-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD/CNY Breaks Above 7.2000, Weaker Equities Adds To Risk Off Mood

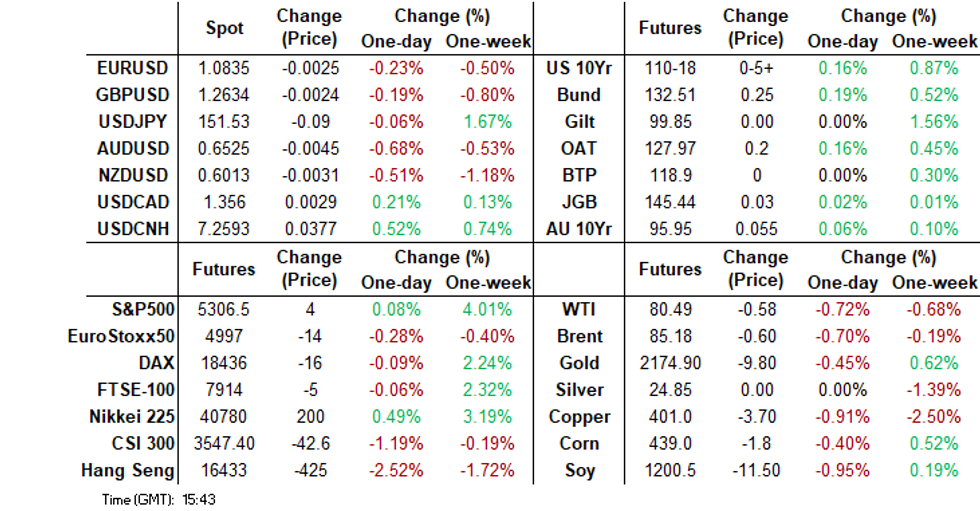

- Weakness in China related assets was evident today. HK/China equities weakened amid earnings concerns, and fresh US regulatory risks. Onshore USD/CNY spot finally broke above 7.2000, which helped push the broader USD index back above pre FOMC levels.

- Yen outperformed in the G10 space, unable to test above the 151.90 level. US yields are lower.

- JGBs have underperformer somewhat, but only at the margins. BoJ Governor Ueda wants to curb BoJ bond buying eventually.

- Looking ahead, UK retail sales are out, along with the German IFO. In the US the Fed's Barr & Fed's Bostic will speak.

MARKETS

US TSYS: Treasury Futures Edge Higher, Fed's Barr & Bostic Speak Later Today

- Jun'24 10y futures have edged slightly higher as we head into the Asia break, volumes remain on the light side, while we trade well within Thursday's ranges after making lows on the open of 110-12+ and trade near highs of 110-16 at 110-15+ up + 03 for the day. 5Y futures have traded similar up +02 to 106-30 just off highs made earlier of 106-30+.

- Looking at technical levels: Initial support lays at 109-24+ (Mar 18 low/ the bear trigger), further down 109-14+ (Nov 28 low), while to the upside initial resistance is seen at 110-26+ (Mar 21 high), while above here 111-01+ (50-day EMA), a break above here would open a retest of 111-24 (Mar 12 high).

- Treasury curves have bull-steepened today with yields 1-2bps lower, the 2y is -1.7bps at 4.619%, the 10y is -1.4bp at 4.253%, while the 2y10y is -0.320 at -36.826, down from a high of -32.00 on Thursday.

- Looking ahead: It's an empty calendar for Friday, while Fed's Barr & Fed's Bostic will speak later today

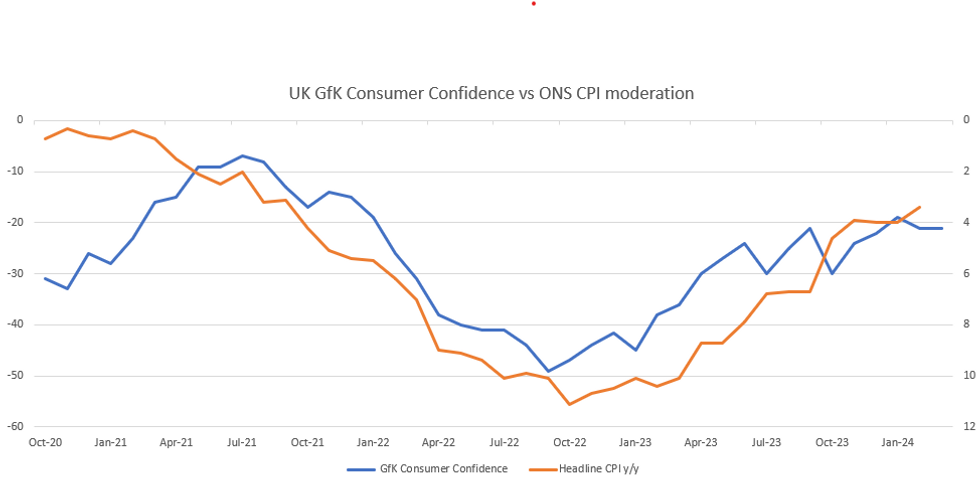

UK DATA: UK Consumer Confidence Unchanged for Second Consecutive Month

UK GfK Consumer Confidence printed weaker than expected remaining at -21 in February (vs -19 forecast) although on a year-on-year basis, this month's reading is a +15 point improvement.

- The chart below shows that since inflation moved notably above the 2% target in mid-2021 consumer confidence has generally been inversely correlated. And hence since headline inflation started to moderate towards the end of 2022, consumer confidence has improved.

- However, more recently as inflation has begun to approach more 'normal' levels, the relationship is beginning to weaken, as price increases become less dominant in consumers' minds.

- In terms of the month-on-month changes, 2 subcomponents were down, whilst 3 increased. The General Economic Situation over the last 12 months and the Major Purchase Index both fell 2 points to -45 and -27, although both remaining above March 2023 levels.

- Meanwhile, Personal Financial Situation over the next 12 months improved 2 points to 2, after stalling at 0 for 2 successive months, this a a significant 31 points improvement year-on-year. Finally, Personal Financial Situation in the last 12 months and General Economic Situation over the next 12 months both improved by 1 point, keeping all subcomponents comfortably above levels seen in March 2023.

- March's survey was conducted among a sample of 2007 individuals from March 1st to March 15th, 2024.

JGBS: Futures Supported On Dips As US Tsy's Rally, Ueda Wants To Scale Back Bond Purchases Eventually

JGB futures went lower post the lunch time break, getting to 145.29, but from there we rebounded and last track near 145.42, +.01. This is close to where we started the session.

- Some modest downside pressure may have been evident from comments by BoJ Governor Ueda, who appeared before parliament. The Governor stating that the central bank will eventually scale back its bond purchases (long end rates should ultimately be determined by the market). This is unlikely to be in the near term as Ueda stated the central bank will assess the market reaction to the recent policy shift.

- Still, the continued push higher in US Tsy futures, last at 110-18, +05+ for the 10yr future, has likely had some positive spill over to the JGB futures space. Broader risk aversion in the equity space has likely helped this move.

- In terms of JGB yields, the 2yr has hit multi decade highs above 0.205%. Most other parts of the curve are firmer in yield terms, although more so at the front end. The 10yr JGB yield was last up a touch to 0.745%.

- In the swap space, the 10yr was last around 0.88%, little changed for the session.

- Earlier data showed national CPI a touch below expectations, but y/y headline momentum still rebounded from Jan levels (to 2.8% from 2.2%). Core CPI, ex fresh food and energy, continued to moderate to 3.2% y/y.

AUSSIE BONDS: Yields Push Lower, Curve Bull-Flattens, RBA's Review Out Earlier

ACGBs (YM +5 & XM +5) are richer today after recovering some of the sell off post US data overnight. The RBA release half-yearly review earlier stating the the economy remains highly resilient.

- US Current Account Balance slightly narrowed at -$194.8b vs -$209.0b expected, while futures saw some pressure after slightly lower than estimated weekly jobless claims data: 210k vs. 213k est (prior up-revised to 212k from 209k, however).

- The RBA released its Financial Stability Review, stating that the Australian financial system remains highly resilient. Less than 1% of home loans are 90 or more days in arrears, although mortgage repayments have increased by 30-60% since the May 2022 rate hike. Most borrowers are expected to cope well if rates remain higher for an extended period, and local commercial property owners exhibit little financial stress. While banks anticipate a slight increase in arrears, they are projected to remain low overall (See link)

- Cash ACGBs are 3-7bps cheaper, the curve has bull-flattened with the 2yr -4.3bp at 3.800%, the 10y is -5.8bps at 4.031%, while the 2y10y is -0.450 to 21.25

- The AU-US 10-year yield differential 2bps lower at -20bps, while AU swap rates are 2-7bps lower.

- RBA-dated OIS pricing is 1-3bps softer for meetings beyond June. A cumulative 41bps of easing is priced by year-end.

- Looking ahead: The calendar is empty on Monday, while Tuesday we have Westpac Consumer Confidence

NZGBs Slightly Cheaper, Trade Balance Narrowed, Conway To Speak Tuesday

NZGBs did very little on Friday closing in line with opening levels, yields were 1-3bps higher and curves bear flattened. Earlier NZ trade balance data was released showing an improvement to the deficit at -NZ$218m from a revised -NZ%1,089m in Jan. The 12-month deficit is steadily improving from mid-2023 lows, near -NZ$17bn to now just under -NZ$12bn.

- (Bloomberg) -- Recession Is Back, Soft Path to Drive RBNZ Pivot. NZ has entered a recession as GDP fell 0.1% in Q4 2023, driven by declines in residential construction and inventories, while per-capita GDP also decreased for the fifth consecutive quarter, signalling challenges for the economy despite expectations of gradual recovery in 2024 amid significant monetary policy tightening. (See link)

- Swap rates closed flat to 1.5bps lower, with the 2s10s curve flatter.

- The NZ trade weight Index made new yearly lows down 0.61% to 70.73, while the AU-NZ 2yr swap is just off monthly highs at -0.81, the NZD is down 0.46% to 0.6018, while Equities finished up 0.48%.

- RBNZ dated OIS has edged lower again with pricing 3bps softer for meetings beyond October. A cumulative 76bps of easing is priced by year-end.

- Next Week: RBNZ's Conway speaks about Feb MPS on Tuesday, while ANZ consumer Confidence on Wednesday

FOREX: USD Index Above Pre FOMC Levels, Yuan Fall Weighs, While Yen Outperforms

The BBDXY is up more than 0.20%, putting the index up around the 1244.40 level. This is above pre FOMC levels from earlier in the week and back to earlier highs from March.

- The USD has benefited from a break higher in onshore USD/CNY spot, which finally pushed through resistance at 7.2000 at the onshore open today. USD/Asia pairs are higher across the board, while AUD and NZD are comfortably the weakest performers in the G10 space.

- AUD/USD is off around 0.70%, last near 0.6525. We aren't too far from earlier lows in the week (0.6504). Weakness in China/HK equities has also been in focus, with earnings concerns along with fresh investment/regulatory fears from the US another headwind. The RBA Financial Stability Review stated the system remains highly resilient. Borrowers are coping with higher rates, in aggregate, at this stage.

- NZD/USD was last near session lows at 0.6010/15, which is also fresh lows for the year. The pair has dipped 0.50% so far today. Outside of the 0.6000 level, note the Nov 17 intra-session low from lats year 0.5940.

- Yen has outperformed, amid the risk averse backdrop. USD/JPY initially went a touch above post BoJ highs (getting to 151.86), but just shy of 2023 highs at 151.91. Lower equities and lower US yields have helped the yen. We sit back near 151.50/55 in recent dealings. Feb national CPI was close to epxectations.

- BoJ Governor Ueda appeared before parliament, stating that the central bank will eventually scale back its bond purchases. This is unlikely to be in the near term as Ueda stated the central bank will assess the market reaction to the recent policy shift.

- Looking ahead, UK retail sales are out, along with the German IFO. In the US the Fed's Barr & Fed's Bostic will speak.

JAPAN DATA: Offshore Investors Sold Local Stocks, Bought Bonds Ahead Of The BoJ Hike

Japan weekly investment flows were volatile through last week. We saw offshore investors selling down local share holdings sharply, with -¥1464.6bn in net outflows from this space. This was the largest weekly inflow since mid September last year. It came ahead of the BoJ decision on Tuesday (which saw rates rise, albeit with a dovish outlook). It also follows a generally positive inflow backdrop since the start of the year into the space. Focus will be on whether these investors return this week, given the positive backdrop for headline indices over recent sessions (fresh highs for the Nikkei 225).

- Offshore investment inflows into local Japan bonds surged though up ¥2157.7bn. This was the largest weekly inflow since March last year. Inflow momentum into this space has been very strong since the start of March.

- In terms of Japan domestic outflows, we saw local investors selling both offshore stocks and bond holdings. Selling of overseas stocks was the third straight week of outflows from this space by local investors.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Mar 15 | Prior Week |

| Foreign Buying Japan Stocks | -1461.6 | 374.3 |

| Foreign Buying Japan Bonds | 2157.7 | 1156.1 |

| Japan Buying Foreign Bonds | -803.9 | 1582.9 |

| Japan Buying Foreign Stocks | -522.2 | -651.4 |

Source: MNI - Market News/Bloomberg

ASIA STOCKS: HK Equities Erase Thursday Gains Down 2-5%,China Equities Down 1-2%

Hong Kong & China equities have pushed lower throughout the day with HK equities erasing all of Thursday's move higher, while the CSI300 has hit a key technical resistance while the weaker yuan isn't helping. The Biden administration is investigating if SMIC violated export rules for chips powering Huawei's Mate 60 Pro, while introducing new restrictions on chip tool shipments to China. Meanwhile, Chinese President Xi Jinping will meet US business leaders to reassure amid declining foreign investment, and a new US bill aims to restrict American investment in certain Chinese stock index products. Additionally, China's NEV retail sales are set to soar in March, with a projected 37% year-on-year and 93% month-on-month surge driven by price cuts.

- Hong Kong equities are lower today after giving up all of yesterday rally, the HSTech Index is down 4.23% which could be tied back to the US investigating is SMIC violated exports rules, while the Mainland property Index is down 2.42%%, the wider HSI is down 3.04%. In China the CSI300 has hit the 200-day EMA has bounced straight off it, the index now trades off 1.46%, while the smaller cap CSI1000 is down 1.69% and ChiNext is also down 1.83%.

- China Northbound flows were -6.02billion yuan on Thursday, with the 5-day average at 3.62 billion, while the 20-day average sits at 2.911 billion yuan.

- A quick wrap of the past week in the China property space, China Builder Radiance defaults on dollar bond, China Vanke secured a 14yr 1.4b yuan loan from Industrial Bank which will be used to repay the companies debts, China Evergrande's $78 Billion has been accused of a $78b fraud in the 2 years prior to defaulting, China State-Owned developer Yuexiu cancels 1B yuan bond issuance.

- The Biden administration is investigating whether China's top chipmaker, SMIC, violated U.S. export rules to produce a chip for Huawei's Mate 60 Pro phone. There are concerns about whether SMIC illegally obtained U.S. tools to manufacture the chip, prompting a review by the administration. Despite pressure from China hardliners, no conclusion has been reached yet. Additionally, the administration announced new restrictions on shipments of chipmaking tools to advanced Chinese chip factories and is urging allies to stop shipments to China as well.

- Chinese President Xi Jinping is set to meet with several US business leaders next week during an annual forum in Beijing, with attendees including figures such as Tim Cook of Apple and Stephen Schwarzman of Blackstone. This meeting follows the China Development Forum, which has seen less publicity than usual, amid efforts by Chinese leadership to reassure foreign companies amid declining investment from abroad.

- A new bill in Congress aims to restrict US mutual funds from investing in certain Chinese stock index products, part of a broader effort targeting investments in China. The legislation seeks to prevent American investors from being misled about the value of Chinese companies, with additional measures proposed to increase scrutiny on Chinese companies' financial practices and their role in US supply chains. However, the bill still faces significant hurdles in Congress before potentially becoming law.

- According to preliminary data from the China Passenger Car Association, retail sales of new energy vehicles (NEVs) in China are expected to surge by 37% year-on-year and 93% month-on-month to reach 750,000 units in March. This increase is attributed to price cuts in NEVs. Additionally, retail sales of passenger vehicles are forecasted to rise by 3.7% year-on-year and 50% month-on-month to 1.65 million units in March.

ASIA EQUITY FLOWS: Asia Equities See Inflows Post FOMC, Tech Names Benefit The Most

- China equities closed slightly lower on Thursday, significantly underperforming Hong Kong equities. Despite the default by China Property Developer Radiance Holdings on their debt, the rally in the HS-listed Mainland Property Index continued. Meanwhile, a new US bill proposed in Congress aims to restrict US mutual funds from investing in certain products tracking Chinese stock indexes. The CSI300 is up 15% from last month's five-year low but faces resistance at the 200-day SMA. Northbound flows turned negative on Thursday, with a net outflow of -6.02 billion yuan, marking two of the largest outflows for the year in just the past three days. The 5-day average now sits at 1.13 billion yuan, below the 20-day average of 2.42 billion yuan.

- South Korean equities surged higher on Thursday, driven by a more dovish Fed, which spurred tech names higher. Foreign investor flows saw their biggest inflow since January 11th and the second-largest inflows since October 2021, with $1.678 billion entering the market. Earlier, SK PPI rose to 1.5% from 1.3% in January, while Thursday saw exports grow to 11.2% from -7.8% in February. The 5-day average is now $264 million, above the longer-term 20-day average at $140 million and the 100-day average at $164 million.

- Taiwan equities also benefited from the dovish Fed, with tech names receiving a boost, along with positive revenue guidance from Micron Technology. The Central Bank hiked interest rates to 2.00% from 1.875%, in line with consensus. The Taiex closed up 2.10%, while foreign equity flows turned positive after five days of outflows, with a net inflow of $529 million, taking the 5-day average to -$421 million compared to the 20-day at $137 million and the 100-day at $171 million.

- Thailand equities saw an inflow on Thursday after $1 billion in outflows the prior two days, although these outflows were expected to be from an institutional account leaving the region and being matched with domestic buyers due to the stability in the market. Averages are largely irrelevant due to these very large flows.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -6.0 | 5.7 | 66.0 |

| South Korea (USDmn) | 1678 | 1323 | 10190 |

| Taiwan (USDmn) | 529 | -2107 | 6444 |

| India (USDmn)** | -270 | -168 | 1595 |

| Indonesia (USDmn) | 35 | 16 | 1787 |

| Thailand (USDmn) | 56 | -1090 | -1913 |

| Malaysia (USDmn) ** | -1 | -217 | -189 |

| Philippines (USDmn) | 8 | -58.7 | 215 |

| Total (Ex China USDmn) | 2036 | -2301 | 18129 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To March 20 |

ASIA PAC STOCKS: Asian Equities Mostly Lower As Tech Names Plunge, Japan Higher

Regional Asian equities are mostly lower on Friday with the exception of Japanese equities, in a sign investors are rethinking the optimism that propelled the region’s shares higher in the prior session, as fresh signs of persistent inflation appeared in the US, tech stocks are the worst performing sector in the region largely being pulled lower by weaker equity prices in the Hong Kong and Chinese markets, while the US Justice department is suing Apple for violating antitrust laws which may also be weighing on the tech sector.

- Japan equities have edged higher today, earlier National CPI missed expectations coming in at 2.8% y/y vs 2.9% expected, Finance Minister Suzuki spoke in Tokyo earlier about FX moves, while BoJ Governor Ueda appeared before parliament, where he mentioned the bank will eventually scale back its bond purchases, but not for the time being. The Topix Bank Index is the top performing sector up 1.61%, the wider Topix Index is up just 0.53%, while the Nikkei 225 broke above 41,000 for the first time earlier, however trades just off those levels now at 40,920 up 0.25% for the day.

- South Korean PPI data was out earlier this morning rising to 1.5% from 1.3% in January, equities are slightly lower in early trading with the Kospi down 0.25% after surging higher Thursday on higher tech prices, while foreign investors flooded the SK equity market on Thursday with $1.678b of inflows.

- Taiwanese equities opened higher this morning, however has turned lower after Asian tech stocks in China & HK plunge, the Taiex is currently down 0.16%. Late on Thursday the Central Bank rose interest rates from 1.875% to 2.00% with analysts suggesting that the Taiwan central bank's unexpected interest rate hike, aimed at addressing inflation concerns, is likely to be the final adjustment for this cycle, with minimal market impact given Taiwan's relatively low policy rate compared to the rest of Asia. Foreign investors bought Taiwan equities on Thursday with $529m of inflows, breaking a run of 5 consecutive days of outflows.

- Australian equities are lower today, as banks weigh on the markets the surge in employment on Thursday has pushed chances of a rate cut back further with just 41bps of cuts priced in for the year. The ASX200 closed down 0.15%

- Elsewhere in SEA, New Zealand Trade Balance narrowed from the month prior coming in at -$218m vs -$1,089m, equities closed up 0.53%, Singapore equities are down 0.35%, Philippines equities down 0.90%, Malaysian equities are down 0.12%, Indonesian equities are unchanged while Indian equities are 0.20% higher.

OIL: Tracking Lower Amid Heightened Risk Aversion/Higher USD

The active Brent front month contract (K4) has weakened today, last near $85.20/bbl. This isn't too far off Thursday lows in US trade (close to $85/bbl). We are down 0.70% so far today and tracking marginally lower for the week at this stage. WTI was last near $80.50/bbl having followed a similar trajectory so far today.

- Sentiment today has been weighed by a firmer USD backdrop, (BBDXY +0.20% and above pre FOMC levels), while China related asset sentiment has faltered in the FX and equity space, another headwind at the margins.

- Developments elsewhere indicated that Israel would invade Rafah no matter what the US states (BBG). Houthi rebels in Yemen also reportedly told Russia and China that its vessels will not be targeted in the red sea as they move through the area.

- For Brent, we sit nearly 3% off recent highs ($87.70/bbl). Still, we are comfortably above all key EMAs, with the 20-day back near $84.10/bbl. A resumption of the up move could bring Oct 20 highs from last year into play (at $88.30/bbl).

GOLD: Down Amidst Firmer USD Backdrop, But Still Up For The Week

Gold sits lower in the first part of Friday trade. The precious metal was last near $2175, around 0.30% weaker for the session so far. This follows Thursday's drop by a similar amount. We did break above $2200 for the first time (highs near $2221) post the FOMC, but these gains weren't sustained.

- Gold has likely faltered amid a stronger USD backdrop, with the BBDXY index back above pre FOMC levels, last close to 1244.0. The risk averse tone evident particularly in equities has likely helped contain the fallout for gold so far in Friday trade. Gold is still up for the week at this stage, last nearly 1% firmer.

- Levels wise, the trend backdrop remains supportive, all key EMAs are trending higher. The 20-day, the nearest to spot, is back at $2136.6. Topside focus will remain on a fresh push back above $2200.

ASIA FX: Weakness Across The Board As USD/CNY Breaks Above 7.2000

USD/Asia pairs are higher across the board. Much of the focus has been on the yuan, after USD/CNY broke above resistance at 7.2000 for the first time this year. Both spot KRW and THB have lost 1%, while IDR is off by around 0.80%. The USD is firmer against the majors as well, the dollar index back above pre FOMC levels. Regional equities are lower for the most part, particularly in China/HK amid earnings concerns and fresh regulatory fears coming out of the US.

- Spot USD/CNY broke above 7.2000 not long after the open. The USD/CNY fix was set above 7.1000, while the fixing error widened versus yesterday's outcome. Headlines crossed from Reuters that state banks were USD sellers post this break, but Bloomberg noted such flows were absent close to the open. Spot USD/CNY is around 7.2250, close to session highs. USD/CNH spot was last above 7.2600, fresh highs back to mid Nov last year. Onshore equities are also weaker, along with sharp losses in HK, have also weighed.

- Spot USD/KRW is around 1 higher, but the pair found selling interest above 13040. The pair was last near 1337. The 1 month NDF was last near 1335, modestly weaker in won terms versus end Thursday levels in NY.

- Spot USD/THB broke to fresh highs going back to late 2023. The pair got to 36.48, but we now sit lower at 36.38, still 0.90% weaker in baht terms for the session. Earlier comments by a BoT official hinted that the neutral bias by the central bank may be re-assessed. The weaker baht wasn't overly concerning though.

- USD/IDR is also up strongly last near 15790, 0.80% weaker in rupiah terms. This is back to early Feb levels. IDR has been weighed by broader risk aversion.

INDONESIA: Indon Sov Debt Yields Steady, Foreign Investors Continue to Sell Bonds

Indonesian USD sovereign debt curve is little changed on Friday, yields are flat to 1bp higher. There has been very little in the way on any market drivers, or bond issuance. Looking back over the past week yields are 1bps higher to 8bps lower as curves bull flatten. The BI kept rates on hold at 6% as they wait for the Feb to start cutting, while Prabowo's Presidential Election win is being questioned by a rival in court, while foreign investors continue to sell Indonesian bonds.

- The INDON sov curve is largely unchanged on Friday with the 2Y yield is unchanged at 4.94%, 5Y yield is 1bps lower at 4.91%, the 10Y yield is 0.5bp higher at 5.01%, while the 5-year CDS is also unchanged at 71.5bps

- The INDON to UST spread difference tighter on Thursday as the UST front end widen a touch the 2yr is 32bps (-3bp), 5yr is 67.5bps (-2.5bps), while the 10yr is 75.5bps (-1bps).

- In cross-asset moves, the USD/IDR is 0.69% higher, the JCI is 0.08% lower, Palm Oil is up 0.9%, while US Tsys yields are 1-2bps lower.

- Foreign Investors sold bonds again on Wednesday now marking 10 of 11 days of net selling. The 5-day average is now -$21m, the 20-day average is -$51m while the longer term 200-day average has turned negative at -$0.90m

- Foreign investors have now withdrawn $1.1 billion from Indonesian bonds since the February 14th election, reflecting concerns over incoming President Prabowo Subianto's ambitious spending plans, including a proposed free school lunch program. Despite Subianto's pledge to maintain fiscal discipline, his proposed spending spree, estimated at 460 trillion rupiah ($29 billion), has raised worries among investors about potential fiscal loosening. Meanwhile, uncertainties surrounding cabinet appointments and legal challenges disputing the election results add to investor apprehension.

- Earlier, Indonesia's Feb Broad money supply rose 5.3% y/y, vs 5.4% y/y on Jan

- Looking ahead: Indonesia has a very quiet rest of the month in terms of data, with the next major data release not until April 1st

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2024 | 0700/0700 | *** |  | UK | Retail Sales |

| 22/03/2024 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 22/03/2024 | 0730/0730 |  | UK | DMO to release calendar for FQ1 (Apr-Jun) Ops | |

| 22/03/2024 | 0800/0900 |  | EU | ECB's Lagarde in Euro Summit | |

| 22/03/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/03/2024 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/03/2024 | 1300/0900 |  | US | Fed Listens event | |

| 22/03/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/03/2024 | 1600/1200 |  | US | Fed Vice Chair Michael Barr | |

| 22/03/2024 | 1630/1630 |  | UK | BOE to announce APF sales schedule for Q2-24 | |

| 22/03/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 22/03/2024 | 1700/1800 |  | EU | ECB's Lane lecture on inflation and MonPol at AMSE | |

| 22/03/2024 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.