-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Starts The Year On The Back Foot

- Greenback underperforms at the start to 2021 as participants assess global coronavirus situation

- JGBs briefly bid on the back of reports suggesting that Japanese gov't might declare a state of emergency in Tokyo & neighbouring prefectures, gains evaporate as U.S. Tsys & Aussie Bonds soften

- Sterling limited after PM Johnson flags potential for tightening Covid-19 restrictions

- Oil inches higher ahead of much awaited OPEC+ meeting, AxJ equity markets bid as virus situation in Tokyo sparks concerns

BOND SUMMARY: Core FI On Back Foot, JGBs Shake Off Initial Strength

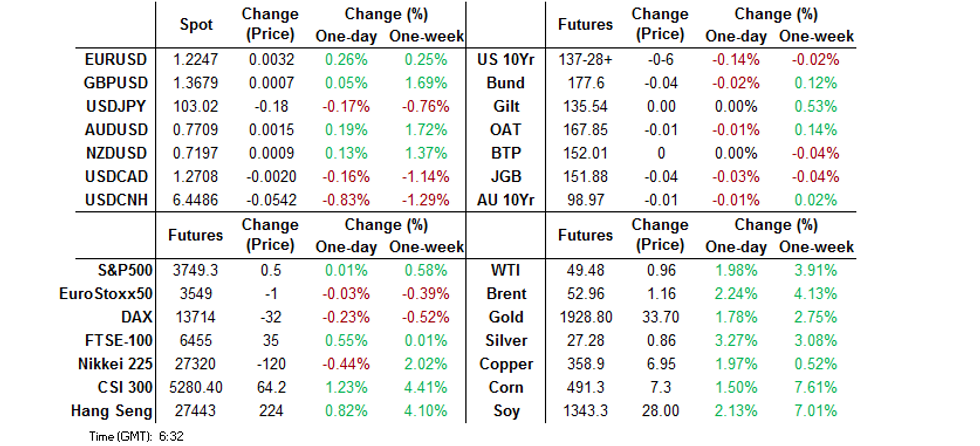

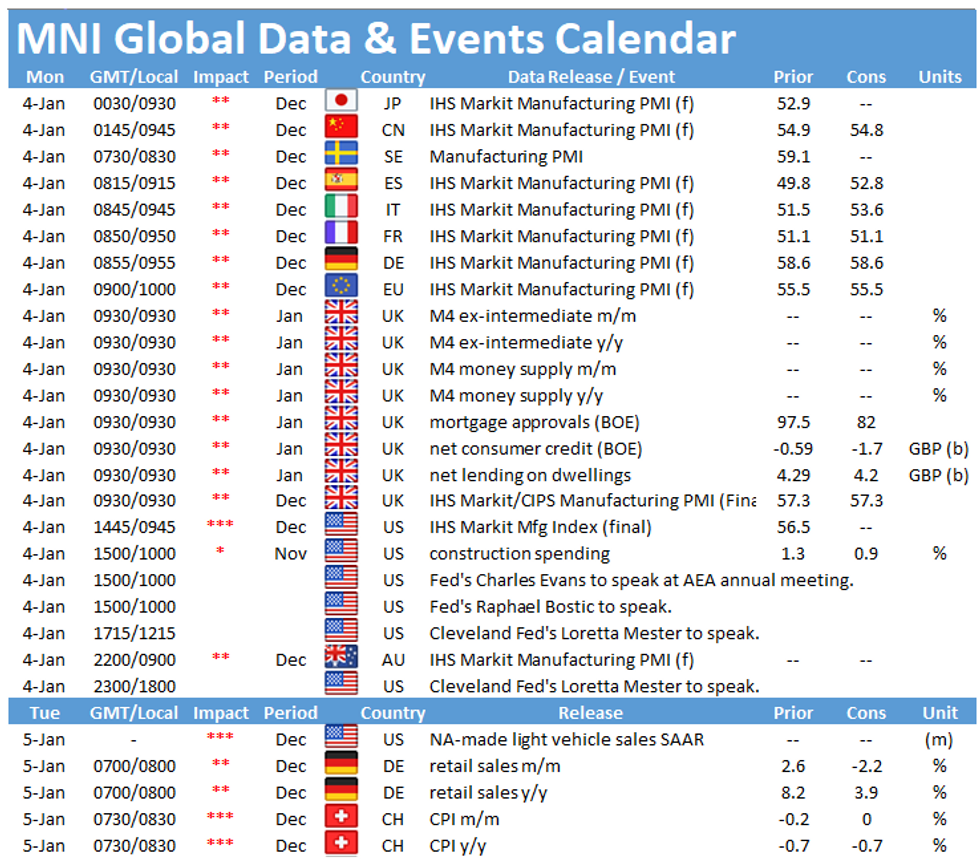

A lower re-open for T-Notes preluded a further sell-off as trading resumed after 2020 became history, although e-minis struggled to recoup their early dips. T-Notes stabilised around their current levels in the Tokyo afternoon and last trade -0-07 at 137-27+. Cash Tsy curve bear steepened, with yields last seen 0.4-3.3bp cheaper. Eurodollar futures run unch. to -1.0 tick through the reds as we type. The space found itself under a modicum of pressure as participants seemingly focused on the positives re: U.S. coronavirus situation, with Anthony Fauci observing that the national vaccination campaign is picking up speed. U.S. Pres Trump's last-ditch attempts to disrupt the transition process & lingering Sino-U.S. frictions failed to provide much support to the FI space. Construction spending & final Markit M'fing PMI headline the U.S. docket today, with 3-Month & 6-Month Bill supply also due.

- Aussie bonds also faltered, taking their cue from dynamics driving U.S. Tsys. YM last sits -0.5 & XM changes hands -1.0. The latter slid early on, before ticking off lows in afternoon trade. Steepening impetus hit cash ACGB space as well, with yields last seen -0.4bp to +1.7bp across the curve. Bills trade unch. to -1 tick through the reds. Coronavirus matters dominated the local headline flow, after NSW mandated mask-wearing in indoor venues. The final Markit M'fing PMI report confirmed a continued recovery in Dec, albeit at a marginally slower pace than suggested by the flash reading. CoreLogic House Price Index growth accelerated to +0.9% M/M in Dec from +0.7%.

- JGB futures firmed up at the start to the session, after several reports circulated by the Japanese press suggested that the gov't may declare a state of emergency in Tokyo and three neighbouring prefectures as soon as this week. However, the contract wiped out gains into the lunch break and struggled to recover thereafter. It last sits at 151.91, just 1 tick shy of last settlement. Cash JGB yields are marginally mixed, though 40s still outperform. PM Suga held a presser, during which he confirmed that the central gov't considers declaring emergency in Tokyo and surrounding regions. He didn't disclose any details, but some hints trickled through via the local media, as FNN noted that a new state of emergency could last for a month & NHK reported that it would involve more limited restrictions than April's.

FOREX: Greenback On The Backfoot As 2021 Underway

A fairly sluggish start to 2021 trade. The U.S. Congress is set to confirm the election of Joe Biden for the next U.S. President this week. Outgoing Pres Trump reiterated his calls for a vote recount in Georgia. The political outlook in the U.S. will remain cloudy at least until after Tuesday's Georgia Senate runoff. Aside from some lingering political uncertainty in the U.S., global coronavirus concerns are weighing on the U.S. dollar.

- GBP/USD is up 8 pips at 1.3679, sterling could face some headwinds after the UK recorded another daily high in new Covid-19 cases, while PM Johnson warned that tougher restrictions might be imminent. Opposition leader Starmer urged the PM to declare a nation-wide lockdown within 24h. There was some optimism on reports that the UK is poised to give the first shots of AstraZeneca's vaccine on Monday.

- The weekend saw Tokyo Gov Koike & govs of three neighbouring prefectures urge central authorities to declare a state of emergency in the area to stop the spread of new Covid-19 infections, but the central gov't said it will consult experts before making a decision. Latest reports indicate a 1 month lockdown from Jan. 9. USD/JPY last down 20 pips at 103.00, dragged lower by a weaker U.S. dollar.

- AUD/USD last up 8 pips, getting a bit of a boost after reports that New South Wales found no new cases of Covid-19 yesterday, indicating stricter containment measures over the festive period could be having the desired effect. Markets ignored weaker domestic and Chinese data, while a bid in oil helped support AUD.

- NZD/USD has wavered around neutral levels, with liquidity sapped by a public holiday in New Zealand. The rate last changes hands at 0.7193, up 5 pips.

- The PBOC fixed USD/CNY at 6.5408, around 159 pips weaker for the yuan than the previous fix. Despite this, USD/CNH opened below the 6.50 handle and has proceeded to decline further, last at 6.4547 and touching the lowest levels since June 2018. The PBOC drained a net CNY 140bn from the system today.

FOREX OPTIONS: Expiries for Jan04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100-15(E958mln-EUR puts), $1.2220(E729mln-EUR puts), $1.2275(E561mln-EUR puts), $1.2430-40(E589mln)

EQUITIES: Mixed Picture

Equity markets rose on Monday, climbing even as safe haven gold saw a bumper session. Stocks look set to continue to benefit from goldilocks conditions: expectations of widespread vaccine distribution in 2021, further central bank support, and government aid.

- The U.S. Congress is set to confirm the election of Joe Biden for the next U.S. President this week. Outgoing Pres Trump reiterated his calls for a vote recount in Georgia, while a group of GOP Senators led by Ted Cruz signalled that they will object to the certification of Trump's election defeat. Most expect their initiative to fall flat. The political outlook in the U.S. will remain cloudy at least until after Tuesday's Georgia Senate runoff.

- Asia-Pac equity markets are mostly higher, Japanese bourses are the exception after Prime Minister Suga said he's considering declaring a state of emergency for the Tokyo area for 1 month from Jan. 9 to stem the spread of Covid-19.

- Shares in China and Hong Kong edged higher. Major indices have shrugged off NYSE's decision to delist China's three biggest telecommunication companies (China Mobile, China Telecom, China Unicom HK), even as the companies themselves slid.

- Futures in the US and Europe are flat-to-slightly lower. FTSE 100 futures are the exception after the U.K. announced it is poised to give the first shots of AstraZeneca's vaccine on Monday.

GOLD: Yellow Metal Reclaims $1,900

Gold has gained to start 2021, benefitting from some headwinds to the greenback as the yellow metal reclaims the $1900 handle, gold last up $24.04 to $1922.74.- The U.S. Congress is set to confirm the election of Joe Biden for the next U.S. President this week. Outgoing Pres Trump reiterated his calls for a vote recount in Georgia, while a group of GOP Senators led by Ted Cruz signalled that they will object to the certification of Trump's election defeat. Most expect their initiative to fall flat. The political outlook in the U.S. will remain cloudy at least until after Tuesday's Georgia Senate runoff.

- Aside from some lingering political uncertainty in the U.S., global coronavirus concerns are weighing on sentiment and helping boost gold.

- The U.K. recorded another daily high in new Covid-19 cases, while PM Johnson warned that tougher restrictions might be imminent. Johnson told the BBC on Sunday that the gov't may have to keep schools shut. Opposition leader Starmer urged the PM to declare a nation-wide lockdown within 24h, while Scottish First Min Sturgeon said that the Scottish gov't will consider "further action" to contain the spread of the virus when it meets on Monday. Elsewhere Japan is considering imposing another state of emergency for 1 month from January 9 and the U.S. has seen a spike in cases after the New Year holiday.

- There is some optimism around the vaccine after the announcement that the U.K. is poised to give the first shots of AstraZeneca's vaccine on Monday.

OIL: Oil Higher To Start 2021 Ahead Of OPEC

- WTI last up 0.97% at 48.98, Brent last up 1.02% at 52.33.

- Oil markets are fighting the conflicting influences of a spike in coronavirus cases globally and hope that vaccine roll outs can accelerate the return to normality.

- The UK recorded another daily high in new Covid-19 cases, while PM Johnson warned that tougher restrictions might be imminent. Johnson told the BBC on Sunday that the gov't may have to keep schools shut. Opposition leader Starmer urged the PM to declare a nation-wide lockdown within 24h, while Scottish First Min Sturgeon said that the Scottish gov't will consider "further action" to contain the spread of the virus when it meets on Monday. Elsewhere Japan is considering imposing another state of emergency for 1 month from January 9.

- The OPEC+ group looks likely to increase output by 500k bpd from January, while Russia's deputy prime minister said in December Russia would be supportive of additional gradual increases in February. The OPEC+ group will meet today to make a decision on February output levels.

- Government officials from Saudi Arabia and Russian reiterated commitment to OPEC+ agreement to support oil market stability last week at a Saudi-Russian Joint Governmental Committee for Commercial, Economic, Scientific and Technical Cooperation.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.