2% from the prior 7.0%. This signals confidence in the growth outlook, and Das highlighted a number of positives - private consumption is recovering and government activity is likely to boost Capex.

- On inflation the 4.5% forecast for the current financial year was retained. A lot of focus was on food inflation and the near term outlook. Governor Das stated the central bank needs to be vigilant to the upside risks, especially from food.

- India needs to move to the 4% CPI target on a durable basis Das added. Presumably this is needed before a shift to neutral/easier policy settings can unfold.

THAILAND DATA: May CPI Data Aids BoT June Policy Hold

May headline CPI inflation came in higher than expected at 1.5% y/y after 0.2% in April pushed higher by domestic diesel and food prices. The government expects June CPI to moderate to around 1% due to power subsidies but also lower food prices. The Bank of Thailand (BoT) has said for some time that government subsidies had been keeping headline artificially low and that it focuses on the outlook, thus we expect it to be on hold at the June 12 meeting. Core price pressures remained subdued though and were steady at only 0.4% y/y.

- April was the first month that headline inflation returned to the BoT’s 1-3% target band since April 2023. At its last meeting, BoT forecast 2024 headline and core inflation at 0.6% before picking up to 1.3% and 0.9% respectively in 2025.

- The government has been pressuring the central bank to cut rates, despite its independence, given headline inflation has been negative and the new finance minister Pichai has called for a review of the target band. BoT disagrees and says that the band remains “appropriate” and that soft growth is due to structural factors which monetary policy can’t impact and negative inflation was due to government subsidies and price caps.

- Food prices rose 1.1% y/y in May from 0.3% due to a pick up in most food items including rice & cereals. Non-food rose 1.8% y/y from 0.1% driven by housing and transportation. Energy rose 7.2% from -0.1%.

Source: MNI - Market News/Refinitiv

ASIA FX: Steady USD/Asia Trends Mostly, Although Baht Continues To Rally

USD/Asia pairs are mostly range bound as the market awaits the US NFP print later. Spot THB and IDR are modestly firmer. USD/CNH is steady despite stronger export growth figures although import growth cooled. The RBI held steady as expected. Still to come today is the Taiwan trade figures for May. Next week we should have China new loans/credit figures as well as May inflation data. The BoT decision is also due.

- USD/CNH is little changed, last near 7.2575/80. Onshore spot is also very steady. Local equities are weaker as the May bounce continues to get unwound. We had mixed May trade figures, better exports but slower import growth. The currency didn't react a great deal to the print.

- Onshore South Korean markets returned today, with local equities playing catch up, up 1% for the Kospi. The 1 month USD/KRW NDF is higher though back to 1366/67, off around 0.25% from end Thursday levels in NY. This puts us back close to the 20-day EMA.

- As expected, the RBI left rates on hold at 6.50%. There were two dovish dissenters, but Governor Das's press conference suggested the core view for the central bank is to wait until food inflation trends become clearly int he next few months. The central bank did nudge higher its current financial year growth projection. USD/INR is very steady in the first part of Friday trade, holding under 83.50 for now.

- USD/IDR is lower, back to 16220/25, off 0.20%, with BI intervention efforts in recent sessions perhaps starting to gain greater traction. The JCI is 0.50% lower and now trades at ytd lows though.

- USD/THB has slipped further, now down to 36.35/40. Baht bulls will eye a test of the 100-day EMA near 36.24, we are now sub the 50-day, which is back close to 36.50.A stronger than expected May CPI print, albeit for the headline, should lean against a BoT shift next week.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/06/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/06/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/06/2024 | 0800/1000 |  | EU | ECB's Schnabel participates in panel discussion at the Federal Ministry of Finance | |

| 07/06/2024 | 0900/1100 | *** |  | EU | GDP (final) |

| 07/06/2024 | 0900/1100 | * |  | EU | Employment |

| 07/06/2024 | - | *** |  | CN | Trade |

| 07/06/2024 | 1230/0830 | *** |  | US | Employment Report |

| 07/06/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/06/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 07/06/2024 | 1415/1615 |  | EU | ECB's Lagarde in Atelier Maurice Allais | |

| 07/06/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 07/06/2024 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.