-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: US Tsys Tick Higher In Asia

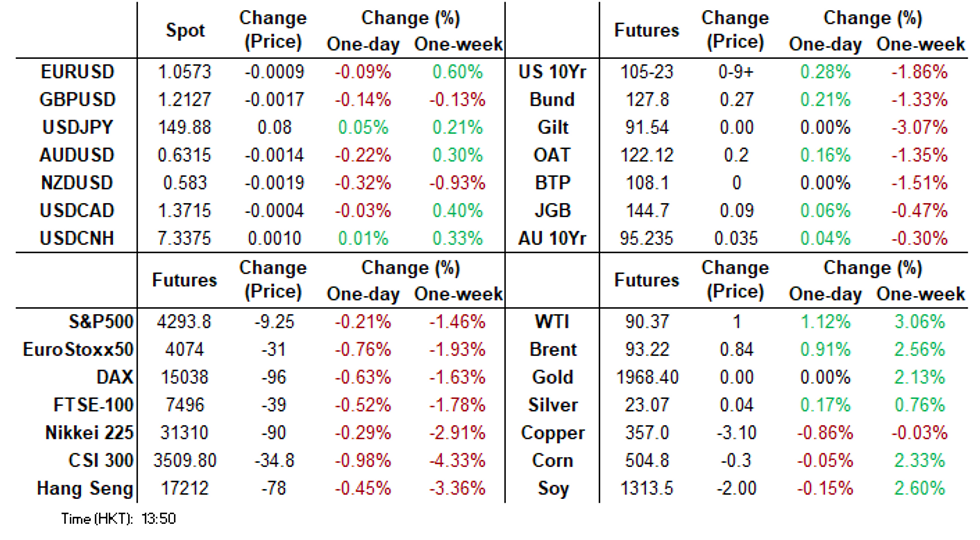

- Tsys ticked higher through the Asian session as risk-off flows added a layer of support, US Equity Futures are lower and the USD has ticked higher. President Biden noted in an address to the nation that he will be asking congress for ~$100 billion in resources for Israel, Ukraine, Taiwan and the US southern border. Regional FI followed Tsys higher.

- The Antipodeans are lower in Asia today, AUD and Kiwi continued moves seen late in yesterday's NY session before paring losses. Kiwi is the weakest performer in the G-10 space down ~0.3% a touch above YTD lows, last printing at $0.5830/35. AUD/USD is down ~0.2%, the pair is holding above the $0.63 handle for now.

- Elsewhere WTI is up ~1% and above the $90/barrel level as concerns over escalation in the Hamas/Israel conflict add support. Gold is 0.2% higher at a 13-week high in the Asia-Pac session, after closing +1.4% at $1974.46, off a high of $1977.78, on Thursday. The demand for bullion remains robust, primarily driven by a surge in safe-haven purchases due to escalating tensions in the Middle East.

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 105-24, +0-10+, a 0-10 range has been observed on volume of ~123k.

- Cash tsys sit 1-5bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys ticked higher through the Asian session as risk-off flows added a layer of support, US Equity Futures are lower and the USD has ticked higher. President Biden noted in an address to the nation that he will be asking congress for ~$100 billion in resources for Israel, Ukraine, Taiwan and the US southern border.

- There several highlights flow wise including buyers in TY (4.35k) US (2.65k) and FV (3k).

- Fedspeak from Dallas Fed President Logan crossed early in the session, she noted she is not yet convinced that CPI is trending toward target but higher long term yields will give the Fed time to evaluate data.

- German PPI and UK Retail Sales provide the highlights in today's European session, further out the data calendar is thin. Fedspeak from Philadelphia Fed President Harker and Cleveland Fed President Mester is due.

JGBs: Futures Near Session Highs, Tracking US Tsys In Asia-Pac

In Tokyo afternoon dealings, JGB futures are stronger and near session highs, +13 compared to the settlement levels, having more than reversed overnight weakness induced by US tsys.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined National CPI, which printed in line with expectations at the headline level but slightly above expectations for core and core-core measures.

- Accordingly, the direction in JGBs has likely been assisted by the partial reversal of yesterday’s US tsy weakness in today’s Asia-Pacific session. Cash US tsys are 1-5bps richer, with the curve flatter. Reuters reported that drones had hit US bases in Iraq.

- Cash JGBs are mixed, with the belly of the curve performing the best. Yield movements are ranging from -1.2bps to +1.7bps. The 5-year is outperforming on the curve at 0.362% after BOJ said it would offer 5-year loans to banks on Tuesday (See link ICYMI). The benchmark 10-year yield is 0.2bp lower at 0.838% versus the cycle high of 0.851% set yesterday.

- The swaps curve is richer, with the belly outperforming. Swap spreads are tighter.

- Next week, the local data calendar is empty on Monday ahead of Jibun Bank PMIs and Department Sales on Tuesday.

- Monday sees BOJ Rinban operations covering 1- to 25-year JGBs.

AUSSIE BONDS: Dealing At Session Highs, US Tsys Richer, Q3 CPI Next Wednesday

ACGBs (YM +5.0 & XM +5.5) sit at highs after grinding higher through the Sydney session. With the local calendar empty, the unwinding of early weakness appears linked to the partial reversal of yesterday’s US tsy weakness in today’s Asia-Pacific session. Cash US tsys are 1-5bps richer, with the curve flatter. Reuters reported that drones had hit US bases in Iraq.

- That said, today’s local price action was also likely supported by technically driven buying. Some local participants have possibly used the heavy price action this week to either cover shorts or enter longs after futures contracts were pushed to cycle lows.

- Cash ACGBs are 5-6bps richer, with the AU-US 10-year yield differential 3bps lower at -21bps.

- Swap rates are 6bps lower, with EFPs little changed.

- The bills strip has bull-flattened, with pricing +2 to +7.

- RBA-dated OIS pricing is 1-7bps softer, with Dec’24 leading.

- Next week, the local calendar sees nothing on Monday, ahead of Judo Bank PMI data and RBA Governor Bullock’s speech at CBA’s Annual Conference on Tuesday. Q3 CPI data is due on Wednesday, with Bloomberg consensus expecting a cooling in headline and core CPI measures. The Trimmed Mean measure is forecast to fall to 5.0% y/y from 5.9%.

- Next Friday, the AOFM plans to sell A$800mn 0.5% Sep-26 bond.

NZGBS: Bull Flattening As US Tsys Partially Reverse Thursday’s Move

NZGBs bull-flattened, with benchmark yields flat to 4bps lower. In addition to the previously outlined trade balance data, price action today has likely been influenced by strong demand (cover ratios 2.5x to 3.8x) seen at the weekly supply. Technical issues within the YieldBroker tendering system prompted the NZ Debt Management office to reschedule yesterday's bond auction to today.

- Nevertheless, today’s intra-session strengthening in NZGBs, particularly for the 10-year, appears linked to a partial reversal of yesterday’s US tsy weakness in today’s Asia-Pacific session. Cash US tsys are 1-5bps richer, with the curve flatter.

- Swap rates closed 3-4bps lower, with implied swap spreads narrower.

- RBNZ dated OIS pricing closed 1-5bps softer across meetings. Terminal OCR expectations sit at 5.63%, the lowest level since mid-September and 23bps lower than early October levels.

- Next week, the local calendar is light until ANZ Consumer Confidence on Friday.

- Next Thursday, the NZ Treasury plans to sell NZ$200mn of the 4.5% May-27 bond, NZ$200mn of the 3.5% Apr-33 bond and NZ$100mn of the 2.75% May-51 bond.

GOLD: Firmer In Asia-Pac After A Large Gain On Thursday

Gold is 0.2% higher at a 13-week high in the Asia-Pac session, after closing +1.4% at $1974.46, off a high of $1977.78, on Thursday.

- The demand for bullion remains robust, primarily driven by a surge in safe-haven purchases due to escalating tensions in the Middle East. The US has reported an increase in drone attacks in Iraq and Syria. Additionally, an American destroyer in the Red Sea intercepted cruise missiles launched at Israel by Houthi rebels in Yemen.

- Once again, geopolitical risk dominated a further climb for US Treasury yields. Higher government bond yields, in the face of rising geopolitical uncertainty, appear to have driven flows into alternative portfolio hedges like gold, which has rebounded almost 10% off the October lows.

- According to MNI’s technicals team, Thursday’s clearance of $1965.5 (61.8% retrace of May 4 – Oct 6 bear leg) opens $1987.5 (Jul 20 high).

FOREX: Antipodeans Lower In Asia, Narrow Ranges Elsewhere On Friday

The Antipodeans are lower in Asia today, AUD and Kiwi continued moves seen late in yesterday's NY session before paring losses as US Tsys ticked higher. WTI has firmed back above the $90/barrel handle and US Equity Futures are lower.

- Kiwi is the weakest performer in the G-10 space down ~0.3% a touch above YTD lows, last printing at $0.5830/35. Downside support now comes in at $0.5812, low from 19 Oct, the $0.58 handle and $0.5719 a Fibonacci projection.

- AUD/USD is down ~0.2% at $0.6315/20. Technically the outlook remains bearish, support comes in at $0.6286 Low Oct 3 / 13 and the bear trigger. Upside resistance is seen at $0.6393 High Oct 18.

- Yen is little changed looking through a mixed September CPI report and has dealt in narrow ranges today. Attention is on the 150.00 handle and the recent 150.16 high (Oct 3). A clear break of 150.00 would reinforce bullish conditions and open 150.40, a Fibonacci projection. On the downside, a breach of 147.43, Oct 3 low, would be an important bearish development.

- Elsewhere in G-10 EUR and GBP are a touch lower however ranges have been narrow. BBDXY is up ~0.05%.

- German PPI and UK Retail Sales provide the highlights in today's European session.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/10/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 20/10/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/10/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 20/10/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 20/10/2023 | 1300/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 20/10/2023 | 1615/1215 |  | US | Cleveland Fed's Loretta Mester | |

| 20/10/2023 | 1930/1530 | ** |  | US | Treasury Budget |

| 20/10/2023 | 2000/1600 |  | US | Fed Financial Stability Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.