-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN MARKETS ANALYSIS: Wheat & Fed Whispers

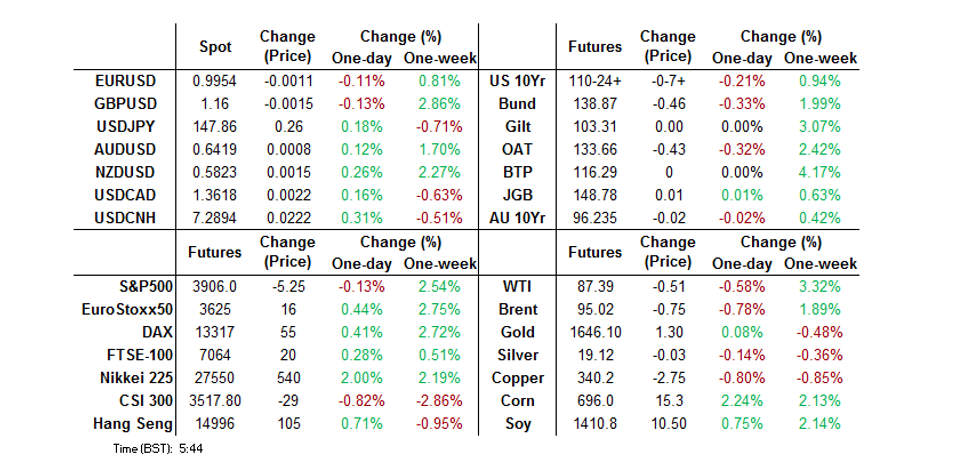

- Early Asia-Pac trade saw participants digest the latest article from WSJ Fed whisperer Timiraos which pointed to some support for the Fed’s higher for longer interest rate mantra.

- Inflation worries surrounding Russia indefinitely suspending the Ukrainian grain export deal also factored into early price action.

- Eurozone GDP & CPI data, German retail sales & U.S. MNI Chicago PMI will take focus on the data front today. ECB's Visco & Lane are set to speak.

US TSYS: Curve Twist Flattens, Off Early Lows That Were Inspired By Latest WSJ Fed Whisperer Piece

Early Asia-Pac trade saw participants digest the latest article from WSJ Fed whisperer Timiraos which pointed to some support for the Fed’s higher for longer interest rate mantra.

- Inflation worries surrounding Russia indefinitely suspending the Ukrainian grain export deal also factored into early price action.

- Block sales in TY (-3K, -2.5K & -2.5K) as well as screen-based flow drove the contract through Friday’s base, although the 26 Oct low (110-16) was not tested on the move.

- The space then regained some poise before turning bid on the back of the latest round of soft official PMI data out of China.

- There has been a fresh, albeit modest round of cheapening as we head into London hours, with TY getting nowhere near closing the opening gap lower.

- The contract trades -0-08 at 110-24 as a result, just below the middle of its 0-11 range, on solid volume of ~126K.

- Cash Tsys run 5bp cheaper to 1bp richer across the curve, twist flattening, with 3s providing the weakest point on the curve and a pivot observed around the 20-Year point.

- MNI Chicago PMI data and the latest Dallas Fed m’fing activity survey headline Monday’s local docket. Eurozone CPI data set to provide some interest in pre-NY trade, although most of the focus is already on Wednesday’s FOMC decision.

JGBS: Curve Twist Flattens On BoJ Rinban Tweak

The early twist flattening move in JGBS has held, with the major JGB benchmarks running 1bp cheaper to 4.5bp richer, pivoting around 7s. The long end is off of firmest levels of the session.

- The move came as Tokyo reacted to Friday’s after hours move from the BoJ, which saw the Bank alter the frequency of its scheduled Rinban operations covering 10- to 25- & 25+-Year JGBs to 3x per month from the prior 2x (after upsized and unscheduled purchases were conducted in recent weeks) as the Bank looks to step up the defence of its YCC mechanism.

- JGBs tested overnight session lows in early Tokyo trade, before moving into positive territory in the afternoon, printing +1 ahead of the close.

- Domestic headline flow was limited at best, with mixed local data failing to provide any impetus for the space.

- Final manufacturing PMI data and 10-Year JGB supply headline Tuesday’s domestic docket.

AUSSIE BONDS: Close To Neutral After Offshore Matters Push The Space Around

Offshore matters were in the driving seat on Monday, with trans-Tasman spill over from a rally in NZGBs (see earlier bullets for more detail on that matter) allowing Aussie bond futures to more than unwind losses witnessed during the final overnight session of last week.

- The space then corrected from best levels as U.S. Tsys came under some early pressure, before softer than expected official PMI data out of China and a move away from session lows for U.S. Tsys allowed the space to stabilise during the Sydney afternoon.

- Virtually in line with expected local data had no impact on the space.

- That leaves YM -1.0 & XM -2.0 at the bell, while wider cash ACGB trade sees 1-2bp of cheapening across the curve, with a lack of month-end index extension demand evident (in line with the sub-average nature of most desk estimates).

- 3- & 10-Year EFPS were a little over 3bp wider on the day, while Bills finished flat to 7bp cheaper through the reds, steepening.

- Looking ahead, the latest RBA monetary policy decision headlines on Tuesday, with a 25bp rate hike widely expected and ~30bp of tightening priced into the OIS strip. See our full preview of that event here.

NZGBS: Imminent WGBI Index Inclusion Supports NZGBs

The NZGB curve bull flattened on Monday, with the early cheapening more than unwound, as the imminent inclusion of NZGBs in the FTSE Russell WGBI was seemingly in the driving seat during Monday’s NZ session.

- That left cash NZGBs flat to 6.5bp richer across the curve, with swap spreads tightening as the swap curve twist flattened.

- Softer than expected official PMI data out of China would have added some incremental support to the bid that already developed pre-data.

- Terminal OCR pricing nudged higher on the day, last printing just below 5.20% after operating closer to 5.10% in the early rounds of trade.

- Building permits data headlines the domestic docket on Tuesday, with participants also set to be on the lookout for any trans-Tasman spill over from the latest RBA decision.

FOREX: Yen Underperforms Amid Wider U.S./Japan Yield Spreads

The yen weakened in the interim between the BoJ's monetary policy decision last Friday and this Wednesday's Fed meeting. Japan's central bank left all main parameters of its ultra-loose stance unchanged and reinforced its dovish messaging by upping the frequency of bond-purchase operations used to enforce the YCC framework. By contrast, the FOMC is expected to raise the fed funds rate by another 75bp this week.

- Spot USD/JPY ran as high as to Y148.28 before trimming gains to last change hands at Y147.81. One-week option skews held gains registered last Friday in a strong rebound from near-cyclical lows. U.S./Japan yield differentials expanded, with 2-year gap last 3.0bp wider & 10-year spread 1.9bp wider.

- The pullback in USD/JPY may have been facilitated by worse than expected official Chinese PMI outturns, with the non-manufacturing gauge unexpectedly plunging into contractionary territory. Spot USD/CNH fluctuated in positive territory as the session progressed and last deals ~210 pips better off.

- The Antipodeans traded on a firmer footing ahead of the RBA's cash rate target decision tomorrow, defying the negative lead from China's PMI figures.

- Eurozone GDP & CPI data, German retail sales & U.S. MNI Chicago PMI will take focus on the data front today. ECB's Visco & Lane are set to speak.

FX OPTIONS: Expiries for Oct31 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.4bln), $1.0000(E2.4bln)

- EUR/JPY: Y140.00($825mln)

- USD/CAD: C$1.3900($630mln)

ASIA FX: USD/Asia Pairs Mostly Higher, China PMIs Disappoint

Most USD/Asia pairs are higher, led by USD/CNH. Disappointing China PMI data, coupled with firmer UST yields has kept broader USD sentiment supported. KRW and INR have seen some outperformance though. Still to come is September trade data for Thailand. Tomorrow, we get the China Caixin PMI and South Korea October trade data. Regional PMIs are also due, along with Indonesian CPI.

- USD/CNH dips have been supported, although the pair hasn't been able to extend gains beyond the 7.2930 region. The USD/CNY fixing was up, fresh highs for this cycle. The official PMIs also slipped into contractionary territory for both manufacturing and non-manufacturing.

- The won has outperformed, buoyed by firmer local equities. USD/KRW has been supported sub 1420 though. Tomorrow the focus rests on October trade data. The market expects negative y/y export growth, but the trade deficit is expected to improve modestly further.

- USD/TWD didn't see much downside. Spot is back to 32.19, with the 1 month NDF slightly higher at 32.21, +0.40% on closing levels from last week. A weaker China currency appears to have been a bigger influence today, as onshore equities are up +1.25%.

- Spot USD/THB started the new week on a firmer footing and last deals +0.08 at 37.97, slightly down from session highs. Thailand manufacturing production rose less than forecast in September (+3.36%, y/y versus +6.55% forecast). Still to come is September trade figures. Foreign investors bought a net $75.81mn in Thai stocks last Friday, the sixth consecutive net daily inflow and the largest one since Aug 31.

- Spot USD/IDR operates at 15,593, up 41 figs on the day. Bulls look for a breach of Oct 21 cycle high of 15,634, while bears keep an eye on Oct 5 low of 15,162. The latest round of Indonesia's monthly CPI figures will hit the wires tomorrow. Headline inflation may have accelerated to +5.99% Y/Y last month from +5.95% prior, while core inflation is expected to have quickened to +3.40% from +3.21%.

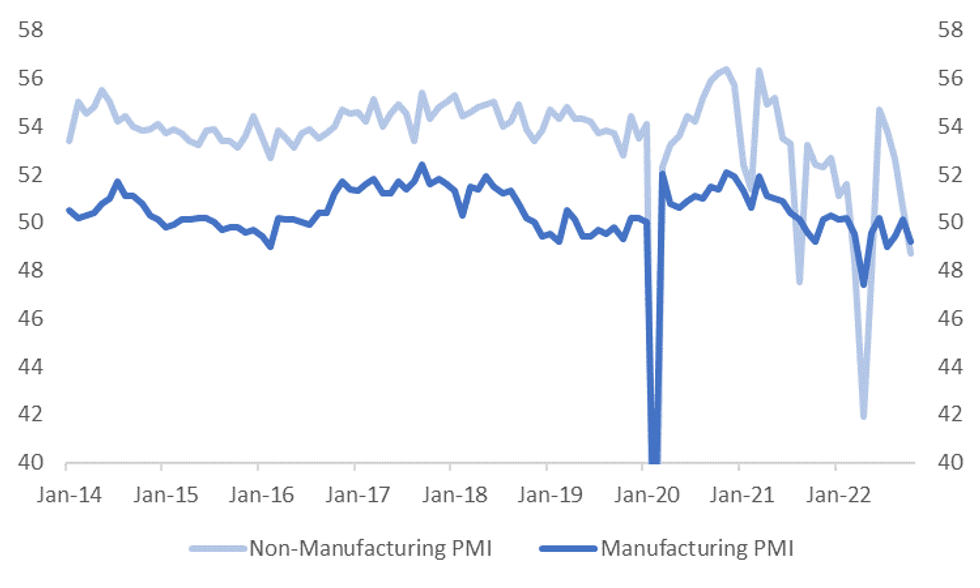

CHINA: Both China PMIs Back Into Contractionary Territory

Both China PMIs were weaker than expected. The manufacturing print at 49.2, versus 49.8 expected and 50.1 previously. The non-manufacturing PMI fell to 48.7, against a 50.1 forecast and 50.6 prior. Interestingly, no economist surveyed pencilled in this degree of fall for the non-manufacturing PMI. The composite PMI fell to 49.0 from 50.9. These data prints point to downside risks for China growth momentum in the early stages of Q4.

Fig 1: China PMIs Both Into Contractionary Territory for October

Source: MNI - Market News/Bloomberg

- The manufacturing PMI headlines remains within recent monthly outcomes, but the non-manufacturing print is back to fresh lows since May of this year. It points to a decent loss of momentum for the services sector, given the headline reading was at 54.7 in June of this year.

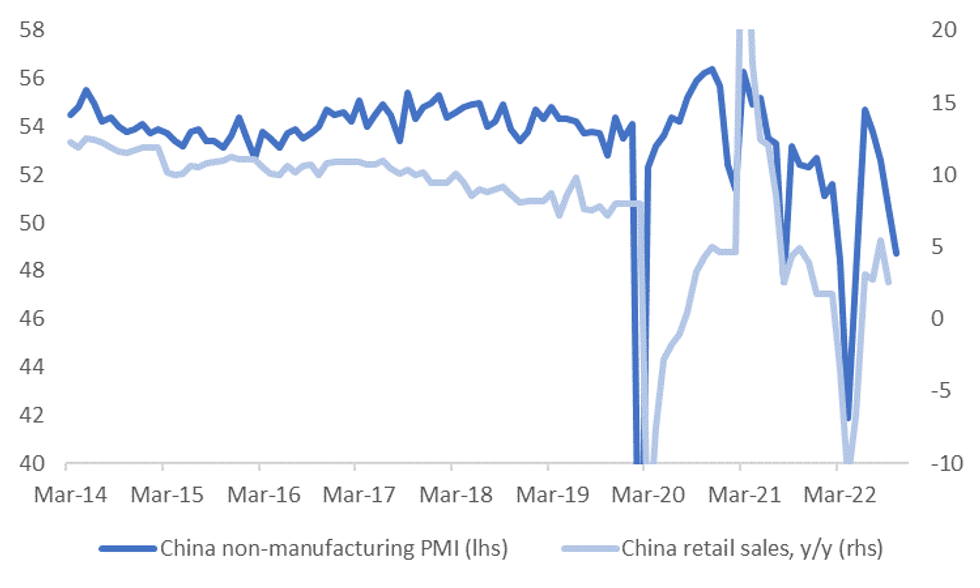

- This suggests further downside momentum in consumer spending indicators like retail sales, see the chart below.

- It also comes amid a more elevated backdrop for domestic covid case numbers as well as we head into November, which could inhibit any rebound in the near term.

- The detail of the PMI surveys showed disappointing outcomes for new orders (48.1 for manufacturing, fresh lows back to April, 42.8 for non-manufacturing) and employment also slipping against both survey readings. The only bright spot for the manufacturing PMI was a tick up in export orders to 47.6 (form 47.0).

Fig 2: China Retail Spending - Momentum Could Still Be Skewed To The Downside

Source: MNI - Market News/Bloomberg

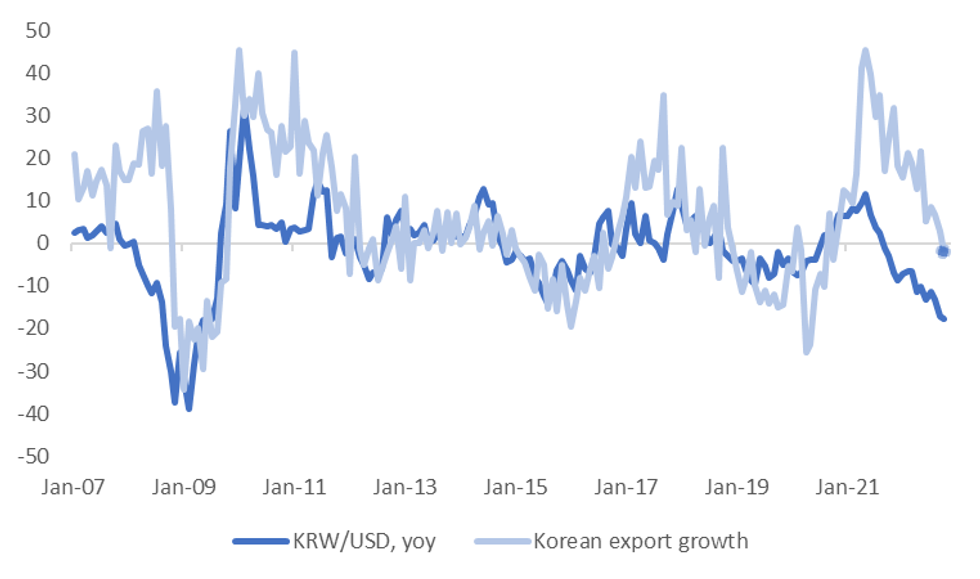

SOUTH KOREA: Exports Expected To Be Negative Y/Y, Can The Trade Position Surprise On The Upside?

The market expects South Korean export growth to be -2.1% y/y for October, with this data due early tomorrow. If realized this would be the weakest print since October 2020. Arguably the Korean won is already priced for such a move, see the first chart below.

- The won looks to have sold off too much relative to slowing export growth this past year, but the negative trade position is likely partly responsible for this wedge.

- In any case the directional correlation between the two series is still fairly strong. It is difficult to argue for a very strong turnaround in won sentiment amidst a slowing export growth backdrop.

- The other areas of focus will be tech export momentum, and export growth to China, which fell -16.3% y/y in the first 20 days of October.

Fig 1: South Korean Export Growth & KRW/USD Y/Y

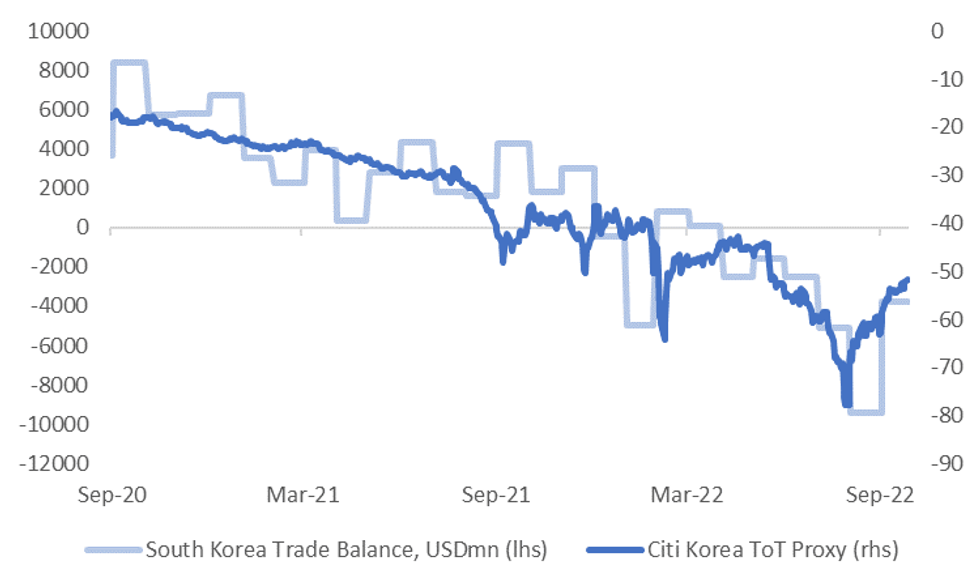

- There may be more relief for the won from a trade balance standpoint. The second chart below overlays the trade position against the Citi terms of trade proxy. The proxy has been on the improve amid lower commodity prices and suggests further improvement in the trade position.

- The trade deficit has improved noticeably from the lows, with the market forecasting the October deficit at -$3.5bn, versus -$3.8bn last month. The country is reportedly quite advanced in meeting stock levels for LNG ahead of the upcoming winter period as well (see this link for more details).

- Still, it may require a decent upside surprise to offset the expected dip in export growth from a KRW FX sentiment standpoint.

Fig 2: South Korean Trade Balance & Citi Terms Of Trade

Source: Citi/MNI - Market News/Bloomberg

EQUITIES: Mostly In The Green, Mainland China Stocks Lagging

Major Asia Pac equities are in the green, with China mainland stocks the exception. US futures have spent much of the session in negative territory, but are away from worst levels and this follows 2-3% gains through Friday's session for cash equities.

- The HSI opened lower, but we are now back in positive territory (last up 0.90%). Tech sentiment is better (the sub index up close to 3.5%). Macau gaming stocks are higher, (+4%) following reports China mainland residents will be able to visit from Nov 1 via the smart visa process (per Reuters reports). This offset the negative weekend news around mass testing due to a covid outbreak.

- At this stage, the CSI 300 is down -0.15%, while the Shanghai composite is close to flat. Official PMI prints disappointed, both manufacturing and services slipping into contractionary territory. Rising covid case numbers is also causing concern amid a further rise in total case numbers.

- The Nikkei 225 is up +1.7%, likewise for the Kospi +1% and Taiex up +1.30%. This follows the strong lead from tech stocks through Friday offshore trading.

- The ASX 200 is up +1%, led mainly by financial names, with materials/resource companies still lagging to a degree on the back of recent commodity price softness.

GOLD: On Track For 7th Straight Monthly Loss

Gold is not too far away from Friday's session lows. The precious metal has been unable to gain much traction above $1645 through the first part of trading today, last around $1644, down slightly on closing levels from last week.

- This follows a 1.11% dip on Friday's session, which was enough to unwind gains for the week. Gold is also on track to fall again this month. This would be the 7th straight monthly fall, which commenced in April.

- A firmer USD, coupled with a bounce in nominal UST yields (real yields were unchanged) were headwinds through Friday and this remains the case today.

- There is some support sub $1640, beyond that is the October 21 lows just under $6120. On the topside, last week's gains above $1670 proved unsustainable.

OIL: China Weighs On Prices But Likely To Gain On The Month

Oil prices are down so far today by about 0.5% with WTI trading just under $87.50 and Brent around $95/bbl. WTI is still above its 20- and 50-day moving averages. It looks like oil is heading for its first monthly gain since May, possibly of over 10%, due to OPEC+ announcing production cuts to occur in November.

- Prices were lower today due to weak PMI data from China showing that the economy has contracted in October. This added to existing concerns that demand for commodities out of China is slowing due to its Zero-Covid Policy. But supply concerns are still supporting oil as OPEC+ cuts are imminent, the northern hemisphere winter approaches and European sanctions on Russian oil are due to come in on December 5.

- USD developments in the wake of Wednesday’s Fed meeting will also drive oil prices at the start of November, as a lower dollar reduces the cost in local currencies.

- In other news, Iranian oil minister Owji has gone to Moscow to discuss Russian investment in Iran’s oil and gas sector, according to Bloomberg.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/10/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/10/2022 | 0730/0830 | ** |  | CH | retail sales |

| 31/10/2022 | 0800/0900 |  | ES | Retail Sales | |

| 31/10/2022 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/10/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/10/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/10/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/10/2022 | 1500/1600 |  | EU | ECB Lane Speech at Danmarks Nationalbank Conference | |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/10/2022 | 1900/1500 |  | US | Treasury Financing Estimates | |

| 01/11/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.